Nightly Crypto Report: Bitcoin and GBTC Go Alone

As I look across the crypto market over the short term, I see fresh bearish-after-bearish setup. Mostly, I see these setups across major alt coins, as I tend to ignore most micro alts with poor liquidity. Even the local setup (red) in Ether may be failing. Yet Bitcoin continues to push higher. The condition of the market as a whole continues to grow my caution, and yet the Bitcoin train keeps chugging. What does this mean? Well, for me:

1. Caution means I watch my position size more closely than I already do. I am trading very small except for the CoreAlgo (though I took some profit today).

2. I'm prepared for surprises in both directions.

3. Take setups in either direction as they show in order to mix my portfolio exposure.

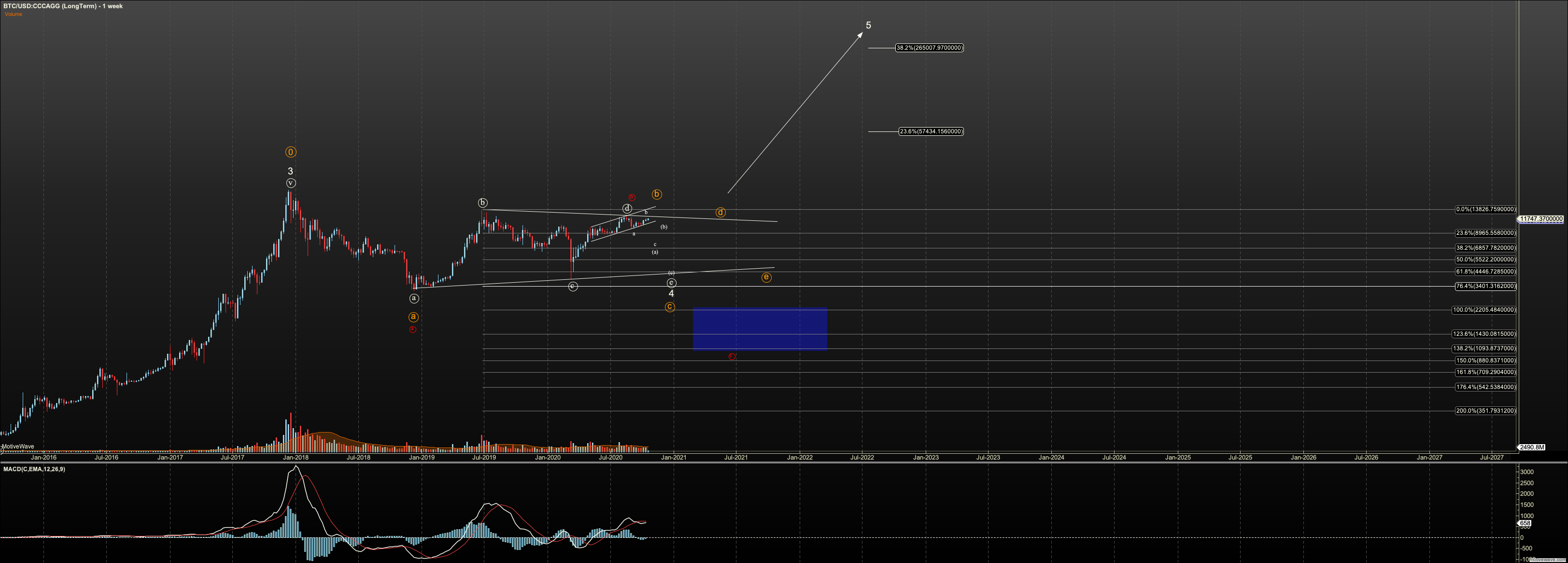

Bitcoin

Bitcoin pushed higher for a fifth wave, as I was looking for in the red setup. This makes the red setup viable as long as we hold $11,340. I have also extended the white and orange counts with this move up and they are relabeled as shown. For orange to hold ideally it remains above $10,800. However, I am making note that that level, from a raw TA approach, is just above neckline of the head and shoulders (H+S) structure I noted on last week's webinar. Honestly, though a B wave low can be lower, much below that level may cause bulls to start selling the H+S.

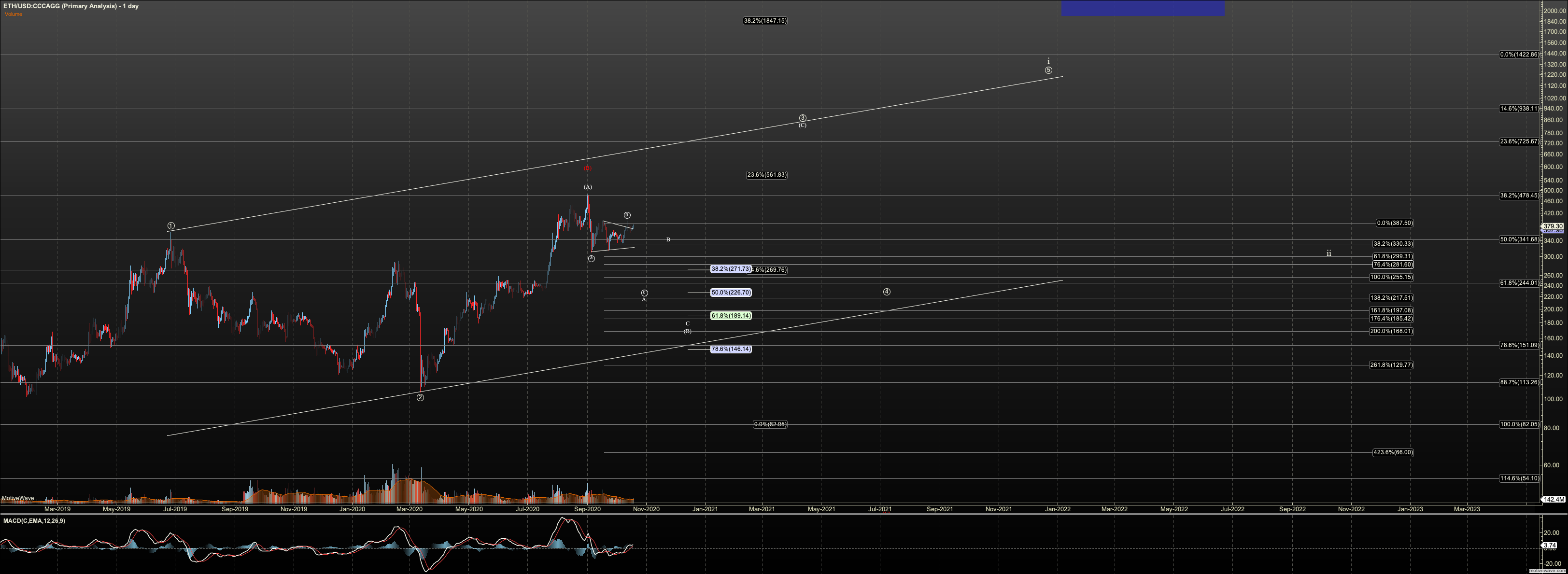

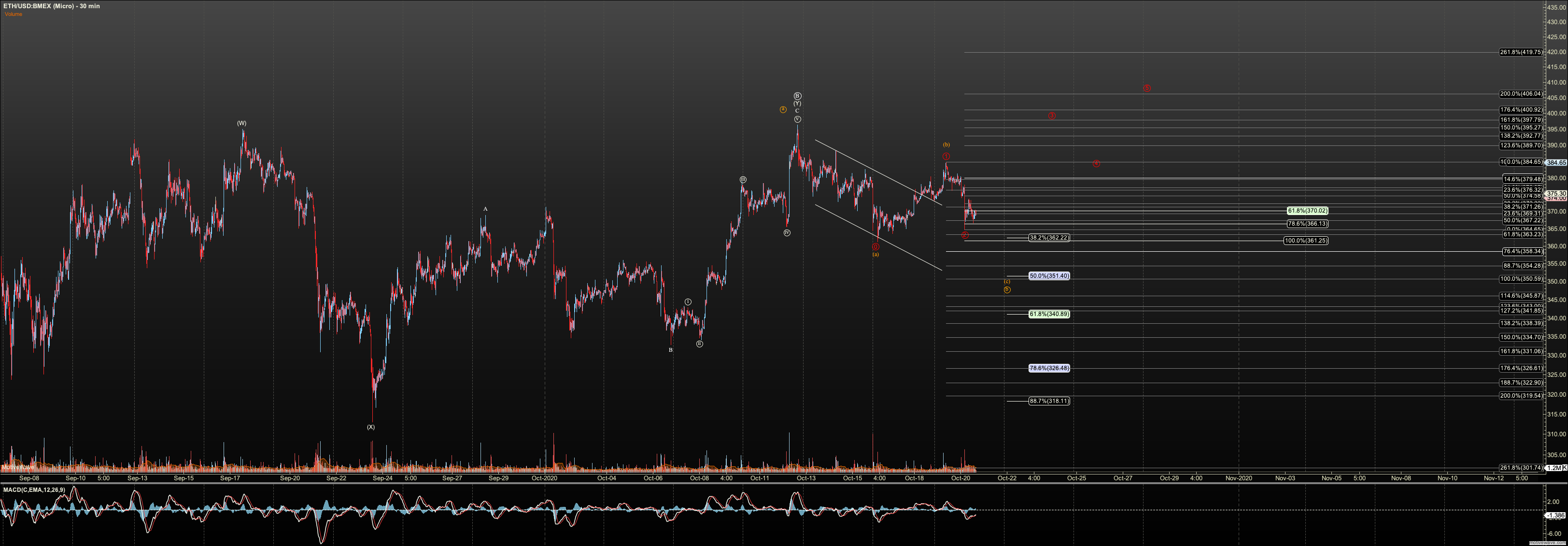

Ethereum

Ether pushed below the $366 level mentioned in regard to the red setup. It has not invalidated, but I really believe we will not see this setup hold. We retraced 88% of wave 1 and have not seen an impulsive reversal. I took a shot but am out. I have kept the red setup on because it is still valid, but I much prefer orange with $351 still ideal.

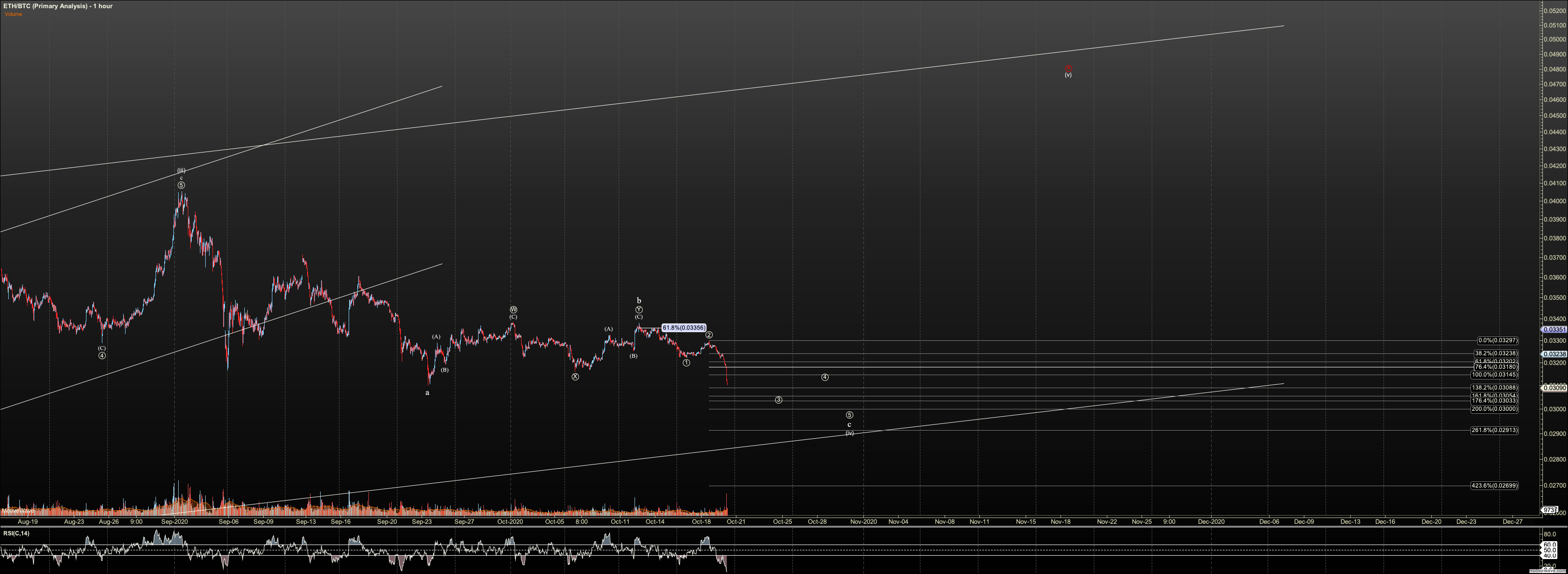

ETHBTC

Wow, we really ran down hill today in this third. I do not expect much of a bounce until circle-3, ideally near 0.0305.

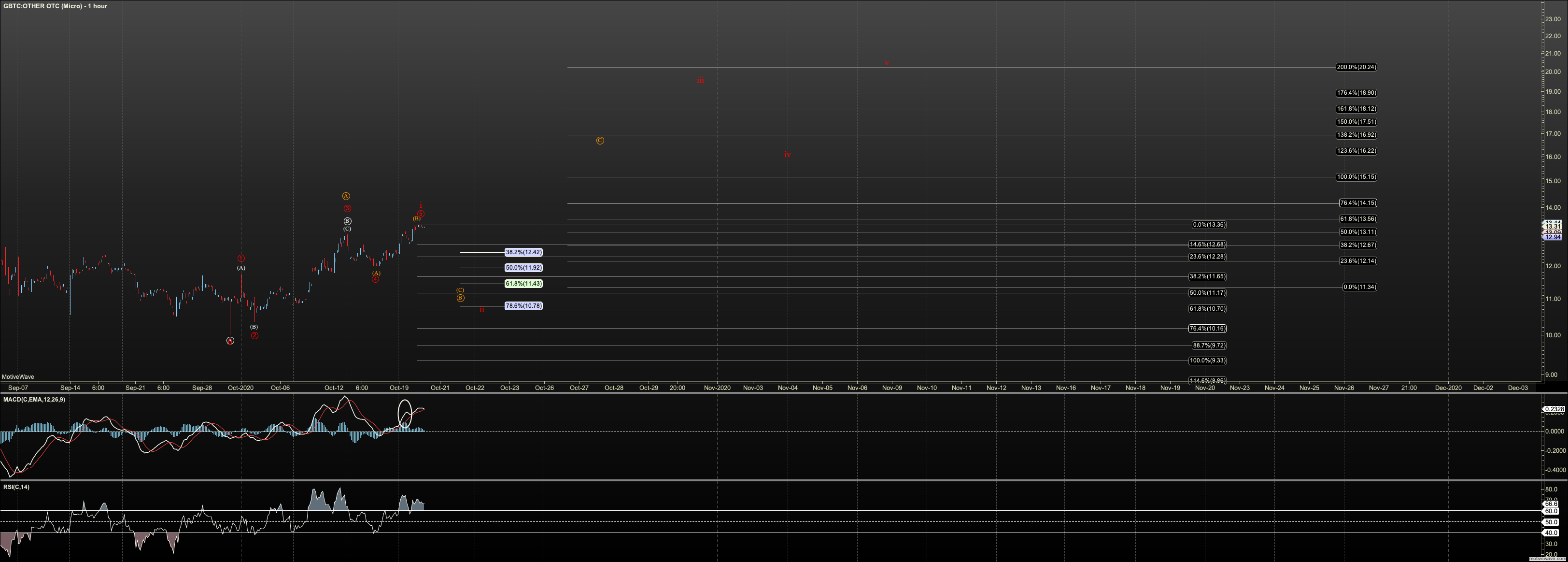

GBTC

We saw a decent 5th wave in GBTC in red. I cautiously share that this may mean a major bottom that points us toward $20, and potentially on to $40. However, I have to cautiously note that I do not see a Bitcoin count to match this. Perhaps it is only portending another high B. (extended orange). But it is a very valid setup so long as it holds. $10.17, and ideally $11.43. I was asked about how I can project a count higher in GBTC and not in Bitcoin. I want to share an important lesson to derive from this question, which I know many struggle with.

Remember, we don't control, nor predict the market. Elliott Wave only gives us an understanding of market structure visually and mathematically. At any time, many views are valid. However, levels derived are very objective for validating and invalidating counts and provides entry zones at low risk. Therefore, we have to divorce ourselves for looking for market prediction. A setup is a setup, and that is what we trade when the risk to reward is right. Remember the most successful of traders, often operate at a sub 60% success rate (often worse) but are successful via skew. Elliott Wave excels in identifying skew. I have lost, over time, most of my consternation about trades stopping at a loss. Part of losing that concern was positioning down and learning that skew will right the ship over time. So, with this setup you have to decide what you want to do with it based on:

1. Is BTC offering much certainty? Definitely not, as I've stated over and over since March. Sometimes you have to choose between taking questionable setups but only when risk to reward is best, or sit on your hands. But perhaps I don't see the bullish potential in BTC? Well, that's why I've added the quantitative approach to BTC with the Core algo. But we all swim in high uncertainty together. I'm right there with you.

2. Will you advance your trading to embrace uncertainty and learn what trades you take despite, or when to sit on your hands? These are lessons all traders much learn.

For me the uncertainty is irrelevant when the parameters of a trade are clear.