Nightly Crypto Report: Bear Rally or More?

So far it appears we are fitting my white nano count to the tee in Ether and Bitcoin. We hit support, and bounced, and it appears we can look higher in wave (C). I posted long trades intraday, and so far those trades are profitable. Now it gets interesting. Do we push through key levels above, giving rise to another impulse watch? Further, the nano in GBTC appears very bearish. Do we finish the (C) wave tonight, and then start to roll overnight, giving a reason for GBTC to gap down. I can't say for sure, but this all is interesting to watch.

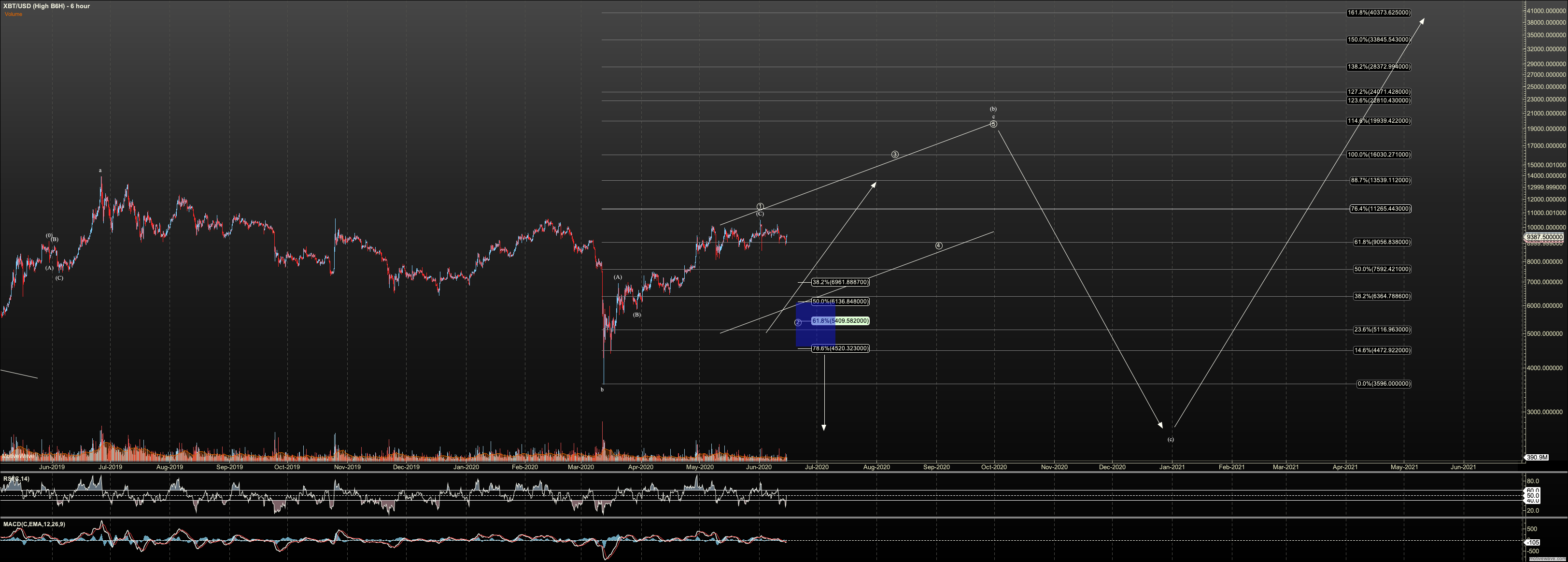

Bitcoin

We appear to have an impulsive reaction to wave (B) support. I have taken off the red count. Ideally, wave (C) reaches at least $9870 Bitmex. A push through there will have me start to watch for a full impulse. I am managing this trade by using my 50% stop method so I can squeeze out some profit despite the B wave top risk. The ideal a wave below is near 7-handle but I'll target it more precisely with a top.

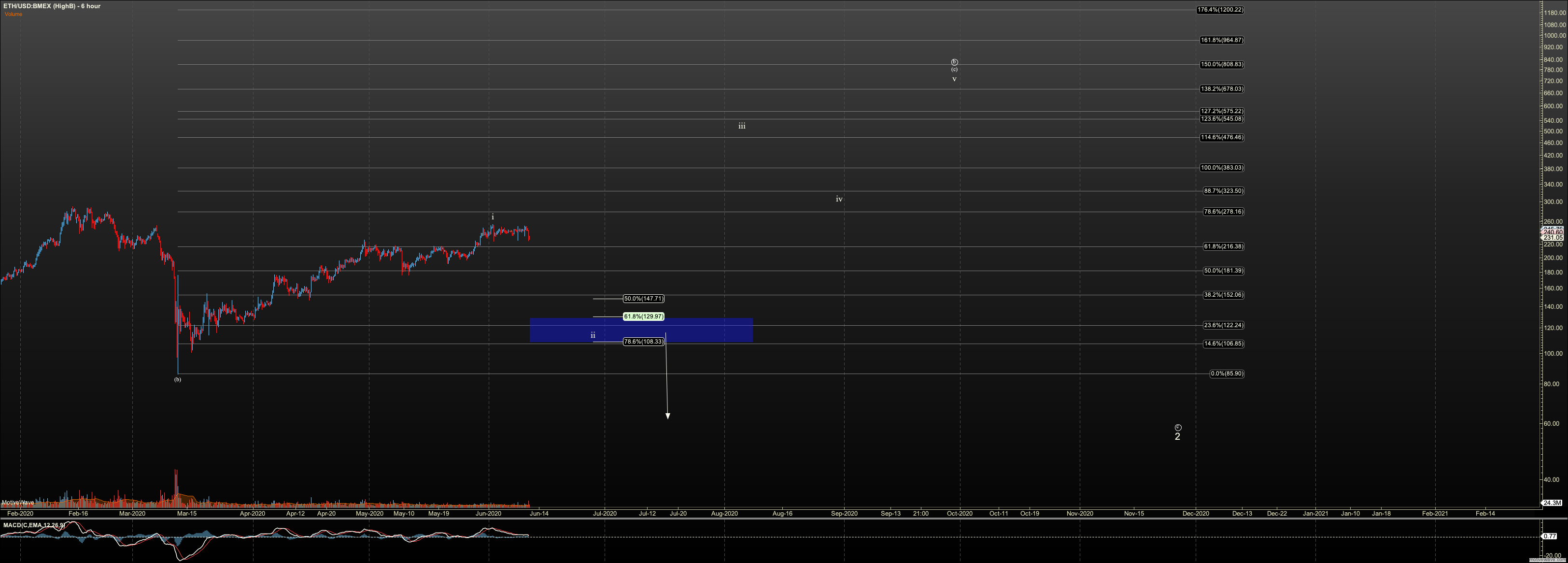

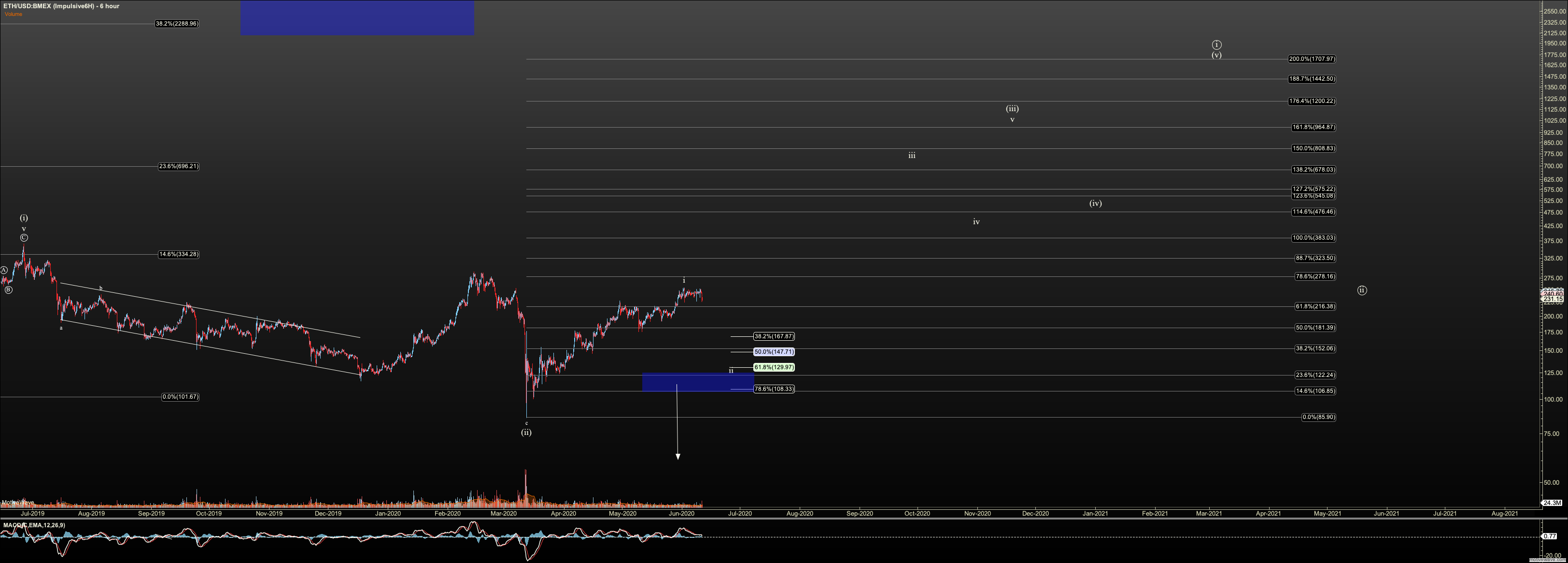

Ethereum

Copied from BTC: We appear to have an impulsive reaction to (B) support. I have taken off red count. Ideally, (C) reaches at least $246 Bitmex ($250 kraken). A push through there will have me start to watch for a full impulse. I am managing this trade by using my 50% stop method so I can squeeze out some profit despite the B wave top risk. The ideal a wave below is near $180 to $165, but I'll target it more precisely with a top.

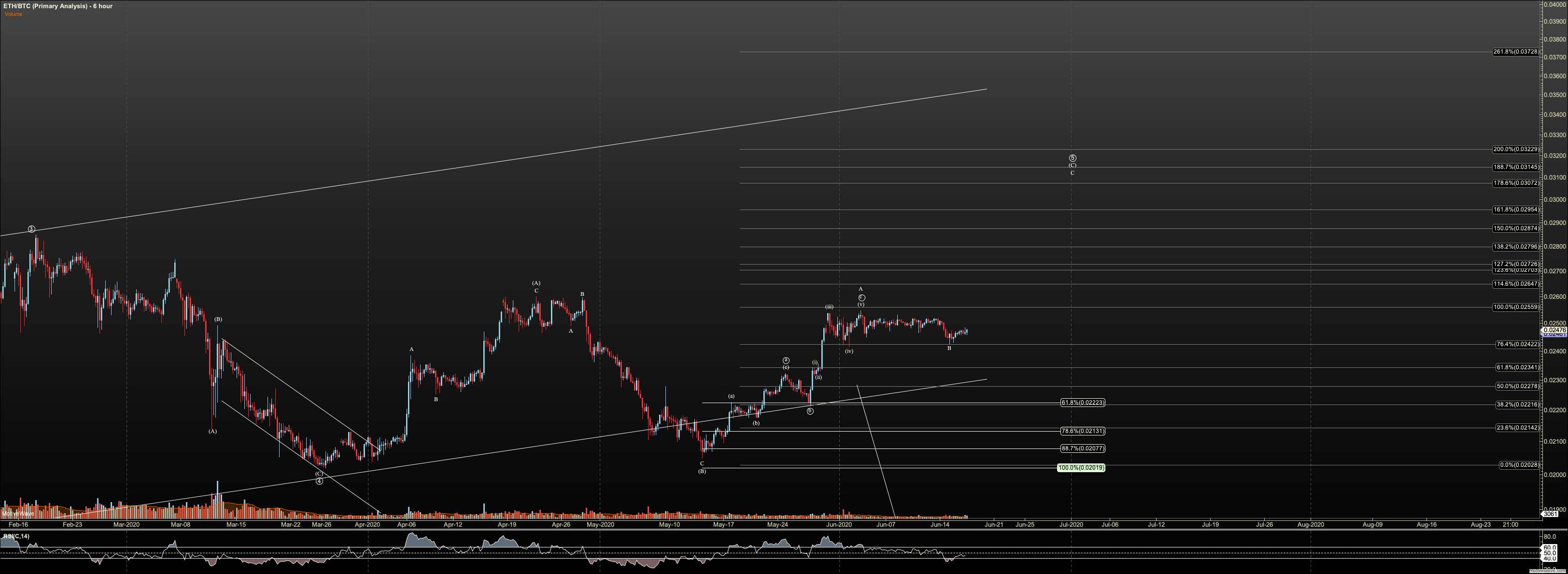

ETHBTC

No change: We continue to move sideways which is very shallow for a B. We appear to be pushing higher but there is still room for whipsaw.

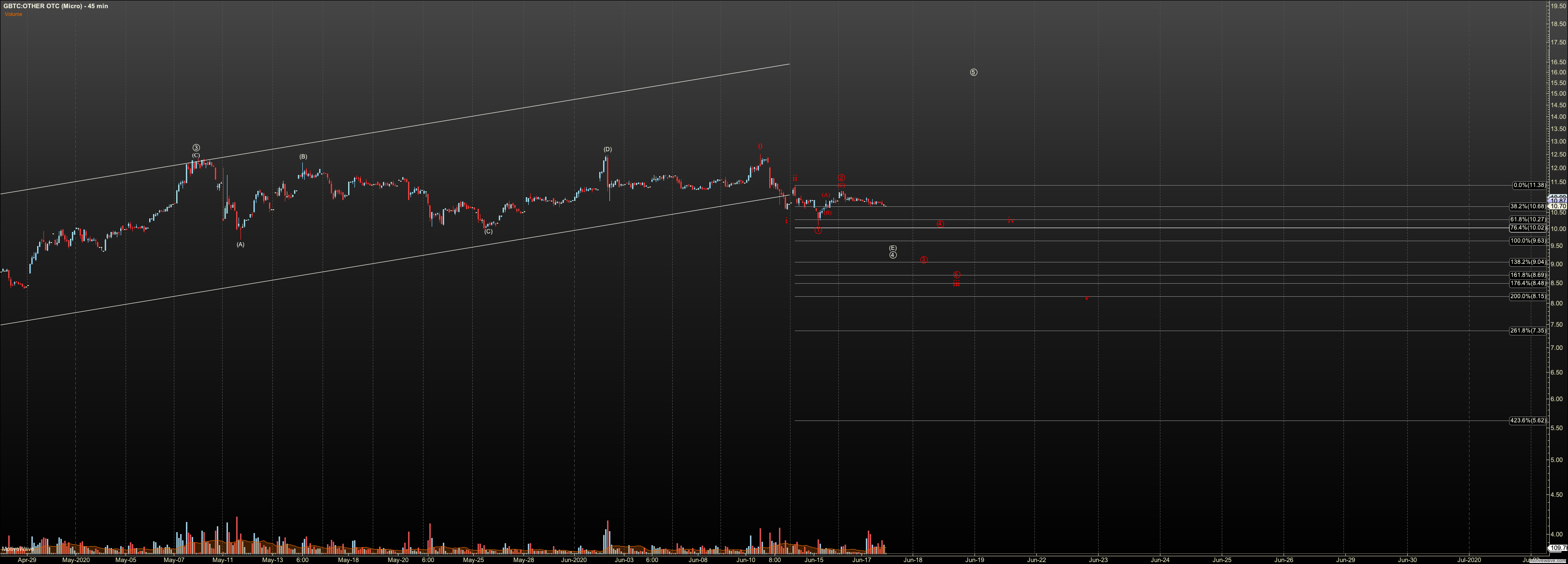

GBTC

I see the close in GBTC as pretty bearish but some of that is the typical nebulous nano structure. If the (C) in Bitcoin is still in progress we may see a strong reversal and perhaps an invalidation of red at $11.24. But like I said in 'General', we can finish (C) in Bitcoin tonight and start the next draw down. This is a nice time to be on the sidelines in GBTC.

ST Tactics:

I am flat in GBTC after today's action. My 50% level was hit in Bitcoin so I am half out of my core. I am now looking for short term short scalps but note I will not be putting on such a heavy short position so as to call my portfolio primary short.