Nightly Crypto Report: A Little Micro Clarity?

As you know, if you've followed, I've been looking for $5328 Bitcoin to tell us whether we were going to get that drop in C. That is simply the 132.8% extension of what I was calling the A-B, and since that extension usually contains the B wave, a sustained break of that level usually suggests you are not in a B wave. So, we have an issue. We have broken it and seen a run to $5346, the 150% extension, and yet could not sustain. So, what do we have?

Well, I studied the chart intently this morning, and I can now make out a leading diagonal off my previous alt (4), actually with near-perfect fibs in its substructure. The only 'gripe' I can make is the length of the 1 in time, noted by circle 1 on my chart. It is proportionally long in the Y axis, but I care more for price axis in my analysis. Now, if this diagonal is valid, we are likely in wave 2 before launch in third of our (5), and support for that 2 is $5014. Further, diagonals often produce shallow retraces, which is opposite of equities. And, so we may not see deeper than $5187. You'll note on my chart that I have moved the C wave to $4821 to alt (4).

Note If this leading diagonal is, in fact, a B wave, constructed as a WXY, which often push past the 138.2%, then we'll still see that C wave lower. The tactics, again, of dealing with these alts is to layer in, leaving ammo for the C wave, until we have a clear impulse for a tighter stop to top off. If I see it, I will alert you.

Honestly this setup makes sense where GBTC left us at yesterday's close, in a likely heart of a third.

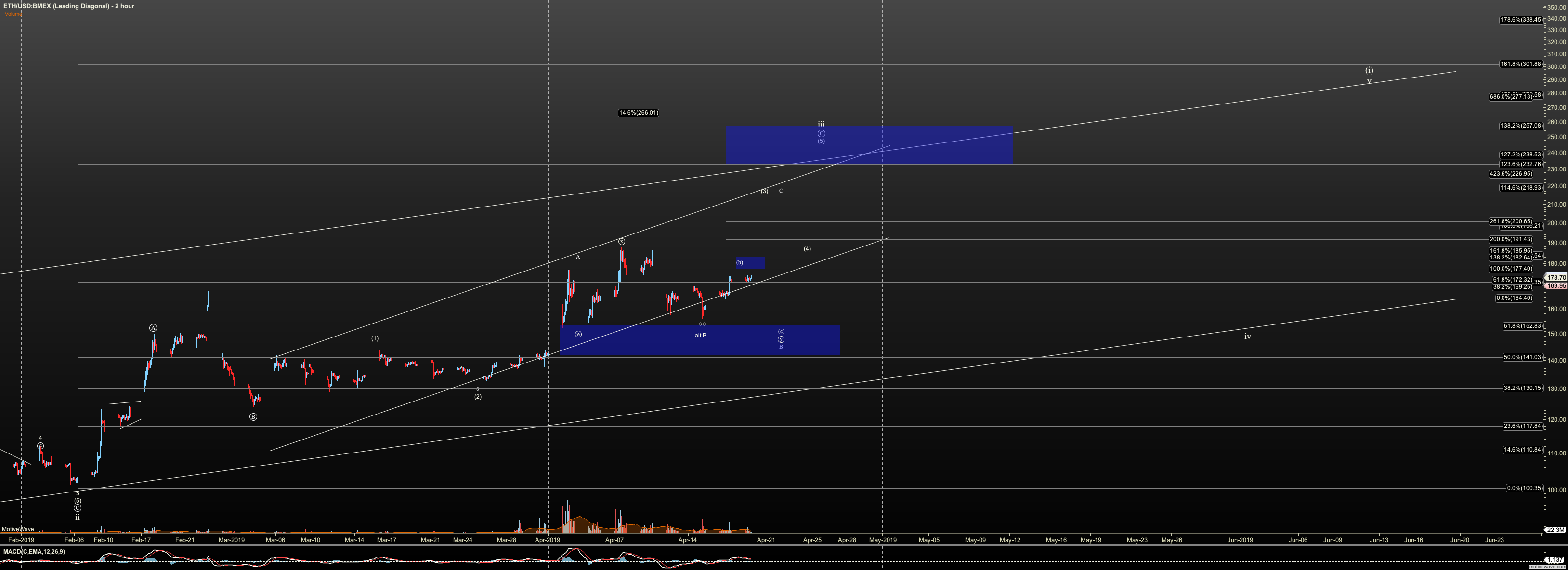

For Ether, I really have no more clarity. I am watching the $183 level still, its 138.2% extension. Below that, a C wave to the $140's remains possible. As stated, we likely have 'layered diagonals' now and will remain zoomed out to key levels versus trying to micro it.

I also have nothing to add on ETHBTC as it continues to hold its setup,.