Nightly Crypto Report - Market Analysis for Oct 29th, 2019

The Bitcoin Train is Warming Its Engine

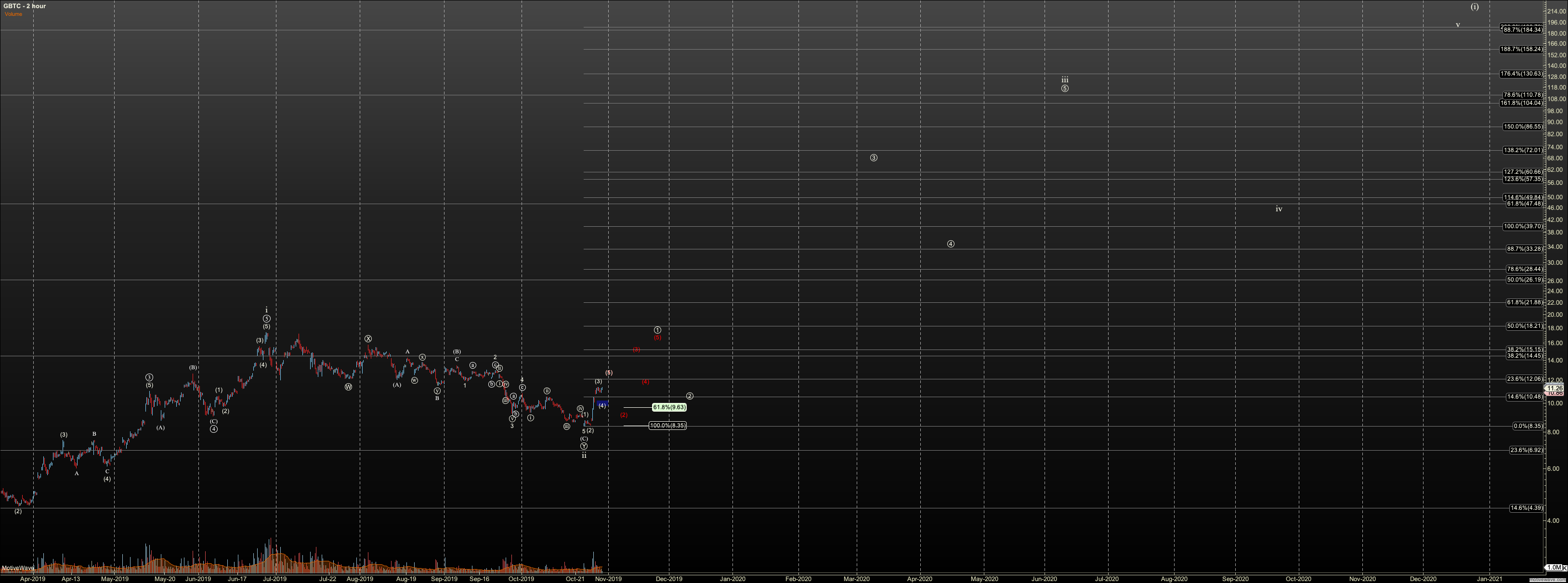

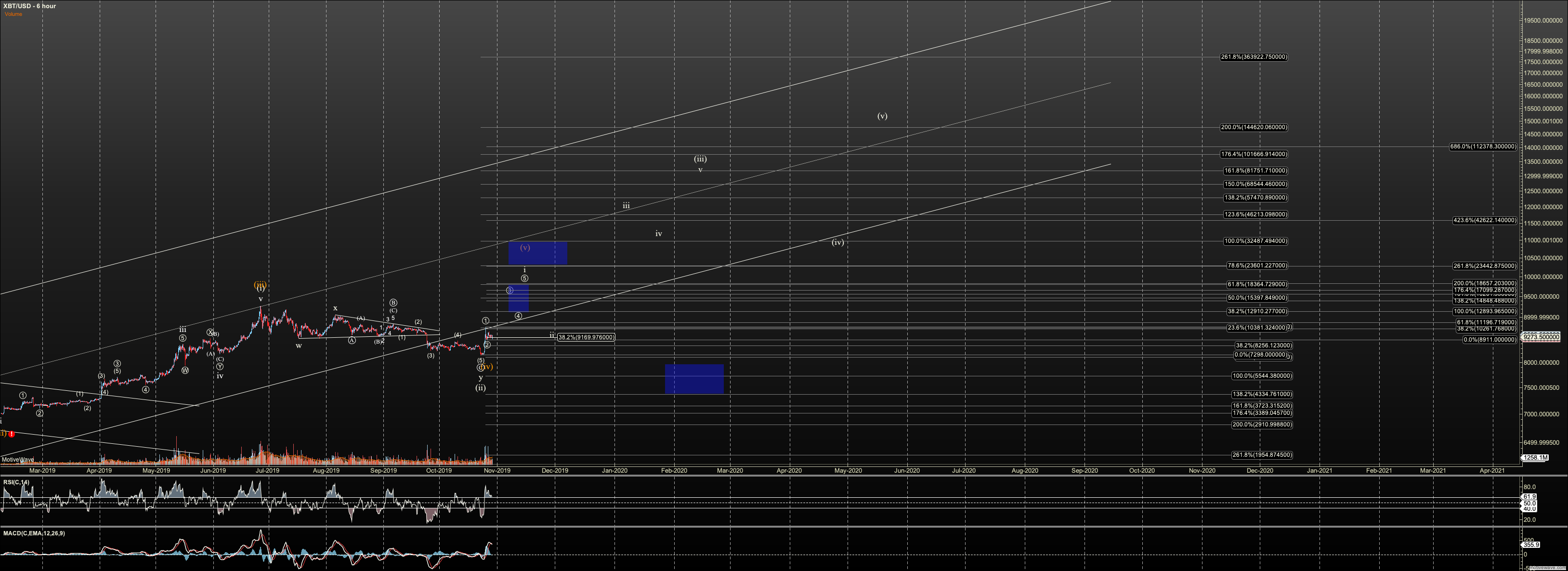

For Long Term Traders: I'm going to rewrite that portion of the nightly as soon as possible, so it is missing from this report today. However, if our October 23 bottom holds, my targets for this bull run are: $188 GBTC, $144K Bitcoin, and $3040 Ethereum

Housekeeping: Next I would like to apologize, though I had no control, for recent circumstances. Currently our power is on, but there has been many areas on and off the list. We've heard warnings of more outages, then we were taken off the list. I'm sure we'll be back on at some point. Buying generator got us lights and working computers, but not working internet. Even the cell towers are not working well. Anyone have a spare dial up motem? (joking)

Short Term Traders:

As per above, it is my thesis that Bitcoin, Ethereum, and GBTC have bottomed on October 23, regardless that it was truncated on almost every chart. As you know I have been resistance to the truncation potential, but other than Ethereum, we've crossed levels in what can be defined an impulse, that make it hard to argue against this bottom. So, you know me. I will trade this thesis with manageable risk until it comes off the rails. I do not believe that about the entire crypto market. Many charts seem to be stretching for zero. But these charts have a solid bottom structure, as many charts not included here.

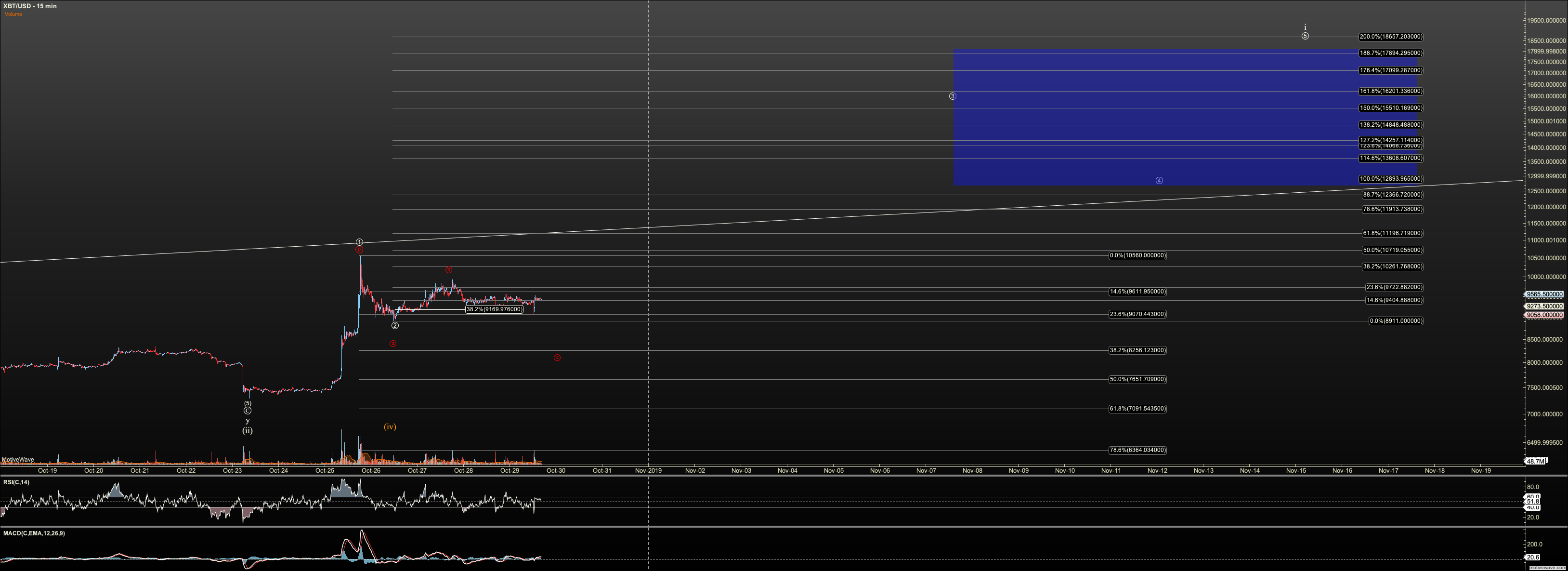

1. Though the nano structure can be argued both for a three wave top, and a fourth in progress, it is my thesis that we have five waves off the low based on typical fibs off the low. Further, if we've corrected in a fourth wave it was quite deep for Bitcoin.. And, even further extended fifths that look like part of a third wave are quite common in Bitcoin in times of extreme sentiment and short squeezes. Tonight, we have the potential of a high B coming or all of this correction done. Over $9800-9820 would suggest a good chance of acceleration. It does take $11,600 to confirm a third wave in my work, but once in the heart of a third it will move fast, and I expect to see $18,300 and $18600 in circle 1, the beginning of our larger wave three. Note how that level lines up with the previous high. If we see the +/-50% in that area for circle 2, there will be many calling a double top. Let them call it. This will be the last chance to board this train if we continue to perform as expected. Remember I'll consider the bottom thesis questionable under $7850 and invalid, of course, under the October 23 low.

Note that I am still watching alternative that we have bottomed in a fourth (orange), and we are going to have a major bull market top at $25-30K. But if true it was a very deep ivth and nearly at the point where I'd call it not valid ($6800)

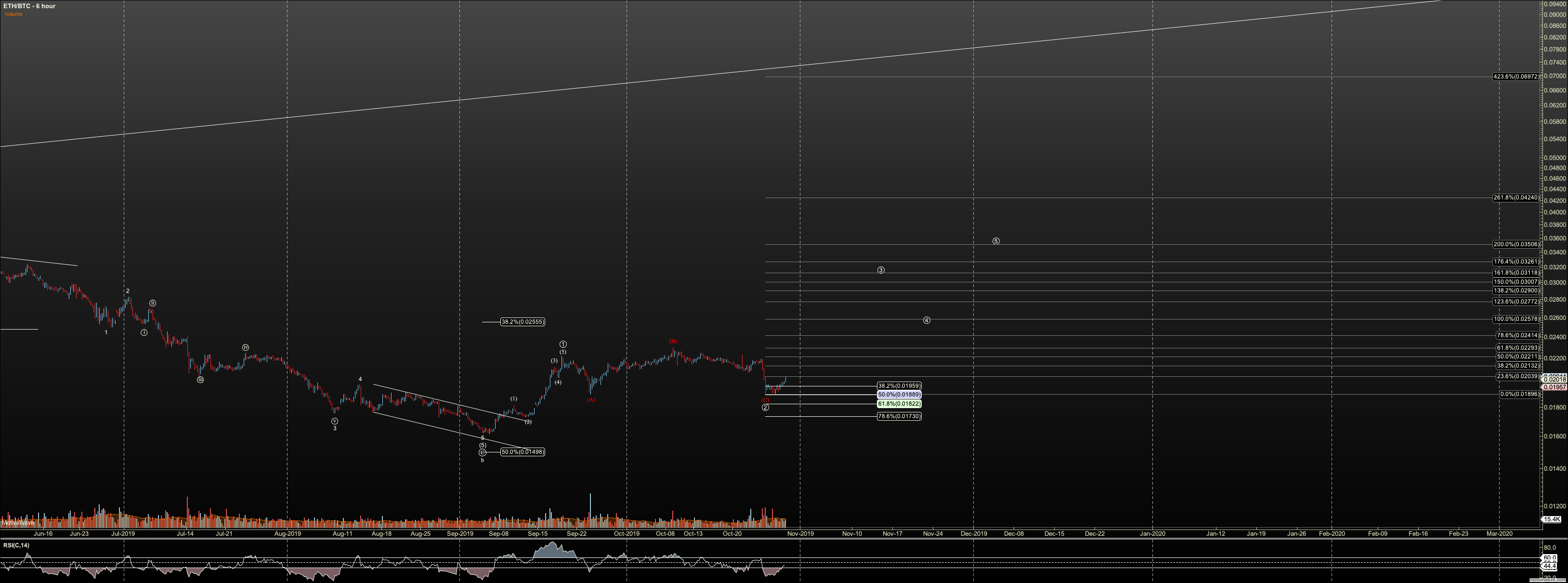

2. Much the same can be said about Ethereum regarding the questions of whether the current correction over the last few days is a wave four or two. My thesis is a two at the moment. Further, we're starting to see acceleration of ETH vs. BTC with a potential bottom in the ETHBTC pair right in my support. The acceleration we are seeing tonight, may be a high B wave. High B waves are strong signing of an engine reving. That of course is not bearish but may produce a C wave to near the bottom of this correction at $176 before the final take off. Right now my target for the next degree is $302 which corresponds to the 50% extension off the 2018-2019 1-2 setup. Not bad confluence. $161 is the first warning this bottom will not hold with invalidation coming upon a break of the October 23 low.

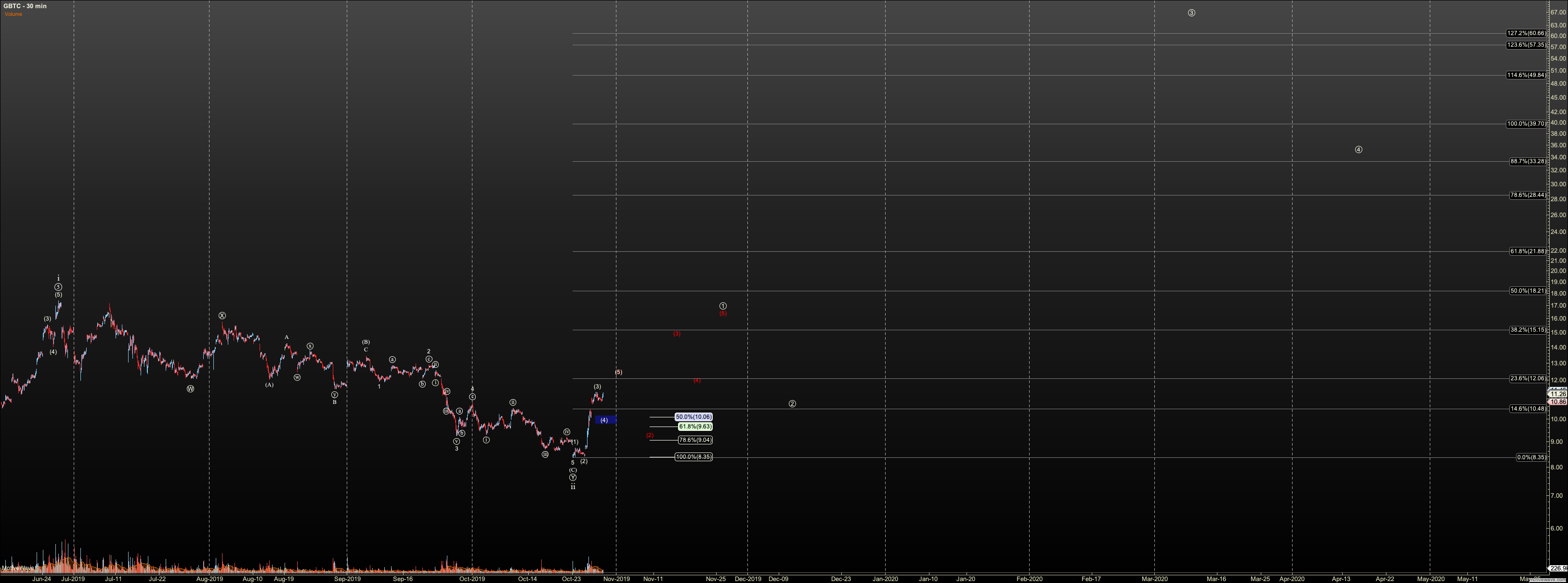

3. GBTC is running ahead of Bitcoin this week with a 10% increase in premium. I have to warn that it is starting to look like it wants to skip a degree through a mega extension. We see that in coins a lot, but never in GBTC from what I recall. If the case, we may be in a direct to $20-21 move which corresponds to $18K+ Bitcoin and $302 Ethereum. Honestly I hope that doesn't happen and we do instead top at $12 and get deep pullback. But if Ethereum and Bitcoin are done with the little 2, which is not confirmed but starting to show, this may just run. I am not going to count the 'direct to $20 move yet' but I do feel the need to warn. I have seen similar action before.