Nice Follow Through On Metals

Since the market is closed on Wednesday, and the metals have provided us a nice follow through today, I am providing the mid-week update a day early.

As the metals were completing their corrections over the last several weeks, silver gave us its usual high probability bottoming indications with the 144-minute MACD bottoming out. And, it was at that time I noted that looking down was not the most profitable of ventures any longer.

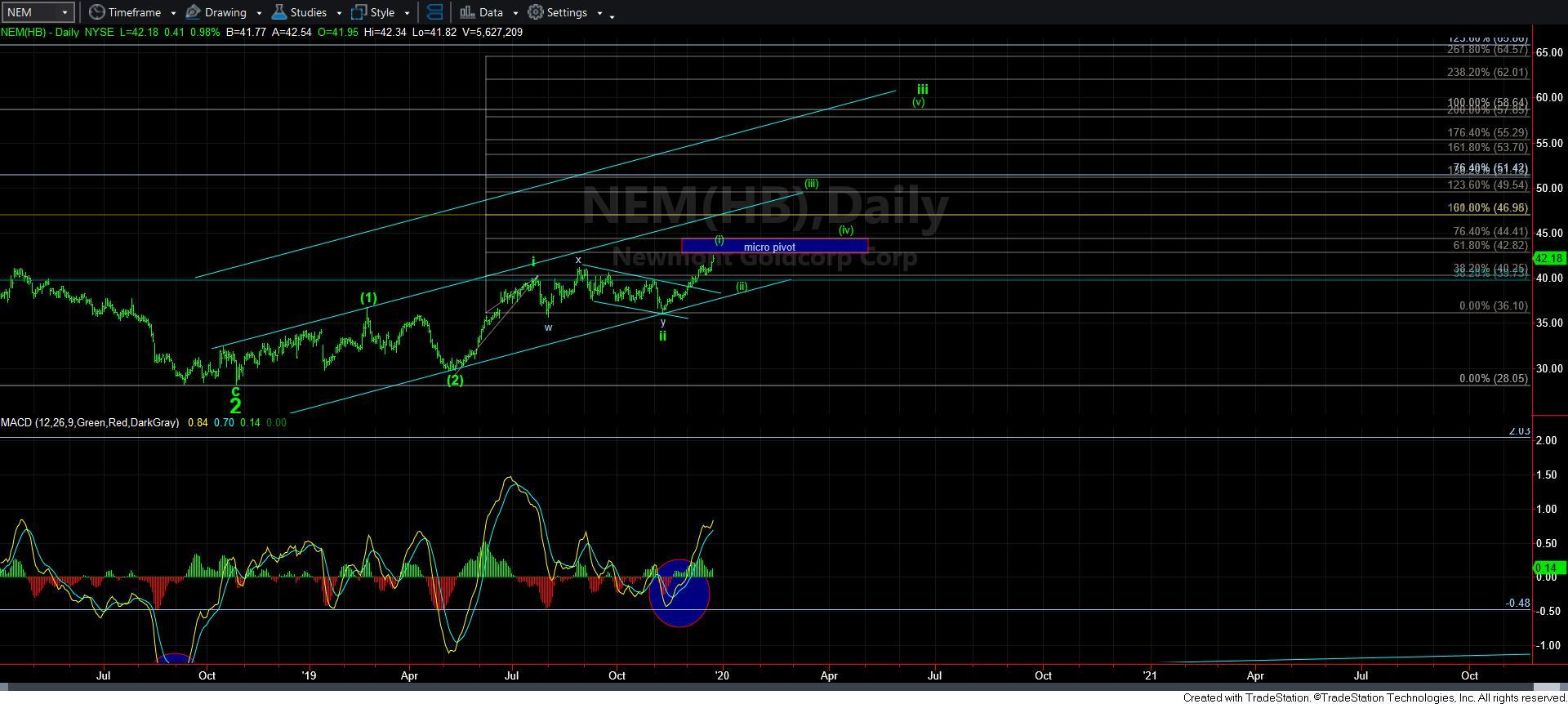

Since that time, the metals market has turned up, and we seem to now be within the heart of a 3rd wave of the 5-wave structure I wanted to see off the recent lows. And, as I have been outlining over the last several months, once we complete this 5-wave structure off the recent lows, and then see a corrective retrace, we will be ready for the major move higher I expect in 2020.

In following up on the silver structure, which to me seems the cleanest of the main charts we have been following, we are now in the wave [iii] within wave iii of wave [1] of the larger degree wave [iii], as you can see from the 144-minute chart attached.

Over the last several weeks, I have had many of our members question me about what our next upside targets in silver would be. And, until today, my answer has been that I need to be a bit more sure that wave [ii] has bottomed. With today’s action, I can more comfortably begin to project some targets in silver. However, I must warn you that silver does not always like to adhere to standard targets when it runs, as it is truly one of the most emotionally driven charts out there. Yet, I am going to provide some general guidelines so that you can at least begin to plan your trades.

Assuming we are able to complete 5-waves up in the current structure towards the target box for wave [1] (which is in the standard targeting region of the .382-.618 extension of waves [i] and [ii]), and we then see a corrective pullback in a wave [2], our ideal target for wave [3] of [iii] is the 1.236-1.382 extension of waves [i] and [ii] within the 23-23.75 region. Again, silver can always exceed this region for its wave [3], but that would be a reasonable target to work with at this time.

And, if we are going to go beyond that by another wave degree, then the bare minimum expectation I would have for silver’s [5] of [iii] would be the 25 region (1.618 extension), but with stronger potential to extend towards the 2.00 extension in the 27 region.

So, there are your general targets for the year 2020 in silver. But, it is all with the proviso that the current [1] [2] structure develops and triggers over the coming months.

As it relates to all the other charts, if you will simply peruse the specific charts, you will see we should be on our way to completing their respective 1st waves for the next rally phase they are setting up for 2020 as well.

Lastly, I want to remind you that until we actually complete this 5-wave rally, and follow it up by a corrective second wave, and thereafter break out over the top of the initial 5-wave structure, I am going to maintain patience with regard to trading the metals market from an aggressive posture. But, once that set up does trigger, then it would be an ideal opportunity to play the long side with leverage, as that would signal a 3rd wave melt-up phase during which we can profit quite handsomely utilizing Fibonacci Pinball as our guide.