Next Few Weeks Are Key In Metals

While there is potential that silver has seen a near term top, GDX may still have one more push higher, and gold is kinda in between these two potentials.

Starting with silver, while the upside really does look incomplete at the last high, I have to recognize the potential that it may have topped in a wave (i) pursuant to the count I am tracking on the 144-minute chart. But, we will still need a break down below the 41 level to make this a higher probability. For now, I have added a proposed path for the coming weeks. Clearly, I will adjust it as we get more information. But, as long as we remain below 44.50, I am going to be looking for a 2nd wave pullback. However, should we see a break out through that resistance sooner than later, then I will assume we are further along in the wave count, as per the weekly SLV chart I outlined the other day.

Gold still looks to need a pullback. Will that pullback be the yellow 2 or the c-wave of (4) is yet to be determined. We will need to see how the market breaks down below the 3650 level to begin to assess the nature of the pullback we want to see in the coming weeks. I would still prefer the green c-wave decline, as I have a hard time adopting such a rare count as I have outlined before. But, I will keep an open mind and make that determination based upon the structure of how we break down below 3650.

I have no way to even consider a 4th wave as being complete in GDX. And, whether we see a c-wave of a 4th wave decline or a more protracted a-b-c full structure (meaning we are still topping in wave 3) is also yet to be determined. However, I still view it as more likely that we are going to see a sizeable decline for a 4th wave, as I have no reasonable 4th wave to which I can point at this time.

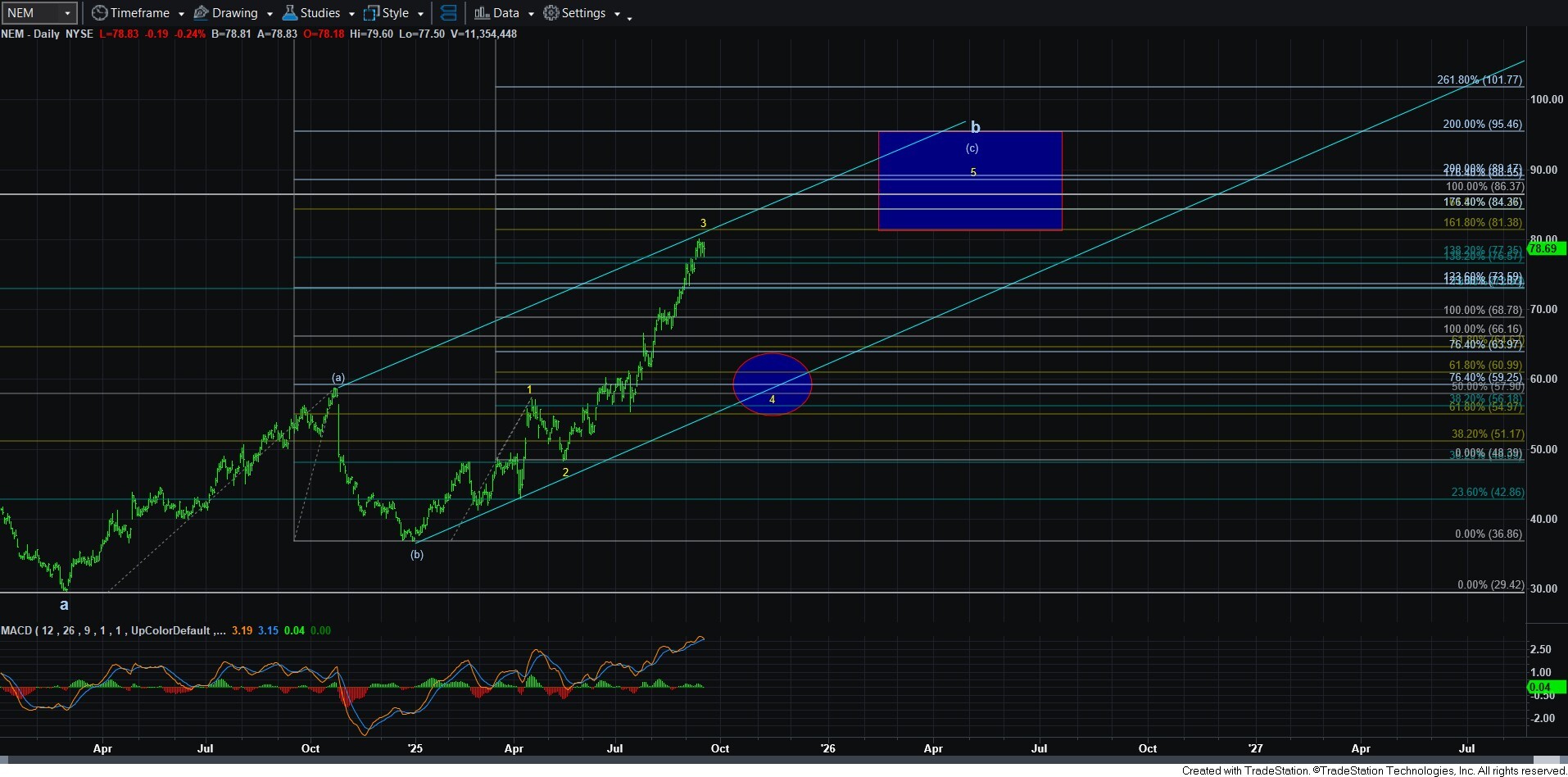

Moreover, NEM also strongly argues for a 4th wave pullback, which seems to best align with the c-wave in GDX. And, since we are likely dealing with an ending diagonal in NEM, it would usually see a spike down as a 4th wave, which often sees overlap into wave 1 territory. But, I added an ellipse for a general target for a reasonable expectation for a 4th wave pullback.

Overall, I am still seeking more of a correction/pullback across the complex. I know that is very hard to believe due to the extreme strength we have seen of late. But, it is hard to view this market as completing is long-term bull cycle without a 4th wave being seen. Therefore, I am going to maintain this expectation before I am looking for a final rally to complete this long-term cycle.