Next Few Days, Next Two Weeks

The next few days are very important to what's most likely to show up over the next two weeks. Because sentiment generally precedes both news and market movement, we can say that there are some very troubling globally impacting news themes likely over the next couple of weeks, or conversely, there would be a very encouraging global picture emerging over the next couple of weeks. And, if the markets are in an EW diagonal, and I don't know if they are (or specifically whether SPX is), then it would probably be a mixture of both extremes because diagonals seem to have a weird two opposing concurrent realities property associated with them.

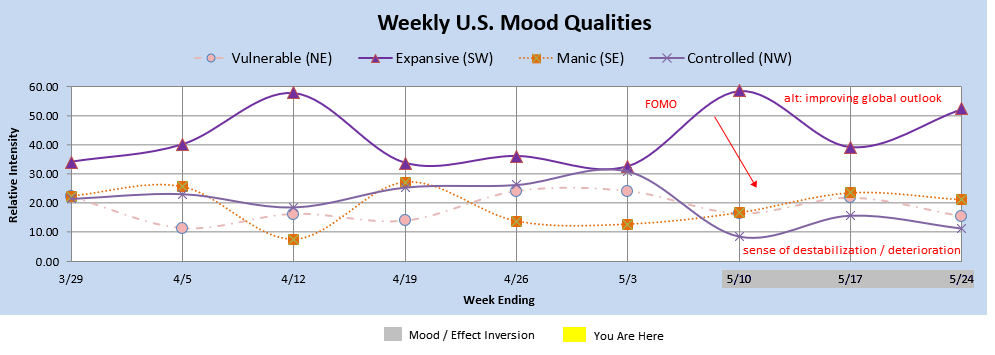

Today (Wednesday), we were looking to see if the bulls had any FOMO left to power one more push up. As of mid-day, it's been looking like they've been trying very hard, but not making much progress in terms of a rally of any kind. Although Thursday's MMI is calculated as up, more often than not, a downward move is usually seen following a FOMO pattern. Also, even though Friday's MMI is calculated as up, the mood pattern is a "let it go" pattern so we could see a release one way or the other. So, bulls are definitely on notice here to be cautious.

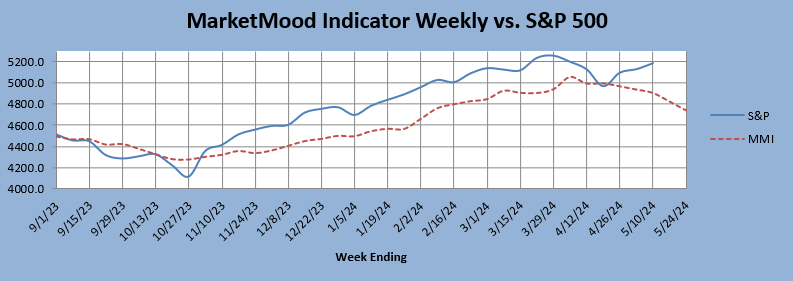

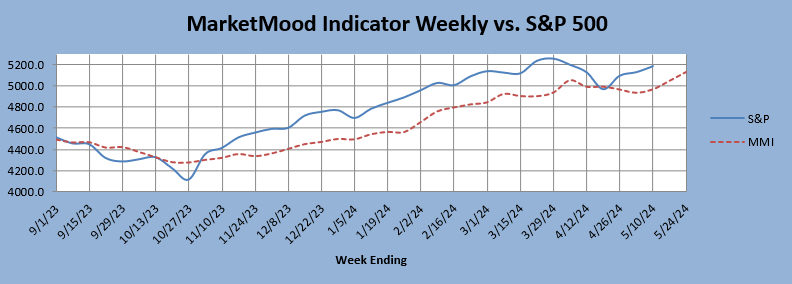

We are watching two weekly possibilities. A flip down this week, points the weekly MMI vs. S&P chart down for at least two more weeks. Without that, the weekly chart is pointing up for at least two more weeks.

Base case, flip down this week in MMI (or very early next week at the latest), market turns down sharply for at least a couple of weeks--

Alt case: No flip in weekly MMI, market keeps climbing for at least a couple of weeks--

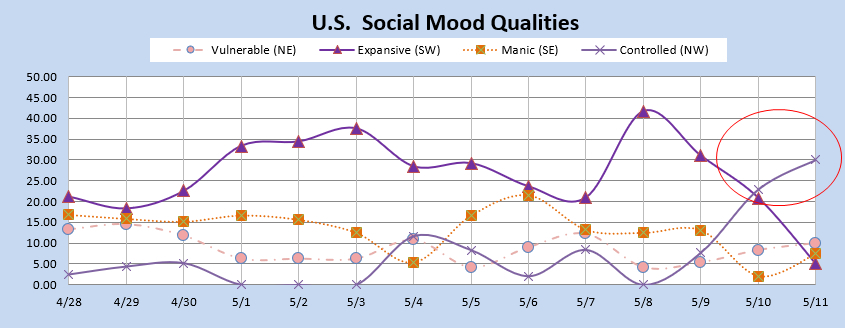

Also, something interesting is showing up in the daily mood pattern as the end of this week approaches that appears to support the flip case in the weekly chart. The weekly chart implies the "Controlled" quality becoming dominant in the flip case by end of this week / early next week, which would tend to show up in a very abrupt shift in an emotional sense to a much more serious mood overall. The daily chart (below that) has no flip, but has the Controlled quality becoming dominant Friday and Saturday. This can't be seen as definitive just yet but certainly is hinting strongly at something to pay attention to.

Weekly Sentiment Qualities:

Daily Sentiment Qualities: