Neutral on S&P 500 and Metals, Next Several Weeks Key

Our primary multi-week view on U.S. Indices is neutral. As represented by the SPDR S&P 500 (SPY), the market has support at 284-286 and resistance at 289-291 in the SPY.

The next several weeks has the potential to dictate the next 6-12 months. A corrective retrace into mid-June that stays below 290-293 supports a conditional probability of a sharp drop through the summer. Above 290-293, and all-time high odds in the 300s increase quickly.

At the micro level, the next resistance band is at 289-291.

Here are the paths: (1) [P=65%] SPY finds a bottom in the 273-275 area and then bounces to as high as 290-293, or (2) [P=35%] SPY goes more directly to ATHs, above 293.

Bottom line: In an ideal world, SPY pushes higher into mid-June, but stays below 290-293, which sets up the highest probability path for the actual waterfall. However, similar to the thoughts above, the rate of change in probabilities is a bit concerning for the bears and needs to be watched. This could mean that a tradable long higher could be in the offering for a swing trade even if a more sustained path lower is found after that.

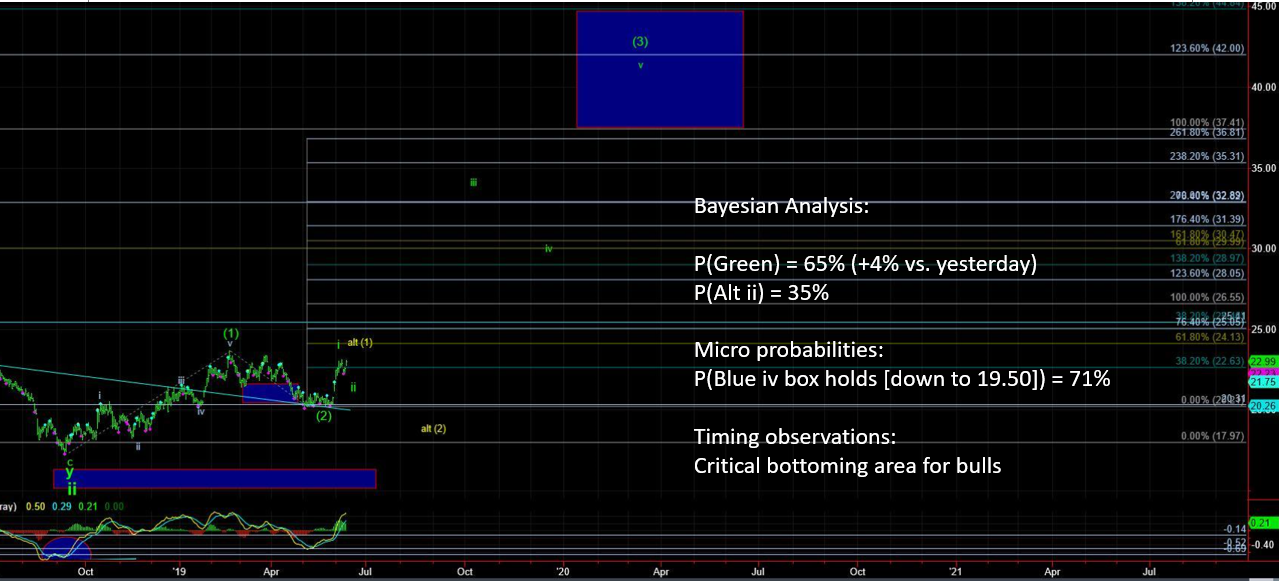

In metals our primary multi-week view also is neutral, with GDX support at 21.50-21.75 and resistance at 23-23.50.

Let’s keep with the path simplifications for now: (1) [P=16%] GDX continues to the moon, (2) [P=62% ] GDX sees a retrace that holds as deep as 21, and (3) [P=22%] GDX gets below 20-20.50.

Given the rate of change and the nature of the pullback that did satisfy path 2 (the lower 22s were seen, but not a 21 handle). a set up for a sustainable swing trade long is in the making. Be on the lookout for a signal change.

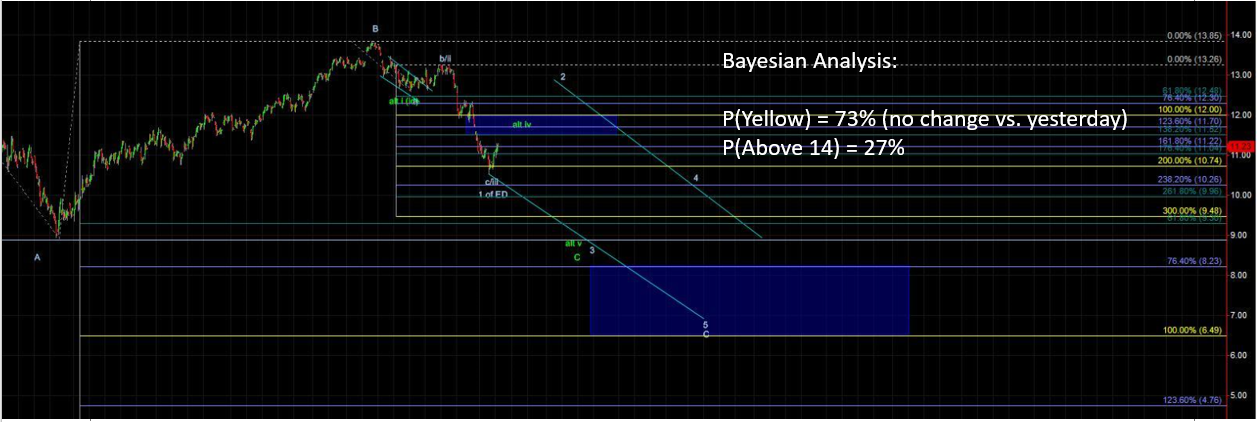

In oil, our primary multi-week view is short. Support in the USO is at 11.50, with resistance at 12.25-12.50.

In the morning on 6/12, the our Bayesian Timing System triggered a short with the micro probabilities pushing the signal into short territory. The action in the afternoon of 6/12 confirmed that path lower; however, I would add that any “obvious” deviation from a path lower is a warning shot to this bearish signal (and in all honesty, the way things look pre-market, a risk management based change back to neutral could be on deck). Watching closely.

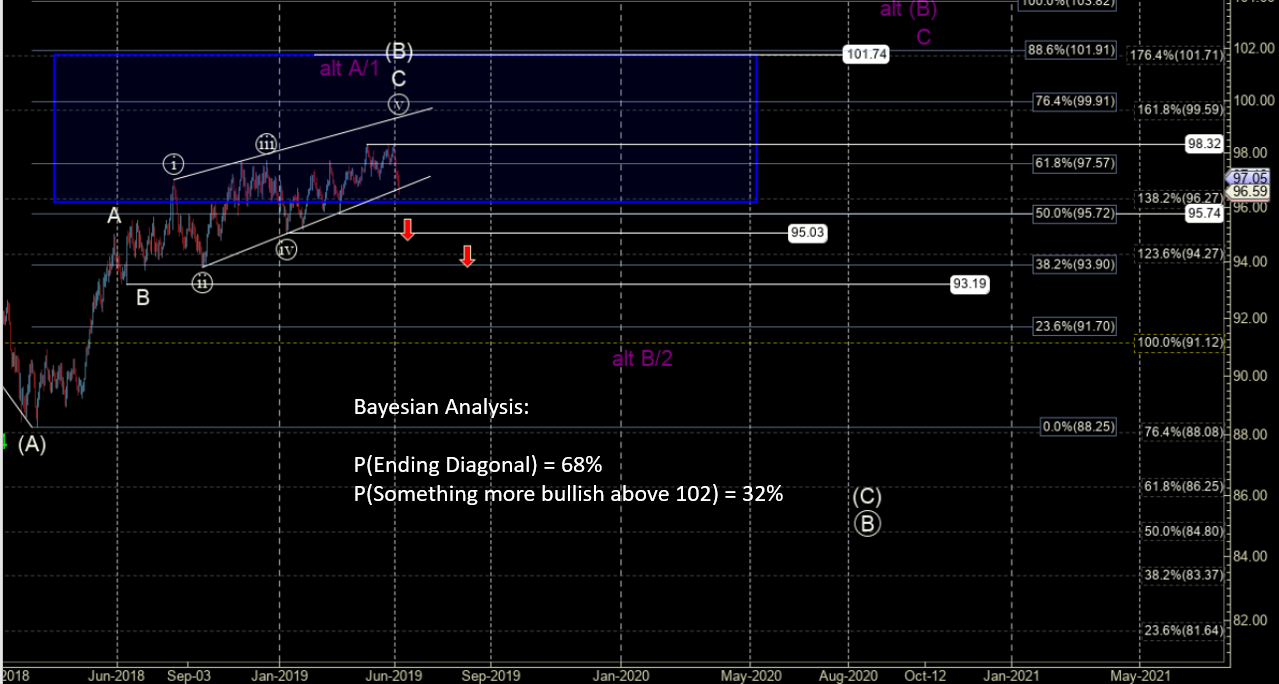

In the U.S. Dollar Index (DXY), our primary multi-week view is bearish. Support is at 25.55 in the UUP, with resistance at 26.50.

UUP continues to chop around with a spike and reversal lower the most likely outcome. The more this churns above 26.10, the higher the chances of another grind higher back above 26.50 before another attempt at a spike and reversal. In fact, Bayesian odds support nearly 2-to-1 that one more high will be seen before lower.

Note: For members interested in real-time trade signals for a dozen or more ETFs across a range of commodities and industry sectors (TLT, UNG, XLE, XLF, XBI, etc.), you are encouraged to check out the Bayesian Analysis Plus service.