Neutral To Bearish Heading Into Wednesday

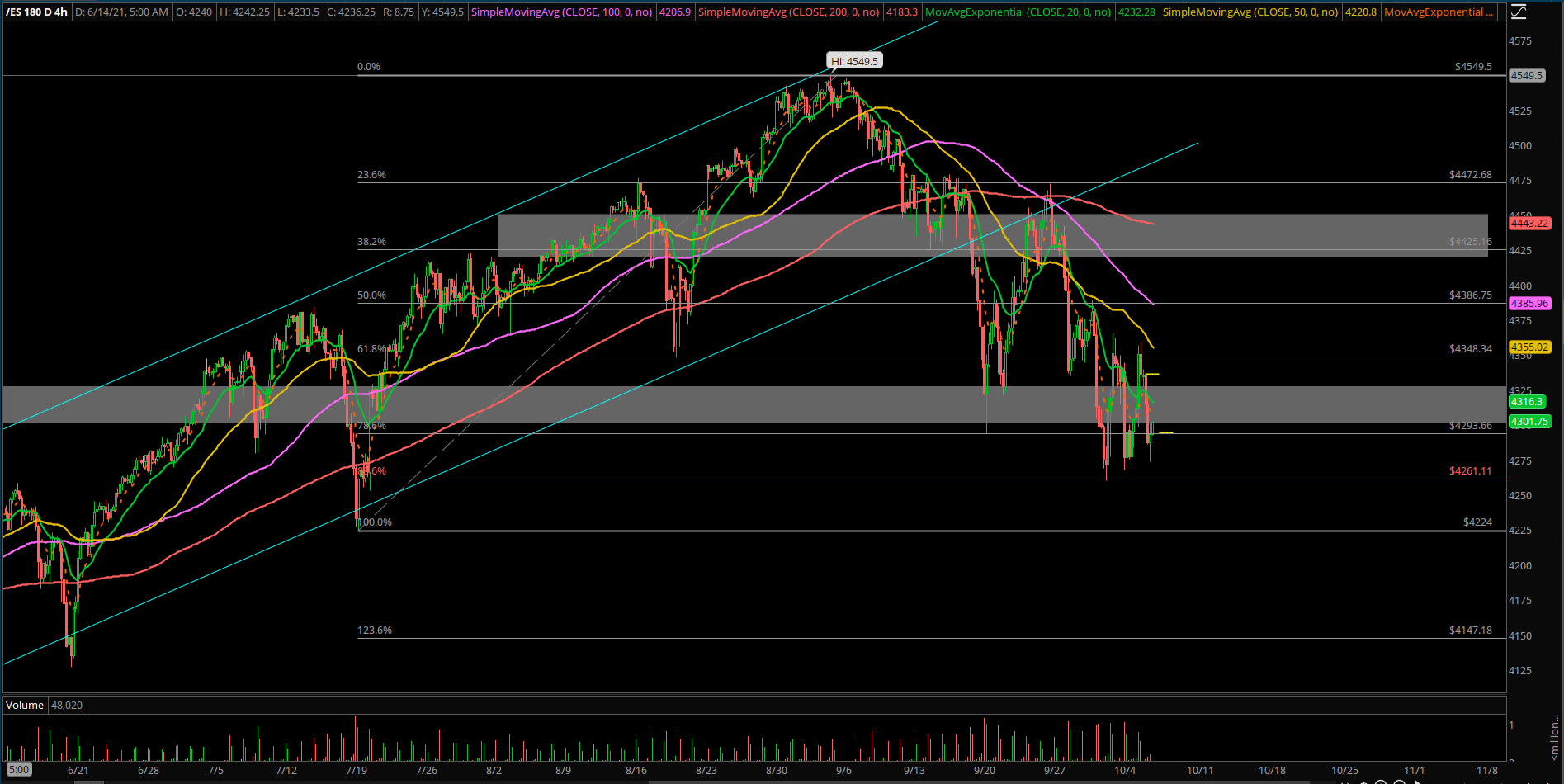

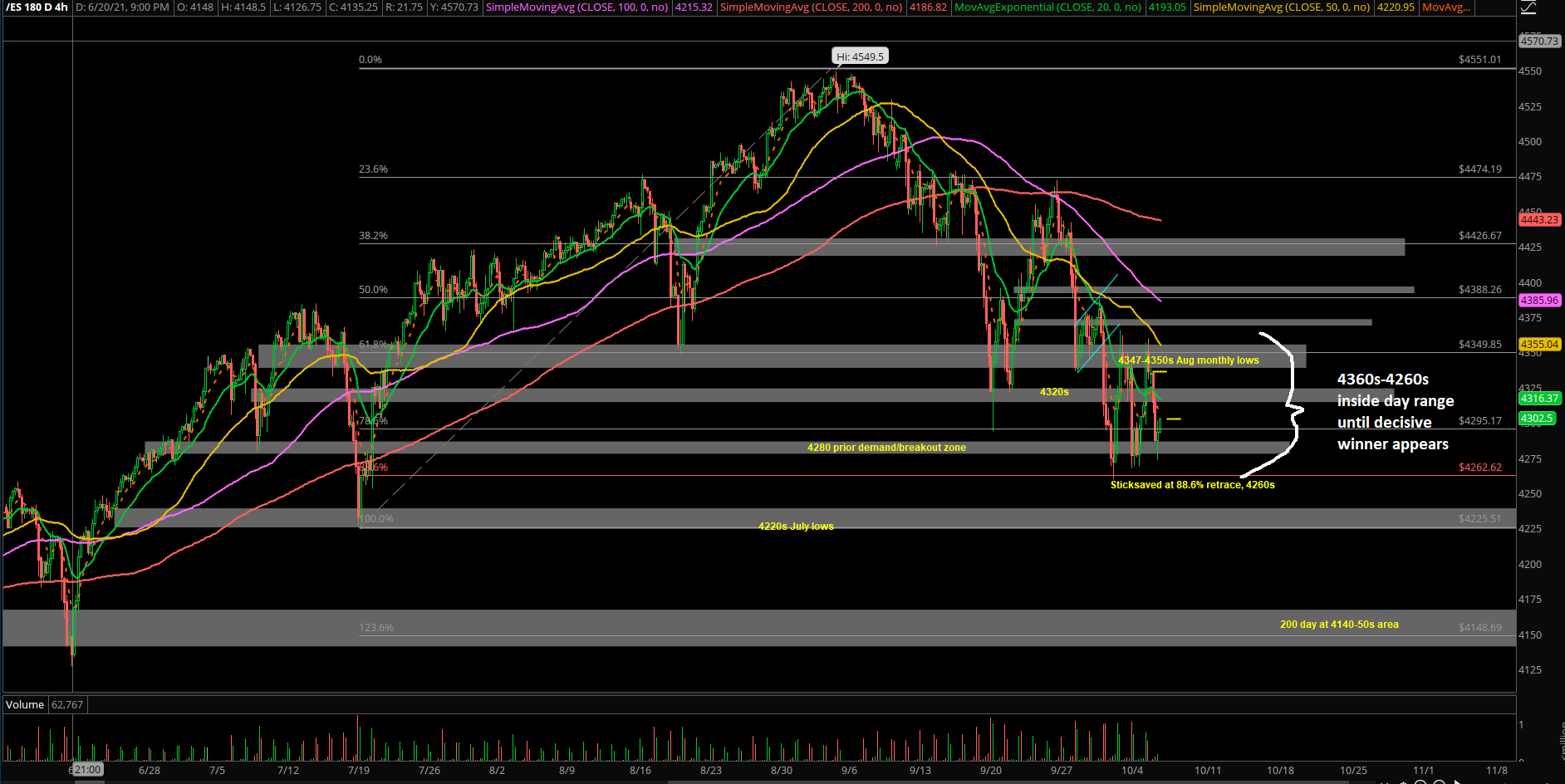

Yesterday’s price action broke above the 4320s on the Emini S&P 500 (ES) and went into a trend day mode. We quickly fulfilled key resistances of 4350-4360s. However, bulls could not sustain the highs into the closing print, and the ES got rejected back down to 4330s for the EOD print.

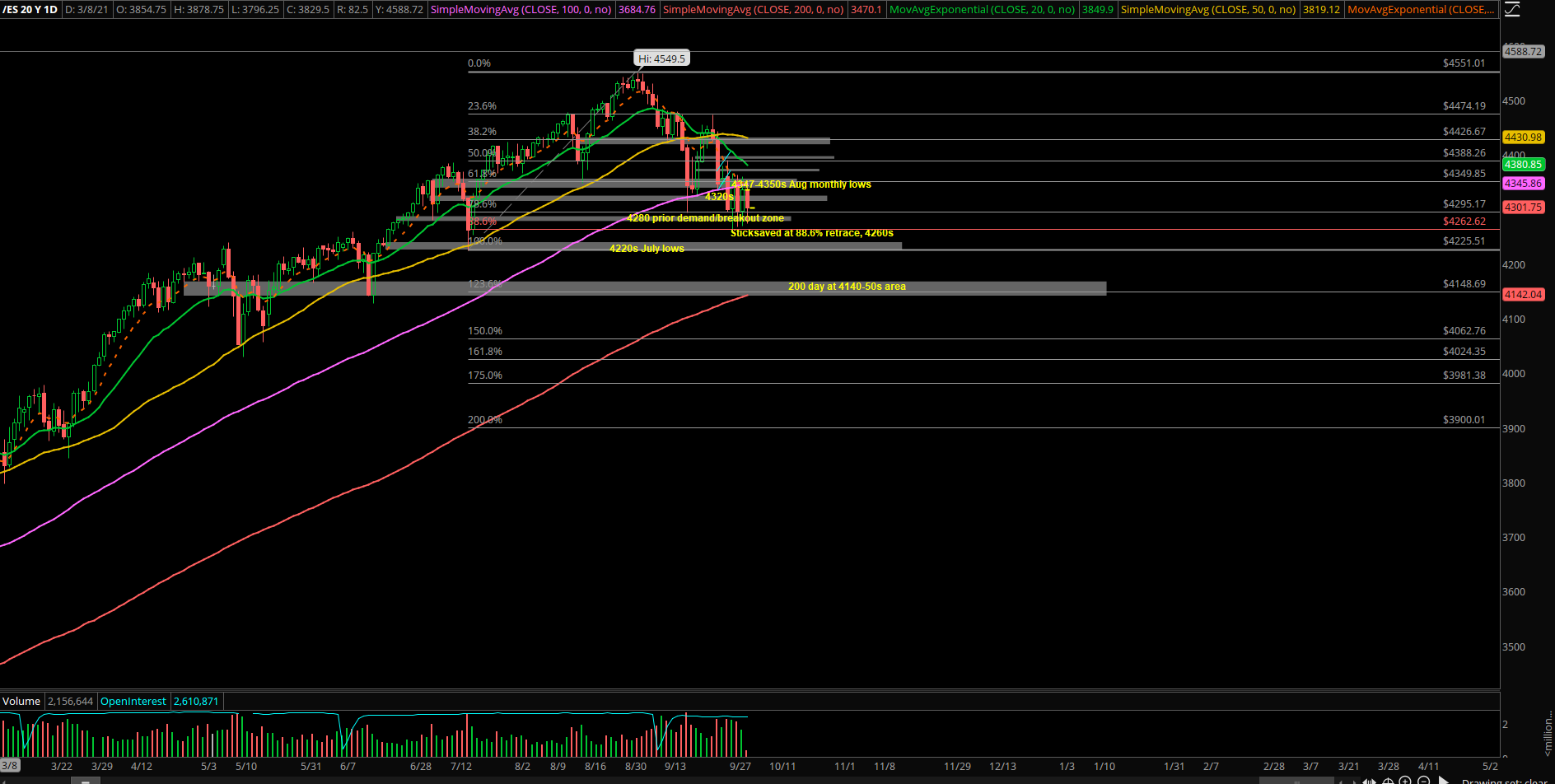

Overnight action has been a continuation model of yesterday’s inside day result. Now, the past 5 sessions could be treated as bearish consolidation, so ultimately the bears need to get below 4260s to immediately flush towards 4220s/4150s

We’re neutral to bearish heading into today given the multiple rejections at 4350s-4360s over the past few days. As of writing, price action is still trending below the key daily 8+20 EMA.

Ultimately, 4360s-4260s bearish consolidation has downside risk of 4220s/4150s. Short-term immediate resistances are 4300, 4320, 4365 need to sustain above the latter to squeeze into 4385/4400/4420 bigger targets. First clue is to either conquer or reject at 4320, similar to yesterday.

Just need to be careful of inside day ranges of 4360s-4260s continue indefinitely until boredom sets in and we finally we get a decisive winner.

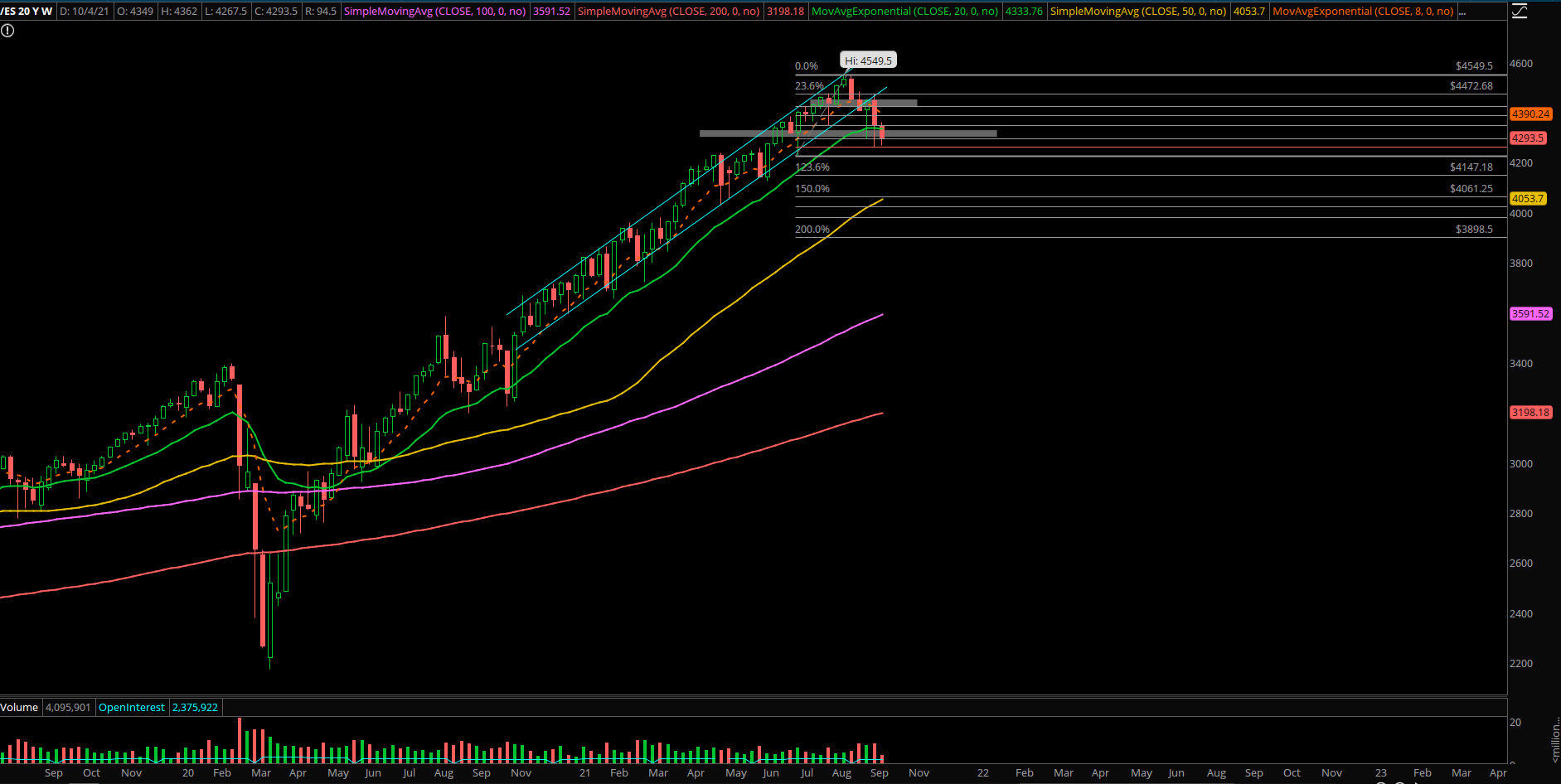

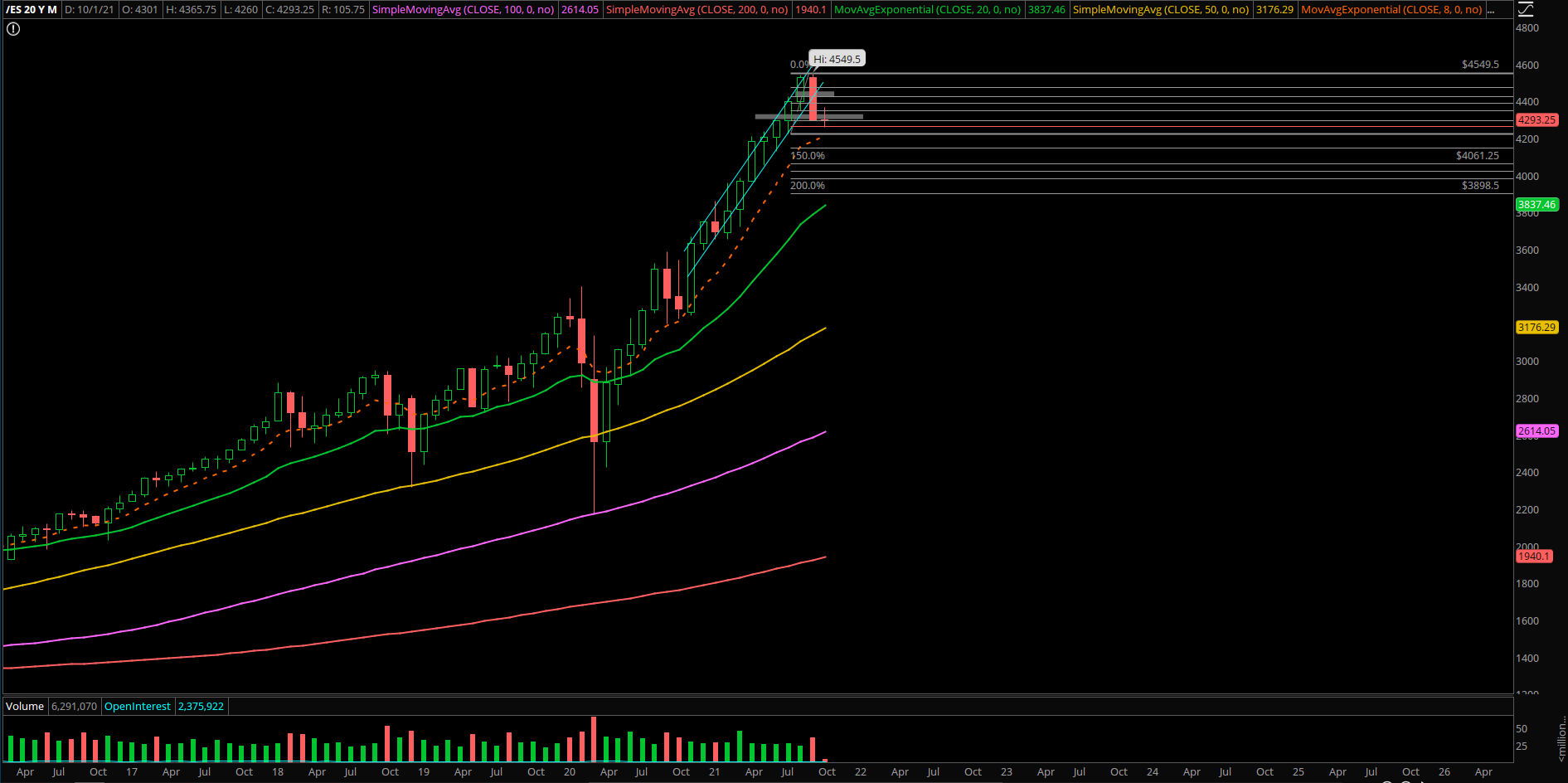

Bigger picture wise, still looking for 4500-4520, then new ATHs heading into EOY. No solid bottom yet, so it’s a work in progress.