Nearing a Pullback - Market Analysis for Feb 5th, 2021

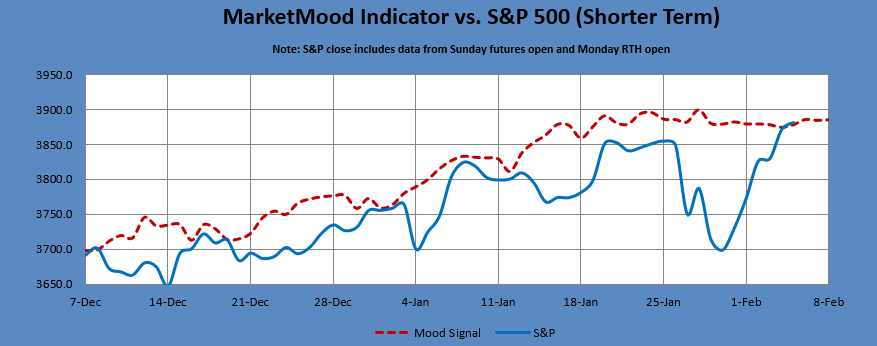

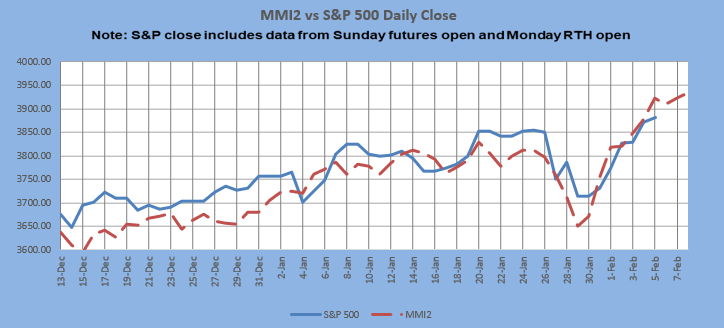

This past week's mood pattern reflected a focus on the government and themes of victimization or feeling attacked. That played out in the news, although when presented in the weekly sentiment analysis section of the latest video (23 Jan), I have to say I had no clue this pattern would be related to U.S. Congress members feeling unsafe and another member being formally reprimanded by the opposing party. The coming week's pattern points to negative facts, news or data. With this pattern along with the bigger picture outlook, a local top and pullback would be a reasonable expectation and something to watch for as the week plays out. Even so, don't forget that the long term trend remains up and is expected to remain up through March (even with a February pullback).

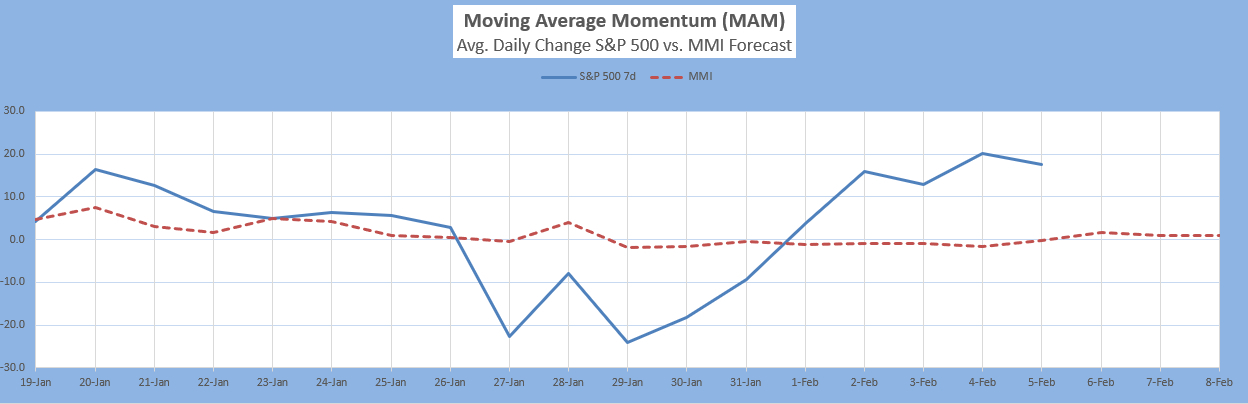

Although a clear change pattern has been in play since yesterday, MMI had no call for today. MM Trend Trader continues to point up. As long as the S&P 500 stays above 3856 Monday, the near term trend remains up and the bulls stay in charge.

Saturday would be a breakout or breakdown day if the market was open, but it's not. There is no clear call for either Monday open or Monday (so far) and weekend futures are likely to be mixed.

Latest daily charts: