NVDA: Strong Earnings, Stronger Expectations

Nvidia has become the clearest symbol of the AI era — not just because of what the company is earning today, but because of what the market expects it to earn tomorrow. Few stocks illustrate the modern push-and-pull between fundamentals and crowd behavior as clearly as NVDA. Earnings growth has been extraordinary, margins remain robust, and by traditional measures the stock has not looked egregiously overvalued for much of this run. And yet, something important has shifted.

As valuations climb into rarefied air, the debate is no longer about whether Nvidia is executing — it clearly is — but about how much of the future has already been committed to price. Expectations, once a tailwind, can quietly become a source of risk when they run ahead of saturation, competition, or simple arithmetic.

Lyn Alden recently laid out this tension in clear terms, highlighting both the strength of Nvidia’s fundamental case and the less-discussed vulnerabilities embedded within it. Her commentary frames the landscape well — not as a call to abandon the stock, but as a reminder that great earnings and great expectations are not the same thing.

Lyn Alden Weighs In

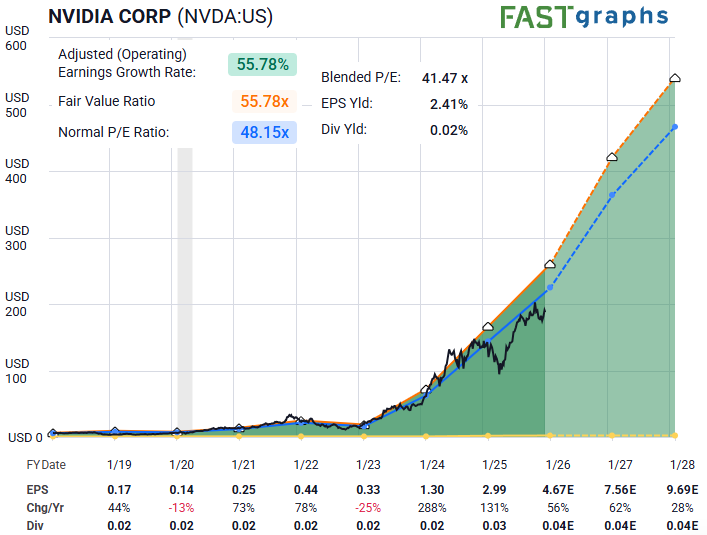

“Nvidia continues to be fascinating from a fundamentals perspective. For this entire bull run, despite surpassing a $4.5 trillion market capitalization, it has not been particularly overvalued in terms of its earnings multiple. In fact, it's trading at a comparable earnings multiple to Costco.

Instead, where the valuation risk shows itself is in its sales multiple. A mature company trading at over 20x sales is hard to maintain indefinitely.

AI-related chip names are trading very differently now than they did prior to the AI boom, and once AI becomes saturated, there is a significant risk of a gravitational pull down. The fundamental bull case remains obvious: massive earnings growth with a reasonable earnings multiple slapped onto it. But there are three main fundamental bear risks to be aware of — and to have an opinion on — if one is going to have a high conviction about the stock.

- The first is about market share. Nvidia is the leader in GPUs, but there are competitors for cheaper price points, and this is a constant arms race. Additionally, TPUs are a competitor in some areas, as Alphabet has recently demonstrated.

- The second is about datacenter bottlenecks. Although the global demand for AI processing seems nearly unlimited at this time, there are some real constraints in terms of construction speed and power distribution for datacenters. These aren't insurmountable but they can result in delays. Even if Nvidia retains its massive market share advantage, a slowdown in datacenter development can eventually result in a slowdown in Nvidia sales.

- The third is that whenever Nvidia's products reach their saturation point, the earnings multiple could fall. It makes sense to trade at over 40x earnings while earnings are growing rapidly. But if Nvidia eventually saturates the market and loses its growth trajectory, it would be reasonable for that earnings multiple to fall to 20x or less.

Thus, as an investor pencils out the next 5+ years of growth, they should consider the risk of an earnings multiple drop. If earnings multiply by 4 but the earnings multiple gets cut in half, that's only a doubling of the stock price, for example.” — Lyn Alden

Sentiment Speaks

Fundamentals tell us what a company is doing; sentiment reveals when the market is prepared to reward or punish it. This distinction matters most when expectations are elevated, because price no longer responds linearly to good news — it responds to shifts in crowd behavior.

That is why we turn to sentiment here, not to contradict Nvidia’s earnings power, but to assess whether the crowd is still acting in expansion mode or quietly transitioning toward completion.

Markets do not price in outcomes with omniscience; they express collective behavior through structure. And that structure, when examined across degrees, allows us to gauge whether enthusiasm remains expansive — or is beginning to compress. To answer that, we now let price speak for itself.

Take a close look at what Zac Mannes is sharing here. This is crowd behavior manifesting itself right before our eyes. Within this display of sentiment, we can recognize that the move up from the low struck near Thanksgiving is clearly a three-wave advance. In fact, it would seem that this micro structure is 3 waves up for the (a) wave, 3 waves down for the (b) wave, and now a completed 5 waves up for the (c) of circle ‘b’. If true then what’s next?

Price should form a micro 5 waves down from this current area to better confirm the circle ‘c’ wave underway. Breaking strongly above the $195 area in the near term would begin to make this less likely. The target below for ‘c’ should range somewhere in the $154 region.

From that point, if/when seen, we would anticipate a corrective, overlapping structure to form a bounce — typically back up to about 50% of the prior decline. But that is a few steps ahead from where we currently find ourselves.

The key takeaway is that crowd behavior is flashing a yellow light in the near term. NVDA remains a phenomenal company. But at this stage of the run, the question is no longer how strong the earnings are — it’s how long the crowd’s behavior continues to pay for perfection.