NLY: Not Just Another Pretty Dividend

Produced by Levi of StockWaves, along with Rida Morwa of High Dividend Opportunities

This series of articles is intended to provide Elliott Wave and Fibonacci Pinball Analysis as an accompaniment to Rida Morwa’s High Dividend Investing (HDI) Service. Our goal is to provide greater context as to where price is within the trend for the opportunities being presented by Rida Morwa’s High Dividend Investing (HDI) group. This will include support regions for potential entries and target regions for the bigger trend.

In this article, we’ll be providing analysis on NLY (Annaly Capital Management Inc).

In High Dividend Investing, our strategy coming into 2022 is to focus on making swaps that improve our income. Selling holdings that have realized significant upside and have lower yields, and rotating into holdings that have trailed with higher yields and more upside.

One pick that has our attention from both a fundamental and technical perspective is NLY. Let’s dive in.

Annaly Capital (NLY) is an "agency" mortgage REIT, meaning that its primary investment is in mortgage-backed securities that are guaranteed by Government-sponsored Enterprises. If a borrower defaults, the GSE will buy back that mortgage at face value.

Agency mREITs find themselves in unique times, and is another classic case of the market following changes in NAV, without considering the big picture. After having a very strong first half in 2021, agency mREITs lagged in the second half as NAVs fell. The market ran away from them. The irony is that this decline in book value was essential for NLY to improve its earnings!

When asked about what it would take to raise the dividend in the last earnings call, CEO Finkelstein said: “In terms of what we want to look for to increase the yields or increase the dividend, we would need to see obviously wider asset spreads and better investment opportunity, more durable earnings. We feel good about where earnings are this quarter, and we feel good about covering the dividend into 2022, certainly. But we do recognize that we have out earned the dividend consistently since the second quarter of 2021.”

To raise the dividend, NLY's management wants to see "wider asset spreads". What does that mean in English? It means that NLY wants to be able to invest at higher yields. Higher yields occur when MBS prices come down. When MBS prices come down, the value of already-owned MBS goes down. This means that NLY's book value has to come down in order for them to raise the dividend!

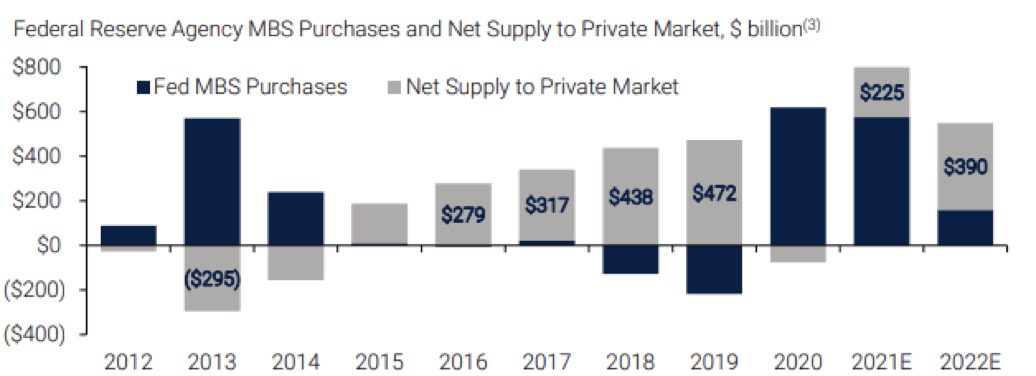

The core problem in 2021 was the Fed buying up all the MBS.

- Source: NLY Q3 presentation

In 2020 and 2021, the Fed bought almost all of the MBS and the Fed bought "blindly" at whatever market price was. As a result, MBS prices have been artificially elevated throughout the year. NLY's response to these conditions has been to remain patient. Management recognized that eventually, the Fed would stop buying so much and that eventually, prices would come down.

Knowing that a price drop was coming, NLY allowed its leverage to drop to 5.2x debt/equity. This compared to 7.2x debt/equity before COVID. This ensures that when prices drop, NLY would be in a position to leverage up and invest at lower prices (higher yields) and get the most bang for its buck, as opposed to some other mREITs that have maintained 8x+ leverage levels and will be unable to buy more. NLY was right, MBS prices were set to come down. Prices drifted down throughout the second-half of 2021, and took a sharp turn down the first week of 2022.

This is the buying opportunity that NLY has been waiting patiently for!

Some investors like to chase around book value, panicking when it declines 5%. We focus on the cash flow. We can get an 11% yield from investing in NLY today, and conditions have improved to the point that NLY can finally consider leveraging back up turbocharging their earnings. The excess earnings will quickly rebuild book value, and will also provide the option for management to increase the dividend substantially!

How can Elliott Wave analysis help us here? This is where our un-matched partnership between technicals and fundamentals gives an extra advantage to the trader/investor.

Briefly, Elliott Wave tracks human behavioral patterns and then places that in a structure that can be followed, and even anticipated, so as to tell us what is most likely next. No analysis method is infallible, however as we have observed for many years, this one keeps us on the right side of the market much more often than not.

What does the current structure of price in NLY tell us? The liquidity crunch of March 2020 was a fire sale for just about all names like NLY. According to human sentiment, the world was ending. These names, and many others, were thrown in the dumpster along with just about everything else.

However, the subsequent bounce from those seemingly cataclysmic lows now tells us what is more probable to take place. For as long as NLY remains above the $7.00 level, we can project to the $11 - $12 range as the next major swing high in price.

In this current stance, we would anticipate 5 waves up. As you can see on the attached chart, we are counting wave 3 as complete and wave 4 as either already completed or very near to doing so.

One of the tenets of Elliott Wave analysis is the principle of self-similarity. This means that 5 wave structures will be apparent at differing degrees and scales of the larger structure. What’s more is that when we are in the corrective phase of the rally phase (wave 4) that correction will typically divide into 3 waves, a-b-c. However, the ‘c’ wave of that correction will also be 5 waves.

Note what we are seeing when we zoom into the NLY chart. The ‘c’ wave is indeed composed of 5 waves down and exactly into the 2.00 extension of the waves (i)-(ii). That is a typical target to strike in a wave (v) as shown. What would we need to see to confirm that a swing low is likely in place? A move back above $8.35 should trigger a larger rally in price. So, for as long as NLY remains above the $7.00 level, should one enter at the $8.00, the risk down would be -$1.00 while the upside is as much as +$3.00 to +$4.00 in capital appreciation.

But, don’t forget the +11% dividend! The investor will get paid to wait for the projected appreciation in price. This makes NLY one of our favorite income-generating picks at the moment.