My Plan On Metals

I want to be very clear about my view of the metals complex so there is no mix up.

I am uncertain as to how to even view the GDX as a reasonable bullish pattern. Rather, we have a lot of overlap which could mean that the bigger wave 2 may take a bit more time. And, this will be my perspective as long as it remains below 25.75. It would take a break out over 28 to make me view this as immediately bullish, and then looking to levels of 40+.

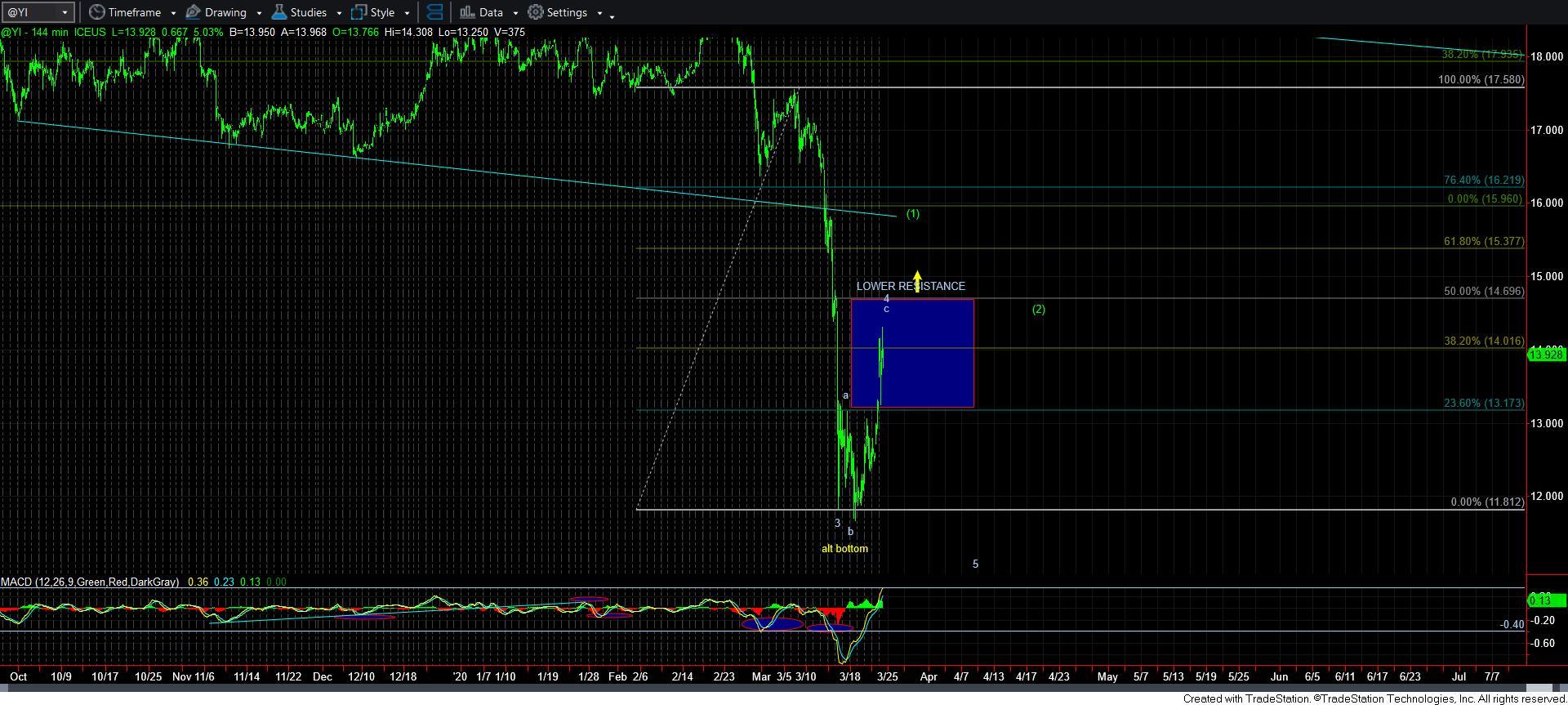

As far as silver is concerned, it is still within the resistance region noted on the chart, so there is a strong probability that we can see that dreaded lower low. But, if we can continue through the resistance, then we can complete wave (1) of the next rally phase. So, I am simply waiting and watching on this chart.

When it comes to GLD, the main concern I have is the 1-2 downside structure in red. While I don’t think this is a high probability, I think it is enough of a probability for me to buy hedges on the GLD to protect my portfolio. Now that we are in the target box today, I am going to stick to my plan laid out before and protect my portfolio. So, as long as we remain below 155.50, I maintain this concern. That is the 8-minute chart resistance, whereas the daily resistance is clearly the prior high in the 159 region. Through that, and the door opens again to the 170+ region for wave 5 of v of (3).

So, it is based upon the uncertainty within the various structures that causes me to remain protective at this time. I hope this clears up my perspective