Much Better - Market Analysis for Jan 22nd, 2025

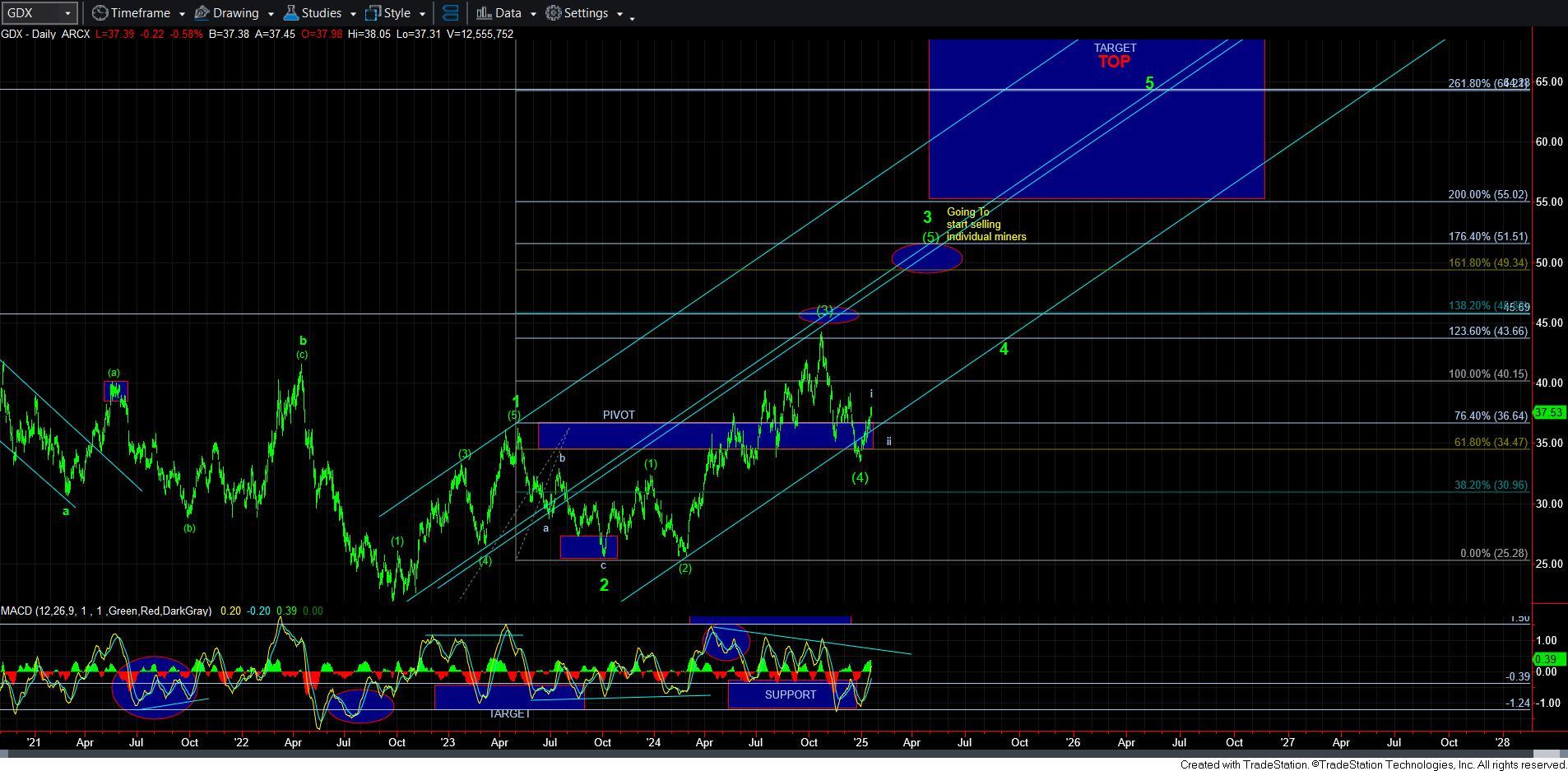

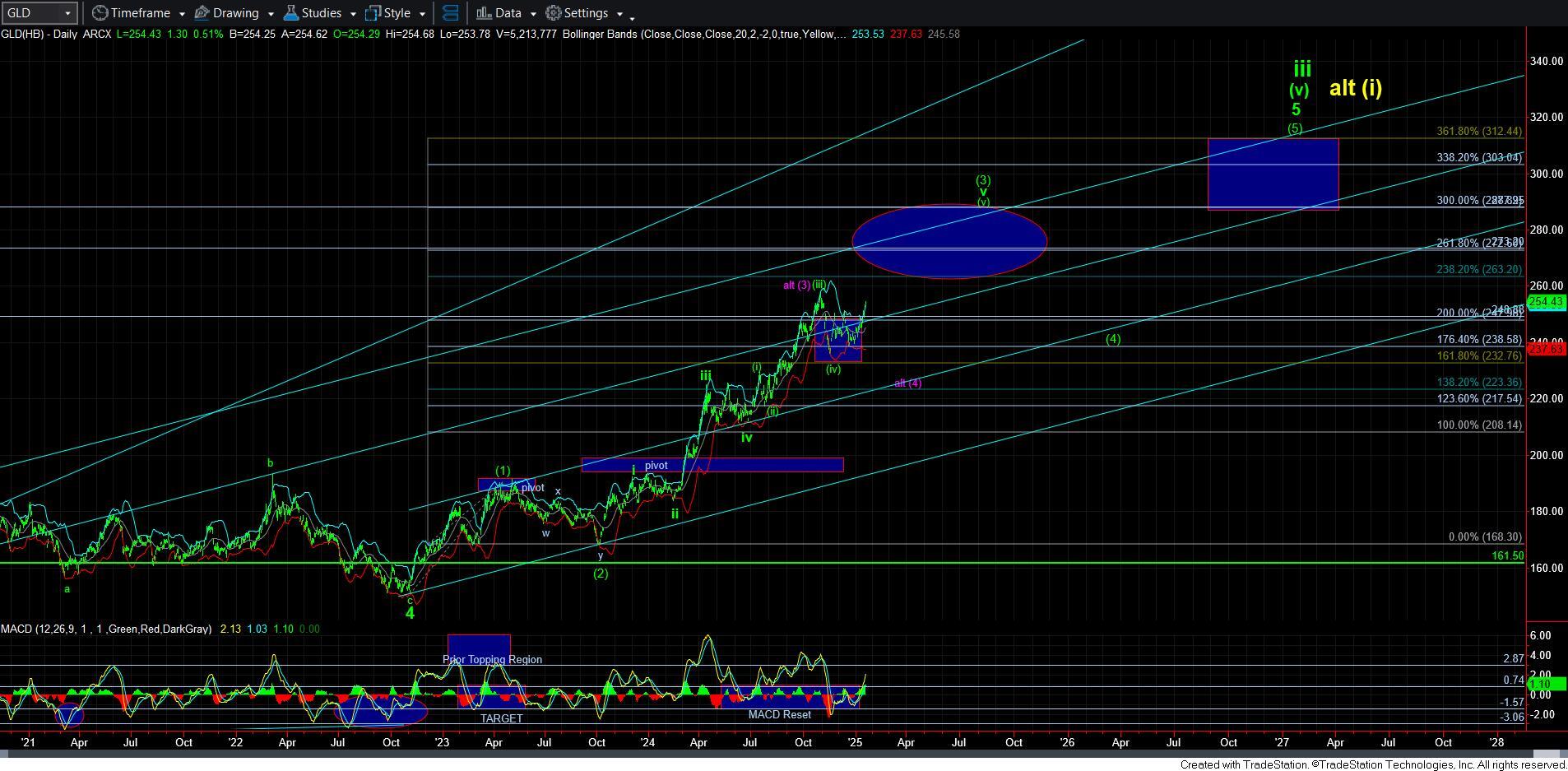

Well, the continuation higher this week has certainly made the GDX and GLD charts a much better leading diagonal structure. So, the probability that their lows are in place have certainly increased.

To make this update very simple, we are now seeking a 3-wave corrective structure in a pullback to make it an even greater probability that we are ready to rally again over the coming weeks and months.

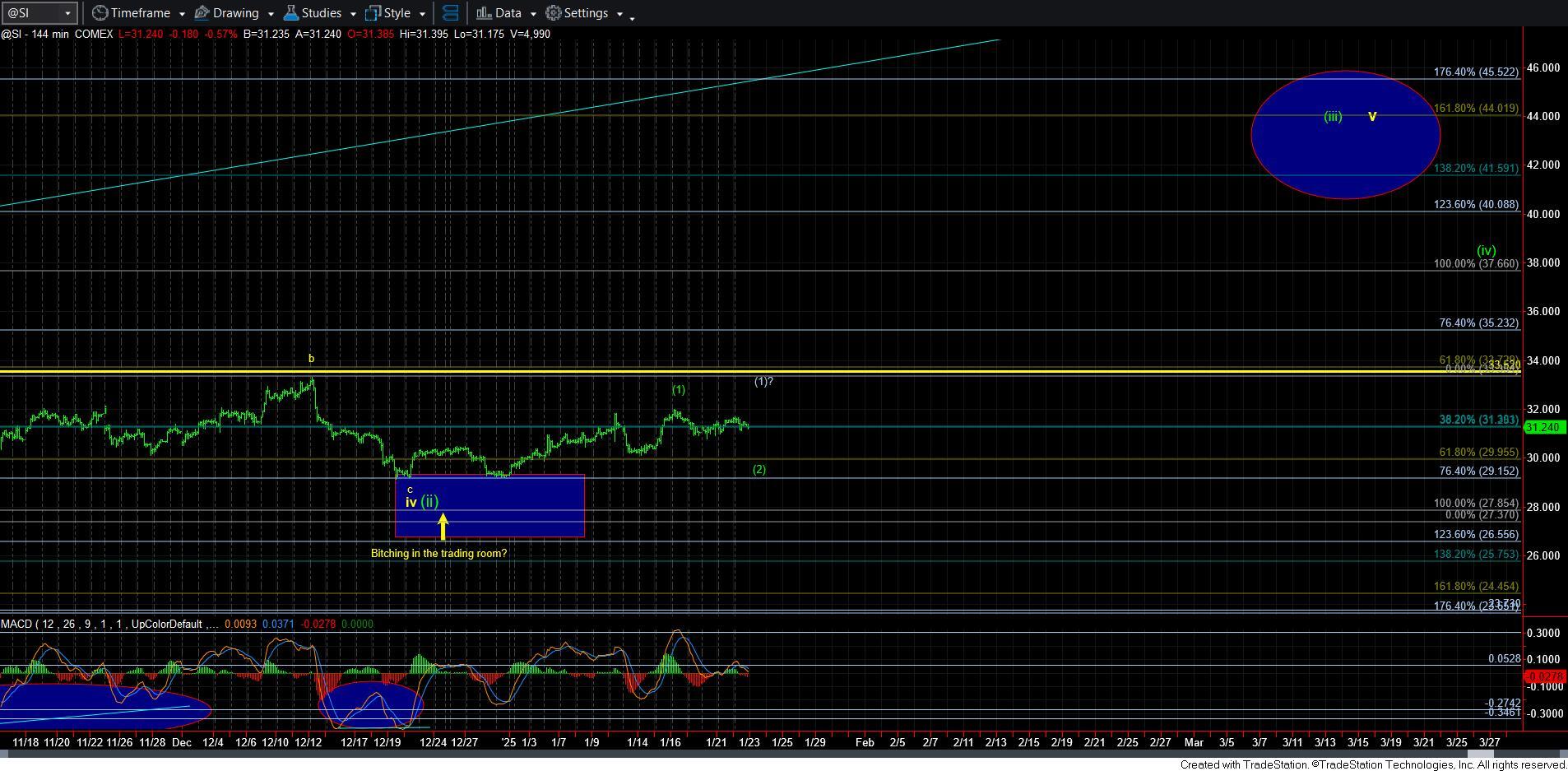

Yet, silver is still leaving the door open for a potential lower low. I really cannot view it as likely as GDX and GLD, as we did not reach the prior highs in silver, which really was my ideal target zone for a wave [1]. So, for now, I view silver as a little less likely that the next rally has begun, as it still retains more probability for a lower low than I would prefer at this point in time.

In summary, I am preparing for a pullback in the metals complex. And, both gold and GDX suggest that the pullback can be a corrective one, which would set us up for a multi-month rally in both those charts. Should silver see a corrective pullback as well, then we can begin to look much higher in that as well, with the ideal targets pointing us north of 40. But, again, silver is not quite as clear that a potential bottom has been struck, so I am leaving the door open for a lower low into the support box before the next major rally takes hold.

Once we begin to pullback, then I will add the support zones for the various 2nd waves in these charts. But, please do remember that we often see deep pullbacks from leading diagonals.