MoodMusings: Complacency and AI

While bulls are cleaning up for the moment, the market (to many that have been around awhile), seems to be shouting "Don't Be Complacent!" Over the last few years, I have spent many hours developing sentiment based trading systems on differing scales as a lower risk alternative to the daily MMI up and down signals. For months now, they have been relatively quiet, probably the most boring trading systems on the planet as they predominately have been saying "No Trade." The LTTI is still reading "Strong Bullish," but I decided to get out early so as not to stress about overnight gap risk (about 150 SPX points ago, but it was still a good 250 point trade). So, as I sit here, bored and decidedly not trading while the market continues ever higher, I'm asking myself if it's possible that I'm being complacent in a another way besides leaving too much risk on the table.

For the last few weeks, sentiment has been scattered and apathetic to an extreme. In general, it appears that nobody cares much about anything in particular, which has made data gathering simple, but with very little nuance and little clear conviction input into MMI, resulting in ambiguous outputs. I have been OK with riding this out, and as we near what is likely the final squiggles in the immediate run up I still have to wonder... "how much longer?"

So, I started considering-- since we are all under the sentiment umbrella of a b wave or diagonal or whatever this is that has people unfocused, ambiguous and complacent, how might I be participating in being complacent? Is it possible that I've gotten lazy or sloppy in the way I code the daily internet search trends? I don't thinks so, but it's something I needed to question.

So, I thought I'd add a fresh perspective and taught an AI the coding categories and had it read the articles used for this past week's data. It does get some things wrong, but at least it tells me why it's coming up with what it does and I can correct it when it goes astray. It did come up with nuances that I hadn't considered. While I'm not ready to turn over the coding to AI (another complacency hazard) as it's likely to keep needing to be corrected, it did nudge me out of a complacency rut. Just for fun, I'll let you in on where "we" are currently diverging and in agreement.

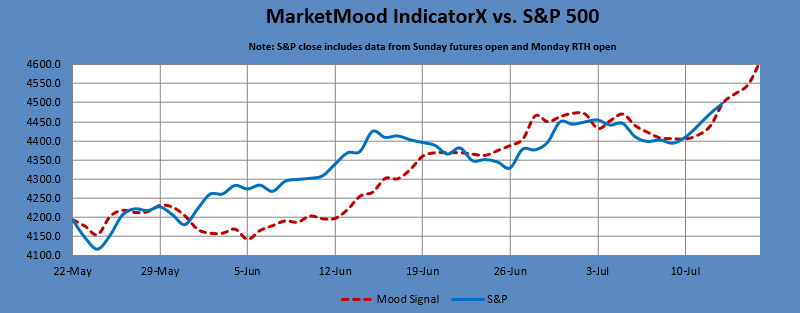

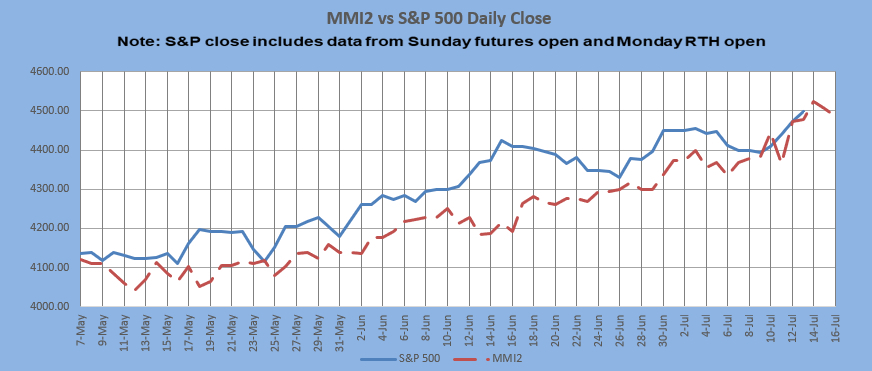

MMI had no call Monday and the chart as the week progresses is beginning to have a bearish tilt to it, though there is still no call for decisive bearish action at this time. The mood pattern is typical b wave / diagonal ambiguous mush and difficult to make sense of. MMI-X (the AI version) was down on Monday (it was wrong on that). The mood pattern showing for Tuesday from its coding of search trends is New Bullish Paradigm in which a day or more of a next bullish EW subwave would be expected (the market has been up). It's mood pattern for Wednesday through the weekend is clearly reflecting "irrational exuberance" and extreme unpredictability or uncertainty. The MMI-X output is strongly higher, but I would add the caveat that the rug could be pulled out at any time per the irrational exuberance and extreme uncertainty.

CDMS (composite daily mood signal) for today with MMI was Intraday Sell (watch for scalp sell opportunities) and CDMS with MMI-X is No Trade. So, even with its straight up looking chart this week, it has no confidence in the advisability of an enter and walk away bullish trade. It will be interesting to see which one gives the first significant trade signal or call for a trend change.

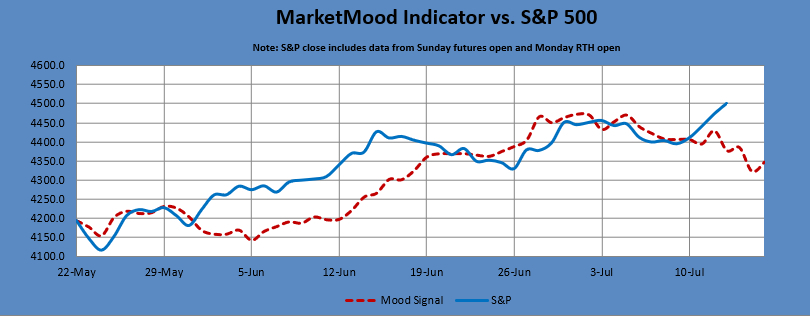

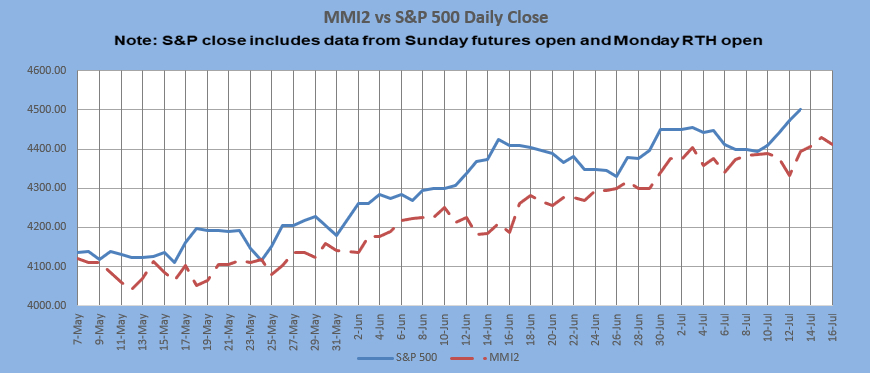

Here are the latest charts I'm looking at from the two data sets:

Original MMI and MMI2--

MMI-X and MMI2-X (only this week's input data is different from MMIs) --