Mixed Signals In Metals Suggests SOME Caution Going Forward

As I warned in the weekend update, silver was getting a bit overheated and was concerning me about a potential early blow off top. So, the bigger caution issue I am seeing on my charts is now the silver chart. If you remember back in the spring, as I was outlining the potential parabolic rally we were expecting, we based our views upon the 2010-2011 market fractal for its parabolic rally and blow off top. As the market began that rally, we were able to then assign a general target region for that rally, which we placed on the weekly SLV chart.

Based upon the calculations from the 2010-2011 silver fractal, and if we were to mirror that fractal, it would point to a high in SLV in the 75 region. While we do not see it struck in the chart attached, it was struck in the overnight action. So, as I said in updates last night, we have now struck the ideal target based upon the 2010-2011 fractal. Does that mean the market cannot go higher? No. It simply means that when you reach your target, it suggests that caution should be exhibited if you are going to expect it to run further.

What I have also found interesting in all my years trading and analyzing silver is that it likes to double top. That could lead to the SLV chart to actually strike its top, yet the futures may not provide us with more than a marginally higher high. So, this is something you may want to consider if you are attempting to play another rally in silver.

The other point I made in my updates in the room last night is that I have no choice but to view that 3-wave start to the rally in October as a 1-2, i-ii. With that in place, I am assuming this pullback is a 4th wave as my primary count. I have added a support box for that wave 4, which represents the .236-.382 retracement of wave 3. And, in one day, we have struck the top of that support box. And, yes, this could be all we get.

So, as you can see on the 144-minute chart, I have added a target for the wave (5). And, it starts with a double top, and extends all the way to the 93 region. Again, I am really not sure if we will get that high, but should we see an initial 5-wave structure off the support box, then we can begin to narrow that target down a bit more.

However, I must warn you that if we break down below the support box in the coming days and weeks, I have a wave (5) labeled at the blow off top high struck last night, as it could have completed all 5 waves as I mentioned above. So, again, I am now going to be a bit more cautious in silver going forward.

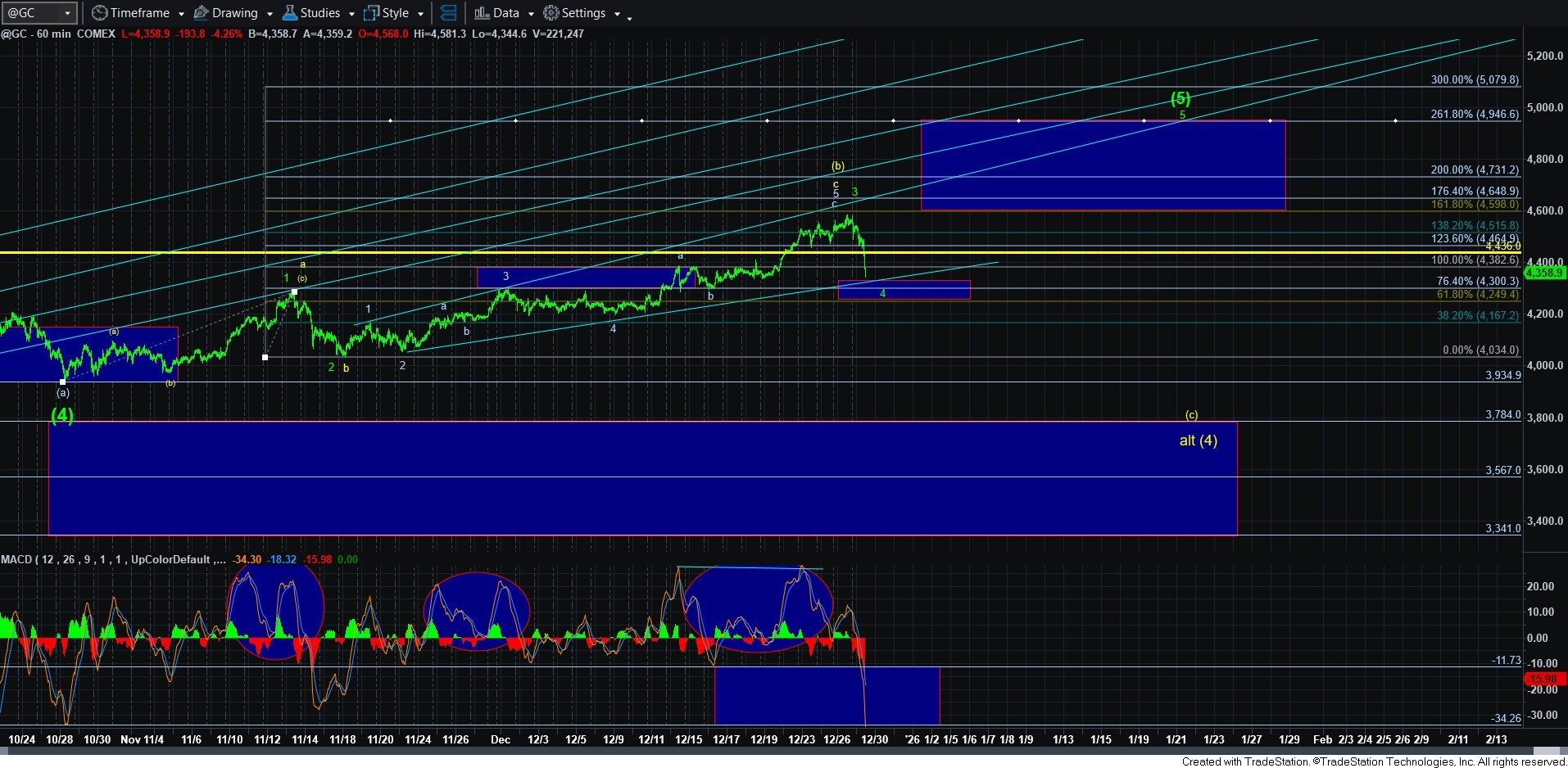

This now brings me to gold. And, I see this as a potential opportunity before us. As you know, when gold moved higher than I wanted to see for the yellow (b) wave, I had to more strongly consider the ending diagonal scenario for its 5th wave. And, while everyone and their mother is expecting gold to easily exceed the $5000 mark, this looks to be coming up short. I assume this is going to also be similar to 2011, wherein everyone and their mother expected gold to well exceed the $2000 mark, and it came up short.

Moreover, as I have been outlining in my updates, the 4th wave should pullback towards the 4300 region, wherein we would see overlap between waves 1 and 4, which is quite common in diagonals. Thus far, we have come close, with the low at 4316. But, I can still argue for one more lower low before this is done. But, please also see how oversold the MACD is on the 60-minute chart, and it is now in a region from which prior rallies have begun.

If you look at the attached 15-minute GC chart, you will see that I am going to primarily view this now as the wave 4 in green. It seems to make the most sense from an analytical perspective. You see, as long as we only have 3 waves down, I am going to count this as the green wave 4. However, should the market fill in the yellow count for wave 1 in yellow, and then provide us with an a-b-c rally for wave 2, this will set up the bigger yellow (c) wave down. So, again, until that full 5 wave structure completes, I think it is prudent to place the green 4 as our primary before us. That means I would expect a larger a-b-c rally to complete wave 5. And, how high it goes will really depend on whether we get a blow off move or not. But, in either case, it seems to project below the main expectation of $5000 at this time.

Also, please take note that I have narrowed and adjusted the target for a high in the long-term GLD chart. It is attached below.

GDX has become a big challenge to me at this time. The current structure seems to be suggesting the blue count is taking shape. And, part of that is me basing my view on both gold and silver having come down to support. This means that if we do get a higher high in this structure, I will intend in selling just about all my mining stocks into that final 5th wave. I will likely then put an alternative on that chart that it has completed all of its 5th wave, with the October low actually being its 4th wave. I really don’t like that count, but have to consider it if we continue higher to complete this diagonal structure.

Now, this does not preclude me from buying it all back when we get back down to the wave (4) support box. But, keep in mind that if that is indeed THE high when we complete this ending diagonal structure in blue, I will only have one chance to sell at that high. But, I will get another opportunity to buy a drop towards the support box. So, in weighing these factors, I will likely sell almost all, if not all, my mining stocks into a 5th wave rally.

So, as you can see, there is an interesting opportunity being presented in gold, but I do have a bit more concern in silver and GDX. And as I outlined in the weekend update, you really have to strongly consider how much risk you are willing to take in the metals complex as we are likely approaching the end of this long-term bullish cycle.