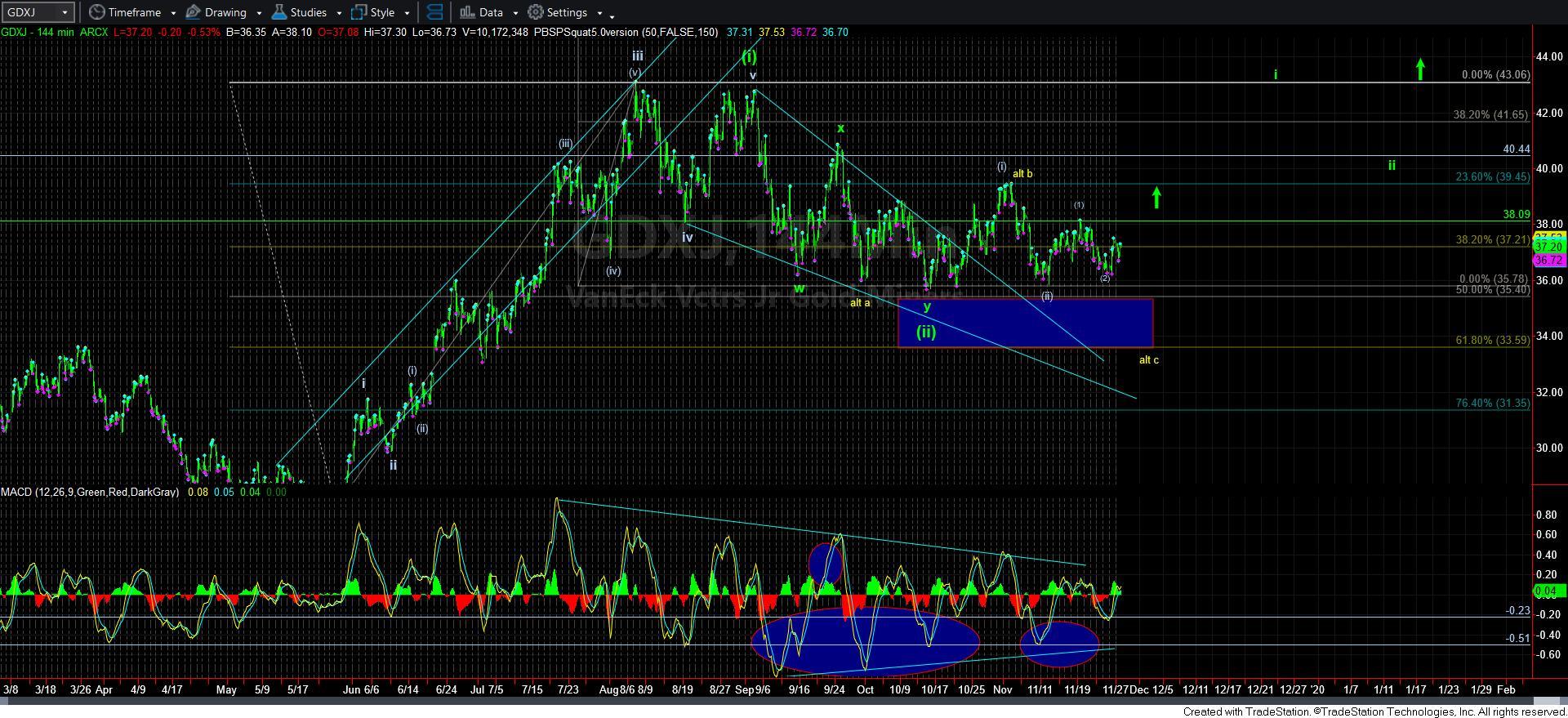

Metals Require Patience - Market Analysis for Nov 28th, 2019

With the micro structure still not providing a clear indication that we have bottomed, I can say that silver retains potential for a spike down to complete a 5th wave as long as we remain below the 17.30 region (March futures).

In the GLD, this is still looking like an ending diagonal for the 5th wave, and it also has not signaled that it has yet struck its bottom.

So, overall, there is not much I am able to add to the discussion, as all we have seen is further overlapping meandering.

The one change I did make in the charts is most clearly seen in the GDX. Based upon the smaller degree structure of waves i and ii, and assuming we are able to move through the 32/34 next resistance region, the ideal target for wave iii of (3) of 3 points us to the 43/45 region. That means that once the market is able to move through the 32/34 region, you should be moving all your long term stops to just below the market pivot, which is the 29 region.

So, as you can also see, if this count is correct, the next move in the metals complex will likely see a very large rally, which is also likely where we will finally see the miners outperform gold itself, at least based upon the wave count and projections.