Metals Quick Update - Market Analysis for May 20th, 2024

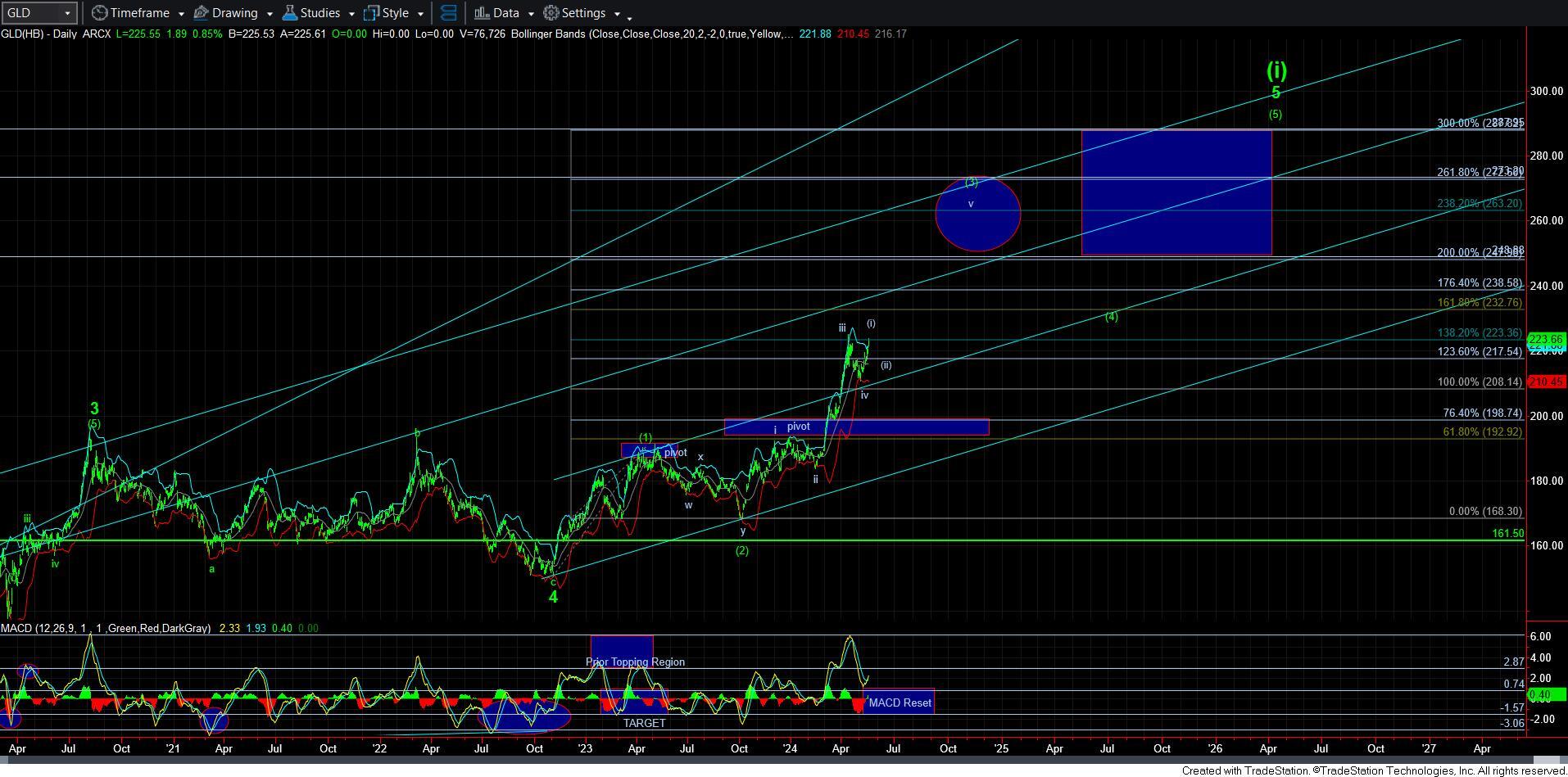

Folks, if anyone has been following me over the last year, not only would you have positions in metals and miners, but I even announced months ago when I was adding LEAPS in SLV and GDX. Feel free to look at the attached GLD chart from the start of this year to understand what I have been expecting. And, I made it quite clear that I am not selling any of those positions until I see this rally completing. So, anyone who has been following us has been doing VERY well.

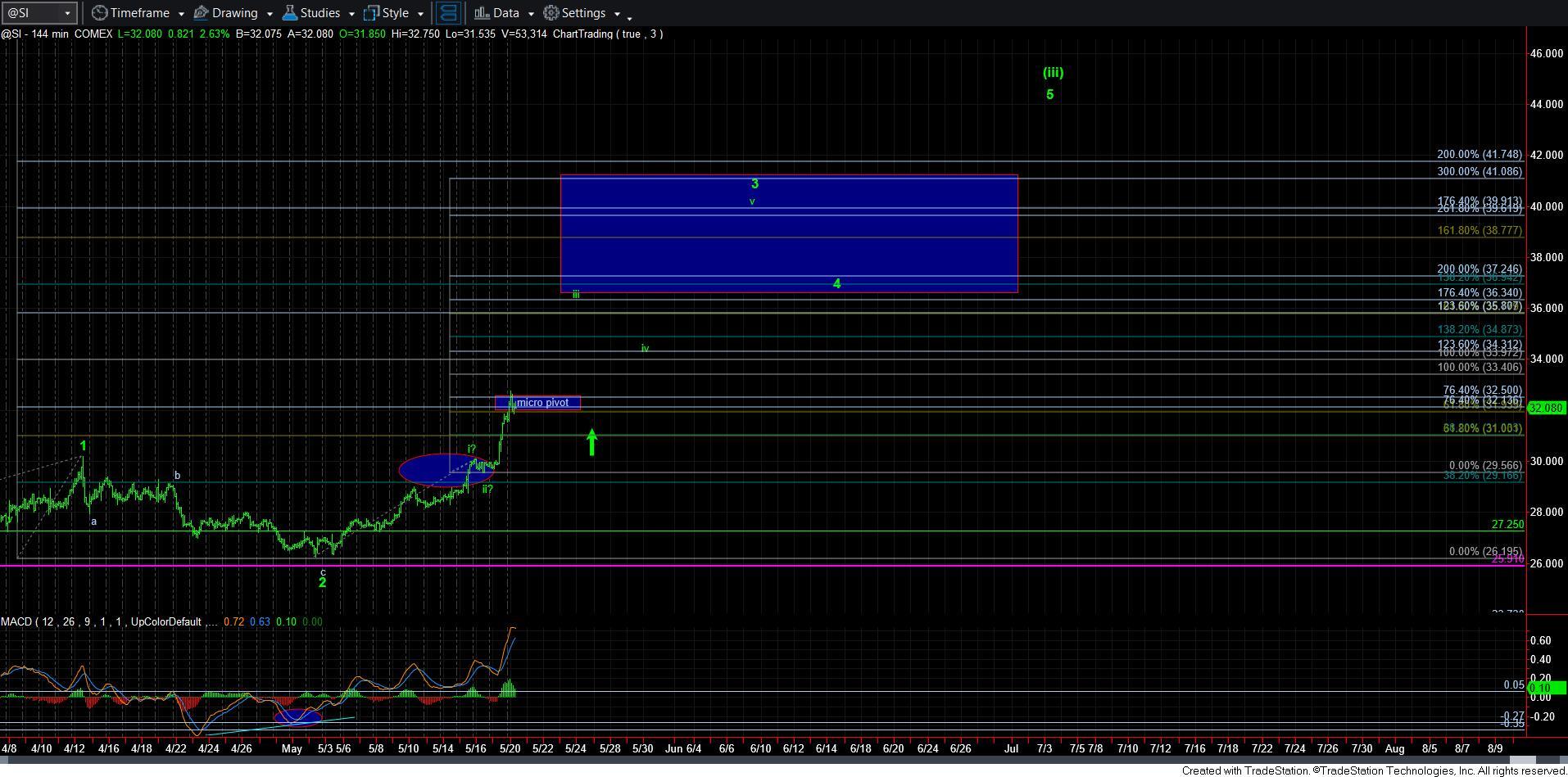

The question with which we have been grappling of late is if the metals are going to give us an opportunity and a set up to go even more aggressive on shorter term plays. And, there is a chance we may not get a micro set up for this initial segment of the break out . .. but there will be others.

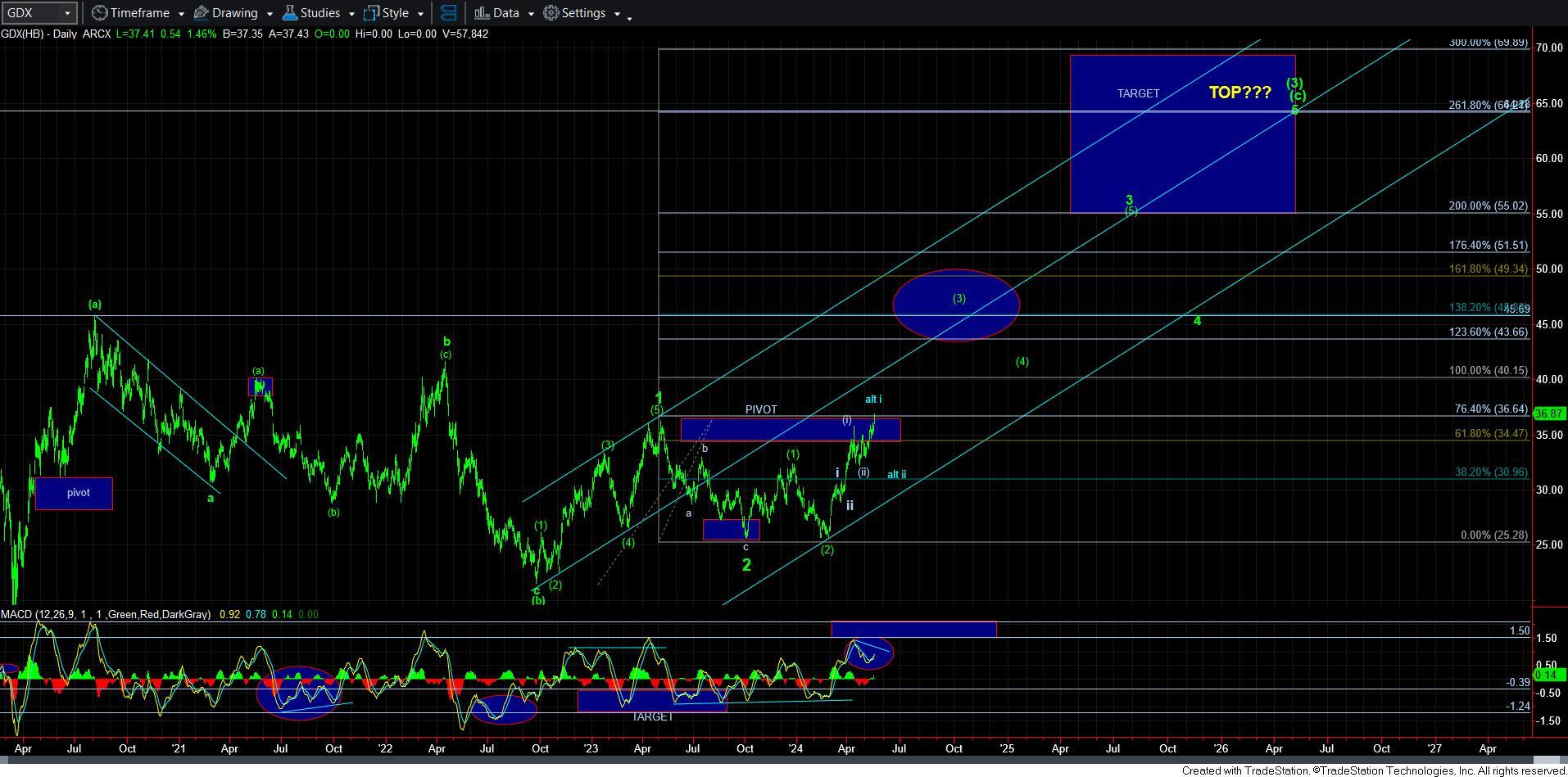

So, please bring down your emotion and rhetoric, as there is still plenty of upside to garner, especially in silver and GDX. But, being emotional will not help you in this game. Someone taught me many years ago to trade the chart and not the money. Please try to focus on that over the coming months.

At this time, I am still going to wait for an ideal set up in order to go aggressively long in the shorter term options play. And, yes, I may miss the first attempt, but I am sure there will be others. I want something that is relatively low risk, as I want to know we are in the heart of a 3rd before I do it. Silver is trying to make that clear, as it is still not able to blow through its pivot. We will soon see, and its next opportunity may be the wave iv if we do not get a bigger pullback starting here..

In GLD, we have gotten back to the prior high, and I am still going to give this a bit more room to show us a potential wave (ii) pullback within wave v of (3), which can be seen on the daily chart. But, through 229 I have to assume we are in wave (iii) of v of (3). Moreover, getting back to the prior does make the alt count significantly less likely.

I am also not going to give GDX too much more room on the upside to prove a pullback as well. But, there are still signs in both GDX and GLD that a pullback is still quite likely. And, clearly continued strength will have me abandon that expectation and have to wait for an opportunity a bit higher before I begin to trade aggressively on the long side in the short term.

Again, please recognize that if you have been following our work, you have been doing quite well this year. However, the only question now with which we are grappling is if we can get an opportunity for a shorter term aggressive long set up. And, sometimes, the metals do not always offer it. That is why I have strongly urged not selling your core positions in this complex.