Metals Pushing The Limits Again

If you have experience with the manner in which the metals trade, then you know that they almost always push their limits. And, silver seems to be doing that as I write this update.

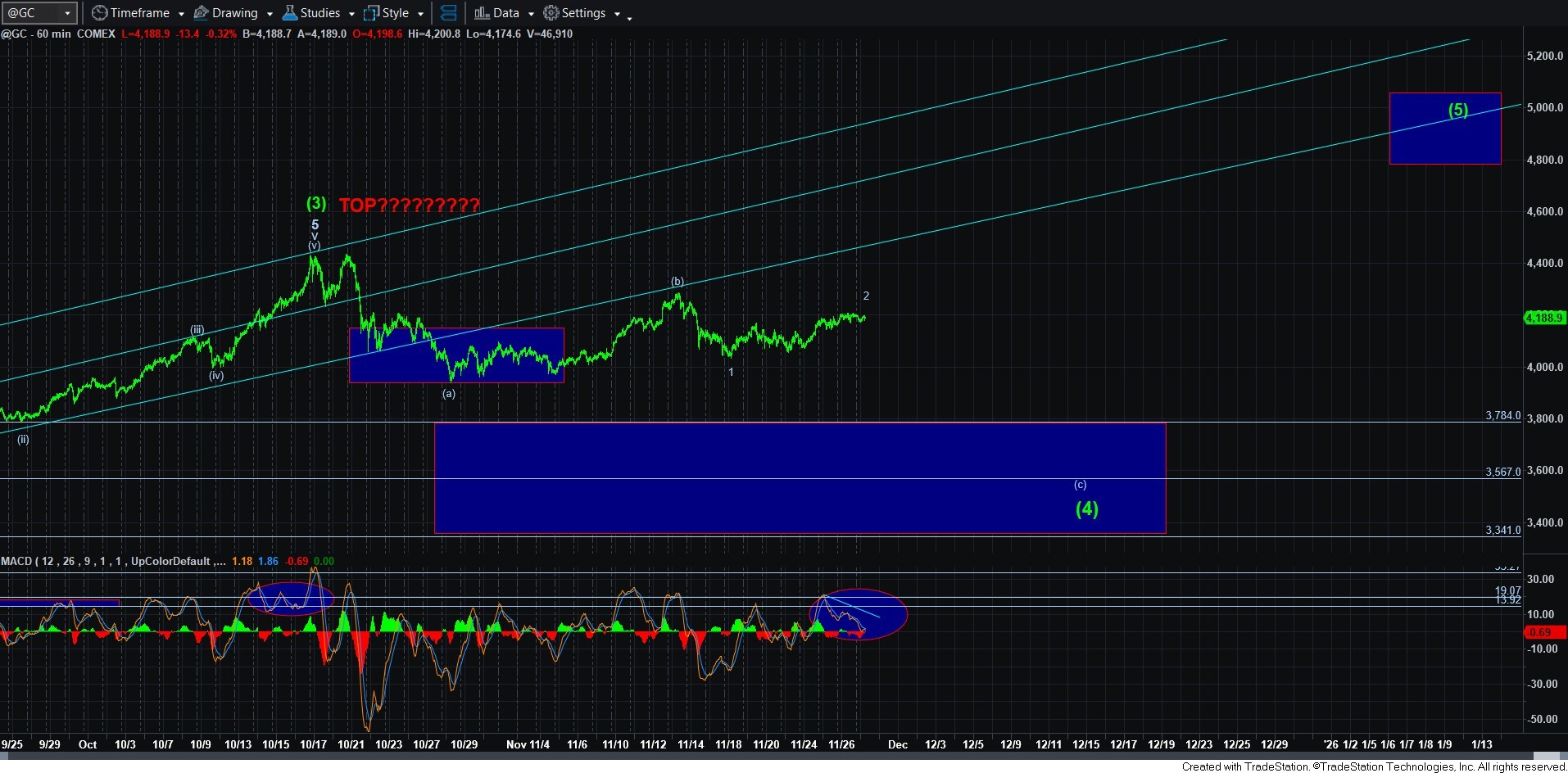

There is no question that the rally that we have seen since silver struck the wave (4) support/target box has been overlapping and corrective looking. This has been quite consistent with the expectation that it has been a corrective rally. And, that is how I currently view it. The question then is how to count it?

First, silver is still retaining its 1-2 downside structure as long as we remain below the (b) wave high. For now, I am leaving that as my primary count and am going to be seeking a 5-wave decline to begin wave 3 down. And, with the MACD on the 144-minute chart now moving into resistance, I still think this count makes the most sense.

But, with us pushing past the .764 retracement of wave 1 down, it does open some questions as to how to view the rally if silver does push past the (b) wave high? Of course, there is an alternative that silver has completed its wave (4). But, I have a VERY hard time seeing that as a strong probability. Even if we do see a higher high over the (b) wave, the best we can come up with is a leading diagonal for wave 1 of (5) – as shown in blue on the 144-minute chart. But, as you know, I do not see leading diagonals as strong trading cues as the great majority of the time they really are corrective structures leading to lower lows. So, I would need a lot more evidence to suggest this is what is playing out. And, even so, it would still likely point to a deep wave 2 pullback, which then project a 5th wave target to the 75-80 region thereafter.

The other issue I have with counting a higher high over the coming 24-48 hours is that this action is being driven with VERY low volume. This also makes this action highly questionable. So, the market will have a lot to prove to me to adopt the perspective that wave (4) is indeed done.

The other factor to consider is that gold is still very much well within its corrective rally. Moreover, I have no reasonable or reliable way in order to count that it has completed its larger degree wave (4) correction as the rally is quite clearly overlapping and corrective off the recent low, and we have not met our minimum target as we have with silver.

The last factor to consider is that GDX is also well within reasonable parameters of an ongoing wave (4), even though its (b) wave has extended a bit higher. Moreover, GDX has also not met its minimum target for wave (4) and neither have most of the individual mining stocks I follow.

Now, for those that have been following me in my positioning, you would know that I have added some of my mining stock positions at the lows we struck a little over a month ago. My standard practice is to begin adding positions back as the a-wave of a corrective structure is bottoming, especially if it hits the target for the corrective structure. And, if you are intending to add more, as do I, on the next pullback, I strongly suggest you review the charts presented by our Metals, Mining and Agriculture analysts as not all mining stocks are created the same. Some are set up to well exceed others in the 5th wave, at least as I see it.

Moreover, I also added an initial position in a more aggressive SLV position with 2026 calls as we were striking the target/support box on our 144-minute silver chart. But, I have left some dry powder to add to that position on the next decline. I am going to be holding that position until we reach our long-term targets north of 60 in silver, and have added some protective puts in SLV, but mostly in GLD.

So, for now, I maintain my perspective that it is a high probability that we see a sizeable decline over the coming weeks in the metal’s charts. And, I will stick with the probabilities presented by the charts for a more complete wave (4) across the complex until proven otherwise.

In the 14 years that I have been providing my metals analysis, I think I have only missed one rally wherein I did not own an aggressive long position due to the market providing an unusual and rare completion to a corrective structure that one time. Moreover, consider that I am neither a perma-bull nor a perma-bear. So, not only have we caught the action on the upside in this complex quite accurately and consistently during those 14+ years, but we have also caught the downside movements as well unlike most in this complex. And, I will continue to apply the same analysis standards that have kept us on the correct side of price for more than a decade.

While I currently have added aggressive positions for the impending 5th wave rally I still seek, I still maintain dry powder to add to those positions as the standard structures we follow and have kept us safe and profitable these last 14+ years still strongly suggest another decline is yet to be seen before that 5th wave begins in earnest.