Metals Have Not Maintained An Immediate Bullish Stance

The amount of overlap we have seen over the last week has placed a bit more near-term uncertainty into the metal’s patterns. So, rather than outline the many potential paths I can now see, especially in silver, I am going to take a step back and remain patient in order to allow the market to clarify its next major move.

To keep silver really simple and to repeat, as long as we remain over the 30 region, silver has several ways in which it can develop the next break out attempt. However, there are several ways this can take shape, and I think it best to simply wait until the market clarifies the pattern it wants to take for that break out.

Of course, should we see an impulsive decline below 30, then it opens the door to the alternative yellow count. But, as of right now, I am not seeing a lot of evidence for that potential.

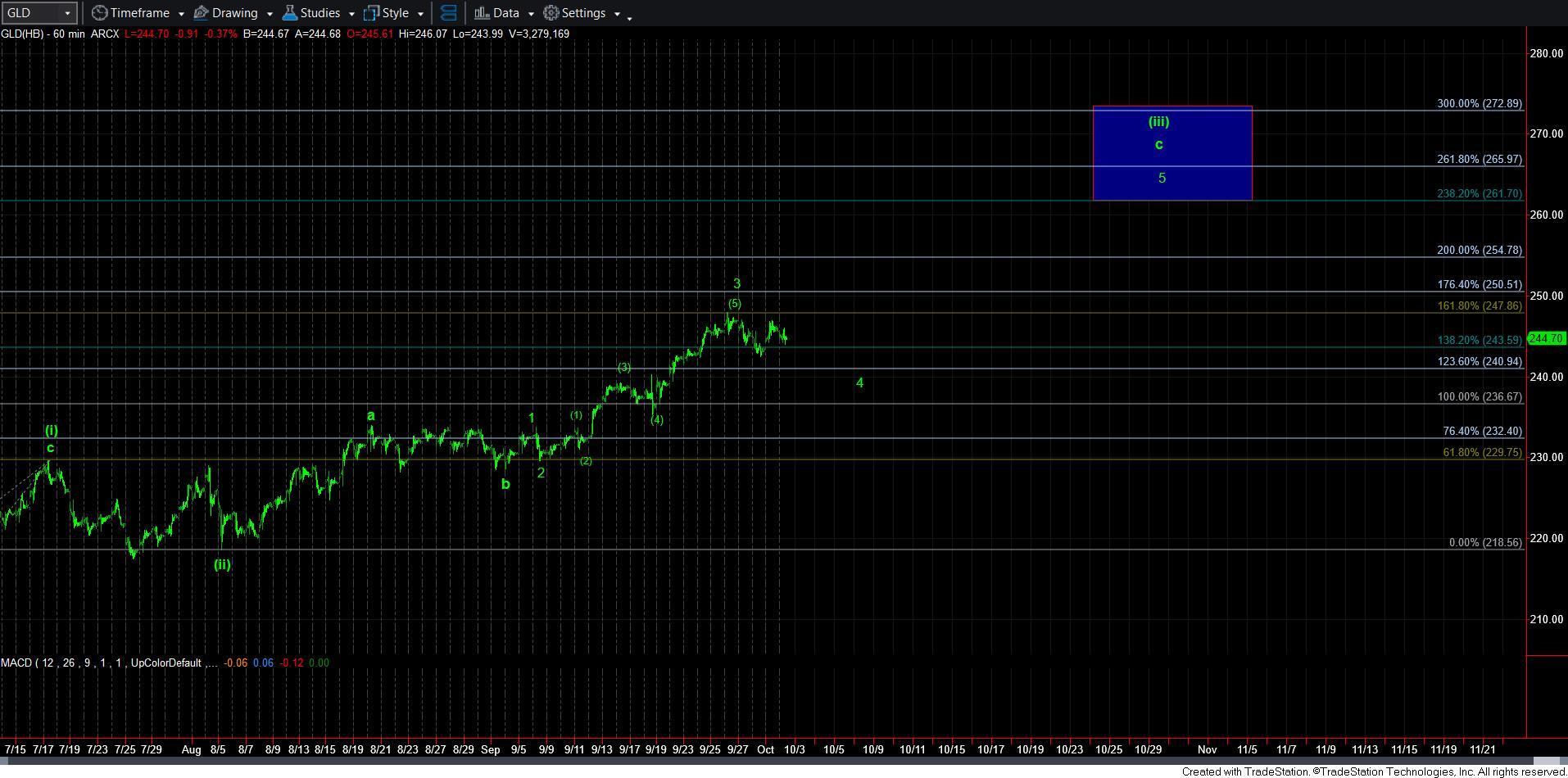

As far as GLD, I am still uncertain as to whether wave 3 of [iii] is done, or if the market is going to push higher one more time before it completes wave [5] of 3. This also aligns with the lack of micro clarity noted in silver.

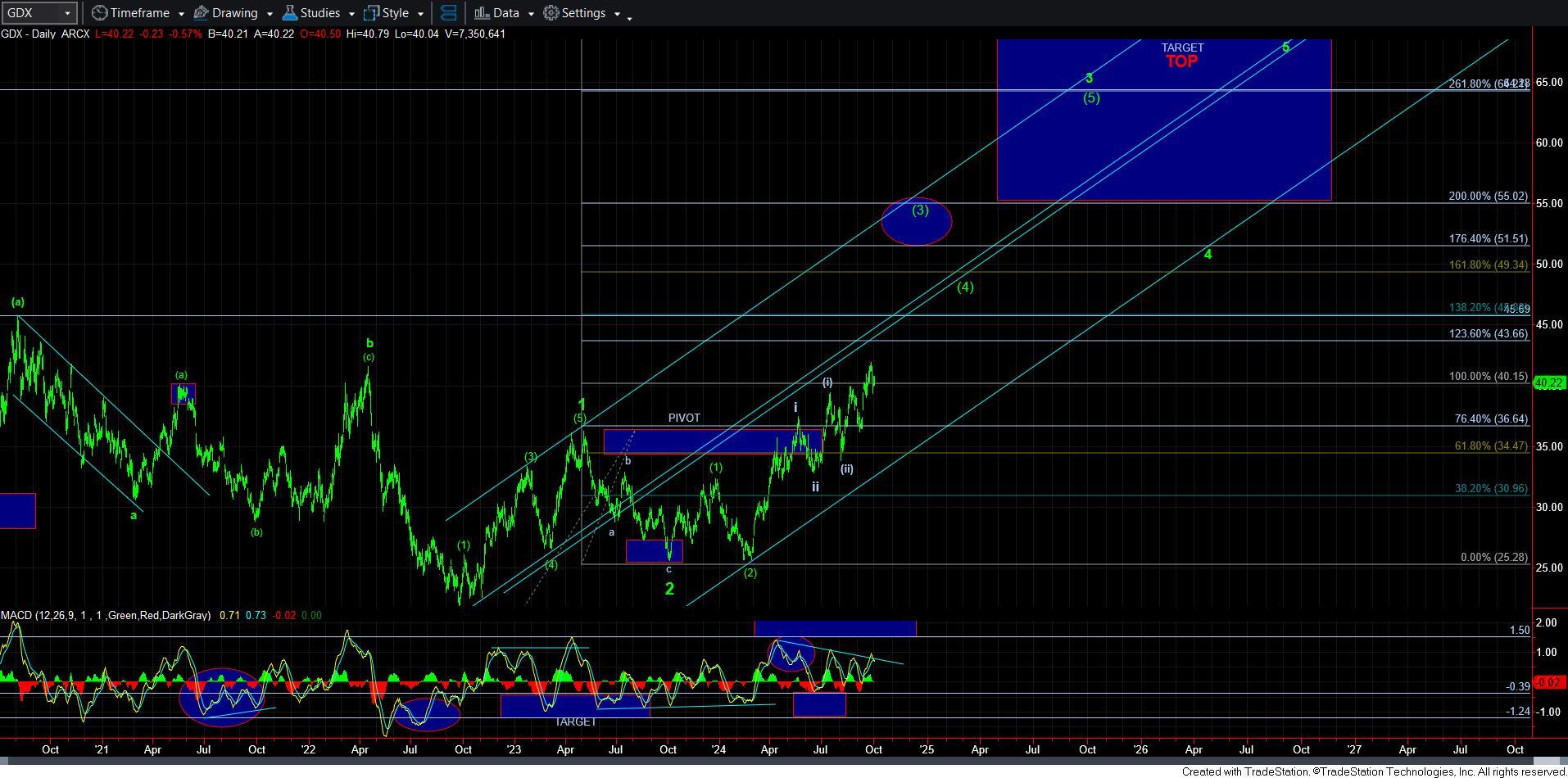

And, in GDX, well, that also lacks clarify in its smaller degree path. However, I am viewing the yellow count as the more likely path in NEM at this time, as long as we remain below the b-wave high.

So, it does look like we can see some downside consolidation in the complex before we are going to be ripe for the next break out set up. And, clearly, as it develops into a more clear pattern and set up for the next break out move, I will certainly outline what I see to all of you.

For those celebrating the Jewish holiday, I want to wish you a happy, healthy, and prosperous new year.