Metals CAN Break Out

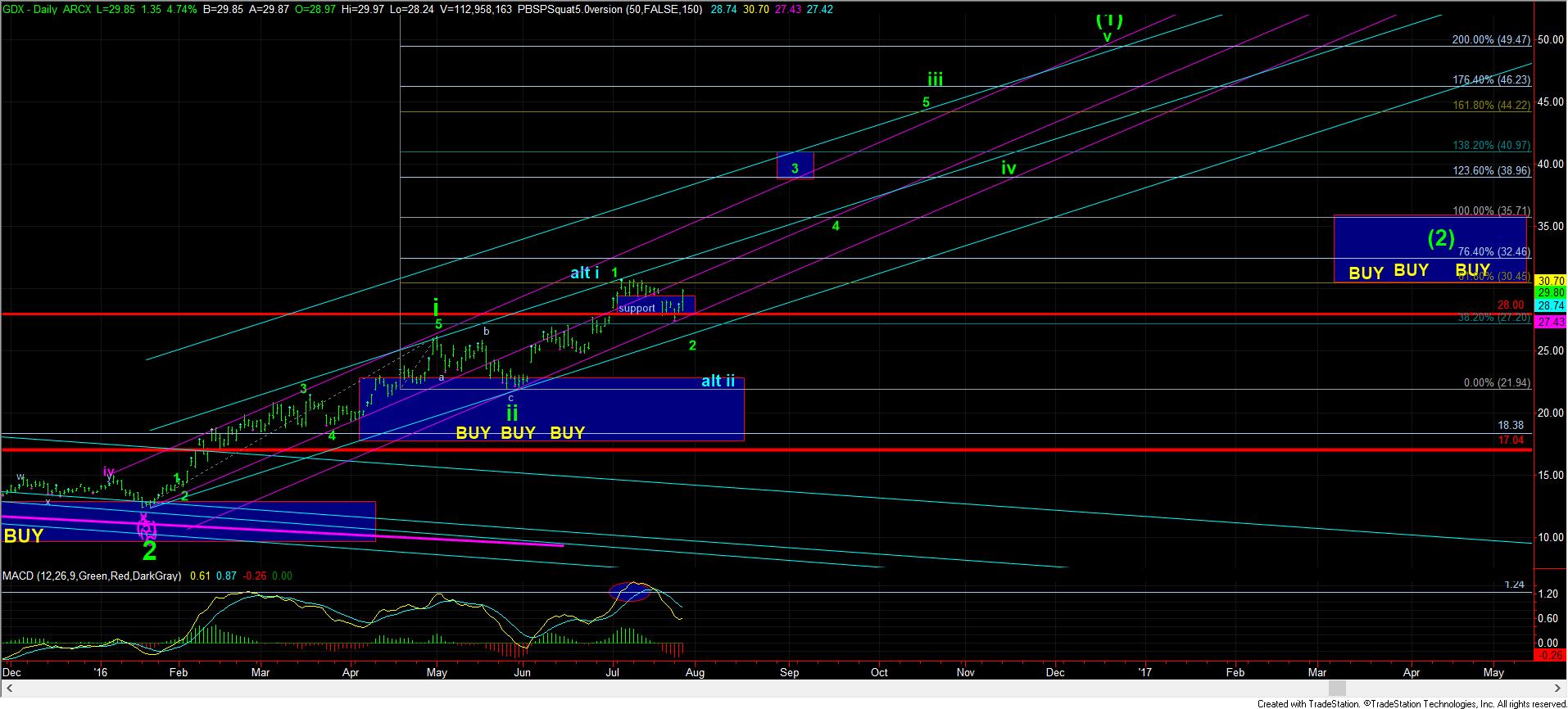

Even though the bottom we struck the other day was complete with a truncated 5th wave ending diagonal (not terribly common), the GDX pushed higher into today, and has a set up to truly break out for much higher targets, as noted on the daily chart.

But, as with most set ups, they must see follow through in our Fibonacci Pinball structure. And, this one is no different. You see, once we hit the 1.00 extension off a bottom, the market is at a point of inflection. If it is an a=c corrective rally, then the first clue is a break down below the .618 extension. However, if the market is going to continue to complete an impulsive structure off the low, and maintain a bullish stance, then it will hold over the .618 extension, and continue on to much higher extensions. This is probably one of the most powerful aspects of Fibonacci Pinball, in its ability to provide early warning signs between an impulsive structure and a corrective one. This is the turning point that provides that guidance.

As of the close, the GDX hit its 1.00 extension off the low. Therefore, it really “should” hold over the blue box on the 8 minute chart, and continue higher towards the 31.50, which will likely be wave (i) of wave 3 of iii, with an ideal target in the 39 region.

However, should we break below the .618 extension, it opens the door to this being a corrective rally, and the market can then drop down towards the 26 region (a=c on the downside) for a bigger wave 2.

In silver, our support today was 19.80, which the market held quite well on the “Fed” pullback. At this point in time, the micro upper support for silver is around 20.10, but we would really need to break the 19.80 region to open the door to the potential we are heading back down to the 19 region to complete wave (iv).

The GLD has been the chart which has me scratching my head a bit. So, I will reserve my opinion about the micro count on that chart for now, and look higher as long as we hold over 127.

So, for now, the bulls have the set up in their favor, and we will likely know by tomorrow if they are able to hold serve. If not, the market will likely provide us with a deeper wave 2 down towards the 26 region in GDX, with silver likely taking us back towards 19 and GLD likely taking us down to the 120-122 region.