Metals Are Still Consolidating

Last week, we caught the top of the rally, as I highlighted the expectation that I wanted to see a pullback/consolidation begin in the metals complex. And, thus far, that is what we have seen.

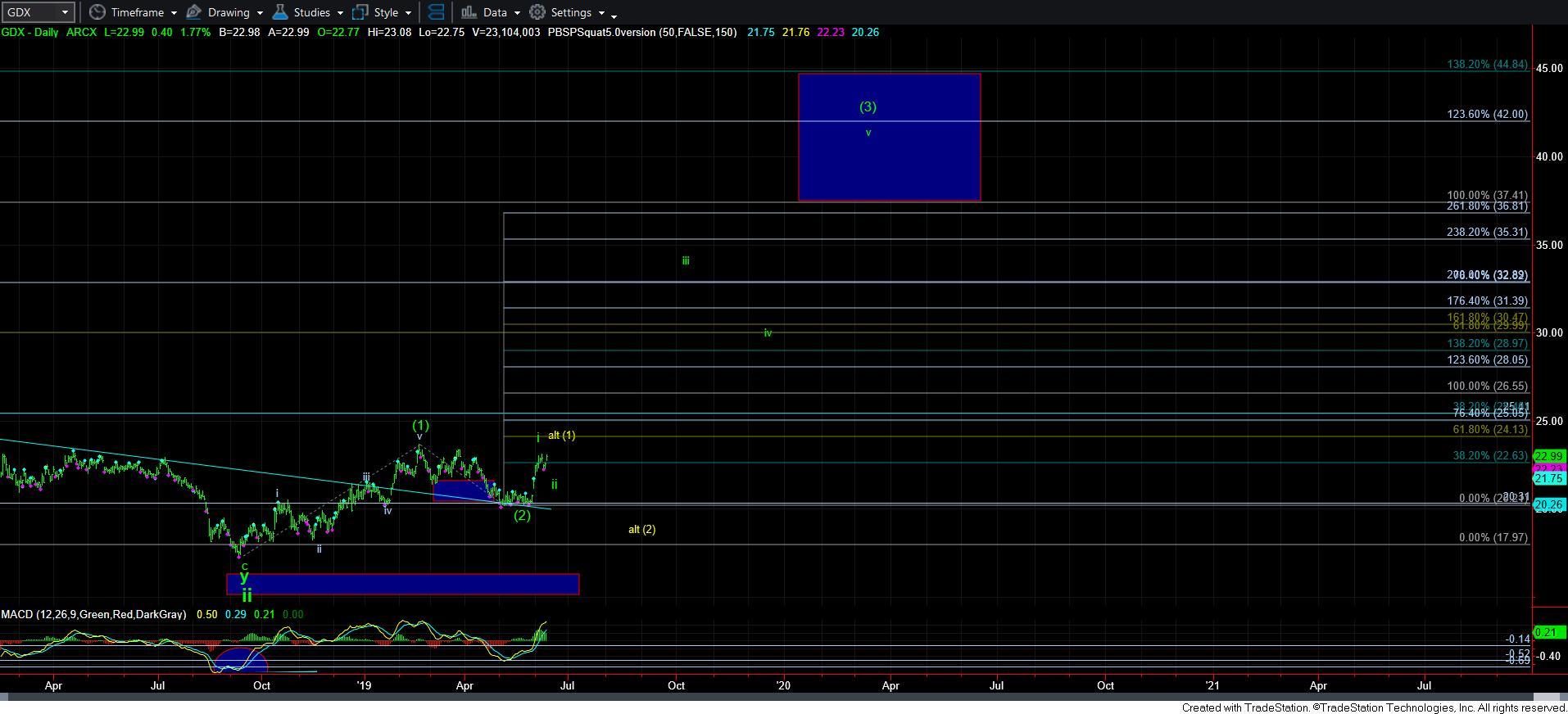

However, what is interesting to note is that the high seen in the charts last week was not the high of wave i, but was the b wave of the initial a-b-c corrective structure off the top of wave i. And, yesterday, we completed the c-wave of that structure, and began to rally off those lows.

Since we have a complete a-b-c structure, it is possible that all of the 2nd wave has completed in the complex. However, I am only maintaining that as my alternative count. I think we may see more consolidation still, which would suggest that yesterday’s bottom only completed the [a] wave of a larger [a][b][c] corrective structure for the 2nd wave.

That means that the rally into today was likely the [b] wave, which should be followed shortly by the [c] wave down. And, amazingly, it seems that all 3 charts present the same way.

However, if we see the metals begin to rally strongly through the last b-wave highs, then it begins to suggest that this is all of the second wave we will see, and that the heart of the 3rd wave may be upon us.

Now, many of you always ask me where I am going to add leverage. So, today, I posted in our chat room that I am now identifying the GLD129.50-138 region as the ideal region to be using leverage. How the market develops to take us into that region will tell me where I would place my stops. But, for now, that is the initial region I am looking towards for leveraged trades. Clearly, as you can see from the GLD daily chart, I am expecting much higher levels to be seen in this next rally, but that is the first region for leveraged trades.

Also, please remember that leverage should only be used during the heart of a 3rd wave. For this reason, I would personally be selling my leveraged positions once we get to the 138/39 region, and then attempt another leveraged trade after a wave iv pullback. Holding onto leveraged positions during consolidations can hurt your profitability, so I tend to take profits when I can, and re-enter on pullbacks.

So, I still remain cautiously optimistic regarding this current break out set up. But, please remember this remains a set up and has not yet confirmed. Once it finally confirms the break out, then we will likely see another rally similar to what was seen in early 2016, and we can begin to trade leverage profitably once again.