Metals Are Rather Simple Right Now

This will not be a detailed mid-week metals report, as the structure is rather simple right now. Moreover, I will not be doing any detailed analysis of the mining stocks since they are quite varied, as some may have bottomed, and others may have not yet. So, that detail is really beyond the scope of this update.

In the short term, I would say much depends on how the GLD chart plays out over the coming 24-48 hours.

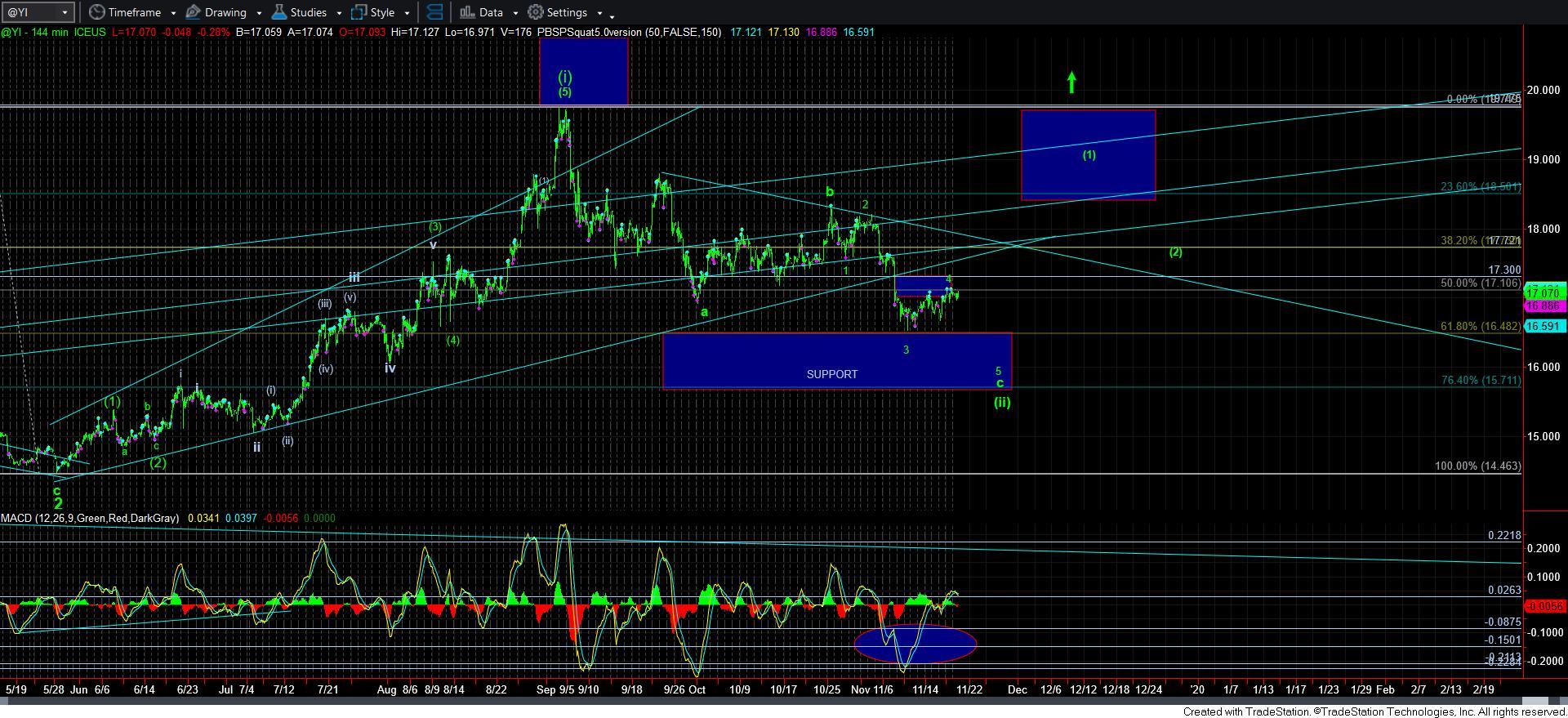

You see, we have a thoroughly completed 4th wave structure, as presented in yellow. Moreover, that structure has pushed to the top of the resistance region we had on our charts as our target region for a 4th wave bounce.

With the decline off the overnight high counting rather well as a 5-wave structure, as long as the market remains below 139.40, then we have a micro i-ii downside structure for the 5th wave lower low presented in yellow.

Alternatively, should the GLD be able to exceed the 139.40 region, it opens the door for the GLD to prove that it has bottomed already, and can prove that with a continued rally to the blue box overhead to complete the blue wave 1.

As a reminder, I will not be getting aggressive on the long side in the metals complex until that blue wave 1 has completed – whether that be from the low already struck, or from the lower low for yellow wave 5. Once that blue wave 1 completes, and we see an appropriate wave 2 corrective pullback, I will then turn aggressively bullish when the market rallies back over the top of wave 1. Until such time, I will remain patient for that break out set up.