Metals Are In A Precarious Posture Again

Before you freak out, I want to again note that the current action has made a drop to GDX 21 much less likely should we see downside follow through. Rather, it would more likely target the 25-26 region.

So, let’s move into the update.

As most of you know, I try to remain very objective when I review market structure and provide analysis accordingly. While I would certainly like to be bullish at this time, I am sorry to note that the market has not provided me a structure with which I can retain a strong bullish bias. Rather, it is signaling more downside to me, until proven otherwise.

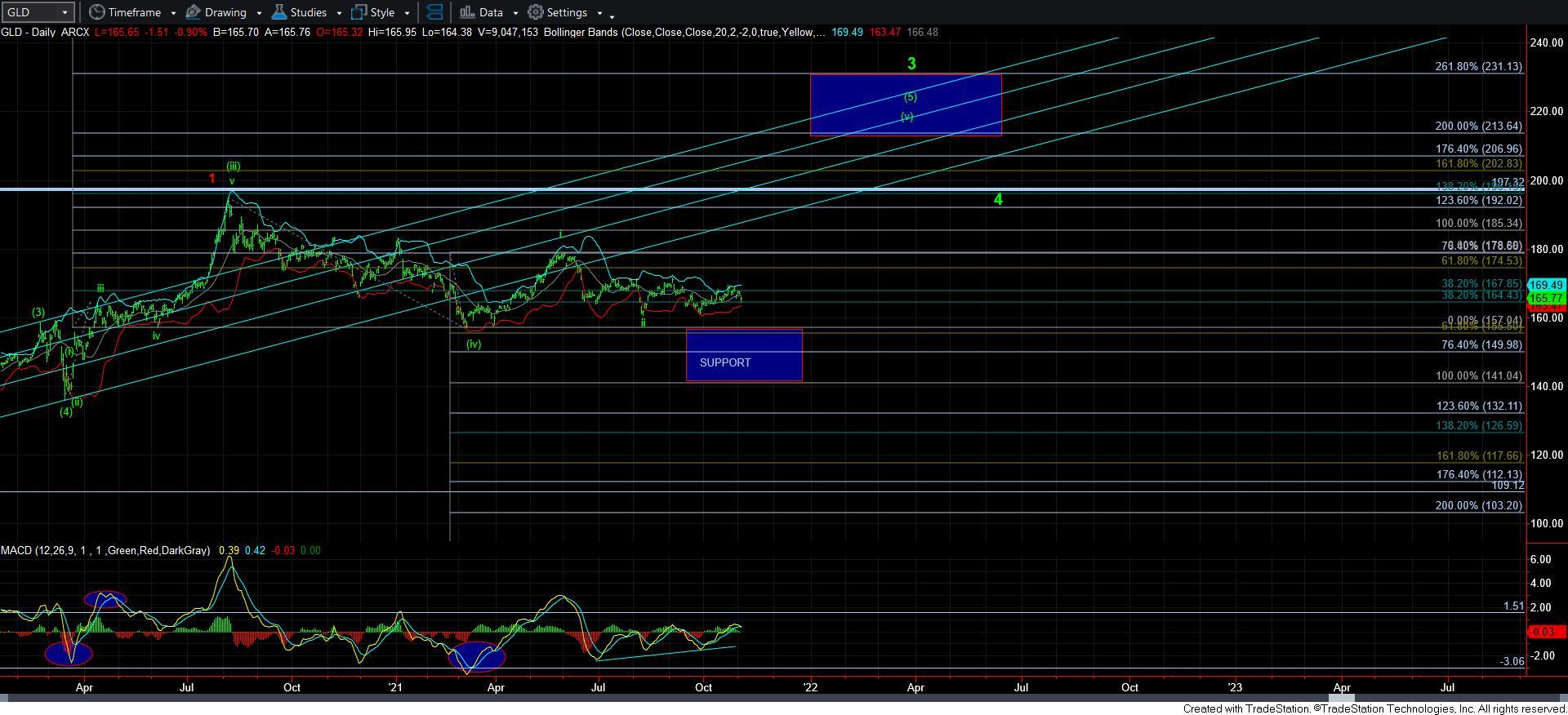

Starting with silver and gold, neither were able to complete their respective 5-waves up off the recent lows. And, the depth of the current silver pullback now only allows for a leading diagonal potential for a 5th wave. If you have followed my work for some time, you would know that I would not rely upon a potential leading diagonal as a bullish indication. Rather, in this posture, it would have to prove it to me before I would even consider it.

Therefore, all we are left with is a 3-wave corrective rally, which suggests we can drop again to lower lows before we get another shot at a bullish structure off a low. Again, unless the market can give me a potential leading diagonal over the coming week or two.

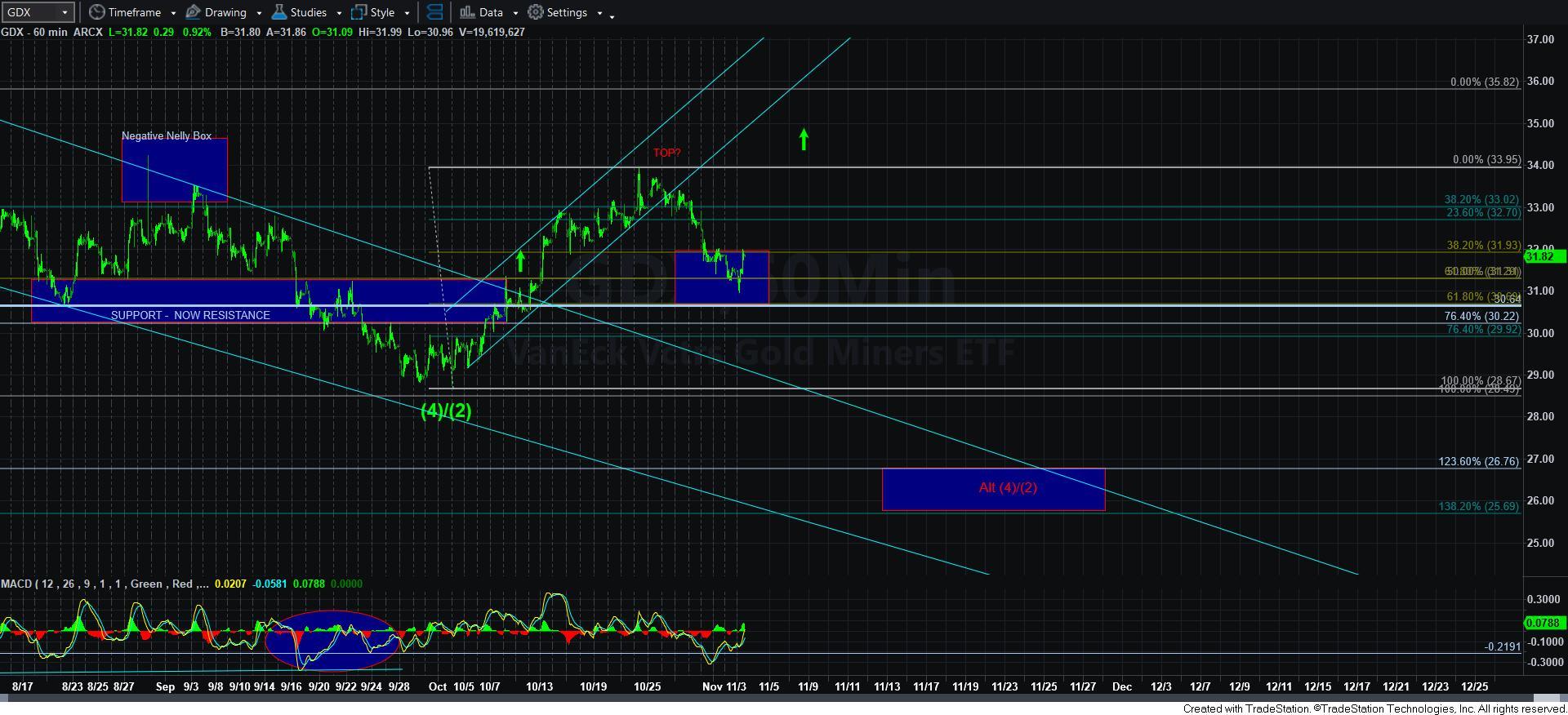

As it relates to GDX and GDXJ, I have outlined there is some potential for GDX to have completed 5 waves up off its recent lows, and GDXJ does have a solid 5-waves up off its recent lows. But, there is an arguable 5-wave decline structure we have seen since they have both topped. It is not the cleanest, but it certainly is not a slam dunk corrective pullback.

Earlier today, I noted in an alert that we should expect a “bounce” in the GDXJ/GDX. And, we got the initiation of that bounce. So, I have provided an 8-minute GDX chart this week so we can more deeply analyze this bounce in the GDX. Based upon our Fibonacci Pinball structure, I have added the pivot in the .618-.764 extension region of the first move off the low. And, yes, I can count a reasonable 5 wave move off the low in GDX. But, the question is if the GDX can complete 5-waves up to the higher target box before it breaks down. So, the GDX is now going to have to thread the needle by breaking out through the pivot without breaking back below it before it completes 5 waves up into the target box above.

For now, I am not terribly bullish. But, as you can see, I have given the market some opportunity to prove otherwise. And, I will be watching this 8-minute GDX chart quite intently in the coming days, and will alert you as to what I see in intra-day updates.