Metals Are A Micro-Mess

I wish I had better news to provide about the metals structure, but I am sorry to report that they are not exactly giving us any high probability indications in the smaller degree structures. While the bigger picture remains quite bullish, I cannot glean anything of high probability from the smaller degree wave counts.

Silver is most indicative of this. You see, I cannot say that the bottom is strongly indicated as being struck yet because the low seems to have been struck on a 3-wave structure. Moreover, the rally off that low can only be counted as a leading diagonal for wave 1 of [1], which you can see on the 8-minute chart attached. And, if you have followed me for even a short period of time, you would know that I do not rely upon leading diagonals as strong trading cues, unless I have another reasons to do so.

Now, should we begin to rally over today’s high in silver, then it would begin to increase the probabilities that a low has indeed been struck in wave [ii] of 3, and should we rally up to the 31-32 region for wave [1] of [iii] of 3, it should finally set us up for the major break out we have been patiently awaiting (well, at least most of us).

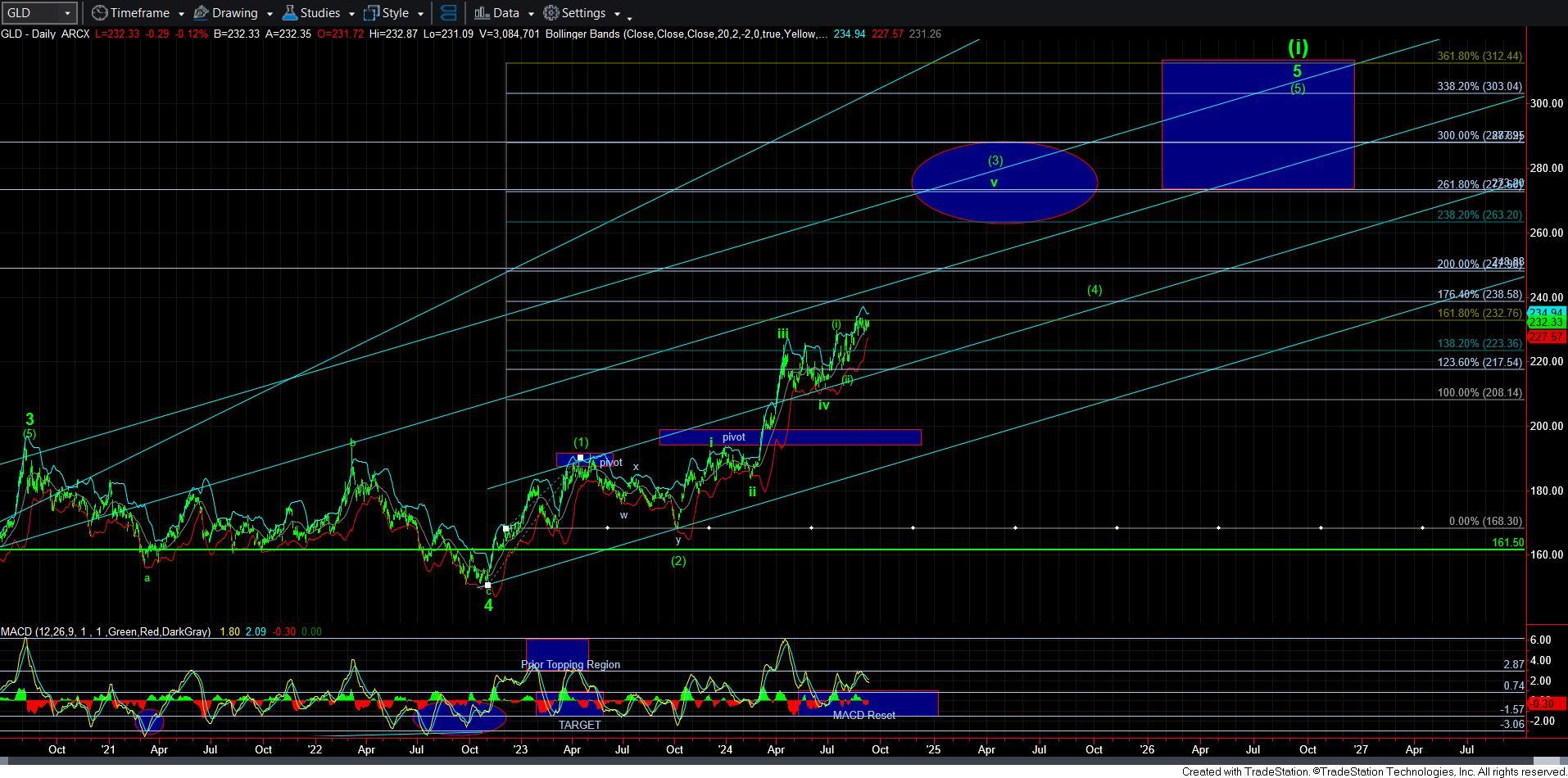

As far as gold is concerned, I cannot make heads or tails out of its smaller degree structure. But, I am starting to suspect that wave v of [3] is taking shape as an ending diagonal due to the overlap we have been seeing of late. But, again, in the bigger picture, I am not seeing anything indicative of a major top having been struck yet, as we still need to complete waves [3], [4] and [5] before we strike a major top in this chart.

But, as long as we remain below 29.55, I have to assume pressure is down for a lower low. Whether that low will complete a more protracted wave [ii] of 3, or whether it will break down below 27.50 and provide us with a deeper wave 2, that is still to be determined. But, again, please do not lose sight of the fact that the bigger picture is still very bullish.

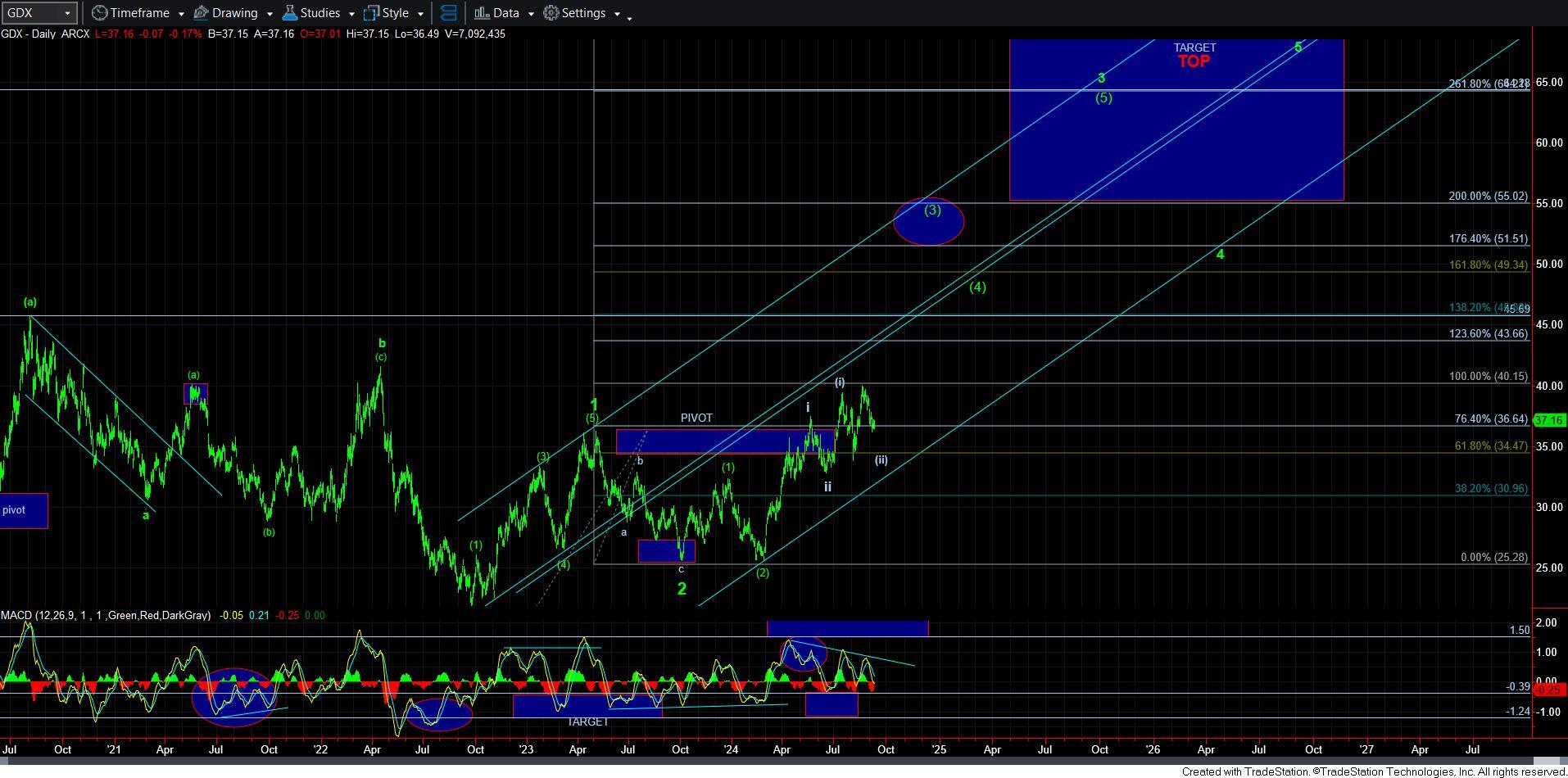

GDX’s chart is no less messy, and does not provide us with a high probability indication in the very near term. And, even NEM has turned a bit messy as well, and may be within a b-wave structure, providing us with a lower c-wave, as shown in yellow. Ideally, it may still need one more push higher, but I cannot provide you with any high probability expectations about the very near term at the moment.

So, across all the charts we track in this complex, I am sorry to say that I simply cannot come up with a high probability smaller degree expectation. Frost & Prechter have even warned that there would be times like this when doing analysis:

“Of course, there are often times when, despite a rigorous analysis, there is no clearly preferred interpretation. At such times, you must wait until the count resolves itself. When after a while the apparent jumble gets into a clearer picture, the probability that a turning point is at hand can suddenly and excitingly rise to nearly 100%.”

Unfortunately, I find myself in such a situation, and am seeking further information for clarify the smaller degree expectations. My apologies.