Messy Micro In Metals

As I have been harping for some time now, the larger perspective in the metals charts are still quite bullish. Nothing has changed my perspective when it comes to the larger degree wave structures I see on the metals charts we follow.

Moreover, the intermediate degree perspective is also setting up bottoming signals. In fact, if we can begin a sizeable rally off the lows we have been hovering around over the last week or so, then we can build a break-out set up in the coming weeks. This is what I reviewed over the weekend, and nothing has changed with this perspective either.

However, the micro charts in the metals do not provide a clearly impulsive bullish structure, although one can certainly take hold over the coming days.

While I can provide several potentials as to what I am seeing on the micro level, I think it may frustrate too many of you, so I am simply going to provide you the micro perspective on the GLD alone right now, as an example of what I am currently seeing. Again, I want to reiterate the bigger perspective is still quite bullish, but the micro structure has yet to resolve to provide guidance for the immediate move we can see this week in the market.

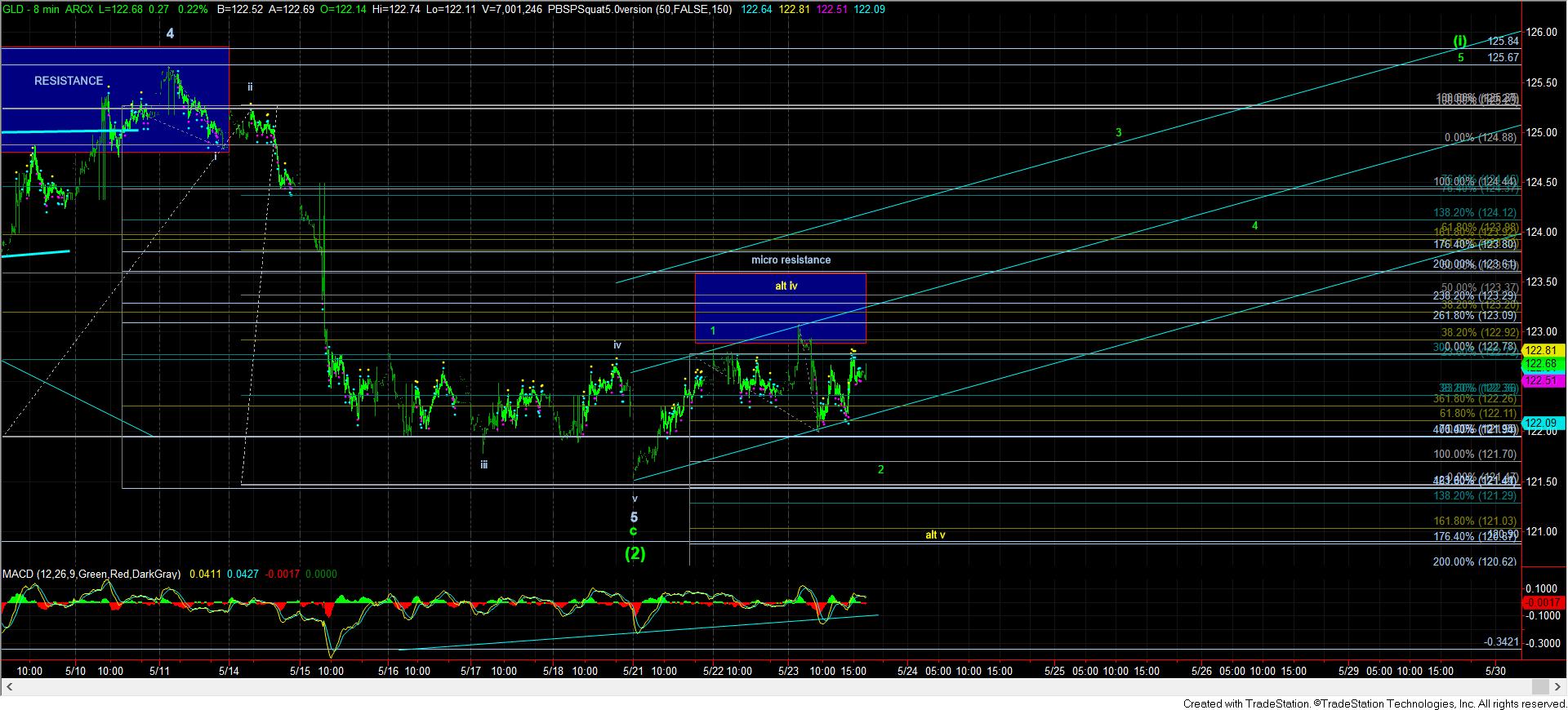

As you can see on the 8 minute chart of GLD, we have a lot of overlap in the structure after what looks to be a bottom having been struck in wave (2), followed by a reasonable 5 wave move off that low. However, while all of the wave 2 pullback may have been completed today at the low we have struck, the move off that low has been rather overlapping, and not clearly impulsive. That leaves the door open for the market to drop down in a w-x-y pattern, pointing to the `121.70 region in the GLD.

Where this leaves me is quite simply that as long as this week’s low holds as support, and, to be honest, as long as 121.70 holds as support, we have the potential to rally strongly back towards the 125-126 region for wave (i) of wave (3) off the recent lows.

As far as silver is concerned, I have to note that I really do not have the most ideal of impulsive structure off the recent lows, but I also don’t have a clearly impulsive structure which is pointing to a major break down in the market. While we may be dealing with a leading diagonal for wave i in silver, I don’t have a highly reliable pattern off the recent lows which suggests I need to be uber-bullish of this chart just yet. So, I am cautiously optimistic that we can move higher this week on our way to completing the wave i off the recent lows.

As far as ABX and GDX are concerned, nothing has changed my perspective on this either. I see the ABX as much more clear than GDX right now. And, as long as we hold over the 12.80 region, it does present as potentially breaking out sooner rather than later. A break down below 12.80 would open the door to a test of the 12 region in a more protracted wave (ii). Moreover, once we see a strong break out through the 14.50 region, I think we will catapult up towards the 18 region in the heart of wave (iii) of wave 1 off the recent lows. And, should GDX be able to rally strongly over 23.06, that would certainly open the upside door for wave (1) of wave 3.

So, while the bigger picture still retains a bullish perspective, the micro structure is not as clean as I would like for it to be at this juncture, which often means I need a bit more patience until the market provides us with a break out over today’s high in GLD, or a break-down of 121.70, which would suggest a more protracted wave v in the 5th wave of the c-wave of (2). And, if we did not see the overlapping pattern off today’s low in GLD, I would likely have been much more immediately bullish in this evening’s update. While it does not mean the market will not break out, even as early as overnight tonight, it simply means I have no micro structure upon which I can rely to strongly suggest it will happen off today’s low.