Massive "Stick Save" For ES

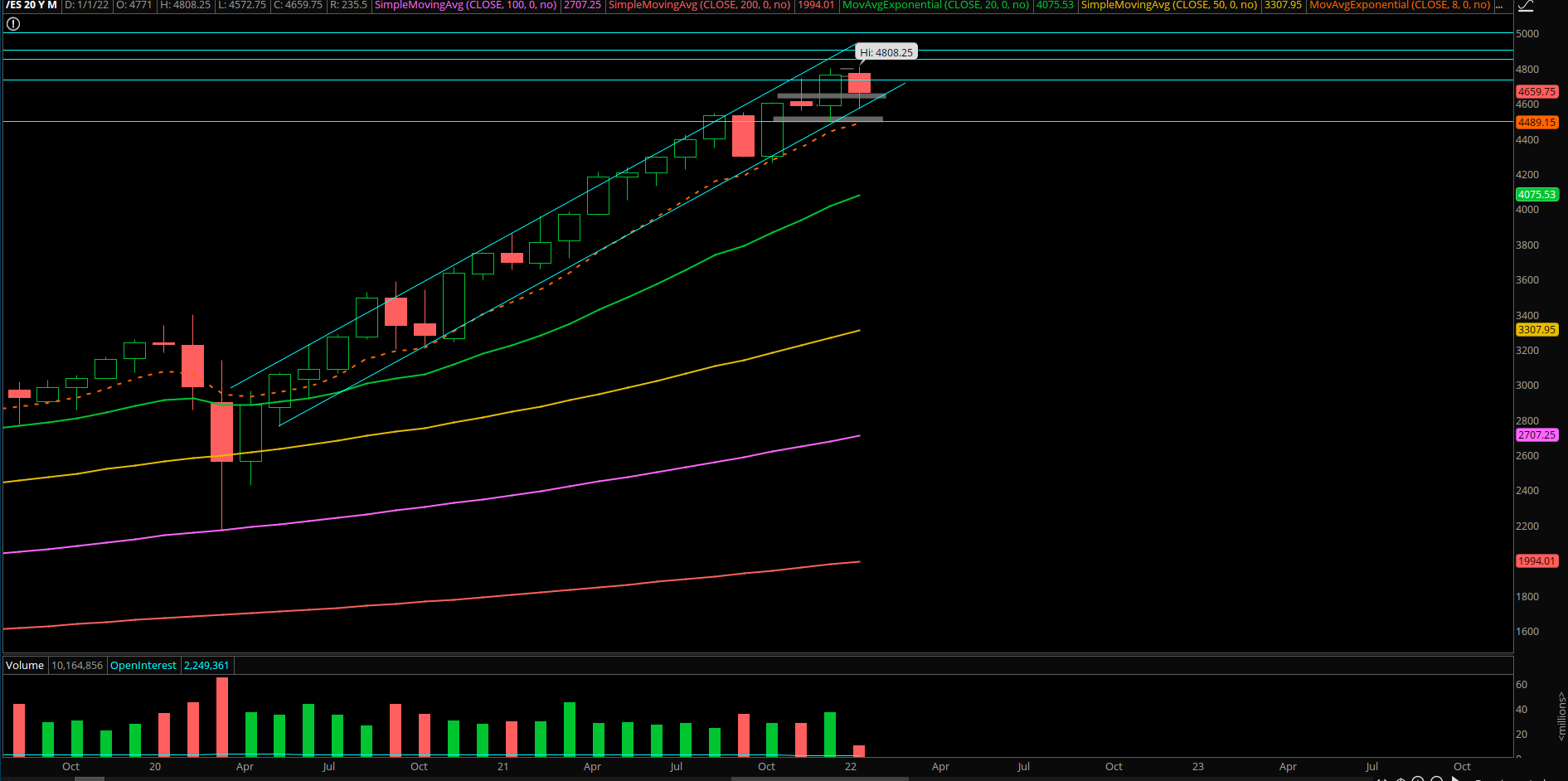

The S&P 500 during the first week of Jan broke below 4750 and then the immediate trending supports of daily 8+20EMA. It then closed last week around the lows at 4668.

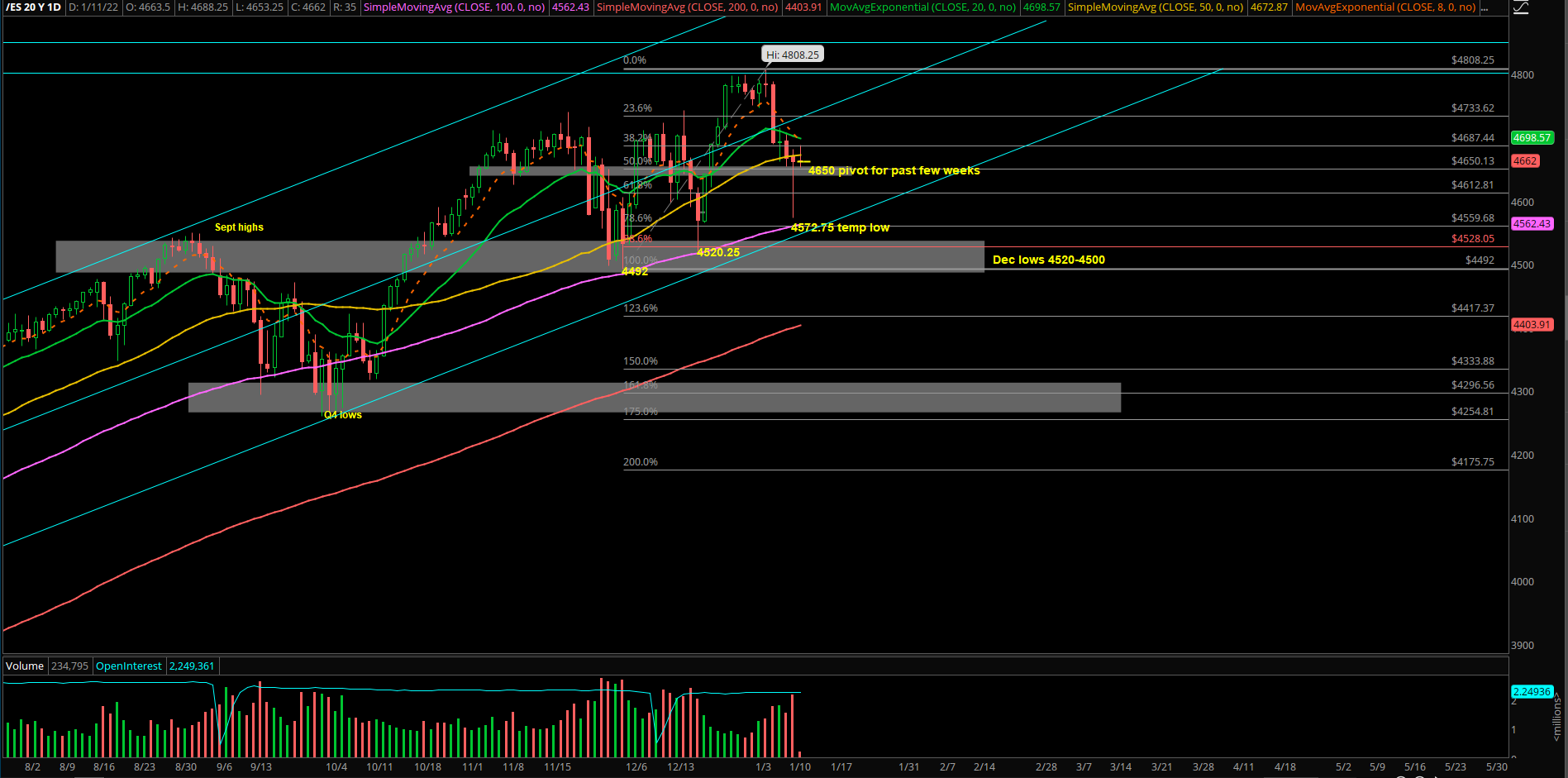

Last week’s 4668-4650 area was an important support area derived from Nov+Dec 2021 and it’s also the 50% retracement since the recent rally from 4520 to 4800.

Yesterday, Monday Jan 11, played out as downside continuation into a low of 4572.75 before finding large demand that staged an intraday V-shape recovery into 4660s.

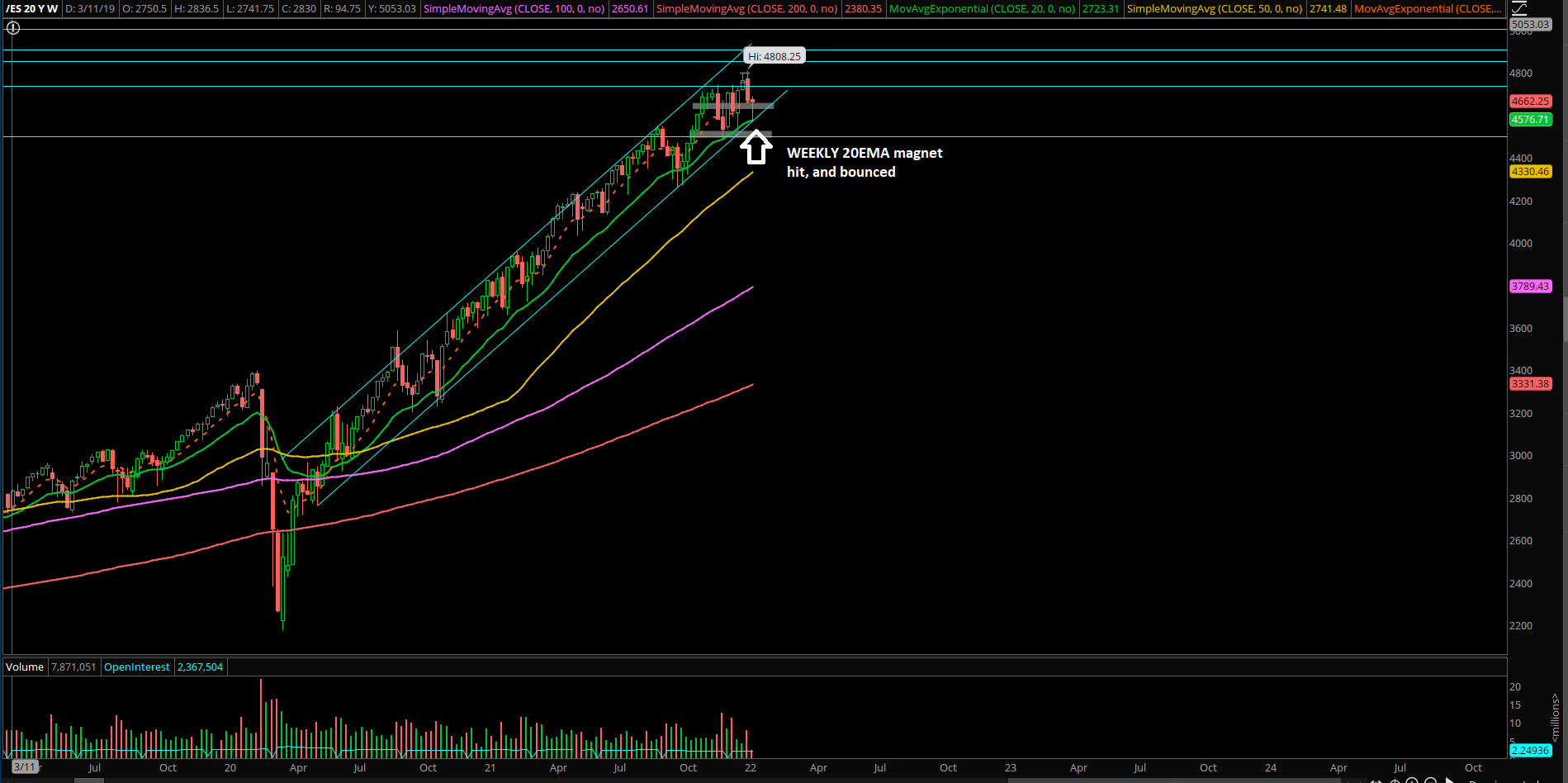

In simplest terms, price action formed a temporary bottom vs the WEEKLY 20EMA magnet. The ES move from the 4570s to the 4660s was almost a +2% intraday move, a massive "stick-save" formation.

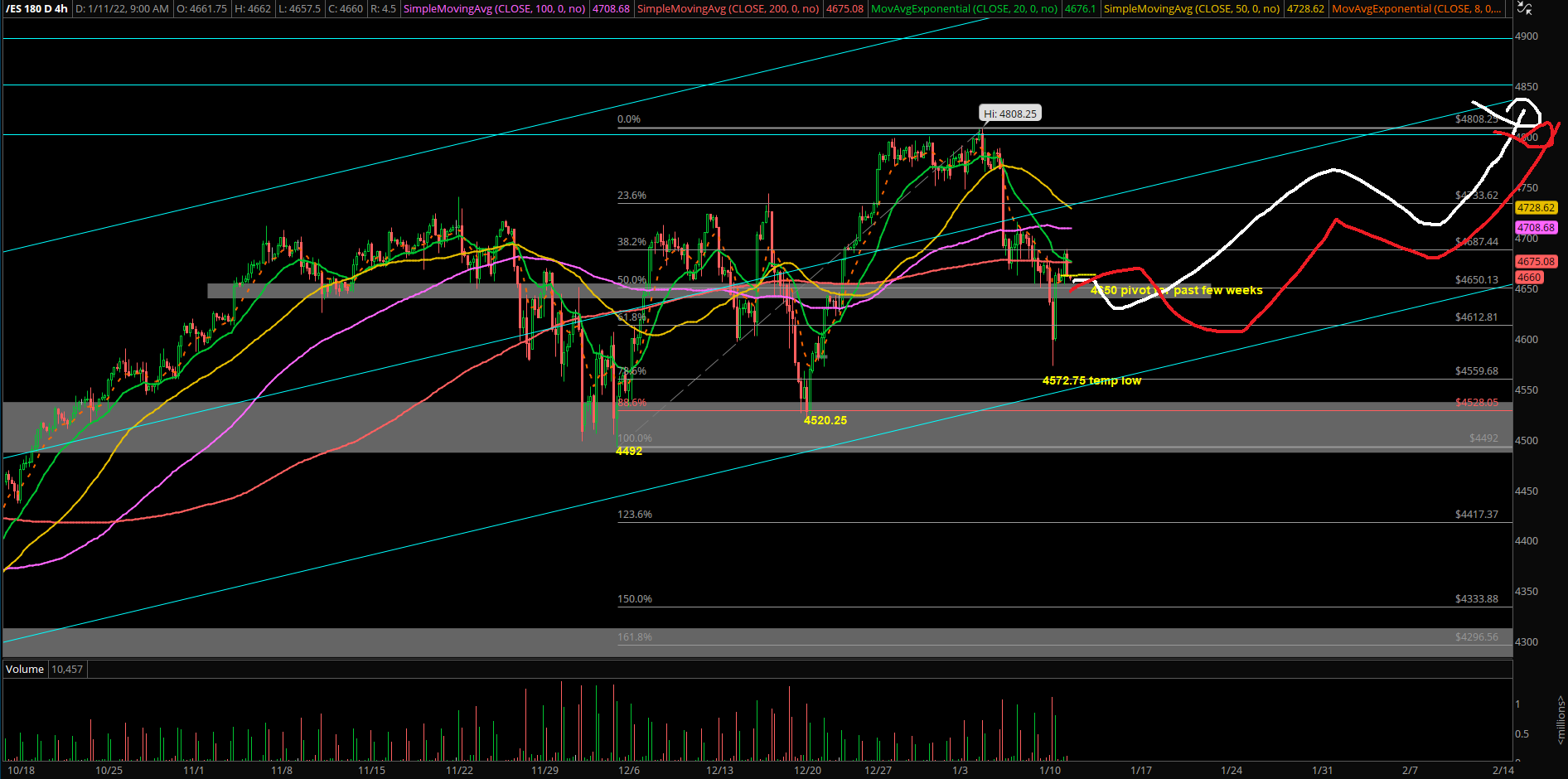

As for today, there's a "Powell timing catalyst" at 10AM, so let's see if it provides the market some juice for bigger moves. In overnight action, the Emini S&P 500 (ES) hit our 4685 level that coincided with the trending 4hr 20ema. It was rejected and is now hovering at yesterday’s closing print of 4662.

This means we’re likely opening within yesterday’s range, and need to be aware of an inside/range day possibility if no there's movement above 4685 or below 4620 within the first hour of RTH open.

Today favors intraday bullish momentum when above 4620 at all times. Adapt if below 4620. Immediate supports are ES 4650/4640/4620 to buy dips against. Immediate resistances are ES 4685/4700/4713 to trim longs against.

For now, we’re utilizing 4572.75 as the temporary bottom. Still need to see a daily close above 4713 to confirm the swing low as in for the bigger picture.