Massive Overnight Stick Save

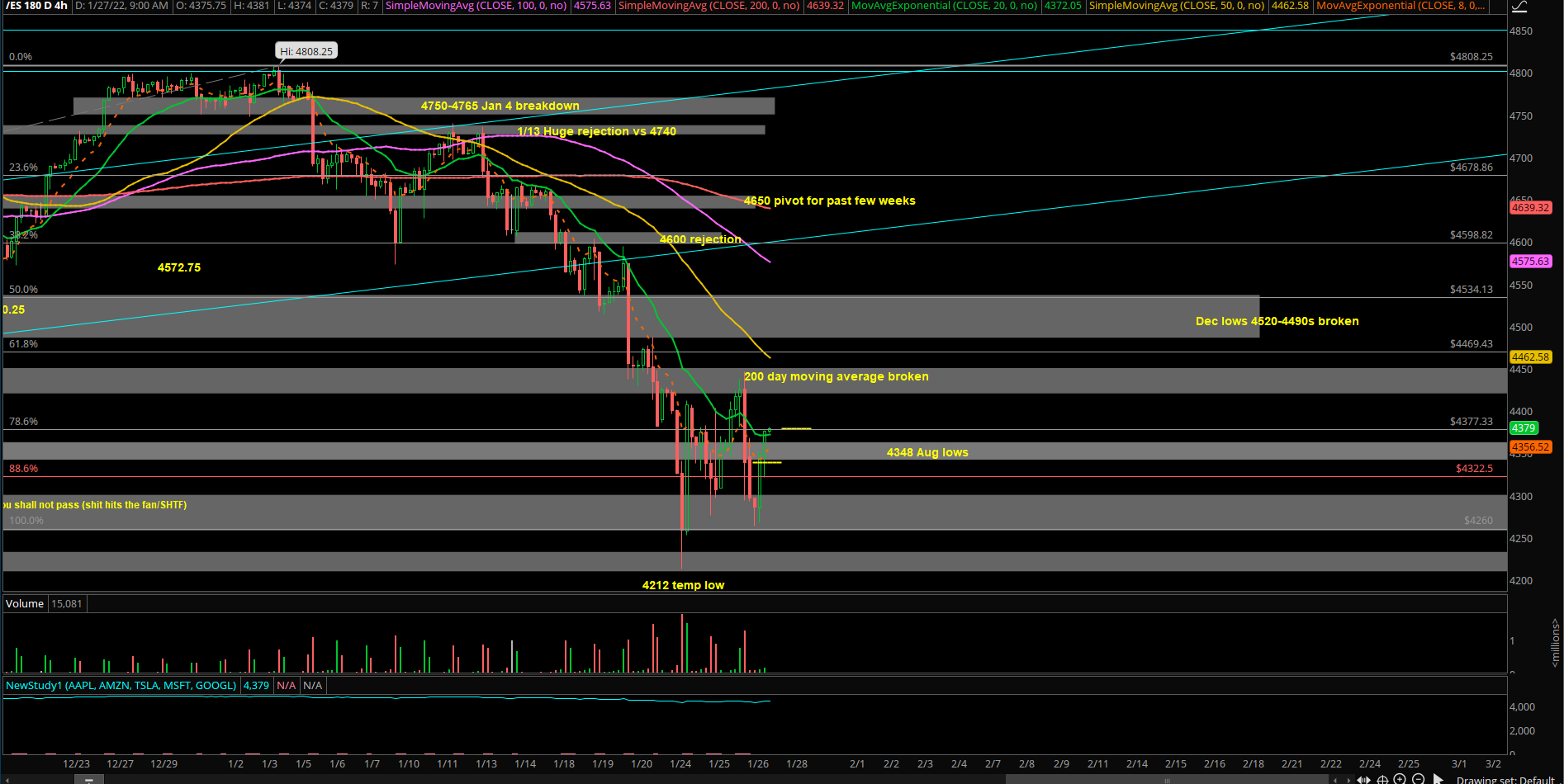

The ES is hovering in the 4370s, +0.75% above the previous day’s closing price as we head into RTH open. Massive +2.5 % off overnight lows!

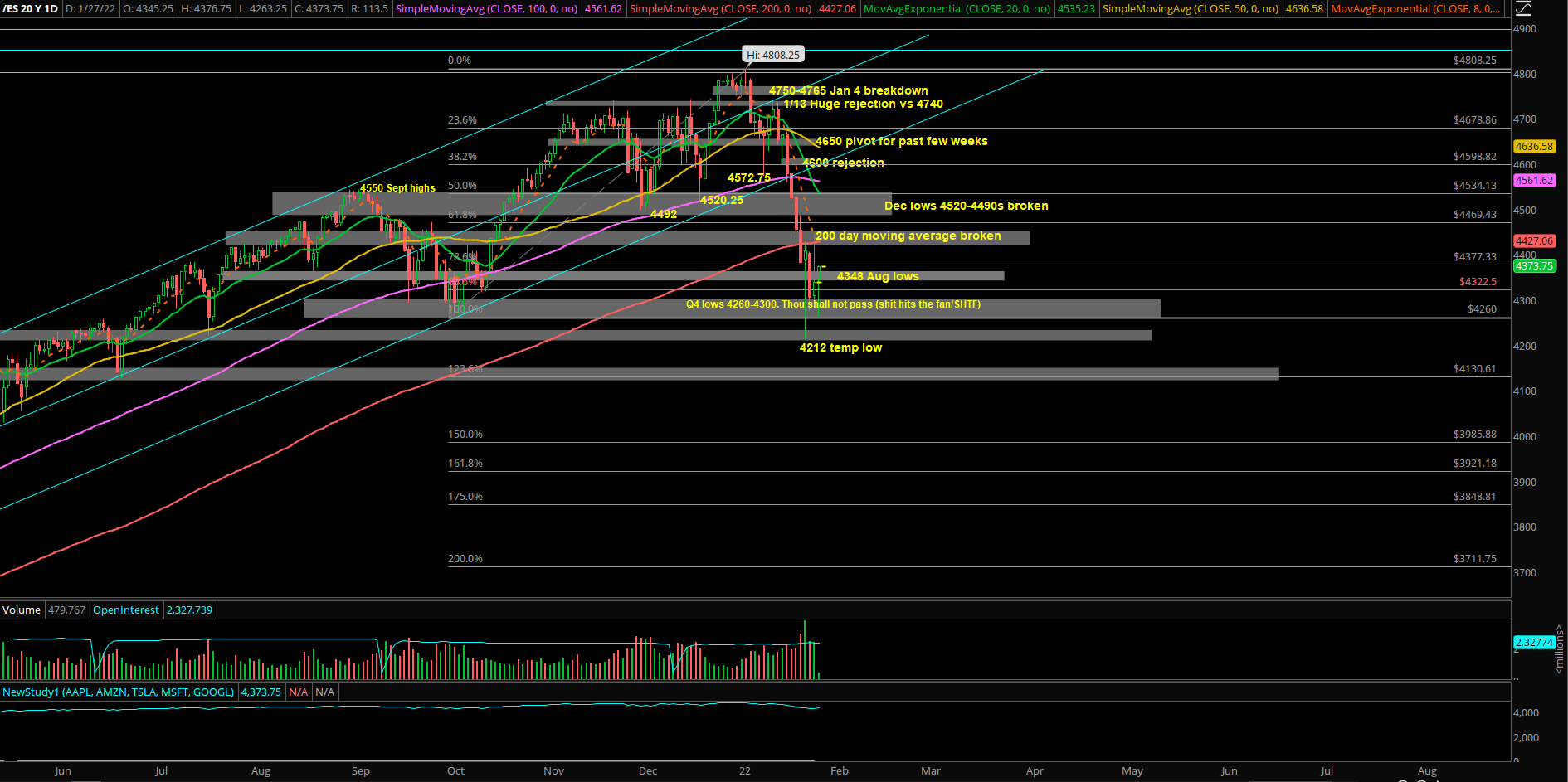

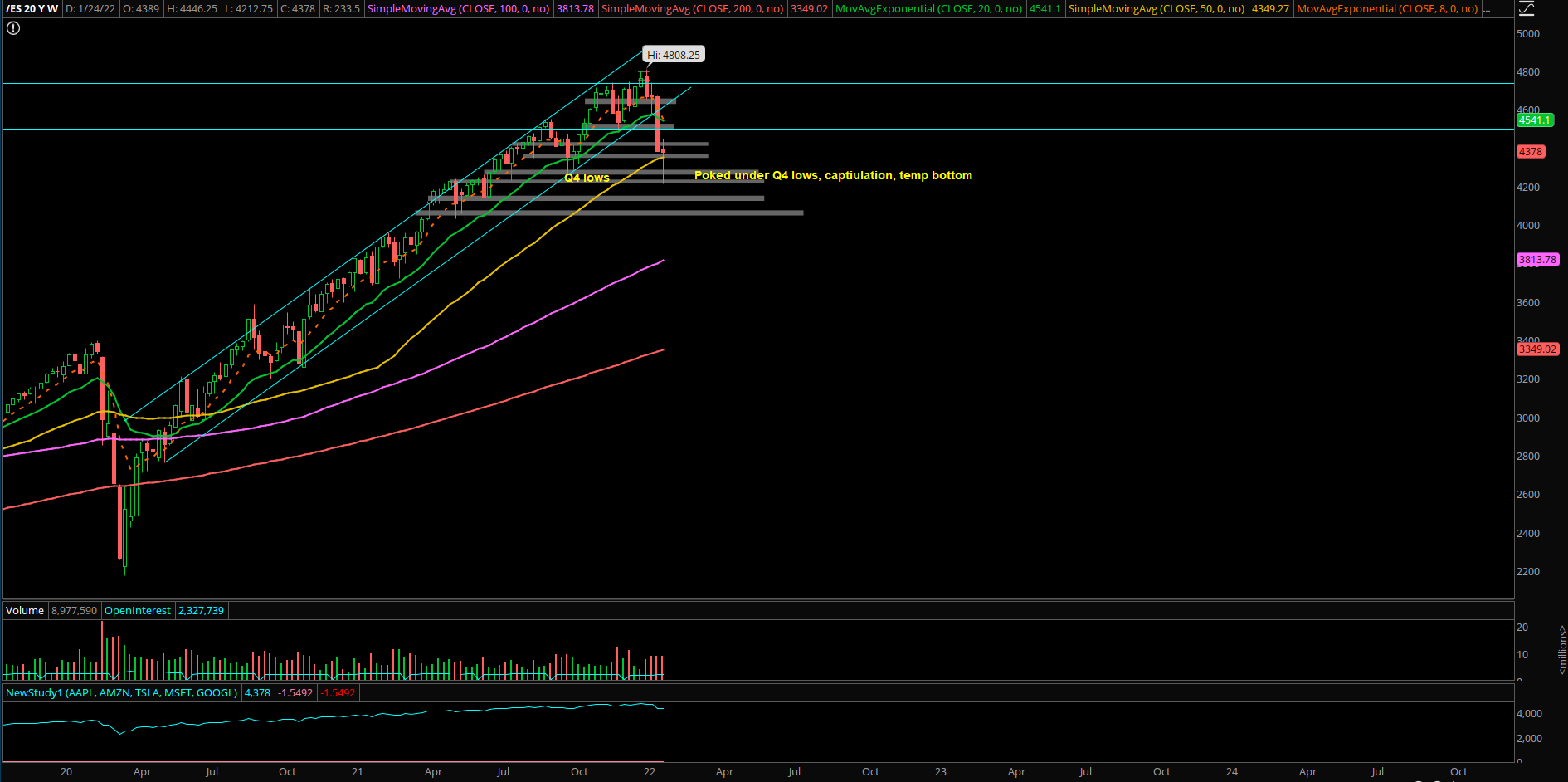

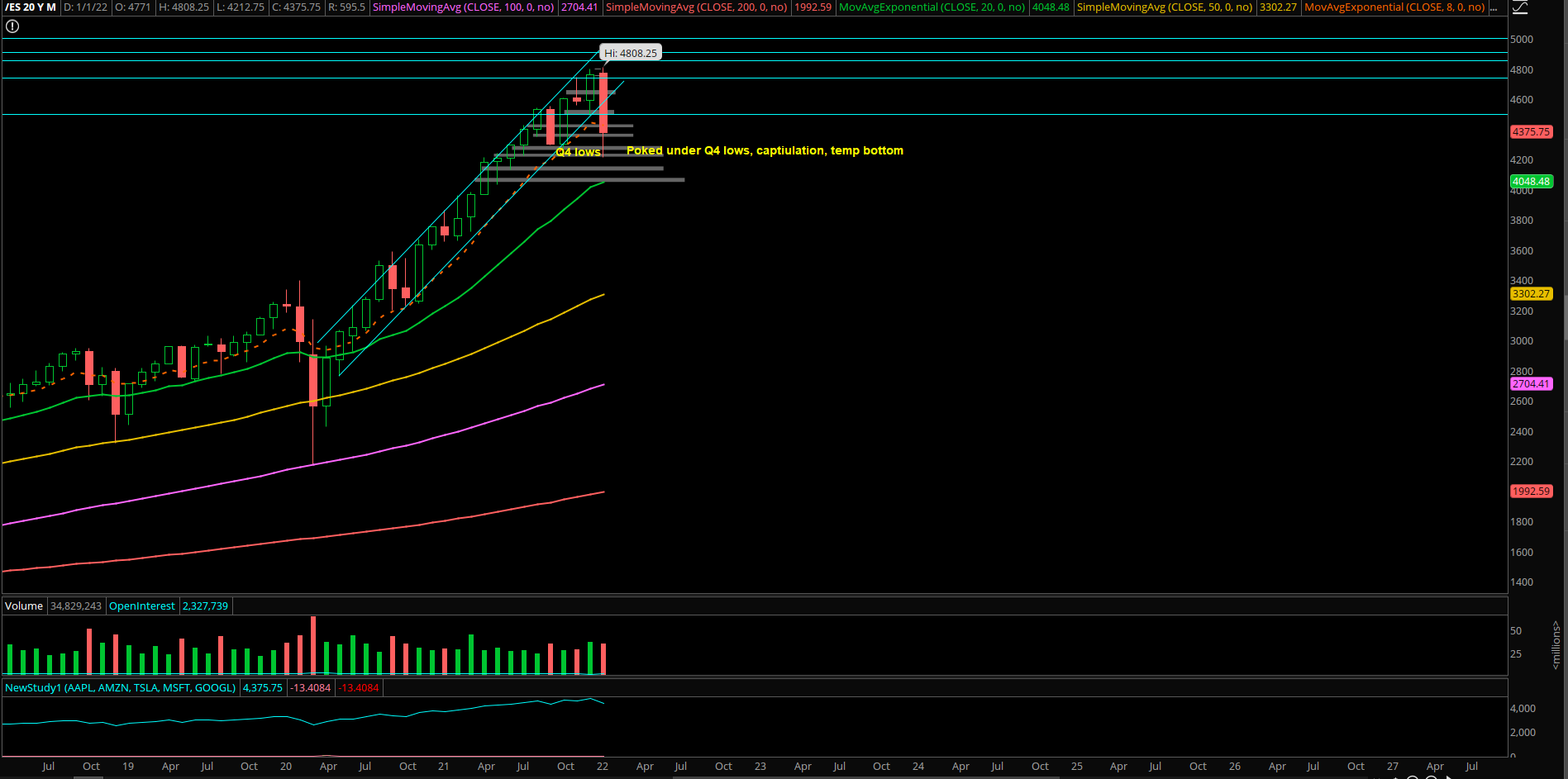

After the FOMC meeting and with the market trading in a 200~ point range for majority of the time this week, it looks like time to get out of this range and bodybag a few market participants judging by the large amount of extreme traps/breakout/breakdown failures.

We’re expecting a massive fight here in the 4385-4400 range once RTH opens, and are bull-biased based on overnight +100 points rally from 4263 globex lows…gummy bears may be trapped!

Main focus this morning should be looking for long scalp setups especially if price stays above 4350-48. Immediate supports are 4350-4348/4325 for long opportunities.

Bears would need to reject at the 4385/4400 current resistance area in order to try and get out of this unfavorable situation from the massive overnight stick-save.

A decisive break above 4420 could entice large buyers to step into play and head into 4450/4500-4520 important backtest area. A decisive break below 4325 would entice large sellers to revisit overnight 4260s low and possibly more price expansion to the downside (not our primary scenario at the moment given the overall context).