MarketMood Weekly Outlook: Prez Trade System Flips From Long To Short

For this past week, we were cautiously looking for a bounce to continue until a likely flip was detected and announced on Wed. Looking at the week ahead, the weekly sentiment pattern (chart not shown) portrays a general background theme of high emotions with a background of increasingly somber tone.

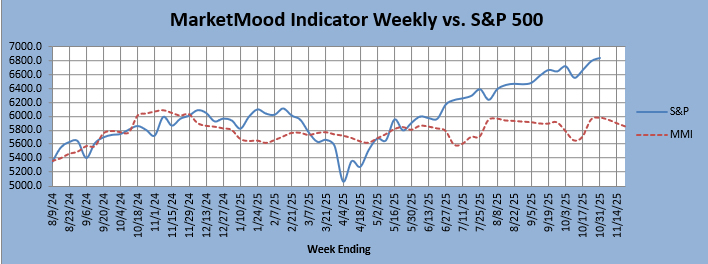

The MMI vs. SPX chart below shows an imminent peaking and fade over the coming weeks.

Latest weekly MMI vs. SPX chart:

This past week, Prez Trader Systems 1&2 continued to hold bullish with a planned exit and reversal by end of week after 3 months. System 3 was on hold. The candlestick chart below reflects the relative choppy sideways-upish motion of the market which mirrors the combination of the committed bullishness of Systems 1&2 and back and forth and non-commitment of System 3.

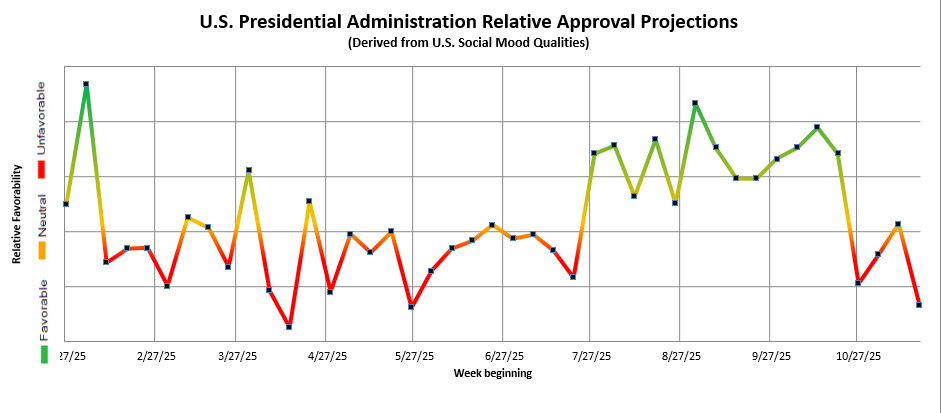

The Presidential Favorability chart (below) shows the relative favorability (relative vs. opposition). It appears to be dropping drastically this week from a peak last week. With trade signals a week behind that, Prez Trade Systems 1 &2 went short early (and the long trade closed) when the low of the week was breached on Thursday with a posted gain of 417 SPX points on this hypothetical trade. System 3 will go short at close on Friday (today) for two weeks. Systems 1&2 hypothetical trades are currently up about 9 SPX points from entry on 10/30/25. They are staying short (System 2 planned exit is in two weeks).