MarketMood Weekend: Enjoy the Calm While It Lasts

Where We've Been:

Friday's mood pattern implied an attitude of faith that somehow everything will turn out OK. MMI was up and with some struggle, the market closed up.

Where We're Heading:

There is a multi-day pattern playing out in the background that completes over the weekend which often goes with abrupt change and somber themes. MMI is nevertheless calculating Monday RTH open as up. MMI for Monday itself is same direction as Monday opens.

Sunday and Monday's mood patterns are quite intense with Monday's associated with near term market breakouts or breakdowns.

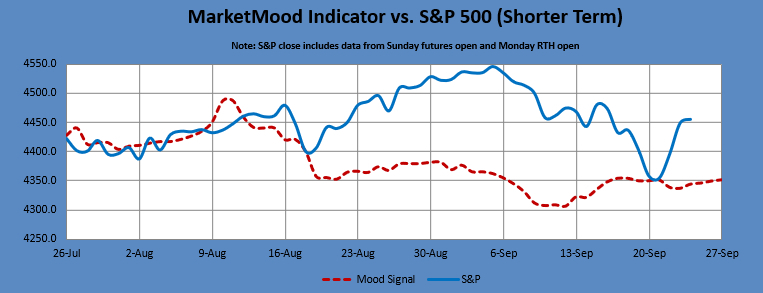

The swing and medium term indicators continue to be mixed. MM Trend Trader remains skeptical of the market rebound and stays full on bearish with any break above the bull / bear trend line seen as a temporary bounce. MM MACD remains in swing buy mode.

Internet search theme source data for MMI inputs: woman, model, info, mistake, past, body, friends, man, movie, creator, death, remembered, TV, firefighters, business, murder, police, military, uniforms, family, grief, sports, winners

Next 3 Days:

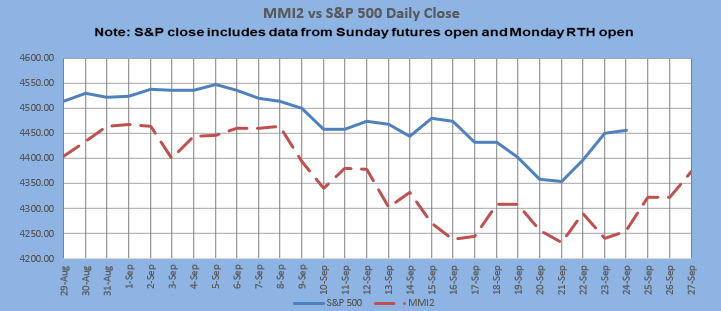

Date | Daily MMI | MMI 2* |

9/27 (open) | Up | Up |

9/27 | Same as open | Up |

9/28 | Up | - |

*MMI 2 uses an alternate dynamic algorithm to convert the same sentiment source data to S&P direction as the original MMI algorithm.

Latest charts follow the summary table.

MM Indicators and Trading Parameters Summary:

Indicator | Scope | Direction |

LTTI | Longer Term Trend | Bullish |

MMTT (main) | Medium Term Trend | Bearish |

MMTT (HP) | Medium Term Trend | Bearish |

MMTT (b/b) | Near Term bull/bear Trend Line | 4432 SPX (cash) |

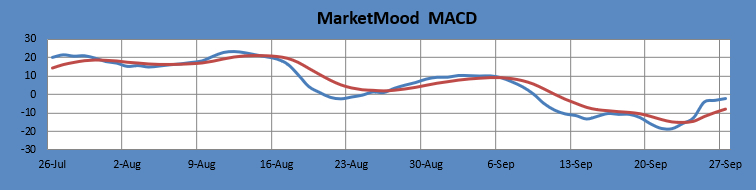

MM MACD | Swing Trade | Buy > 4358 |

MMI | Next calculated daily sentiment bias | Up |

Note: Medium term is roughly 1 week to 2 months. Longer term is roughly 1 month to a year or more.

Intermediate Term Forecast:

There is a slight edge to the upside in the week ahead, although the overall trend remains bullish. The remainder of the year, the market should be in a topping process and getting ready for what could be a substantial pullback in early 2022. More details are available in the Big Picture Update video: July and Beyond.

MarketMood Trend Trader

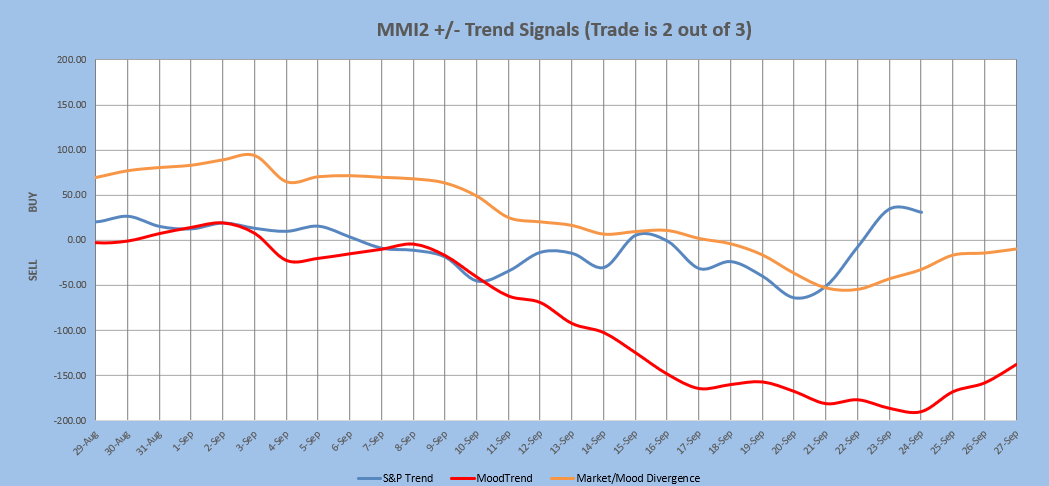

The chart below uses three sentiment trend lines to generate a swing trade signal of BUY if 2 out of 3 are greater than 0 and SELL if 2 out of 3 are less than 0. Trade length averages 9 days, but can be as short as 1 and has been as long as 60. The signal is updated each day after market close. Back-testing shows this signal averaging about 12 SPX points per trade over the last few years. Back-testing a higher probability signal derived only from the two mood related trend lines averages 33 SPX points per trade, but only initiates trades about once every 3 weeks. Note: past performance does not guarantee future results.

Current signal: Sell since 16 Sept. HP signal: Sell since 17 Sept.

MM MACD signal is BUY and the intermediate trend is UP > 4358 SPX (cash). The swing trade signal is buy at or above 4358.

The MM MACD is similar to a standard MACD, except that it uses the MMI signal data to extend several days beyond today, while the standard MACD relies solely on historical market data.

Long Term Forecast:

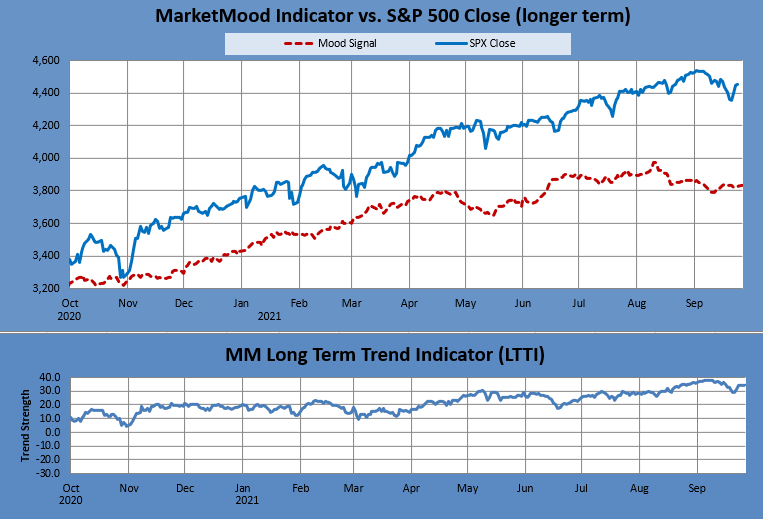

The long term trend is indicated by the general divergence between the stock market and the mood generated forecast (see long term chart below). The MM Long Term Trend Indicator (bottom chart) which is derived from this divergence, indicates: "Bullish Trend, hold long long-term positions." The MM LTTI has had this indication since 4 Nov 2020.

The MM LTTI measures trend strength using the divergence between the market trend and the forecast trend.

Note: Changes to next day MMI signals occur about 5% of the time, and will be announced in updates as well as the daily report should they occur. Same day signals will not change. Day 2 and 3 signals reflect the most current information, and are subject to change. The default trade per the daily signals is executed at market on close. except on Mondays, as there is a signal for Monday open (i.e. "weekend close") and Monday close. Historical data implies that the daily MMI signals tend to be correct as daily direction calls about 63% of the time over the long term.