Market in Wider Trading Range

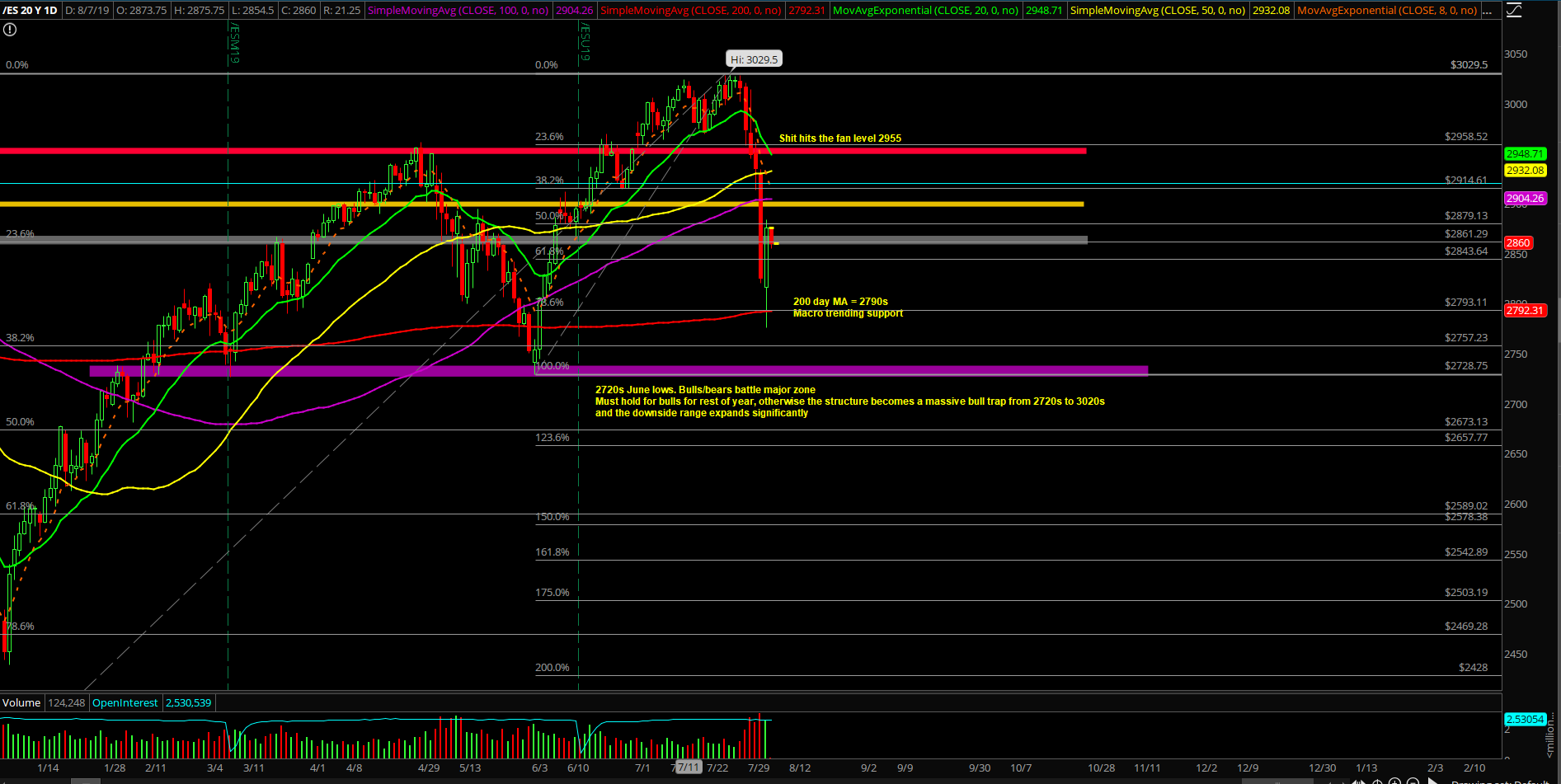

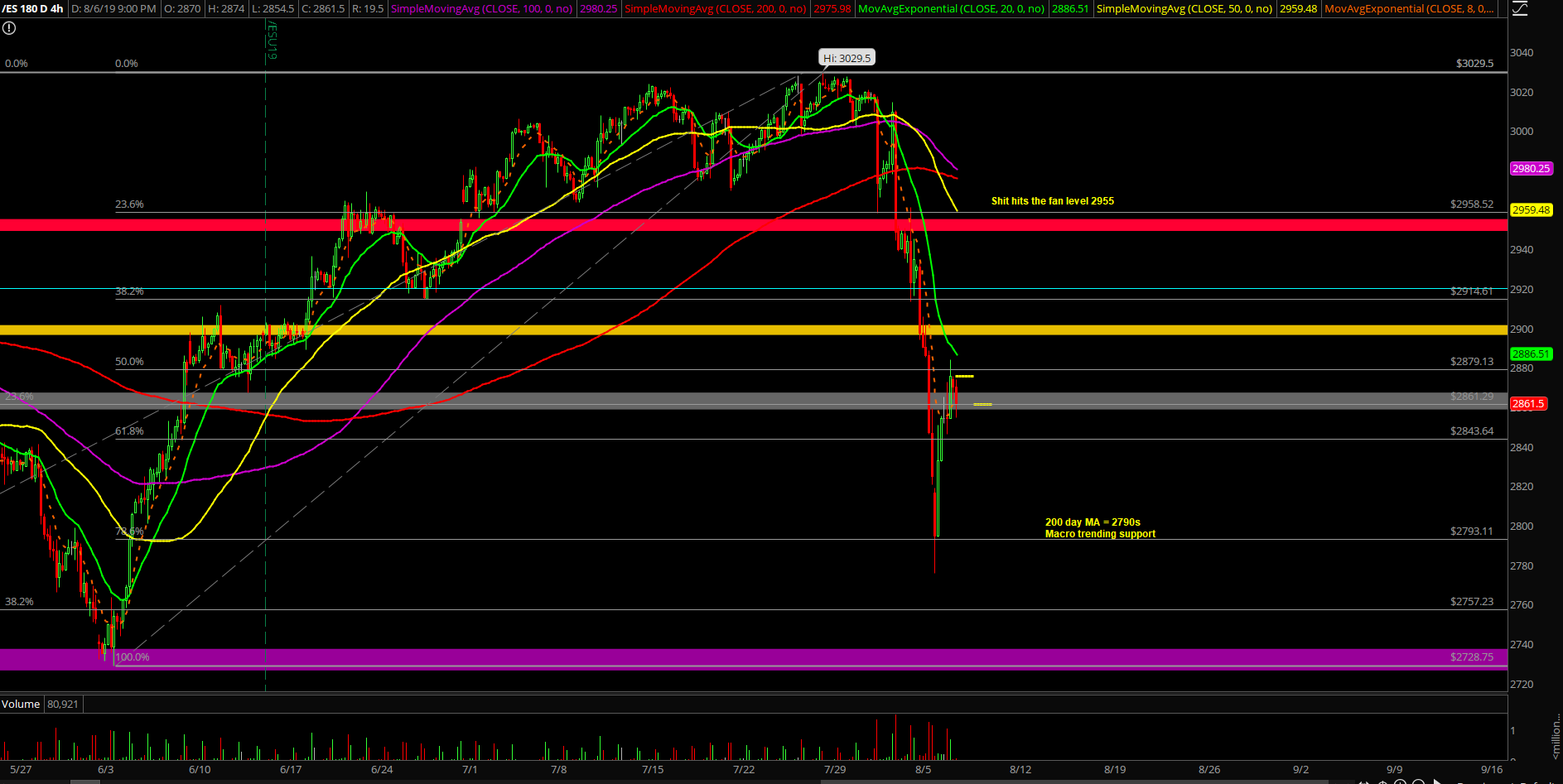

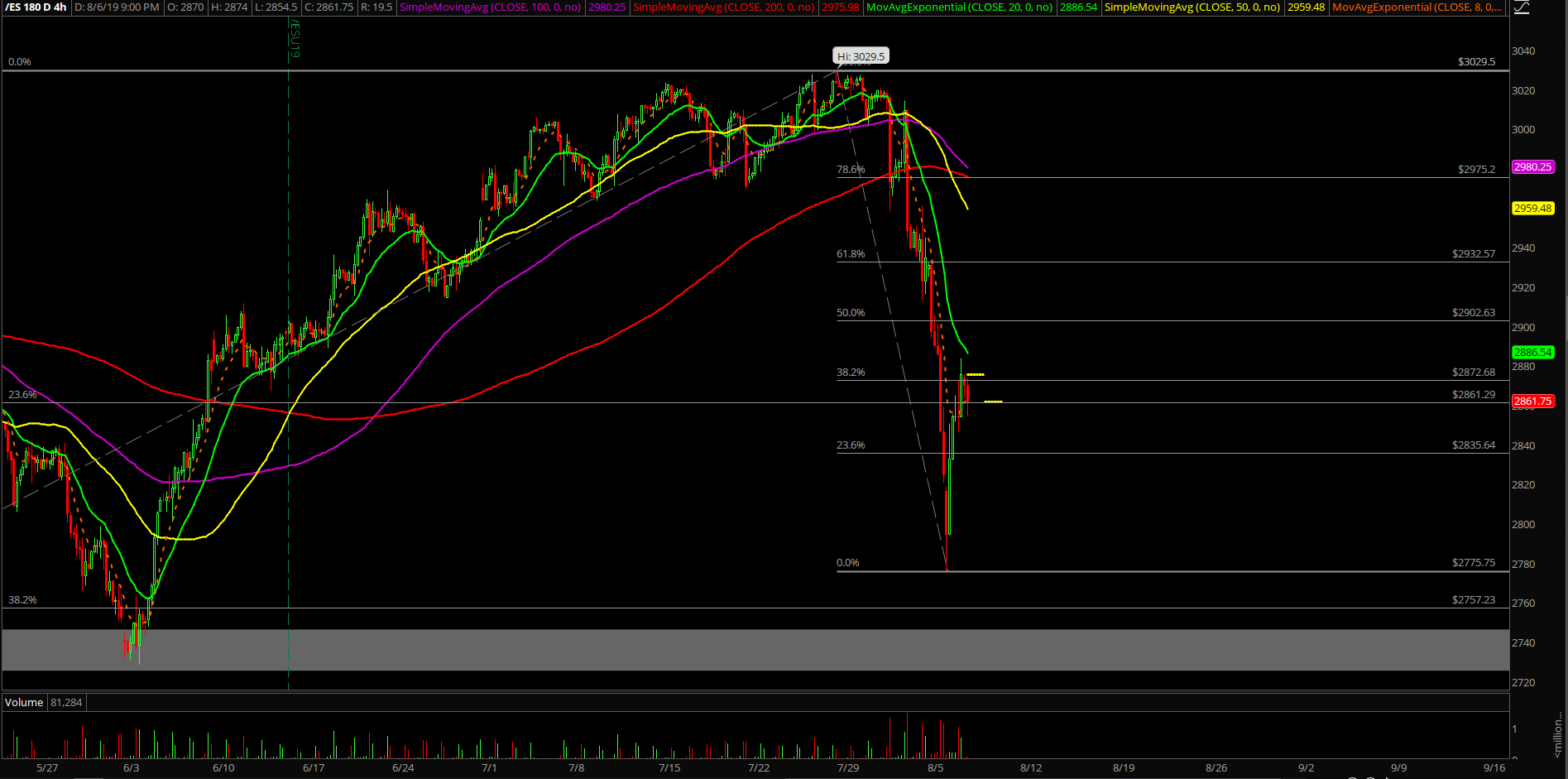

Tuesday’s session was an impressive turnaround as price "stick-saved" at the daily 200SMA overnight with the 2775 bottom being the temporary floor/support that the market needed in order to stabilize.

The main takeaway from this session is that the market has established a key temporary floor and ceiling for this week. This means that Sunday’s high of around 2933 and the Monday night low at around 2775 on the Emini S&P 500 (ES) are the key overall levels for this massive range.

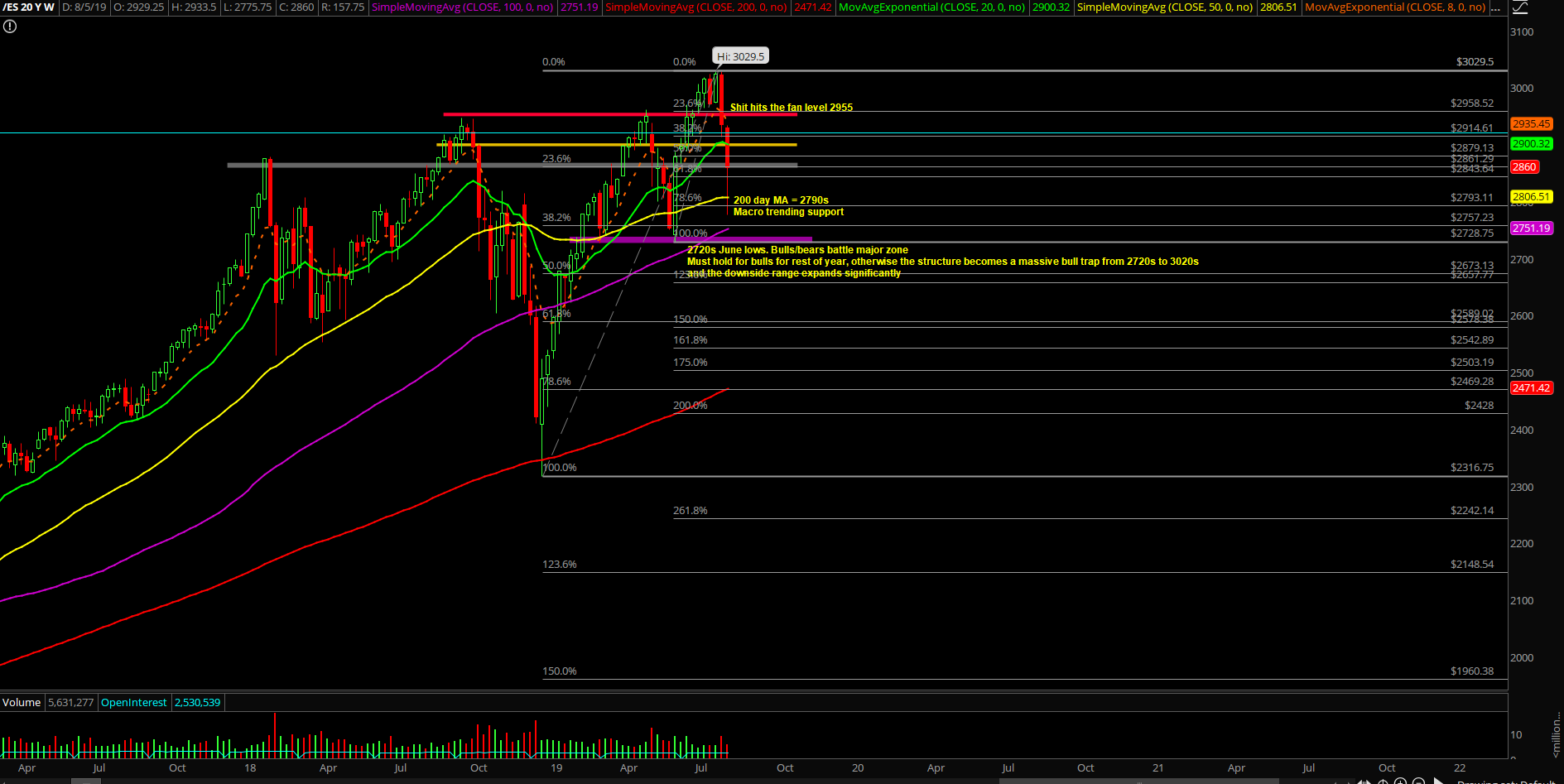

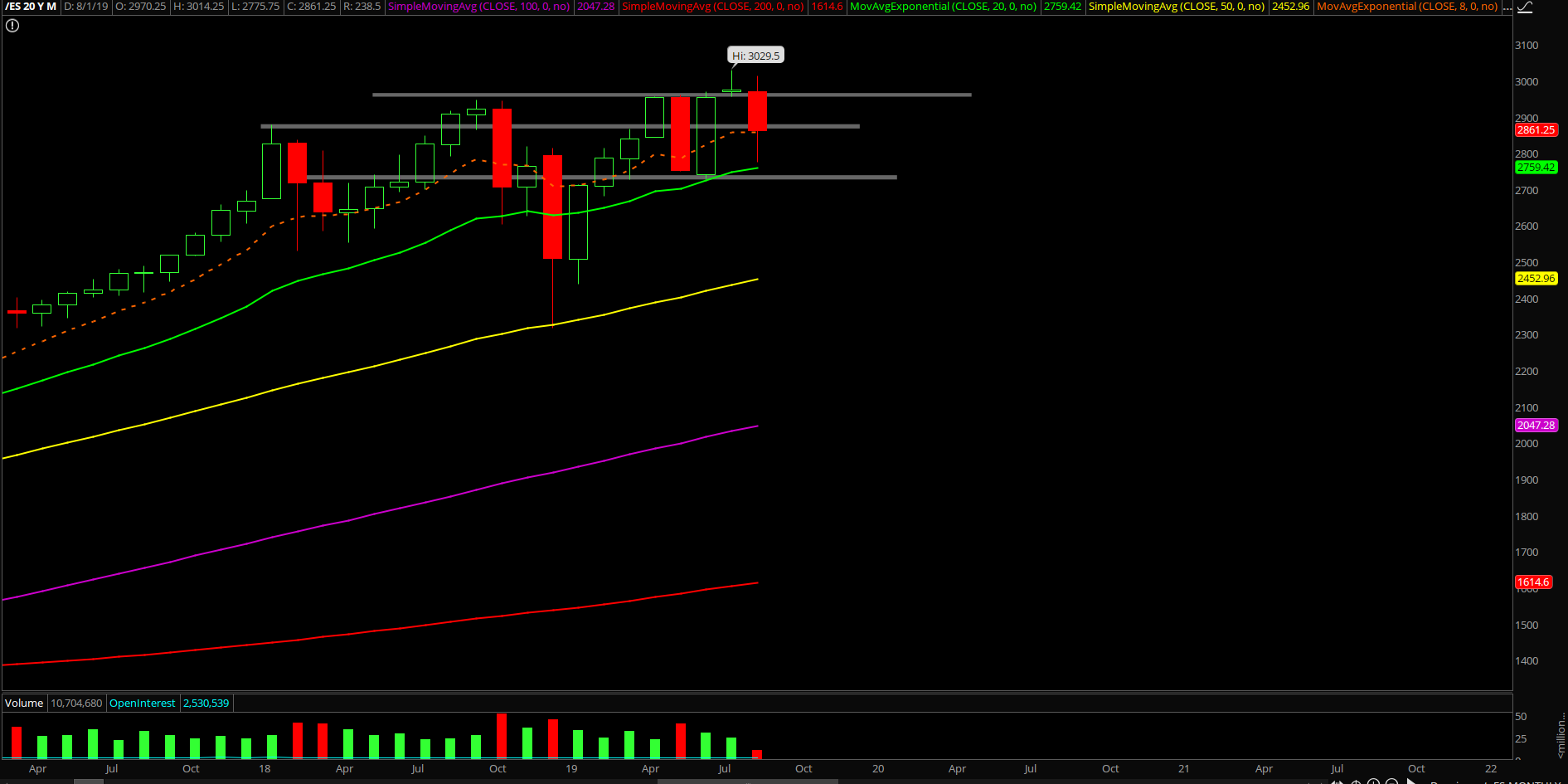

Based on our experience with these types of setups, the daily and weekly structures are telling us that this bounce is likely unsustainable without a revisit into near the temporary support. On the other hand, this could be another V-shape reversal with no looking back like the numerous times of V-shaped recoveries from the past few years in this macro bull market.

What’s next?

The ES closed at 2875.5 on Tuesday at around the highs of the session. Currently, the overnight session is just consolidating at the top 1/4 portion of Tuesday’s range and waiting for the next big move. Let’s see how the levels hold up by the time we do our premarket ES game plan report.

Current parameters/bias:

- 2775.75 is the temporary floor and 2933.50 is the temporary ceiling for this week’s overall range

- The weekly chart is telling us the current V-shape looking bounce looks rather unsustainable and the shorts may get another chance of a great risk to reward setup if price action gets near 2900/2933 resistance zones for another mean reversion to backtest towards 2775.75 or the 2790s 200 day moving average.

- However, we’ve seen many V-shape reversals and into new all time highs in the past, so the conditions are very simple for this setup; there must be no daily closing price above 2933 for a re-visit attempt at the temporary bottom area.

- Otherwise, the probabilities start to go down the drain as the bulls will try to re-take control of everything in the short-term with their eyes on 2955 next if 2933 gets reclaimed on a closing basis. If you recall, 2955 was the ongoing shit hits the fan level for the past few weeks.

- For reference, 50% fib retracement = 2902, 61.8% fib retracement = 2932 derived from the all-time high 3029.5 to 2775.75 current low.

- In this higher volatility environment, the focus should be on the key/extreme levels because the minor levels are more likely to get crushed compared to previous times when the market just handed out free lunches for everybody and their mother.

- It's a faster paced, higher volatility market with a bigger price range, so traders must adjust positioning sizing alongside with wider stops and targets in order to accommodate this overall range expansion for August.

- Going to keep taking shots at key levels utilizing the level by level approach in the ES trading room and try to execute our game plan when intraday opportunities present themselves.