Market Outlook: Value Continues To Outperform

Summary

- Value stocks outperformed in November.

- With Growth down so low, some might think it is "cheap", it isn't.

- Inflation remains a central concern for the market.

- Inflation is slowing, but it is an open question whether the Fed will admit it.

Good Morning HDI!

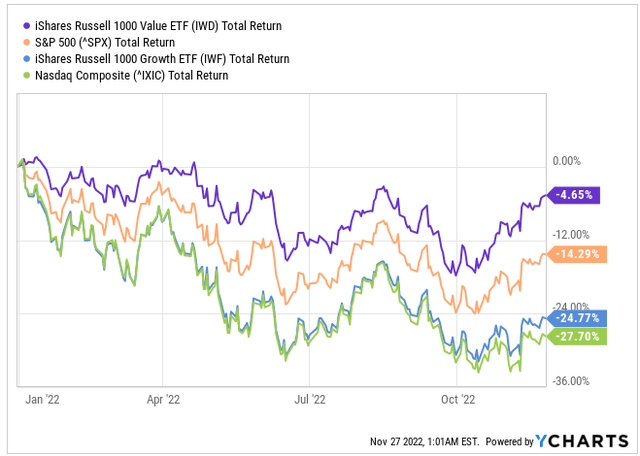

With only a little over a month left in the year, Value stocks have established a convincing lead over Growth stocks. They fell less and are recovering faster. The Russell 1000 Value ETF (IWD) is down only 5% year-to-date, while the Russell 1000 Growth ETF (IWF) is still down 25%.

The themes controlling the market indexes this year have had little variation. It is all about inflation and the Fed. It is inescapable these dynamics will continue to rule the macro direction of the markets.

Yet, it is worth noting that the actual Fed rate hikes have had little impact on the price of Value stocks. The rumor of rate hikes has been far more powerful than the news.

Sell The Rumor, Buy The News

As we sit today, the expectation is that the Fed will hike rates to somewhere in the 5% to 5.5% range. The current target rate of 3.75%-4% is already materially higher than was imagined in March.

On March 16th, Fed Futures were projecting a 0.05% probability that the target rate would be 2.75%-3% in December and a 99.95% probability that it would be something lower.

This illustrates two things:

- Take Fed rate projections with about as much seriousness as your Magic 8-Ball. Even those that correctly projected a more Hawkish Fed weren't even in the ballpark of being right on the magnitude.

- The prices of Value stocks fell with everything else as the Fed became more Hawkish throughout the year – but after the hikes actually occurred, Value prices are sitting in about the same place they were in March before any hike occurred at all. The fear of rate hikes had a much more significant impact than the actual rate hikes.

The prices of Value stocks responded to the fear that the Fed would be Hawkish. But generally, they have not been materially impacted by the actual rate hikes. Growth stocks, on the other hand, have struggled to recover.

It's All About The Cash Flow

Why have Value stocks outperformed Growth so significantly? Because rate hikes have not negatively impacted their earnings. In an inflationary, rising rate environment, having cash flow right now is more valuable than maybe having cash flow in the future.

Q3 2022 was one of the more successful earnings seasons for HDI holdings. We saw numerous dividend hikes, positive outlooks, and in most cases, guidance being met or exceeded.

The proof is in the pudding, and Value companies like we hold in the HDI Model portfolio are producing strong earnings in this environment.

Meanwhile, if we look at earnings for Growth companies, there were a few misses, but what really harmed them was poor outlooks. We've seen announcements of slowing down hiring or layoffs from AAPL, AMZN, META, and dozens of smaller companies in the tech space. These companies are switching from expansion to preservation.

Value companies trade at valuations that are supported by current earnings. In other words, investors buy a company expecting that what they see is what they get. Growth assumptions for Value stocks are typically very modest. Something like 3-5% earnings growth per year is considered really good for these companies. So if actual growth is lower than that, it has only a modest impact on valuation.

Growth stocks have valuations that are not justified by current earnings. They need growth, and without it, the company is worth much less. When a valuation assumes 15-20% growth, and actual growth turns out to be under 10%, that has an enormous impact on valuation.

So with Value companies, we've seen them sell off in fear periodically throughout the year, but then earnings are reported, and investors are attracted to the high current cash flow and dividends.

Growth Is Still Expensive

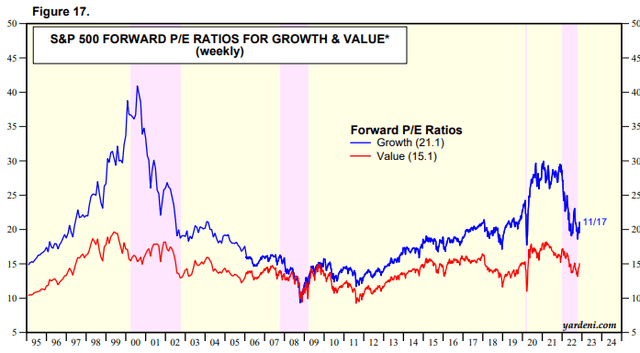

With Growth down so much from its peak, some investors might be considering whether it is "cheap". Looking at the past 20 years, it is still above average. Source

It is only "cheap" relative to post-COVID highs. Much like in 2001, Growth companies were very cheap relative to their 2000 highs. Growth valuations continued to fall until the bottom of the GFC.

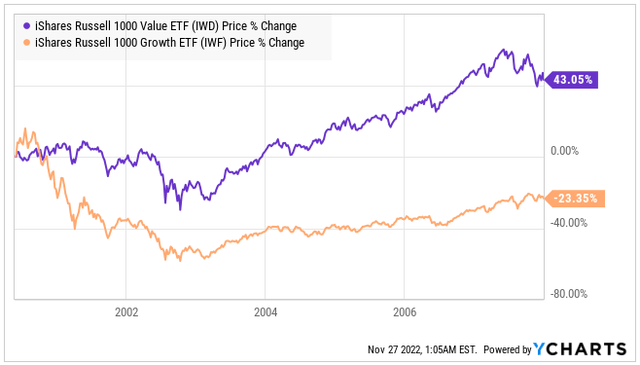

From 2000 through 2007, Value stocks outperformed Growth stocks every single year. Losing less on the down years and gaining more on the up years.

I believe we are likely in the beginning period of this type of outperformance from Value stocks. Note that this period of outperformance spanned a cutting cycle from 2001-2003 and a hiking cycle from 2004-2006. Plus, the beginning of the next cutting cycle in 2007 before Value stocks collapsed in late 2008. It also included a recession.

It is too early to predict whether this outperformance of Value stocks will span 3, 5, 10, or 15 years. History has shown us when Value stocks outperform, they tend to outperform for a long time.

It is very easy to have a "recency" bias and compare share prices today to what they were in the past couple of years to determine whether or not they are a "good deal". Looking at the big picture, Growth is less expensive than it was but is still well above average.

Inflation Is Slowing

I've been saying since March that inflation was peaking. Inevitably, someone questions my assertion, pointing out that the price of this or that is still much higher than it was at some date in the past.

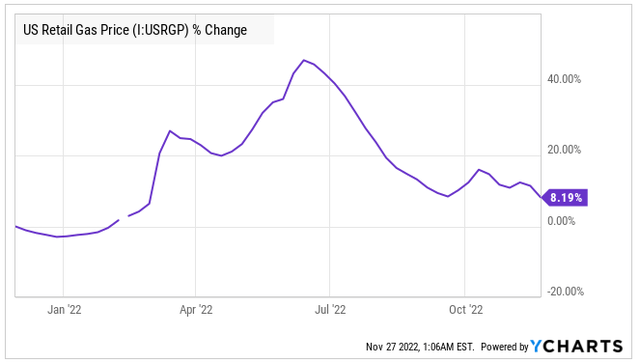

Inflation is not a measure of prices. It is a measure of the trend in prices. Consider everyone's favorite gripe - gasoline prices. Currently averaging $3.76/gallon, that is a lot more than gas has been in recent years. Well above its 10-year average price. A person might describe it as "high", and I don't think they would get much argument. Yet since June, gasoline prices have had a deflationary impact.

Inflation is measured month to month. So gasoline is deflationary when it is cheaper than it was last month, even though it might still be "high" when compared to history.

So when I say "inflation is slowing", I am not saying that things are getting cheaper than they were last year. That would be deflation. What I am saying is that prices are rising more slowly month to month than they were before. The pace of the increase is lower.

In June, the inflation rate for gasoline was over 50% year over year. Today, the annual inflation on gasoline is only 8%. The inflation rate is still positive, gas is still more expensive than it was last year, but it isn't 50% more expensive than last year like it was in June. Therefore the inflation rate on gasoline is declining. As it is for a great number of products.

With 0% inflation, everything would be exactly the same price. It wouldn't be cheaper. With that in mind, let's take a look at some of the factors that are causing inflation to slow down.

Consumers Are Feeling The Pain

As I discussed numerous times last year, inflation, at its core, is the result of supply and demand. When demand exceeds supply, prices go up. Consumer demand in 2021 was skyrocketing, and business after business was talking about their inability to keep up.

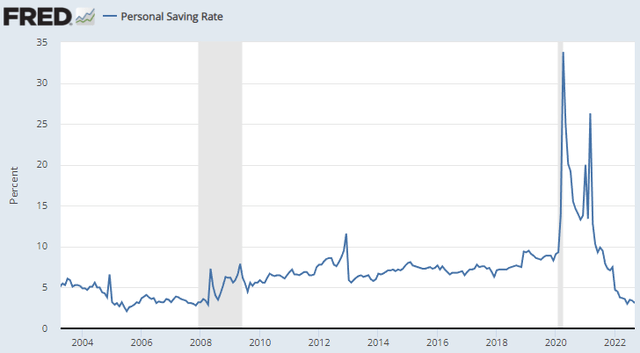

A significant driver was the massive amount of direct stimulus to consumers, at a time when options to spend money were limited. Consumers were getting thousands of dollars while being actively discouraged from going out into public, and in many cases, the businesses they otherwise would have frequented were forcibly closed.

The personal savings rate skyrocketed: Source

The inflation of 2021 and 2022 shouldn't have surprised anyone. Consumers were sitting on large amounts of cash that they saved up and were let loose to spend it all at once.

Today, consumers are no longer saving. Like much in the market, inflation is self-correcting. As consumer budgets become more stretched, they go from "feeling rich" and buying whatever they have the notion regardless of price, to having to think about how buying this or that will impact their budget. Most consumers today are in a position where they can afford some luxuries, but they have to prioritize what they really want versus what they are willing to live without. Personal savings rates are 50% lower than they were in January 2020!

Early reports of Black Friday are that sales are flat to modestly up from last year. Even online sales are only expected to be up 1% before adjusting for inflation. In other words, consumers are buying a lot less than they bought last year. They can't afford it.

Prices went up (inflation), and demand declined.

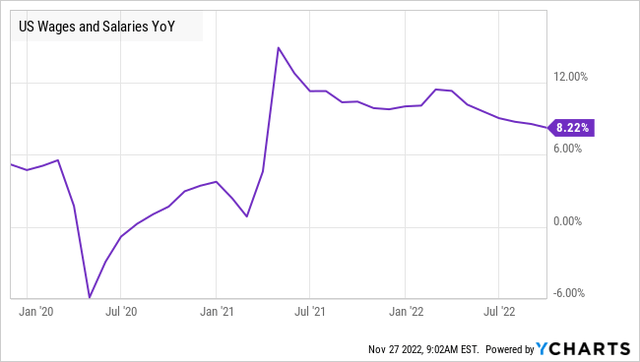

Wage Growth Is Slowing

What do people do when they get a raise at work? They spend it. Wage growth boomed in 2021 as businesses were racing to hire staff to reopen and handle the huge glut of demand. Many businesses struggled to find sufficient employees and were willing to bid aggressively for labor. As a result, employees enjoyed a period of very high wage growth that exceeded inflation.

Today, annual wage growth is only slightly higher than pre-COVID levels and in inflation-adjusted terms, is minimal. Employees might be earning more gross dollars than they were last year, but the amount of stuff they can afford to buy is roughly the same. Especially since inflation in necessities like gasoline, shelter and food has been higher than average.

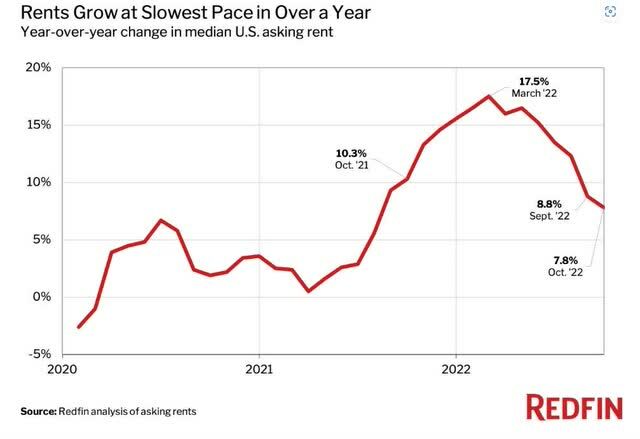

Rent Growth Is Slowing

Shelter makes up a sizable portion of most consumers' budgets and, therefore a sizable portion of inflation measures. Last year, I highlighted the rapid growth in housing and rent prices as a reason why inflation would be much higher than many anticipated. I pointed out how "owners equivalent rent", as measured by the government, created a very delayed picture of inflation writing:

Why is the data from the government so much lower than being reported? The answer is in how the government calculates "OER". This fact sheet, provided by BLS walks you through the process. The short version is that since rent prices change infrequently, each participant is surveyed on rent once every six months. So if a participant is surveyed in October and rent goes up 10% in November, that will not be reflected in the survey until April 2022. Since only 1/6th of the respondents are polled every month, it takes time for changes in rent to be reflected in the numbers. Whereas a company like Redfin is reporting asking rents, which is more or less live data on what rents are right now.

This inflation has already happened, if you have been out apartment hunting, you know it. It is simply a matter of time before it is reflected in official government measurements.

For things like rent or housing costs, I prefer to use real-time sources. Thanks to the Internet, companies with an invested interest in the sector and are involved in the day-to-day realities freely publish their experience. These sources are what I choose to rely on – not government bureaucrats doing surveys on a 6-month delayed basis.

Someone looking at CPI might be confused by the fact the OER inflation has gone up every month this year. After all, one would theorize that the Fed hiking rates would be an immediate headwind on housing since mortgage rates went up immediately, and most consumers buy houses with a mortgage. If you worked at the Fed, you might look at that number and assume the rate hike wasn't aggressive enough!

Yet if you come down from the Ivory Tower and look at what is happening in real-time, you can see that rate hikes did have an immediate impact on housing. Rent growth peaked precisely in March and has slowed down considerably since then.

Redfin

It turns out that the real world isn't as crazy as government metrics make it look. It's the metrics that are measuring what happened 6+ months ago instead of measuring what is happening right now.

Producer Prices Are Slowing

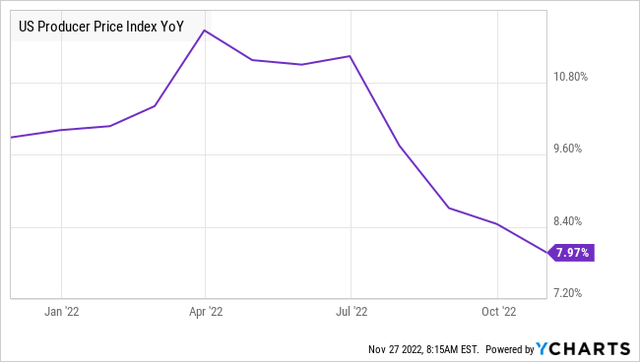

Last year, I highlighted the rapid rise in the PPI (Producer Price Index) as an indication of accelerating inflation. PPI measures the costs to businesses and can serve as a leading indicator to predict CPI (Consumer Price Index). The reason should be obvious: Most businesses do not immediately pass along higher costs to consumers.

When a business raises prices, they have to consider how it will impact demand, what peers are doing, and how much of a hike they can get away with without losing too many customers. Warren Buffett is famously a huge fan of Coca-Cola (KO), but if they hiked prices to $10/can and Pepsi (PEP) didn't, even he might change his brand!

As a result, many businesses are willing to absorb some higher costs, trying to preserve or grow market share. But they aren't willing to operate at a loss long-term. So eventually, even holdouts will hike prices. For these reasons, PPI can give us a glimpse of the future of CPI. This happened in 2021, as PPI took off a few months before CPI did. Today, PPI is slowing down considerably.

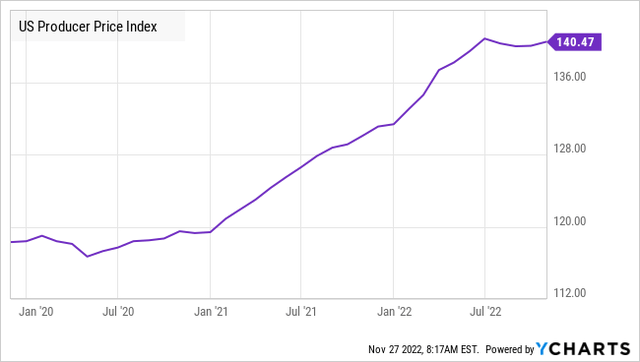

Again, prices are still 8% higher than last year, but the pace of growth is much slower. The year-over-year comparables are also getting higher. If we look at the Producer Price Index as a number instead of a rate of change, it looks like this:

Prices are still much higher than in 2020, but since July, they have not changed. This is in stark comparison to January 2021 to July 2022, where they were significantly higher every month.

Fed Rhetoric Is Softening...Maybe

One reason the market indexes have been up in November is that the rhetoric from the Fed has been getting a little softer. The minutes from the FOMC meeting earlier in November suggest that there is a real discussion about slowing the pace of rate hikes.

In addition, a substantial majority of participants judged that a slowing in the pace of increase would likely soon be appropriate. A slower pace in these circumstances would better allow the Committee to assess progress toward its goals of maximum employment and price stability. The uncertain lags and magnitudes associated with the effects of monetary policy actions on economic activity and inflation were among the reasons cited regarding why such an assessment was important. A few participants commented that slowing the pace of increase could reduce the risk of instability in the financial system. A few other participants noted that, before slowing the pace of policy rate increases, it could be advantageous to wait until the stance of policy was more clearly in restrictive territory and there were more concrete signs that inflation pressures were receding significantly.

The market focused on the Fed slowing. However, slowing is not stopping. How high the Fed might go is still an open question that the Fed itself has done little to resolve.

These comments, combined with the latest CPI numbers showing that inflation is slowing, have inspired confidence that there is light at the end of the tunnel.

The Bottom Line

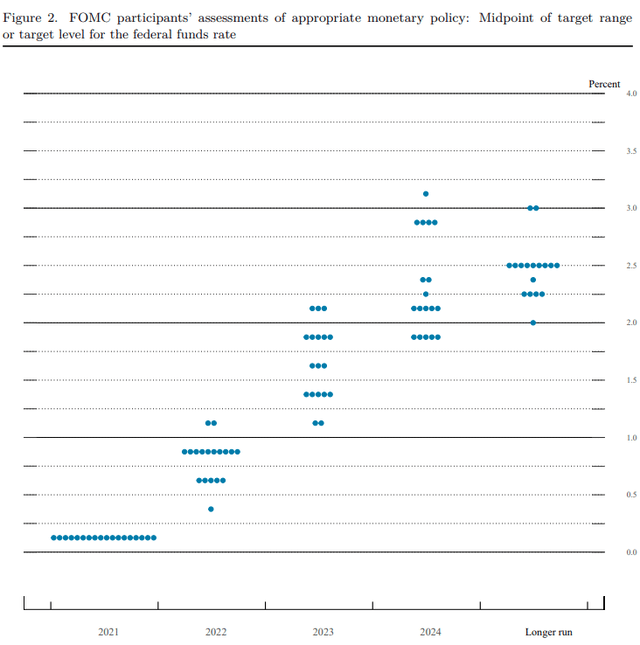

At this point last year, it was an open question whether the Fed would be hiking at all. Remember? In December 2021, the Fed itself released this dot-plot projecting future rate hikes: Source

The most hawkish members of the Fed were projecting a Target rate of 1%-1.25% by year-end and a peak of 3%-3.25% that would be reached in 2024. The current target rate is 3.75%-4.00%, and it is widely expected that the Fed will hike at least 50 bps in December.

In short, the current Fed has proven itself utterly unreliable at predicting even the near term. The Fed itself, the folks who actually vote on what interest rates will be, can't accurately predict what it will do. So in December, the Fed will release a new "dot plot". The market will respond to whatever they say. The stock market will likely react violently in either direction depending on whether it interprets it as "good" or "bad". Ignore it.

Last year, inflation was running rampant. It was obvious to us that the Fed was entirely too late in hiking rates. We believed that if the Fed was going to hike, they should have hiked in early 2021.

This year, inflation is slowing down. The Fed should be stopping its hikes and maybe even cutting as the economy weakens. It isn't. And we aren't very confident that the current Fed will have the awareness to reverse course in December.

It is more important than ever to remain "agnostic" toward interest rates. We will continue owning a mix of fixed-income investments like preferred stocks, bonds, and fixed-income CEFs, while also owning investments with exposure to variable rates like commercial mREITs, CLOs and BDCs.

For every investment, our primary concern will be that the yield is high, that the cash flow is strong, and that the dividend is well covered. We don't need to predict what the Fed will do because we will own companies that are generating profits and paying us dividends.

With Value outperforming Growth, our portfolio should continue to see better price stability than the market indexes. The more important thing is that our income is high, and it is growing.

As we end the year, the market will be obsessed with every word the Fed says, even though the Fed has a terrible accuracy record. At HDI, we will be watching the markets for any price swings that might create favorable buying opportunities or favorable selling opportunities.

Our focus will remain on growing our income.