Market Outlook: The Madness Behind The Income Method

Good morning HDO!

Before we start, I want to send HDO's best wishes to those who were impacted by Hurricane Ian. I know we have a good number of HDO members with homes in Florida, and I hope that you and your families are all safe. We spend our time talking about our money, which is important. Yet, in the face of mother nature and personal tragedies, we learn how unimportant our money really is. To anyone who has been impacted, our thoughts and prayers are with you. Focus on the important things in life, your portfolio will still be there, pumping out dividends when you return.

No Rally Yet

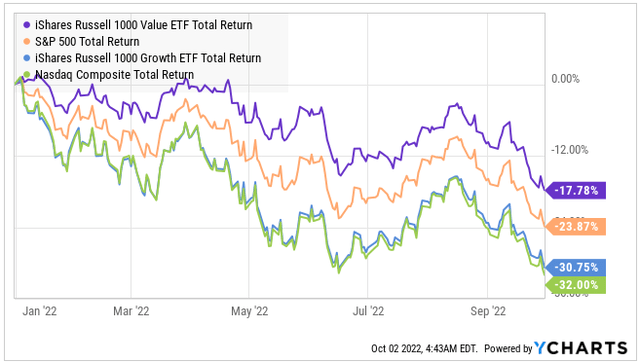

The market rally fizzled. The S&P and the Nasdaq both hit new 52-week lows.

While "Value" stocks like we hold in the HDO Model Portfolio are still outperforming year-to-date, they are down nearly 18%. This is an amount that a lot of people get concerned about. Yet in the stock market's history, this is not an abnormal event. Bear markets come around from time to time, and through your investing career, you will see several of them.

For the S&P 500 and the Nasdaq, this is the deepest bear market since the Great Financial Crisis. For Value stocks, it isn't as bad as COVID was.

Today, I want to focus on dividends. Share prices will do what they do. Will the market recover next week? I don't know, and frankly, I don't care. The market will recover eventually. Until it does, I'll focus on growing my income and buying dividends while they are on sale. As far as I'm concerned, prices can stay low for the next few years.

I've seen many comments asking about dividends in relation to the share price. Questions like "what use is a dividend if the price is down X%?". Today I want to answer that question in-depth and include some backtesting analysis of the Income Method using Portfolio Visualizer.

I preach about focusing on income. Today, I want to pursue more deeply why I am such an evangelist about income investing and why swings in market prices really don't faze me at all.

What is a Dividend?

A dividend is a payment to investors from a company's cash accounts. It goes from the company's bank account to the investor's brokerage.

What investors should be concerned about is the source of these funds. Imagine that you and I create a company, each contributing $100,000. The company has $200,000 in the bank. We could do nothing with the company and just declare a dividend of $20,000 we each collect $10,000, and now the company has $180,000 in the bank.

Clearly, that isn't sustainable, the money will eventually run out, and neither of us will have any profit to show for it because the company isn't doing anything but giving us our capital back.

Now suppose instead of doing nothing, we create a business. We put all that $200,000 to work, and the company generates profits. Say it makes $30,000 by the end of the year in profits in addition to replacing the $200,000 cash. So with $230,000 in the bank, we get to decide how much in dividends to take out. Our options are:

- Take out more than $30,000.

- Take out exactly $30,000.

- Take out less than $30,000.

If we take out more, we will have less than $200,000 for our company to generate profits from. In most lines of business, that means we will likely generate fewer profits, and eventually, the earnings power of our company would decline, and we would have to reduce the dividend.

If we take exactly $30,000 it is less clear. Was this a good year? Can we expect the same return on the same capital every single year? Typically, you will see a variation in profits from year to year. If we're paying out exactly what we make, the risk of eventually needing to cut the dividend is high.

If we take out less than $30,000, we have a lower yield today, but we are maximizing our future potential. We can take out saw $20,000, realize a 10% return on our investment, and now the company has $210,000 in the bank. With more money, hopefully, the business will be able to have higher profits next year or at least continue to produce enough to payout our $20,000 dividend.

This is what we are talking about when we discuss "the dividend coverage". Is the company paying out exactly, more, or less than it earns?

At HDO, a large part of our due diligence is determining whether a company is outearning its dividend. We aren't interested in high yields from companies that don't have the earnings to support them. We look for companies that are covering their dividend and can reasonably be expected to cover their dividend from earnings.

In other words, we are looking for dividends that stem from profits earned by the company.

Prices Are Not Stable

"My dividends aren't enough to make up for the falling price!"

I see variations of this phrase all the time. Some investors seem to be under the impression that the purpose of dividends is to somehow "make up" for a declining price. That isn't the purpose, and it is a very unhealthy way to look at dividends.

A dividend is distributing profits to you. While a company's profitability might have some relation to the share price, there are a million other factors that impact prices. This is especially true when everything in the market is selling off.

I am much more alarmed when a single stock crashes than when every stock crashes. Why? One stock crashing could be indicative of something fundamentally wrong with the company. Maybe the market is predicting that profits will be down and that the dividend might be cut. If one stock is crashing and every other stock is just fine, the odds are much higher that there is something concerning about that company.

When the entire stock market is red, odds are much higher that the sell-off has more to do with general sentiment than company-specific issues. In other words, the company I own will continue making profits and distributing them to me.

In the short-term, sentiment will often be a much more powerful force than dividends. A stock that is yielding 12% is only paying a dividend of 1% per month. It is very unreasonable to expect that dividend to outweigh the power of sentiment, which routinely moves stock prices by more than 1% in a day.

Stock prices are very volatile. The standard deviation for the S&P 500 is around 15% annually. This means that in a "typical" year, we can expect the S&P 500 to move up or down 15%. Not to mention that while traveling to the end of the year, stock prices will swing up and down daily. This is far more volatile than your typical dividend, even when you are averaging a high yield, like 10%.

A dividend stock will pay you a stable cash return, but there is nothing special about a dividend stock that will make it immune from sentiment. The price of dividend stocks will swing like the price of every other stock in the market.

Dividends Are Stable

Since dividends stem from a company's earnings, they are relatively stable. Established companies make relatively predictable amounts of money and can plan in advance how much of those profits they will distribute as dividends. This is especially true for companies that are outearning their dividend by a good amount, as they can experience variation in profits without declining below their dividend.

As investors, we can look at the corporate quarterly filings and see how much dividend coverage a company has, whether it is improving or deteriorating, and we can consider future projections to help us determine if the dividend might be shaky.

Sometimes, there will be "black swan" events that can put a normally safe dividend at risk. COVID was an example of that, as numerous companies saw their revenue plummet almost overnight. During that period, many dividends that could have been considered solid in late 2019 were cut. Yet black swans are called black swans because they are very rare.

During normal times, dividend outlooks are much more stable. Ask me what the price of a given stock will be next year, and I have no clue. Ask me how much of a dividend it will pay next year, and I can provide an estimate that will be right most of the time. The price of a stock will swing several percentage points in either direction every single week. The dividend that a company will pay does not.

Can You "Beat The Market"

Over the decades, I have met a handful of people who are capable of trading in and out of the market and identifying price trends in advance well enough to have market-beating returns over impressive periods of time. I have met a far larger number of people who believed they could beat the market consistently, but over longer periods, but their strategies proved to outperform only temporarily.

I can't tell you how many hedge fund managers I have seen described as "prodigies", usually because they made one concentrated bet that worked out favorably for them. They have their 15 minutes of fame, and then they fade into obscurity as they underperform several years in a row. Beating the market for a month, a quarter, a year, 5 years, or even 10 years is not proof you can do so over your entire retirement.

I'm not going to sit here and tell you that timing the market is "impossible". What I will tell you is that those who manage to make market-beating returns doing it consistently are few and far between. They put a ton of work into it, and even then, they will have many years that they fail.

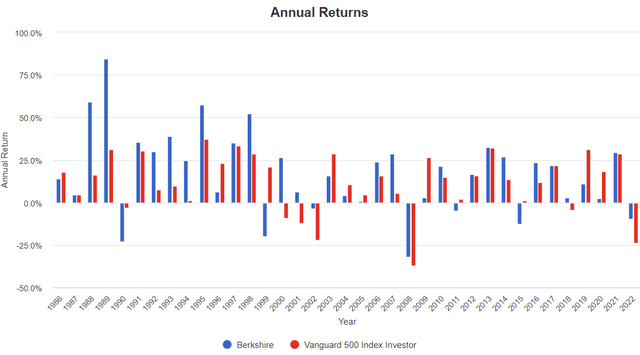

You won't "beat the market" every single year, and that is ok. You don't need to. There is an investor who has done alright for himself – his name is Warren Buffett, you might have heard of him. Here is his track record against the market indexes. The blue is Berkshire, the red is the market:

By my count, Buffett beat the market 24 out of 36 years. In other words, 1/3rd of the time, he underperforms the market. Sometimes by a very significant amount.

This presents a challenge for retirees because it is easy to get frustrated when you fail to "beat the market" over a given period. When the reality is that even the best investors will often go several years without beating the market. It is especially scary when your share prices go down. We are often looking at the market over very short periods of years or even months. Many investors are tempted to react to price changes over those short periods, which can lead to disastrous results as they realize losses at the bottom to move into a sector that is peaking.

The great news is that you don't need to "beat the market" every single year to have a very comfortable retirement.

The Income Method

The instability of prices and the relative stability of dividends is why I created The Income Method. Prices are temporary, they come and go. Often the price changes before I can even place my buy order! How rational is it to base your performance on something that changes every second that the market is open?

What is the goal?

Forget "beating the market" – this isn't a game for me. I'm not out to be like a star athlete, winning for the sake of winning. Whether someone out there makes more money than I do in the market does not impact my life. My goal isn't to have "the most". It is to have enough to support the lifestyle I choose to live. I can live perfectly fine knowing that I didn't get the highest score in the market game. If I don't have the cash I need to support the lifestyle I choose, now we are talking about something that impacts my quality of life.

When I think about it, there are a few facts to use as my base:

- Prices change, and I can't predict what they will be in the future with any significant precision.

- My cash needs in retirement are not a single lump sum. I need recurring and preferably growing cash flow.

- I can't predict how long I will live with any significant precision.

I need cash flow, not some random sum of money. My goal is not to have $1 million, $5 million, or $10 million. Such a goal doesn't even make sense because if I live to 75, the amount of money I need is very different than if I live to be 100.

Why would I set a goal at some random dollar amount? I don't know how many dollars I will need. I don't know if inflation will average 1%, 2%, or 5% over the next 30 years. I don't know if I will live for 30 years. I could guess at these values, relying on historical averages and life expectancies. Maybe my guess will be close, but I don't want my future to rely on a "guess".

So instead of making my goal to have $X million in my portfolio, my goal is focused on my annual dividend stream. Even when the market is down, I can look at my income stream and see whether I am closer or further away from my goal. Often, I am closer to my goal even when share prices are down.

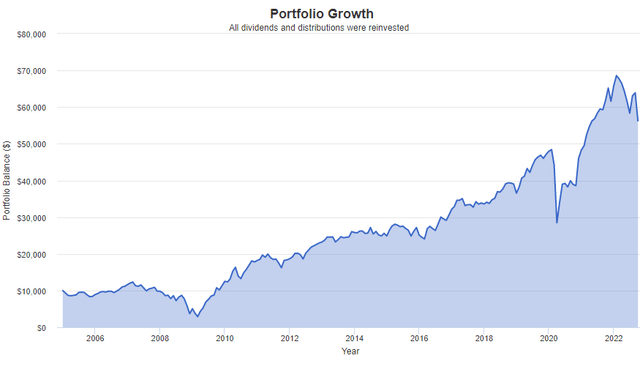

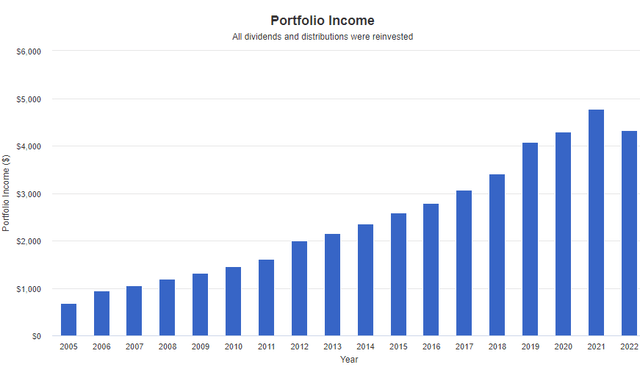

Consider one of HDO's longest-held holdings, Ares Capital (ARCC). The top graph is the changes in price, with reinvestment of all dividends, and the bottom graph is the income.

(Source: PortfolioVisualizer)

(Source: PortfolioVisualizer)

(Source: PortfolioVisualizer)

(Source: PortfolioVisualizer)

Note that the price declined over 80% during the Great Financial Crisis. It was relatively flat for many years and crashed 40% again during COVID. You likely panicked during those years if your goal was to get to a lump sum. In both cases, you lost about 5 years of progress in terms of portfolio value.

If your goal was income, from 2007 to 2009, your income increased 26%. Note that this increase occurred despite a 17% dividend cut in 2009. The reason for this is that reinvesting at lower prices drives future income upward.

In hindsight, there was no reason to panic about ARCC during the Great Financial Crisis, nor was there a reason to panic during COVID. In both cases, the price eventually fully recovered, but when ARCC went from $20 to under $5, many investors panicked. When it went from $19 to below $10 during COVID, they panicked again. After all, that was "6 years of dividends just to get even!"

Investors who focused on the income saw that being able to reinvest in ARCC at 30% yields was the bargain of a century. The price for ARCC has been all over the place, the income has steadily climbed.

By focusing on the income, investors got a clearer picture of how their investment was actually performing. By setting an income goal, as opposed to a value goal, investors can rely on a much more consistent measurement. Price varies wildly from year to year, while income doesn't, even through very difficult times.

Don't Forget To Reinvest

Note that if you were already in retirement mode, you aren't going to be reinvesting 100% of your dividends. After all, income is the goal because that is what you intend on taking out. This is why you need to build reinvestment into your plan. Even when you are retired, you want to ensure your income stream is growing.

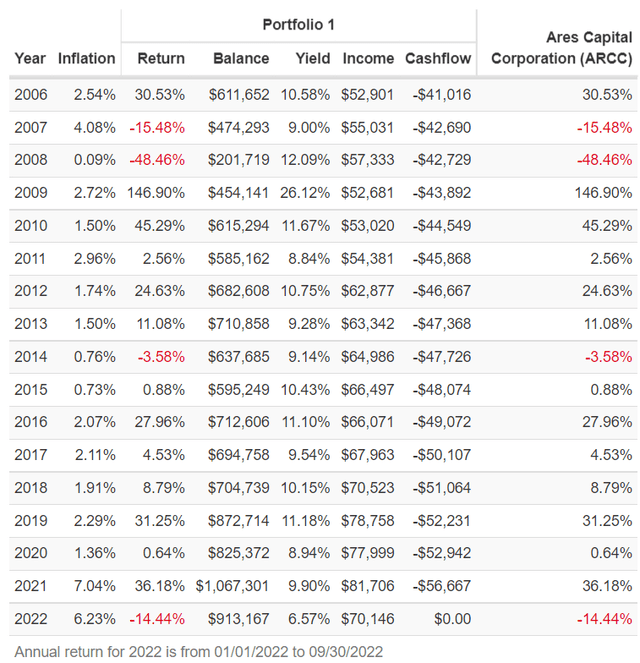

Here is a look at ARCC assuming a $500,000 initial investment and withdrawing 75% of the dividends, and reinvesting the rest in year one. Then increase your income draw with inflation:

Portfolio Visualizer

Note that the income continued to grow with the lower level of reinvestment, and your ability to take out the cash flow needed was never in question. By 2021, The investment produced $81,700 in income, easily covering the $56,667 withdrawal.

Selling Shares Is Not The Same As Dividends

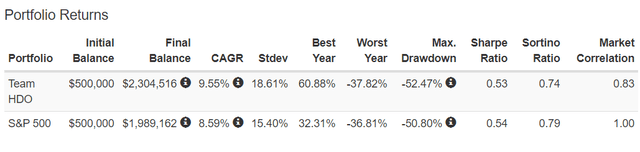

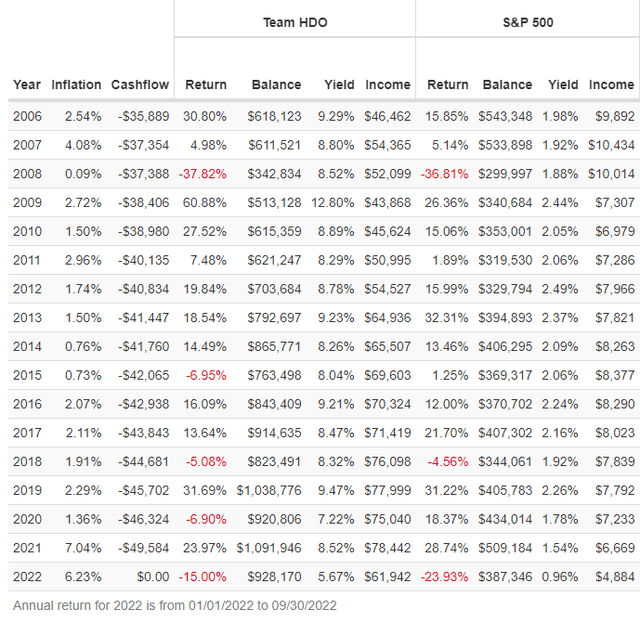

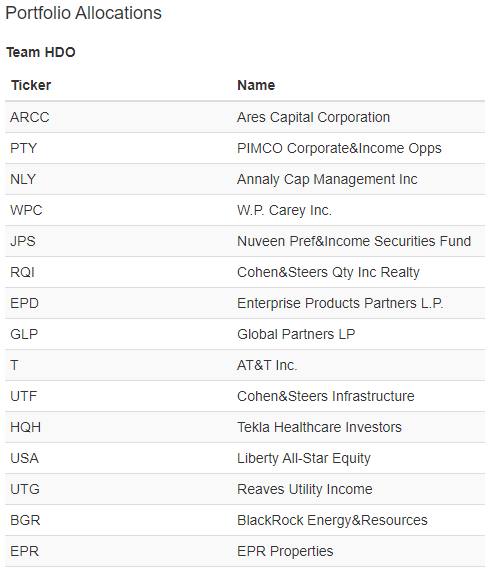

I often hear people say you can "create your own" dividends by selling shares and that there is "no difference" because when a dividend is paid, the price is adjusted down anyway. This is false, and I can prove it. Consider the HDO portfolio picks that existed back in 2006. Here is the team:

Source: Portfolio Visualizer

Source: Portfolio Visualizer

We have a bit of everything in there, BDCs, REITs, mREITs, energy, and CEFs – all the sectors that are our bread and butter. Note that these aren't cherry-picked for anything other than being over 16 years old. Some of these picks don't have particularly impressive track records since 2006. In this group, we've seen numerous dividend cuts since 2006, and half of them didn't outperform the S&P 500 on their own. In short, this is what I would consider a fair cross-section of the HDO portfolio.

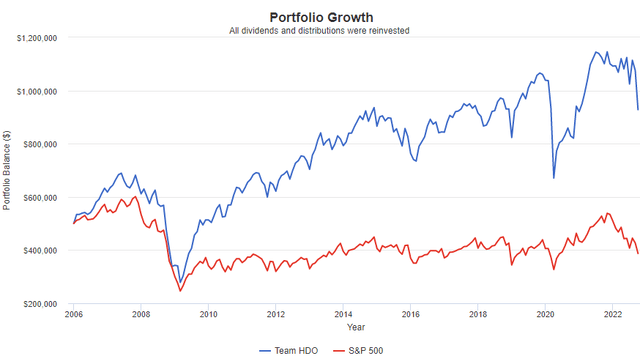

Let's do some backtesting. You can follow along or test your own assumptions here. Without taking out any income, the results look like this with all dividends reinvested.

Yay, Team HDO! We win a little bit. But let's not fool ourselves, a 15% difference in value is something that can change in one bad year, and we've had those, now that in 2020, the entire "lead" was washed away as the HDO portfolio was hit harder by COVID.

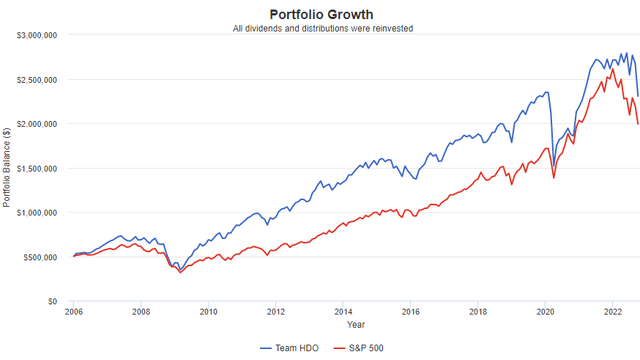

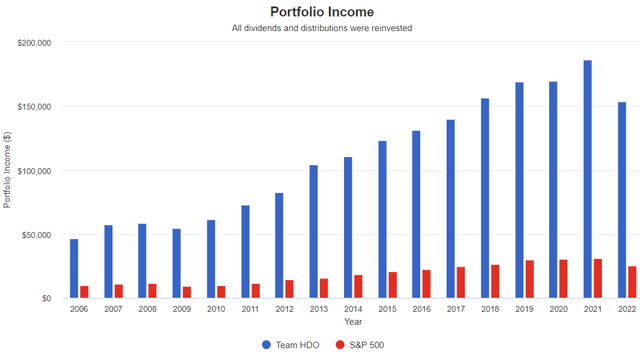

Where Team HDO really shines is the income.

The income for Team HDO grew quickly. Remember, this is assuming reinvestment, but $0 in new outside money invested. Now let's look at what makes the Income Method really special. Here are the same stocks over the same period, but with the assumption that you withdraw $35,000 (75% of Team HDO's income) in year one and then index withdrawals to inflation:

Remember how Team HDO only had about 15% more when we assume reinvestment? When you change your assumption from reinvesting to withdrawing, suddenly, Team HDO's outperformance is $928,000 to $387,000. An outperformance of about 140%!

Tell me again how selling shares is the same as dividends.

Here is why that happens. Note that the cash flow in the left column is how much is being taken out annually adjusted for inflation. The "Income" column is how much dividends are being produced.

Team HDO's dividends were able to cover the cash flow every single year. The S&P 500 was not able to cover it ever. As a result, every year, the S&P 500 shares had to be sold to cover the cash flow. Fewer shares meant less dividend income which meant even more shares needed to be sold. Worse, in down years like 2008, the shares were sold at bad prices, meaning even more shares needed to be sold!

In the end, Team HDO produced over $78,000 in dividends, while the S&P 500 only $6,700. Meaning that the HDO retiree only needed to withdraw about 60% of their dividend income, leaving a very nice cushion, while the S&P 500 investor is faced with selling over $40,000 worth of shares out of a portfolio now worth less than $400,000 just to maintain their income. In reality, the HDO retiree can comfortably give themselves a raise, if desired to about $60,000. The S&P 500 retiree seriously needs to consider tightening up their belt and cutting their income draw. Selling now could be fatal for their retirement account.

You can see how the 25% cushion is vital to ensure that the portfolio continues indefinitely. With a starting point of 2006, dividend cuts in this portfolio were experienced early on, and in 2009, cash flow was about 87% of the dividends. The optimal investment strategy would have been to trim your withdrawal and reinvest more in what was a really great year to reinvest, but obviously, that is a strategy that might not be feasible for some.

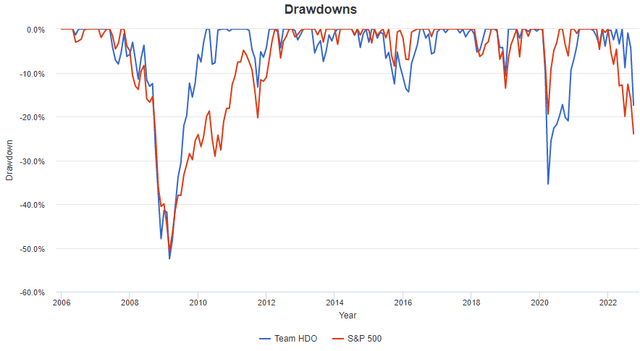

This is the power of never selling a share to fund your lifestyle. For those who are worried about their portfolio values today, note the variance in the "balance" above. Even that volatility is a bit misleading because it only measures year-end. In February 2009, Team HDO was down 52%. In March 2020, down 35%.

Yet through it all, the income remained strong and trended upward. No, it wasn't a perfectly straight line. There were challenges, there were dividend cuts. This is investing, things are not going to work out perfectly 100% of the time.

Don't Guess Whether Your Portfolio Can Support Your Withdrawal: Know That It Can

The important thing is when the rubber meets the road, your portfolio can provide enough income to meet your needs. To know whether your portfolio can do that, I strongly believe that focusing on dividend income is by far the best way of knowing whether your portfolio is going in the right direction in the long term and whether it is capable of supporting your withdrawals.

With dividends, it is easy. You know how much you received; take out less. Preferably, take out 80% or less if you can manage your budget with that amount. Though as the example above demonstrates, needing to take out 90% in a bad year of dividend cuts isn't the end of the world. Your portfolio can survive it.

When you are selling shares, how do you know? You don't. You have to guess. You can't know for certain whether the market will recover next year and you'll be able to sell at higher prices. You don't know if delaying your share sale a month will make things better or worse. You can't possibly know for certain. At best, you're making an educated guess. For many retirees, it's just a wild guess, fingers crossed, hoping they have enough to last their lives. Whatever big number they thought they had in their portfolio is likely 25-30% less today if they meet the market averages.

Every share they sell will generate 25-30% lower returns for them to use as income, which means they have to sell 30-40% more shares than they would have needed if they sold on January 2nd. (If you have a share valued at $100 that declines to $75, you have to sell 1.33 shares at $75 to obtain the same $100)

Conclusion

If you have more millions and billions than you can count in your portfolio, you may not care if you have to sell off the occasional $100,000 worth of stock at a bad price. You have so much that it doesn't matter.

For the rest of us mere mortals, we have budgets we need to live within. When you are relying on income from your portfolio, it is crucial that you know, beyond a shadow of a doubt, that you can take that money out without creating a threat to your future financial well-being.

You aren't concerned about becoming the richest person in the world, you are concerned about making sure you can pay your bills for the rest of your life and have enough left over to spend on the pleasures you enjoy.

You don't want to spend every minute of every day glued to your brokerage account, you want to go out and enjoy your retirement without having to worry about whether you will have enough.

If that sounds like you, then you are the one that I created the Income Method for. Forget the wild variations in the market. Many of them are made by desperate retirees who get fearful when they see their market value declining. After all, they had a goal of getting to $X million, and since January, they stepped backward 25-30%. Their reaction? They "cut their losses" by making them permanent.

The measure of a portfolio is not the big headline number that changes every second the market is open. It is the amount of income that the portfolio is producing. After all, in the end, that is what you need—income coming in every month to pay your bills indefinitely.

When you focus on what that income level is and where it is going, you will find that it is much less volatile than share prices. This will help you find peace in your heart and manage your portfolio with a level head instead of panicking.

There have been times in the past when dividends get cut. Sometimes you will be able to avoid them, sometimes, you won't. Note that in our exercise, we included several picks that had dramatic dividend cuts or even eliminated the dividend for a period. That is where diversity comes in handy, but it is also worth noting that even dividend cuts don't necessarily make an investment "bad". Great returns and great income can be realized even through periods of material dividend cuts.

In the long run, your income will be biased to grow because you set aside a portion of your dividends to reinvest into more dividend-paying investments. Plus, the companies we invest in will hike their dividends as their earnings climb.

The markets are in a panic, yet the fundamentals for dividend-paying companies are strong. This is the best combination for income investors like us. Don't panic over the swings in share prices. Learn to welcome them as opportunities and be thankful that you don't have to make the decision to sell in a down market. Identify the opportunities to grow your income!