Market Outlook: The Legend Of Hapless Hal

Summary

- The bear market continues in full force.

- The HDI portfolio has held up well, but some holdings are doing better than others.

- The legend of Hapless Hal and the lessons we can learn from him.

Good Morning HDI!

It looked like the bear might be heading back into hibernation for a brief moment last week. Then it roared back with a vengeance sending the markets back towards 52-week lows.

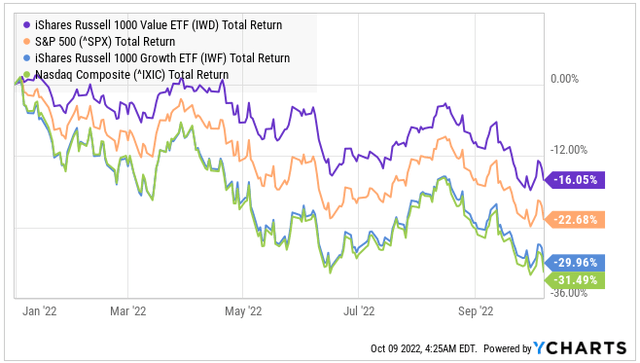

As has been the theme of the year, Growth stocks continue to underperform, while Value stocks hold up better.

Interestingly, Value stocks are one segment that has not yet broken that 20% line, which has been a big reason why the HDI Model Portfolio continues to "outperform".

Yet it seems a bit like a Pyrrhic victory to be outperforming with portfolio values down well into the double digits. One thing that every one of us has in common is that the amount of value in our portfolios is "a lot". For most of us, it represents many years worth of income. For most of us, it is our single largest asset. So when its value declines by nearly 20% or more, that is going to be a very stressful situation.

It is during these stressful times that it is more important than ever to keep a clear head. These are the times when we need to ensure we are making investment decisions based on the underlying quality of the company and not on whatever its share price might be doing. The two are often completely unrelated.

Often I see people commenting or I receive a message from someone declaring they are going to sell this stock or that stock because the price is down. Being in my position, there is no shortage of people who are happy to tell me exactly how much this pick or that pick has gone down. Some demand that I apologize, or admit I was "wrong" on positions that I still hold, am still bullish on and am still buying.

Part of having a diversified portfolio means that some picks will outperform while others don't. That is not only ok, but it is also essential to the health of your portfolio. You don't want all of your holdings to perform the same.

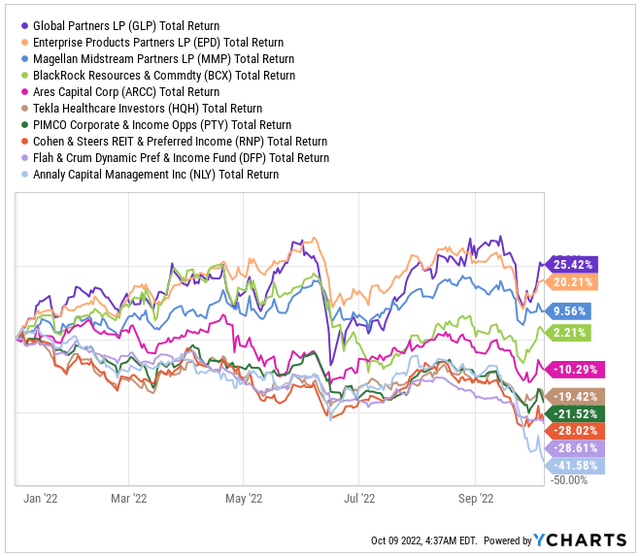

Not Everything Falls Equally

While the average HDI portfolio holding is outperforming the market, individual holdings in the HDI portfolio have had a very wide range of performances year-to-date. Here are a dozen random holdings in the Model Portfolio:

Note that some are up, most are down, some are down a lot. The temptation that many investors fall into is to think of the stocks that are up as "good" and the ones that are down as "bad". I see it all the time, people declaring this stock over here is a "bad" investment, that one over there a "good" investment because of their performance over a relatively short period. So they sell their "losers" and buy their "winners".

Yet note that the "good" performers year to date all have something in common, they are all energy. Does energy always outperform? No. Energy has undergone several periods of significant underperformance, and I guarantee it will happen again. When will it happen? I don't know. It could happen next Spring, or it might not happen for five years, that's why I diversify.

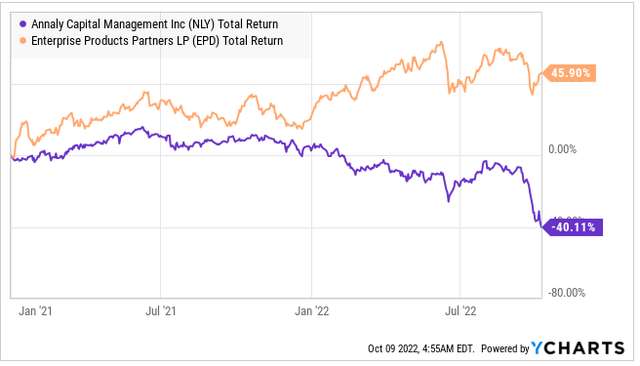

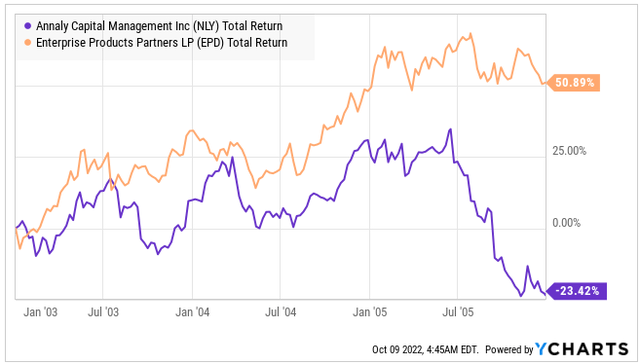

Let's look at a friend of mine and his experience with what is currently one of our strongest investments year-to-date EPD, and one of our weakest, NLY. Two investments that many have described to me as "good" or "bad" investments at different times.

The Legend of Hapless Hal

20 years ago, I met a fellow named Hapless Hal. He was a nice all-around guy, everyone loved to have Hal over for the New Year's Eve poker game. He was known for making rash bets with great enthusiasm.

At the 2002 New Year's Eve party, Hal came into the game excited to be retiring and cashing out his 401k. The market was crashing, and the index fund his 401K was invested in was down 20% over the past two years. Hal just knew that he could do so much better. His idea?

"I am going to put all my money in the best stock. Why bother holding all those losers?"

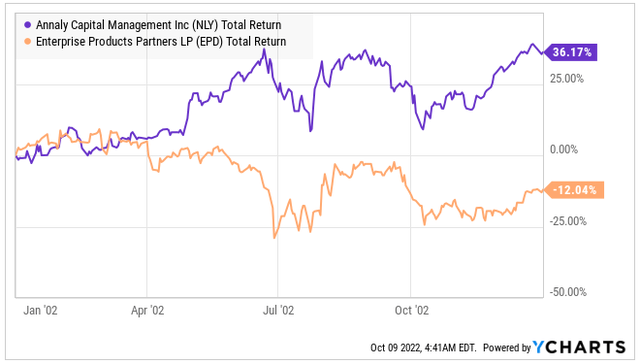

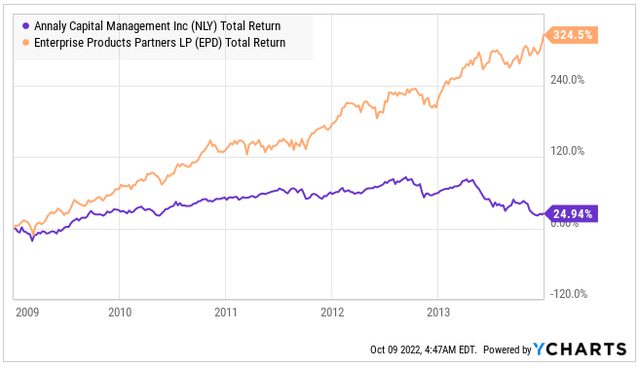

So Hal did a survey around the table about the best stocks and got two ideas from the table, NLY, and EPD. Both were up triple-digits since 2000. Hal decided to bet on EPD. After all, oil would always be in demand. Hal deemed it a sure winner.

The next year Hal came to the game and was angry.

"Look at EPD! This stock has gone nowhere but down since I bought it. What a loser!"

But NLY was up significantly. Look at how much it outperformed!

Hal sold his EPD and bought the real winner, NLY.

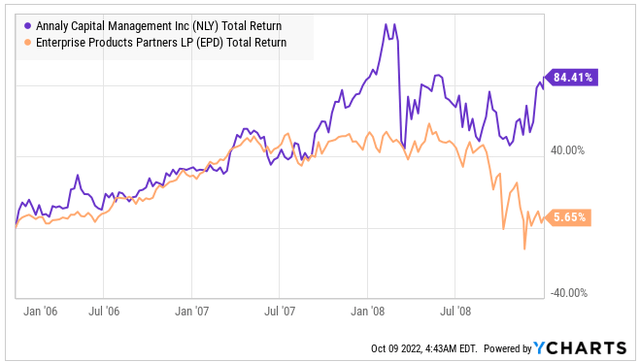

Over the next few years, Hal stuck with NLY even though the performance wasn't great, but it wasn't horrible. But then, in late 2005, NLY fell off a cliff as the Fed increased rates more aggressively than the market expected.

I remember that 2006 New Year's Eve like it was yesterday. Hal came in furious. NLY was down over 40% in just 6 months, giving away all his gains and leaving him deep in the red.

Meanwhile, he was watching his old pick EPD recover. "I should have stuck with EPD!" he exclaimed. Seeking to correct his mistake, he sold all his NLY and bought EPD again.

For a couple of years, Hal was satisfied. EPD was humming along with the rest of the market, but then the Great Financial Crisis came along.

"Oil demand is collapsing because of the recession! The news is saying this will be the worst recession since the Great Depression. I have to get out of oil." Hal bemoaned. Then he looked at his old pick NLY. It was skyrocketing! The dividend was being hiked! Look at that outperformance!

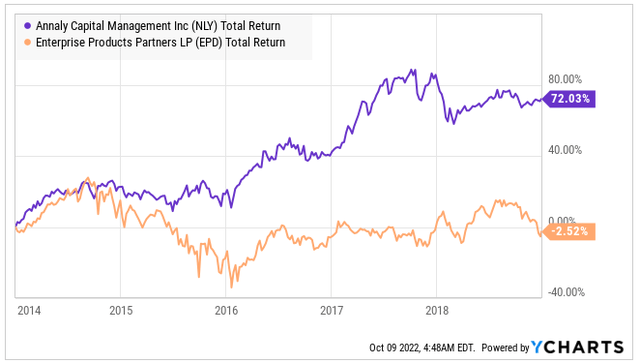

So Hal once again sold his loser and bought the winner. At first, he was happy with NLY. It was outperforming the market, the dividend was rising again. Then in 2013, the Fed rocked the markets, and the "taper tantrum" started. Now Hal didn't really know what "taper tantrum" meant, but he knew it was killing his investment.

So when Hal showed up at the 2014 New Year's Eve game, he was spitting bullets. Once more, EPD was running circles around NLY. "That's it, I'm buying EPD and never leaving it again!" he declared. So he sold NLY and bought EPD. Determined to hold through anything.

Hal gave it a go. When oil crashed, he decided to stick with EPD. He remembered how he sold at the bottom in 2009 and missed out on the recovery.

When Hal showed up at the New Year's 2018 game, his patience was wearing thin. Everyone else at the game was talking about how much their portfolios were up. The bull market was running strong, and portfolios were up. Yet here was Hal, in the same place he was 4 years ago. Hal stared at the chart, seeing how much NLY was up. Sure, NLY had some dividend cuts and crashed back in 2013, but the dividend had been stable since and the total returns were beating the market.

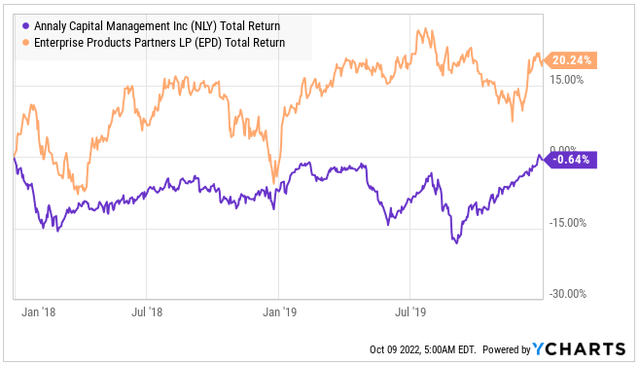

So Hal sold EPD and bought NLY.

The price of NLY fell immediately. Hal was sick of realizing losses, so he told himself "I'm just going to hold until NLY breaks even" And that is just what he did.

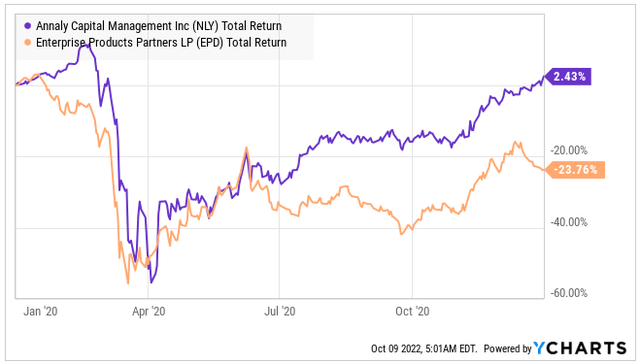

At the 2020 New Year's Eve poker game, Hal was eager to tell everyone he was selling NLY. There were some tough downswings in there, but his position recovered. Once again, Hal sold NLY and bought EPD. After all, President Trump was going to be fantastic for oil!

A year later, Hal was disappointed. Oil was supposed to be really strong, but COVID had pulled the rug out.

Hal looked at NLY. COVID was rough, but it was recovering. In the news, everyone was talking about the strong housing market, projections were for the Fed to keep rates at zero and Hal remembered how strong NLY was in the early 2010s.

On the other hand, oil is never coming back. Everybody "knows" that the future is green. There are articles saying demand will not recover, everyone was working from home. EPD's glory years are history. So in 2021 Hal sold EPD "on the bounce" and bought into the momentum of NLY.

Well, I'll be seeing Hal in a few months, but I think I have a good idea of what trade he will make first thing in 2022.

That's the story of Hapless Hal. The good-natured fellow who just didn't have the patience for investing. Often jumping from the frying pan into the fire.

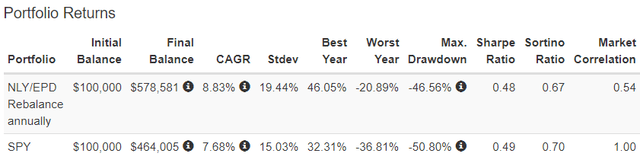

I don't know how much money Hal started with, but after 20 years of investing, he has managed to lose 77% on two stocks that both had a positive total return.

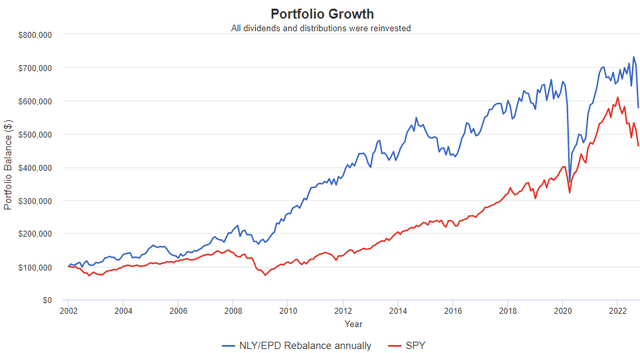

With these same two stocks, Hal could have instead just put 50% in one and 50% in the other and held. The result? Hal would have outperformed the S&P 500 by a fair amount. Source: Portfolio Visualizer

The Power of Diversification

Energy and agency MBS are completely unrelated sectors, which makes them very great candidates for diversification. Note that NLY and EPD have frequently had vastly different results over periods of 1-4 years, this is a dynamic you want to cultivate in your portfolio.

At any given time, you should have picks in your portfolio that are "losers" relative to your top performers. If you don't, then you are not adequately diversified.

The purpose of diversification is to ensure your portfolio can survive any macro conditions. EPD and NLY are great diversifiers because the macro impacts that are good or bad for one are often irrelevant to the other. Interest rates and Federal Reserve policy have little to do with EPD's results. Oil prices have little to do with NLY.

What is outperforming today might not outperform tomorrow. We diversify because we are not fortune tellers, time travelers, or gamblers. I make predictions about the future fairly frequently, and sometimes I am flat-out wrong.

The Federal Reserve is a great example. I expected the Federal Reserve to be much more dovish than it has proven to be in 2022. The picks we hold that are down the most today are generally the picks that would have benefited the most if I had been right. It was a bad prediction. Fortunately, we didn't bet our entire future on that one prediction. If we had, our portfolio would be down +30% today.

Instead, we focused on diversifying. We positioned our portfolio to be agnostic toward interest rates so that a portion of our portfolio would benefit no matter what the Fed did, even though we thought we had a good guess. We bought investments that were cheap, provided high income, and could be expected to maintain or increase their dividends, regardless of what the Fed did.

Fast-forward to today. While we have many picks that are underperforming, on average, our portfolio is outperforming the indexes. More importantly, our income is strong and climbing. We have seen numerous dividend hikes this year.

Don't Be Hal

Don't be Hal. If you are going to trade like Hal, be the anti-Hal. Ask, "what would Hal do" and do the opposite. In other words, don't sell low and buy high, this is what you are doing when you sell your losers to buy the winners. In every trade, Hal was selling the underperformed to buy the outperformer. Well, since the two stocks went back and forth, the result was that Hal always held the underperformer.

This is always very tempting for investors because it is easy to have a very short-term mindset. A stock that is down 30% this year will also look relatively bad on the 3-year, 5-year, and 10-year charts. Why? Because it is down 30% this year. That has a significant influence on the total return. If you want to "buy low" that often means buying when the stock is underperforming peers. If it was outperforming, the price wouldn't be low!

If you are going to trade in and out, you should be looking at your winners and considering selling those to buy stocks that are in the dumps. Sell what is high and buy what is low.

Personally, I prefer not to trade in and out. I understand that means sometimes I'll be holding a stock through a downswing that others might consider predictable. (Though such predictions are much more common in hindsight than they are in real-time!) If the dividend is safe, I know that eventually, the price will come back.

What If A Stock Never Recovers?

Investors often live in fear that a stock won't recover. Now I'm not going to sit here and tell you that every stock will always recover. Sometimes, a company never does. Sometimes a company is permanently damaged and never able to get back to its former glory. It happens!

This is why I encourage investors to follow the "Rule of 42" and aim to have 42 different investments with no investment exceeding 3% of your portfolio. When you are that well diversified, the occasional investment that never recovers, the occasional surprise dividend cut, and other market mayhem that is company specific does not impact your overall returns too much.

At HDI, we don't focus on the gyrations of price. We focus on income. Is the income high? Is the income safe? Is anything happening that might put that income at risk?

If the dividend is high and safe, and we don't believe it is at risk, then why worry about the price? We aren't selling. We didn't sell last year when prices were higher, we sure aren't going to sell today!

As a portfolio, the portfolio will recover. It recovered from the 2018 sell-off. It recovered from the COVID sell-off, and I am very confident it will recover from today's dip. The big question is "when", and right now the Fed and sentiment are in that driver's seat.

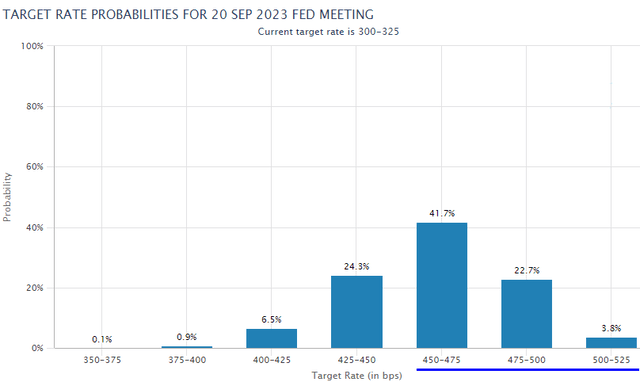

It's All About The Fed

The Federal Reserve is currently the most influential factor driving the market. In September, the market's belief that the target rate would exceed 4.5% skyrocketed. Here is a look at the probability history priced into the Fed Futures market for rate ranges of 4.5-4.75%, 4.75%-5%, and 5%-5.25% by September 2023.

Note how these were near 0% probability for most of 2022, but last month that changed. Last month, they peaked at an 80% chance of rates being over 4.5%. That pulled below 40% last week, causing the stock market to rally before shooting back up to a 66% chance of rates being hiked to over 4.5% as the jobs report came in stronger than expected.

The market is now trying to figure out how serious the Fed is and how high it will go. The Fed has dramatically changed its outlook at every meeting, making forward guidance extremely unreliable. The market is left to speculate, creating the volatility we are seeing in the equity markets.

So far, June lows appear to be holding. They were tested in September and are being tested right now. If those hold, the bottom is likely in for the market, and it is a question of when recovery will take hold. However, if the market starts projecting an even more aggressive Fed and starts expecting rates of 5%+, another leg down is certainly possible.

Conclusion

The bottom line is that the market is gambling right now on what the Fed will do. Every move the market makes can be understood through the lens of speculation over what the Fed will do. I'll leave the speculating to the speculators. Right now, I see income that is on sale, and I will buy it up – redeploying a portion of my dividends while prices are low.

Eventually, the speculation will end, and the Fed will eventually stop hiking. When it does, the recovery will be furious. We saw a peek on Monday and Tuesday of how quick the rebound can be, as many holdings were up 10%+ in just two days.

I'm not going to sit around and attempt to decipher whether moves like Monday and Tuesday are the start of the recovery or a dead cat bounce. I'll just keep redeploying a portion of my dividends as they come in, buying more income while it is cheap. My income grows weekly, and the market can do what it wants. Eventually, the recovery will start for real, and we'll all be looking back at these times wishing we had bought more.

I'm not going to concentrate my portfolio by selling the "losers" and buying the "winners". I know that status is fickle and will frequently change. I will maintain a disciplined and diversified portfolio that has holdings that will benefit if the Fed shocks the market with only a 50 bps hike next month and holdings that will benefit if the Fed shocks the market by hiking 100 bps next month. I'm not gambling with my portfolio. I've constructed it to produce the income I need regardless of what the Fed does.

If the Fed hikes, I collect dividends. If the Fed hikes a lot, I collect dividends. If the Fed cuts, I collect dividends.

The Fed should stop hiking. The Fed is probably going to raise. The Fed might raise a lot more than is reasonable. In all three scenarios, the HDI portfolio is still going to be producing a massive amount of income.

When I'm investing, my goal isn't to have all my money in "the best" stock to have the highest possible gains. My goal is to hold a diverse array of stocks that are all paying me dividends so that no matter what happens, no matter what future predictions I am wrong about, and even if I hold a few total losers, my income keeps climbing. I don't need the highest score. I need an income stream that is reliable and growing every single year regardless of what happens in the world.

I'll leave my gambling to the New Year's Eve poker game. I hope old Hapless Hal can still afford it.

Have a great Sunday!