Market Outlook: The Catalysts That Are Driving The Market

Summary

- The next few weeks will see several potential catalysts for better or worse.

- We talk in detail about these catalysts.

- It all boils down to what the Fed will do, and what the market expects going forward.

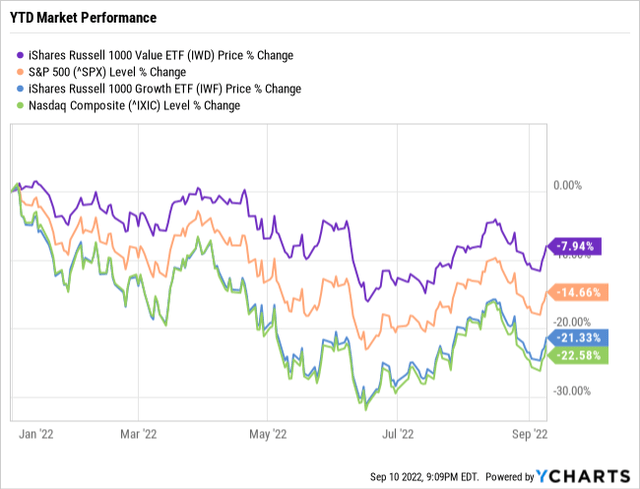

The market indexes were getting close to June lows, but managed to rebound last week. Those of us with significant exposure to Value stocks, like the HDI Model Portfolio, continue to feel much less pain than the market indexes.

The major drivers of market sentiment continue to be:

- Inflation

- Fears of recession

- The Federal Reserve

These news stories continue to dominate the financial news cycle, and any indication of change will drive sell-offs and rallies. Today, let's take a closer look at these risks.

Inflation

For about 6 months, I've been arguing that inflation has peaked and is coming down on its own. Specifically, I have stated that I believe that high gas and food prices have been beneficial in relieving "core" inflation. It might seem odd to many that high gas and food prices are a deflationary force, but they often are.

Think about it at an individual level. Energy and food are generally inflexible expenses. They are items that you will pay for regardless of how expensive they get. While consumers might make some sacrifices like adjusting the temperature of their house to use less energy, trying to be more conscious of driving distances, choosing cheaper foods, etc. These only make a small difference in overall demand. Ultimately, if you need gas to get to work, you're paying the price whether it's $2/gallon or $10/gallon.

Where does that money come from? Ultimately it comes out of your discretionary budget – which, for most Americans, means the first thing you do is start saving less.

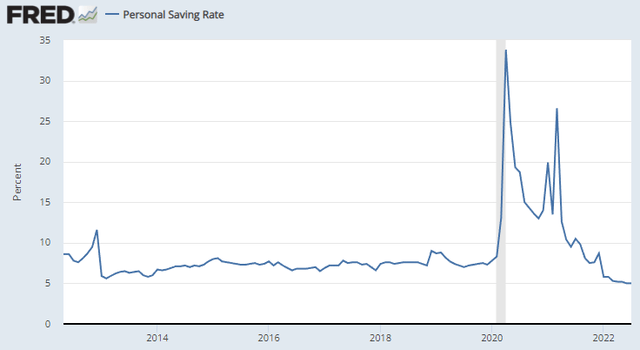

The personal savings rate is now 5%, lower than it was pre-COVID and the lowest savings rate since August 2009. We can see how the savings rate skyrocketed during COVID, and this was one of the huge signs that pointed toward future inflationary pressures.

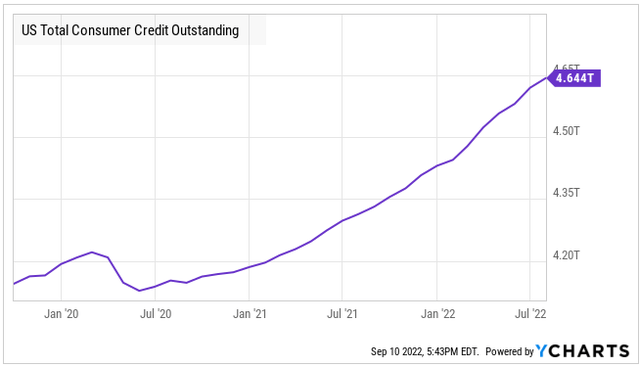

Then consumers turn to credit. We've seen the pace of consumer credit growth accelerate, particularly in April and July, when gas prices were highest.

Finally, consumers start giving up on the things they want and start trimming their budgets.

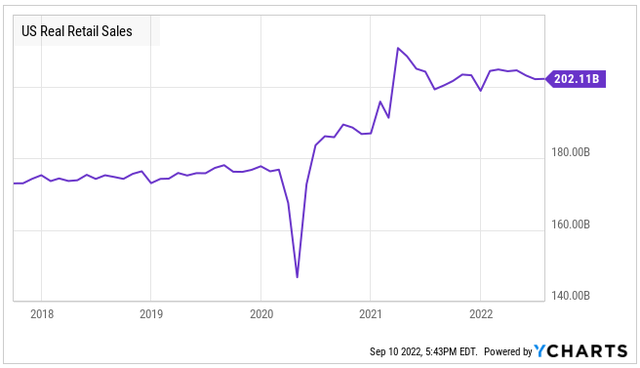

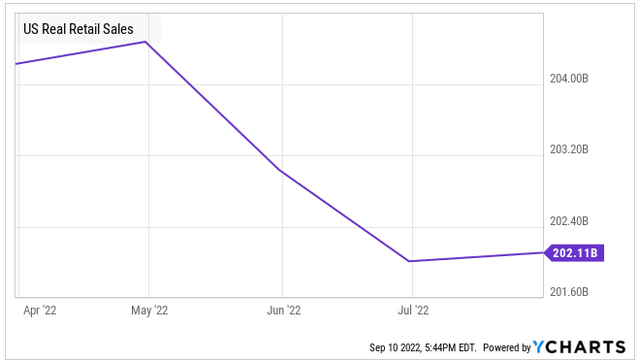

The main driver of inflation all along has been sky-high demand that producers have been unable to keep pace with. We can see this in retail sales.

Note this is "real" retail sales, which means that the numbers are adjusted for inflation. In the past six months, we've seen this moderating as consumers direct their budgets elsewhere.

In other words, consumers are saving less, borrowing more, but still buying less. Where is all the money going? Even Inspector Clouseau could connect these dots. Consumers are spending more on energy, housing, and food.

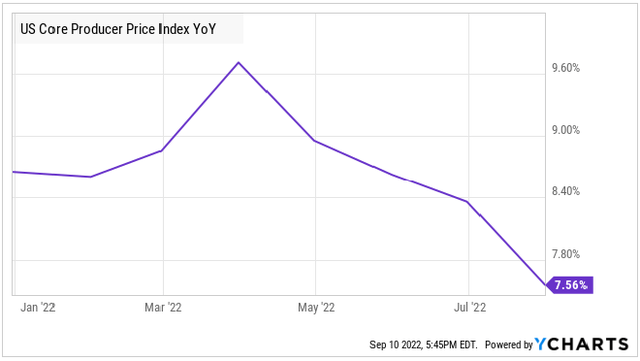

As demand declines, companies are finally starting to catch up. On the supply side, prices have been stabilizing, and core inflation has been declining.

For August numbers, CPI will be reported on Tuesday, and PPI will be reported on Wednesday. How will the market react?

It is worth noting that the year-over-year comparables are particularly low for "core" numbers. Core CPI was only 0.18% in August 2021, so core CPI is likely to edge up a bit year over year. With food and gas prices continuing to trend down in August, the headline CPI number should be down. Which will the market focus on?

So far this year, the market and the Fed have chosen to focus on the headline number. Looking forward, it is very clear that demand is normalizing. However, the market and the Fed have continued to drive in the rearview mirror on this issue. Be prepared for some volatility on Tuesday and Wednesday when these numbers are released.

Fear of Recession

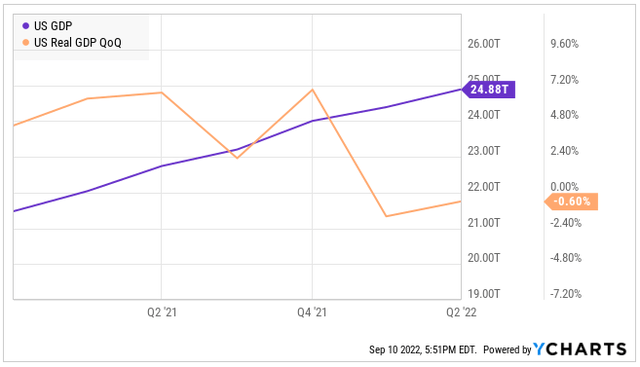

Recession fears seem to be abating in the U.S., with outlooks for Q3 GDP tending to be in the low 1% range. Note that GDP growth was negative solely due to high inflation. In gross dollars, GDP has continued trending upward.

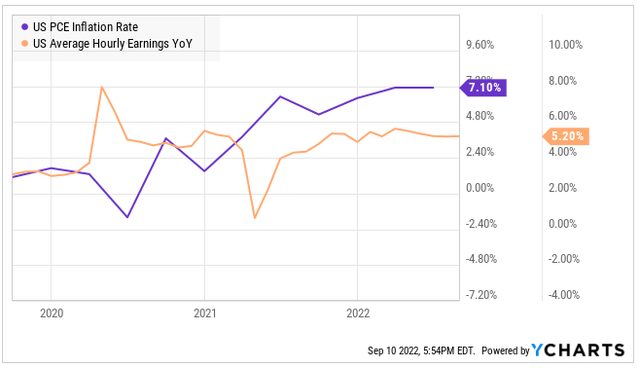

In other words, everyone has more money, but it is capable of buying less. We see a similar issue with wages. Average hourly earnings are up over 5%, well above historical averages. However, wages are rising slower than inflation. Workers have more money than they had last year, but they are finding the cost of living is rising faster.

In other words, everyone has more money, but it is capable of buying less. We see a similar issue with wages. Average hourly earnings are up over 5%, well above historical averages. However, wages are rising slower than inflation. Workers have more money than they had last year, but they are finding the cost of living is rising faster.

There are a lot of factors that are driving a potential recession. First, let's look at what might cause a recession soon, and then some reasons why we believe a recession is more likely to happen later.

Reasons a Recession Might Happen Soon

- High energy prices sap consumer spending.

As discussed above, high prices for essentials reduce demand for everything else.

- The failure of income to keep pace with inflation is a headwind to demand.

As consumers see their buying power decline, they tend to turn to credit until they can't. A recession frequently starts when consumer borrowings get so high that consumers face no choice but to reduce spending.

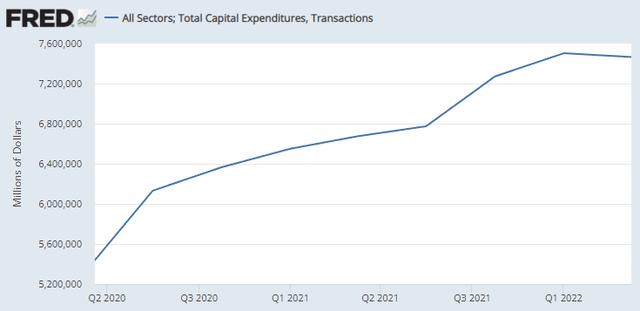

- Capital expenditures slowed down for the first time since 2020.

In Q2, we saw capital expenditures flatline at a $7.5 trillion annual pace. Historically, this has been an indicator of a coming recession. After all, businesses deciding to cut back on cap-ex is usually because the business expects demand to decline. However, it is worth noting that this indicator typically precedes recession by six months to a year. Cap-ex was flat for two years preceding the GFC, this is something we will want to watch.

- A recession in Europe appears inevitable.

Europe is in much worse shape than the U.S. and might already be in recession as energy prices have skyrocketed. Europe is amid an energy crisis, where they might have real shortages in the winter.

This is both a benefit and a headwind for the U.S., on the beneficial side, the U.S. is benefiting as a major exporter of natural gas and NGLs. The relative strength of the U.S. dollar also makes it cheaper to bring in exports, which helps ease U.S. inflation.

On the flip side, many U.S. businesses do a lot of business overseas. Businesses with exposure to European customers will see those segments underperform. In a globalized world, recession in the U.S. has quickly spread throughout the globe during the dot-com bust and the Great Financial Crisis. We haven't seen how easily a recession in the rest of the world might spread to the U.S. since the internet shrunk the world.

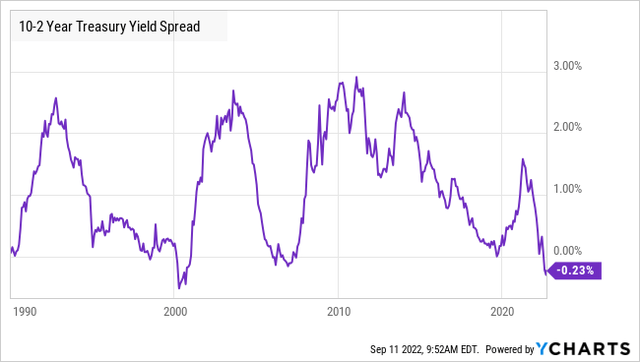

- The yield curve is inverted along the 10-2 year.

An inverted yield curve has frequently been cited as a warning sign for a recession. The 10-2 inversion is the steepest it has been since 2000, preceding the dot-com bust.

This means that the 2-year Treasury has a higher yield than the 10-year Treasury and is frequently interpreted as indicating that the "smart money" in the Treasury markets expects a recession. I discussed yield curve inversions back in March here.

Reasons Recession Won't Happen Until Later

- The important yield curve has not inverted.

The 10/2 yield curve is the most watched, but its history of predictive powers is suspect. Recessions have sometimes not occurred for several years after the curve inverts. Knowing something might happen several years from now isn't particularly useful when planning our portfolio.

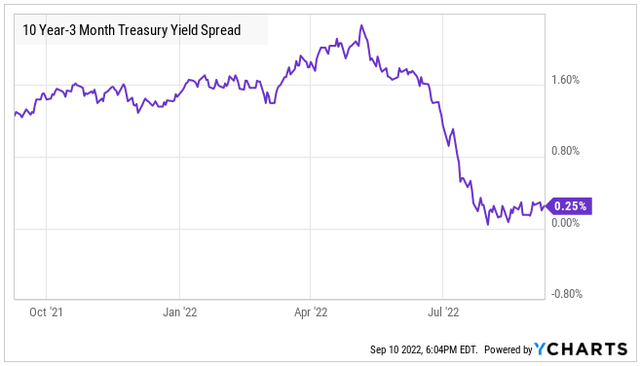

The spread we are watching at HDI is the 10-year/3-month spread. This curve has an even better history of predicting recessions within a year. It has gotten close to inverting but remains in positive territory.

We'll be watching as the Fed keeps hiking. If this yield curve inverts, it will confirm our current expectations that we can expect a recession in late 2023 or early 2024.

- Unemployment remains very low.

At 3.7%, the unemployment rate remains very low. Recessions typically start as unemployment is rising. Unfortunately, that rise typically starts 3-6 months before the recession, so the warning often comes too late. However, it does provide reassurance that recession is unlikely in Q3/Q4 this year. If there is going to be a recession in late 2023, we expect unemployment to be edging up to 4% by July 2023.

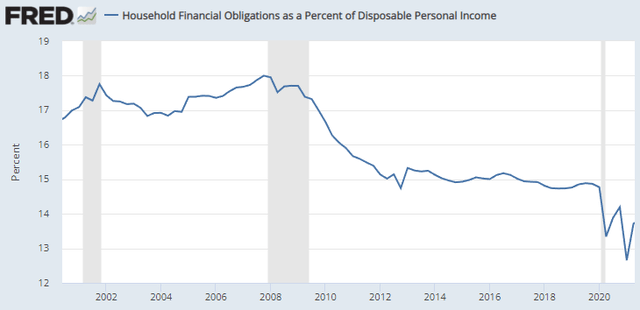

- Consumers have low financial obligations.

The U.S. consumer is relatively healthy, with relatively low bills relative to incomes. This is largely thanks to a decade of very low-interest rates. Following the GFC, consumers have taken on much lower financial obligations than they have in the past.

In both of the past two recessions, household financial obligations were approaching 18% of disposable income. Today, that number is closer to 14%. We expect that number will climb with inflation and rising housing expenses, but the consumer remains in a relatively strong position.

- Monetary policy does not have an immediate impact.

The financial media seems to think that rate hikes should immediately impact the economy – that is silly. The U.S. economy is not a small boat that turns quickly, it is a super-yacht where the Captain can turn the rudder, and changes won't be seen for a long time. The economy has momentum and the results today indicate the culmination of decisions made months or even years before.

The general rule of thumb is that it takes 12 to 18 months for the full effect of monetary policy to be realized. In other words, we won't feel the full impact of the Fed's first rate hike until the middle of next year. It will be 2024 before we feel the full impact of the Fed's expected September rate hike. The economy is already slowing, inflation is already falling, and we haven't even started seeing the real impact of rising rates. When we do, it will likely be the catalyst for a recession.

The Fed

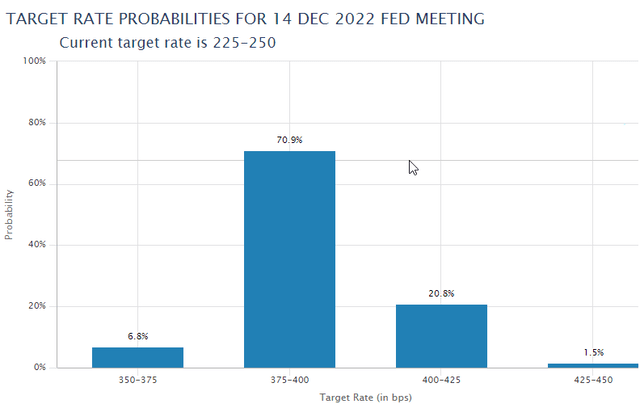

The current consensus is that the Fed will hike rates another 75 bps in September and then slow down with a 50 bps and finally a 25 bps in December this year to end with a target range of 3.75%-4.00%.

This will be the highest target rate since 2007. The futures market is currently split on whether rates will be hiked more in 2023. Whether the Fed meets these expectations, raises more slowly, or telegraphs more rate hikes in 2023 will have a major impact on the market.

The data is clear that the economy is slowing, that demand is declining, and inflation is dropping. The Fed's own "Beige Book" notes:

The outlook for future economic growth remained generally weak, with contacts noting expectations for further softening of demand over the next six to twelve months.

It also noted that "households continued to trade down and to shift spending away from discretionary goods and toward food and other essential items." The report further noted that "Price levels remained highly elevated, but nine Districts reported some degree of moderation in their rate of increase."

Combine that with the knowledge that monetary policy has a delayed impact, which should slow the Fed down. If the Fed slows down, it will create a major rally in the stock market.

However, as investors, we can't rely on the Fed to do what we believe it "should" do. I believe it is more important than ever to remain "agnostic" towards interest rate policy.

If the Fed continues to follow the path the markets are expecting and keeps hiking, our exposure to floating rates through BDCs, commercial mortgage REITs, and CLOs will be very beneficial.

If the Fed stops hiking or slows down to only 0.25%/0.5% in September, then we can expect fixed-income to rally. This would be very positive for the prices of our PIMCO funds, preferred shares, DMB, and other fixed-income CEFs.

The HDI Model Portfolio is positioned to benefit whichever way the Fed goes.

The Bottom Line

In the near term, we can expect the market gyrations to stem from these three catalysts. The market will react to news about inflation, recession, and changing expectations about what the Fed will do.

This week, inflation will be front and center. The problem? We don't know if the market will focus on the headline number, which will certainly be lower, or if it will go back to focusing on core CPI, which I expect will be slightly higher than last month. This is why I'm glad that I'm an income investor. If the market crashes on Tuesday or Wednesday, I'll buy more income while it's on sale. If the market rallies with enthusiasm about headline inflation slowing down, I'll sip my coffee and enjoy the view.

The week after that, the Fed meets, and we will get a decision on rates Wednesday, the 21st. The only sure thing is that there will be a lot of trading going on before and after the Fed meeting. So keep your eyes peeled for buying opportunities there as well.

As income investors, we don't need to guess which way the market will move on a particular day. We've protected ourselves by having exposure to fixed income that will benefit from lower inflation, the Fed slowing down, and will perform better during a recession. If inflation stays high, the Fed hikes aggressively, and recession doesn't start, then our floating-rate investments will thrive. Either way, we have a lot of confidence that our incomes are secure and will keep growing.

For the rest of the month, we can expect the traders in the market to be very active – trying to get ahead of the news and shifting positions rapidly in response to any news. We can benefit from this. When the market turns green, sit back and relax. When the market turns red, go shopping for income!

Have a great Sunday!