Market Outlook May 16, 2021: About The Market Pull Back

Market Outlook May 16, 2021

Why Did the Markets Crash this Week?

There are several reasons that have resulted in this week's mini-market crash that pulled back the S&P 500 index by about 5%. Note that we have to put all these reasons together in order to make sense of the market pullback because they are all related and happened consequently and around the same time. Let us address them one by one, and how did it all start:

First Event: Higher Taxes

The first event that triggered the selling in the Nasdaq and growth stocks was the news of higher capital gain taxes. Some of the higher-tax bracket investors decided to sell early to take advantage of the lower taxes today rather than wait till year-end and sell when everyone usually sells, and get lower exit prices. Apparently, many folks were doing this at the same time, and this caused some turbulence in the Nasdaq index.

Second Event: High Inflation and News about the Fed hiking Short-Term Rates

This was the second wave of bad news that triggered more selling of growth stocks, including Nasdaq stocks. As I explained in last weekend's update, growth stocks tend to be the most vulnerable to higher interest rates because higher rates make their lofty valuations look even more expensive, and their growth prospects will have to be revised lower due to increased production costs without the ability to be fully passed to the consumer. Furthermore, history tells us that growth stocks are a poor hedge against inflation. This created even more panic selling in the Nasdaq index.

Third Event: Data Confirms that inflation at its fastest pace in 12 Years

On Wednesday early morning, we got data from the "U.S. Bureau of Labor Statistics" that inflation speeds up in April as consumer prices leap 4.2%, at its fastest since 2008. This took most economists and analysts by surprise as the consensus increase was at 3.6%.

This news fueled the fear in the markets, and now the Nasdaq pullback is dragging all the indexes down. Sellers are panicking everywhere.

Fourth Event: Trading Volumes are Low

During the first 4 months of this year, money was pouring into equities. It was very difficult for traders and algorithms to have much of an impact on equities, and therefore volatility was very low.

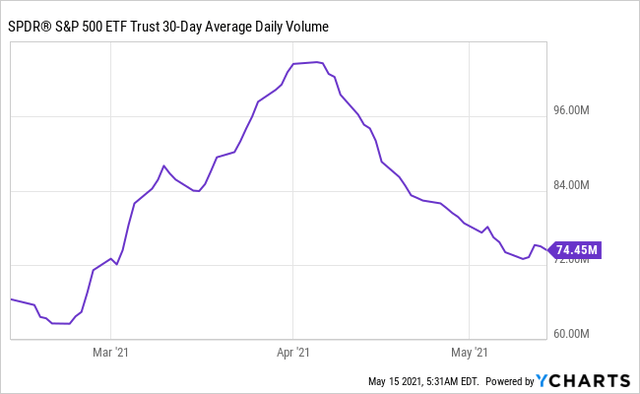

However, I have noted a few weeks ago, as trading volumes get lower, we are more prone to see market volatility. Today, trading volumes are at the lowest since they were in February by looking at the SPY chart below:

As volumes get lower, they become more prone to be more susceptible to trading forces of "hedge funds", large daily traders, and algorithms. And here comes the last piece of the puzzle that explains it all. The Fifth event:

Fifth Event: Short-traders were 'Piling Up'

Seeing that there were large sellers in growth stocks and that the volumes are already low in the markets, short-sellers decided to take advantage and increased their short positions, causing the markets to dip even lower.

The End Result: A Big Recovery

As I have been stating in each week's "market outlook". Any pullback that we get is likely to be shallow and short-lived and followed by a swift recovery. This is exactly what happened this week. The S&P 500 index found strong support at the 4000 level and strongly rebounded from there.

The reason? Liquidity, liquidity, and more liquidity. Liquidity is key and it is the ultimate driver for equities, and we are swimming in it. As long as we are in an environment where:

- Money is cheap.

- The average investor and "institutional investors" are sitting on huge sums of cash waiting for a pullback to put their money to work.

- The economy is booming and will result in more wealth, savings, and investment funds to purchase equities.

- Americans are sitting on excess savings.

- The system is swimming in liquidity from the massive stimulus plans by the government. If you think about it, just the last $1.9 trillion in stimulus plans is equivalent to 38% of one quarter's US GDP (roughly $5 trillion). This is huge! This is in effect free money (or free liquidity) that is benefiting directly or indirectly most Americans. This is not taking into account other stimulus plans that are going into effect or the current infrastructure bill under discussion.

The bottom line, the short-sellers got burned. The markets are in a recovery mode, but what comes next?

Is the Market Pullback Over?

First, I would like to highlight again that this pullback is only a short-term one in a long secular bull market. This bull market is far from over. Now about this mini pullback, I would think that the most likely scenario is that it is over. I have been watching closely how the recovery was unfolding. The first stocks that were recovering were those that were heavily shorted. If that was the only case, I would not be confident about my assessment. However, a few hours later, we started seeing a recovery across the board, which is a good indication that we have most likely already seen a bottom. "Value hunters" and buyers came in force to buy the dip. In my opinion, the short-sellers have been burned, and they are unlikely to try another attempt.

In the unlikely scenario that we pull back again, we may retest the 4000 level for the S&P 500 index or go slightly below. Again, this will most likely be short-lived and present another great buying opportunity.

It is only a matter of time that the markets will start reaching all-time highs again, with the next target for the S&P 500 index being at the 4400 levels. Patience will be rewarded.

The Bull Market Remains Intact

For us investors, the most important point to keep in mind is that the bull market is far from over, and the best is yet to come. The markets do not go up in a straight line and there will be some turbulence from time to time. This is especially true during times of lower trading volume, and the summer season when many investors are on holidays.

As HDO investors, we have been well ahead of the "inflation and interest rate curve" and we are exceptionally well-positioned, not only as a hedge against such events but also to benefit from them. We have also been adding some excellent new picks to further diversify our inflation resilient positions. Furthermore, we have been avoiding growth and Nasdaq stocks, and I have warned our members to lighten up on them a few months ago, and I am happy that my analysis continues to enable us to maximize our gains and minimize losses.

We have highlighted in detail last week the 5 types of high-yield inflation hedges that HDO is currently using. If you did not get a chance to read it, this is the link:

Weekly Picks: Inflation Edition - May 10, 2021

The Best Course of Action

I provide a weekly market outlook to keep our members focused on the bigger picture, on where the markets are likely to be heading next so that you do not get derailed by the daily news that is spread by the media. Bad news sells much better than good news, and this is why the media likes to focus on the bad news. My market outlook is limited to the medium-term with a horizon of two years as it is impossible to analyze further than this. However, it is a rolling two years, and therefore when new risks arise, I will highlight them, and we will take appropriate actions in response to each risk within our "model portfolio".

The best course of action is not to panic, keep your calm, hold on to your positions in case we see any further turbulence during the summer season. Enjoy this spring and summer while cashing in your dividends. I would consider any pullback that we may see as a buying opportunity.

Have a great Sunday!