Market Outlook, July 11: Shrinking Treasury Yields & The Bull Market

Market Surprise: Treasury Yields are Falling

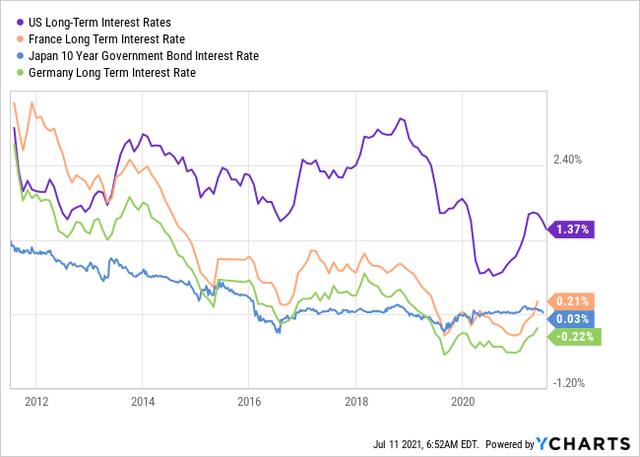

This has been a surprising week for many investors with longer-term Treasury yields pulling down significantly, yet inflation pressures continue to be higher. This has left many investors puzzled.

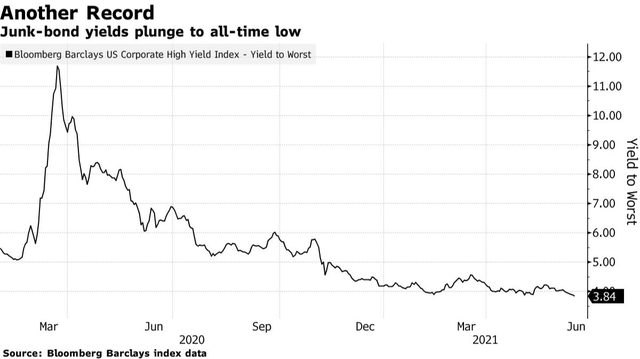

This week the 10-year Treasury yields fell hard and closed the week yielding just 1.36% on Friday. Even the higher risk junk bond yields shrank this week to their all-time low levels, ending the week at the 3.8% level for the first time in history.

Source: Bloomberg News

In fact, this is the first time in history too that high-risk junk bond yields have dipped below inflation levels (or CPI) of 5%, effectively producing negative returns. Today, investors putting their money into either long-term treasuries and/or junk bonds are actually losing money if you factor in inflation.

Many investors, and also various news media, misunderstood the reason behind the declining Treasury yields, believing it is a "flight for safety" or turbulence in the economic and market environment, causing some panic among some investors. This decline in yields has also resulted in questions by our members on why yields are declining despite high inflation, and if there was a possibility that inflation was not real.

So what is the reason behind the pullback in yields?

It is pretty simple as to why long-term Treasury yields have shrunk this week. It is for the same reasons why the equity markets have been rallying: excess liquidity in the system.

- Investors are sitting on a mountain of cash, and investing in all kinds of asset classes to generate some returns, including bonds (Treasuries and Junk). Demand for Treasuries results in higher prices and reduces the yields. U.S. banks are swimming in liquidity with a $2 trillion increase in deposit value since the beginning of the pandemic due to government spending and COVID relief plans. High liquidity in the system puts pressure on interest rates by keeping them low.

- The U.S. dollar is at its lowest point in years, spurring a rise in foreign investment in U.S. treasuries. In this yieldless market, pension funds are boosting their holdings of Treasuries. This massive demand is weighing on Treasury rates even as the economy strengthens.

- Furthermore, negative Treasury yields across the globe (notably in Europe and East Asia) have resulted in international investors chasing U.S. Treasuries which still have "absolute" positive yields. Japan is the largest holder of U.S. sovereign paper, and the negative interest rates in that country are also fueling the demand for the A-range U.S. corporate bonds.

If the decline in yields were the result of higher market risks, we would not have seen the risky junk bond yields at all-time record lows, resulting in negative returns.

So today we have cash inflows by investors hunting for any kind of return, across almost all bond investments, no matter how low the returns are, and despite spiking inflation.

In fact, this is very positive news for our dividend stocks, and I will explain why later in this report.

What has resulted from the 'Market Pullback' this week?

The markets were already over-stretched and needed some consolidation before resuming their way up. The news about declining yields resulted in a knee-jerk reaction due to investors' misunderstandings about the reasons behind it, and the markets sold off. The biggest selloff was in smaller cap stocks resulting in great buying opportunities.

We got a confirmation that this was a knee-jerk reaction, as markets started to reverse on Friday rallying strongly across the board. The good news is that opportunities remain for income investors to "buy the dip" because "smaller cap" high-yielding stocks did not fully recover yet. We will highlight the best opportunities in our "weekly pick" report that will be posted later.

Falling Treasury Yields Are Actually a Very Bullish Sign For Dividend Stocks

As I have been highlighting in my previous market outlooks, this bull market is all about excess liquidity pouring into both stocks and bonds. Investors are chasing yield to park this excess liquidity.

"Falling Treasury yields" are extremely bullish for equities in general and for dividend stocks in particular. One big reason is that long-term bond yields offer much lower yields than stocks, with the S&P 500 and Dow Indexes carrying forward yields of 2-3% along with potential for capital appreciation. The HDO portfolio is of prime importance for yield hunters, with our overall portfolio yield of +7%.

The reality is that growing investor demand for cash returns will result in more money pouring into high dividend stocks, pushing prices higher as opportunities become more scarce.

Inflation Remains Real and Shooting High

The Consumer Price Index ('CPI') in May rose 5.0% over the last 12 months. If we exclude food and energy from the CPI, the index is up 3.8% year-over-year.

From May 2020 to May 2021, prices increased for furniture and bedding (8.6%) and sporting goods (9.0%) – the largest 12-month advances since 1980. Prices for used cars and trucks rose 29.7%, while medical care prices rose 0.9% for the year ended May 2021.

What is worthy to note is that the government inflation calculation (or CPI), considers the "cost of housing" as capital expenditure rather than a consumption item. In other words, the CPI is more related to "how much it costs to maintain a home", rather than its actual "rental costs". Historic data shows that there is typically a lag between when home prices are actually rising, and when that price growth is reflected in inflation reports like the CPI. Today we have home prices in the United States soaring with the Median house price up by 15.7% from a year ago based on the conservative reports issued by the Federal Finance Housing Agency (report released in June 2021 based on figures as of April 2021).

It is only a matter of time until real estate price increases will show up in the CPI inflation reports, and I expect higher inflation readings in the future as a result.

Inflation is real, it is being felt by the U.S. consumer, and it is here to stay. When wages and basic goods such as food prices go up, they usually never go back down. I expect to see another rally in commodity prices, especially the ones that offer the best hedge against inflation (copper, silver, iron, crude oil, and other commercial metals). Gold is not a good hedge against inflation. In times like this, it makes great sense for any investor to have a good allocation to stocks that provide inflation protection, and that will perform well during a "red hot" running economy. This is what I have been warning about since early 2021. It is worth noting that Billionaire Investor Warren Buffett believes that the same scenario will unfold when he stated back in May 2021 that he sees a ‘red hot’ economy with significant inflation.

Conclusion

I am very excited about the prospects of our portfolio for the next two years. Our returns have strongly outperformed all market indexes (the S&P 500, Nasdaq, and Dow) year-to-date and for the past 12 months, and I expect the same going forward. Our strategy is perfectly playing out, with a focus on smaller cap stocks surging and economically sensitive ones being the hottest ones. This has resulted in our "model portfolio" picks surging as a "supercharged economic recovery" unfolds and inflation ticks higher.

Today, we have more good news. The "hunt for income" has resulted in all-time low Treasury yields and junk-bond yields, resulting in negative returns after factoring in inflation. This confirms my belief that the hunt for yield will continue, putting upside price pressure on our model portfolio currently yielding +7%. I expect strong recurrent income and big upside potential as events unfold, and more cash moves into dividend stocks.

I also look forward to this month of July in particular as it has historically a seasonally strong month with an average gain of 1.4% in the past 20 years for the S&P 500 index, and more than 2% in the past 10 years.

Have a great Sunday! Our Best Picks for the Week will be posted Monday morning.

Rida MORWA