Market Outlook: It's All About Liquidity. Investors Buy The Dip Again!

Summary

- Inflation hit another milestone this month. It is running at 6.8%.

- Everyone has more cash, but not everyone is wealthier.

- I explain what the bubble of liquidity is and how it is driving the economy and the markets.

- Our investment strategy at HDI is based on the current macro-economic factors.

We need to be as vigilant as ever and understand all the forces driving this market. Because neither the Fed, nor your favorite politician, and certainly not your banker, really care about your financial security.

Transient Inflation Becomes Less Transient

Have you ever had a house guest who overstays their welcome? Maybe you invited them to stop by for breakfast, and the next thing you know, it's dinner, and they are moving into one of your bedrooms. Watch a few episodes of Judge Judy, and you will see the dangers of letting someone stay in your house "until they got back on their feet"!

Jay Powell finally admitted that maybe inflation isn't transient and is living in our economy full-time. Sure, inflation headed out the door and took a break in August. But instead of moving out, inflation was just on a run to the store for some cheese puffs and a six-pack and is now right back in our living rooms, as strong as ever.

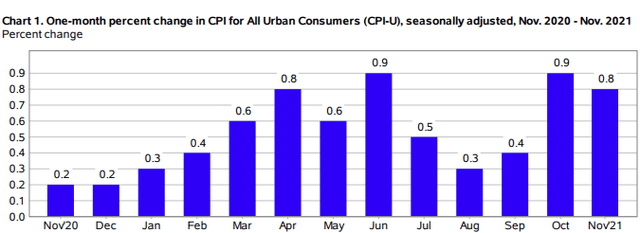

Inflation over the past 12 months is now officially higher than it has been since 1982. Yet, the 6.8% annual inflation number understates the true inflation rate as it includes several months of benign inflation. Here is a look at the percentage of change each month:

- Source: BLS

Note that the three months that are going to next come off of the trailing 12-month number are 0.2%, 0.3%, and 0.4%. Even if inflation slows down to the relatively tame 0.5-0.6%/month, in another three months the annual CPI can be expected to reach 7.5%.

The Fed's inflation projections as recently as September have proven to be laughably inaccurate. The Fed assured us that inflation was coming to stay a month or two. Nine months later, it has become clear as daylight that inflation will be living with us for a very very long time.

The Bubble of Liquidity Explains Almost- Everything

This year, I have frequently explained that the "Bubble of Liquidity" is the main driver for this bull market. This is the strongest force controlling both the economy and the markets. It is because of this liquidity that we have inflation. Today, I want to look at what exactly the "Bubble of Liquidity" is.

Everyone Has More Cash, Not Everyone Is Wealthier

When there is a ton of cash, people are "rich" when looking at gross numbers. Of course, not everyone gets richer equally. Life isn't fair, and the U.S. economy certainly isn't. It rewards those who actively put themselves in a position to benefit.

The money is not magically spread around equally. Some will find their wealth growing faster than inflation. Others will find that they struggle to keep pace with inflation. While they might have more money, their ability to pay bills and buy things can still be eroded.

At HDI, we want to make sure that we are in the group that has income and wealth that is growing faster. This is why it is crucial to understand where all this excess cash is, and more importantly, where it will be going.

We need to be as vigilant as ever and understand all the forces driving this market... Because neither the Fed, nor your favorite politician, and certainly not your banker, really care about your financial stability and security.

Cash For "Everyone"

When saying the "Bubble of Liquidity", I mean an excessive amount of cash or "near-cash" assets like Treasuries, money markets, or agency MBS. In other words, assets that can be converted to cash quickly and have relatively stable values.

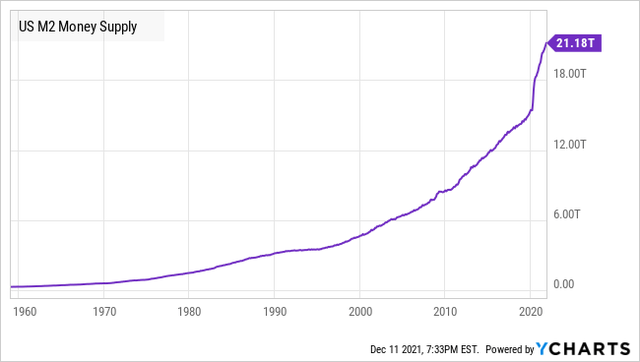

1- Money Supply

It all starts with how much money there is, which is easily measured by the "M2 money supply". This is cash that is in readily available accounts like checking, savings, or money markets.

As you can see, the supply was trending upward but took a very sharp upturn in 2020, going up 23% in 2020 alone. However, growth didn't stop in 2020. M2 has grown another 10% year-to-date.

As of Sept. 30, 2021, M2 grew 13.07% year-over-year, which except for the year 2020, would be the fastest growth rate since 1984.

2020's 20%+ growth rate is by far the most rapid growth in modern times. The response to 2001 and 2009 resulted in growth rates below 10%. We have to go back to 1943 to find M2 growth of nearly 17%. As we covered in our market outlook last week, that created conditions where inflation went up while treasuries rates remained low - that has historically resulted in an extended bull market that can last for years. If you did not have a chance to read last week's market outlook, it is a highly recommended read:

Market Outlook: The Fed Is Trying To Fool You For The 3rd Time: Pullback Won't Last

I expect exactly the same this time around. This bull market will last a long time, and will continue to be driven by a very high level of liquidity.

2- Banks

The first place excess liquidity stops is the banks. After all, one of the main incentives for the Fed to turn on the pump is to prevent defaults. Some might assume that the easiest way to prevent defaults is to provide cash to struggling companies - this is a false assumption.

The primary cause of defaults is when borrowers are unable to refinance their debt. Most corporate debt has "balloon" payments. In other words, the borrower pays interest only, and then at maturity, the entire debt is due. More often than not, the intention is to refinance the debt. A company might easily pay the interest payments from operating cash flow, but paying the entire debt? That is often a large amount of cash relative to the company.

During the Great Financial Crisis, we saw what is called a "liquidity crunch", banks substantially tightened up their lending standards, and even borrowers who had plenty of cash flow to pay interest were unable to refinance at any rate. Companies that thought they could easily refinance suddenly couldn't. With no warning, they could not come up with alternative sources of cash and defaulted. Banks themselves were dealing with high levels of defaults, and in turn, were reluctant to extend credit even to qualified companies.

2020 was different. COVID created the conditions where a liquidity crunch appeared imminent, but the Federal Reserve ensured that banks had plenty of cheap excess liquidity.

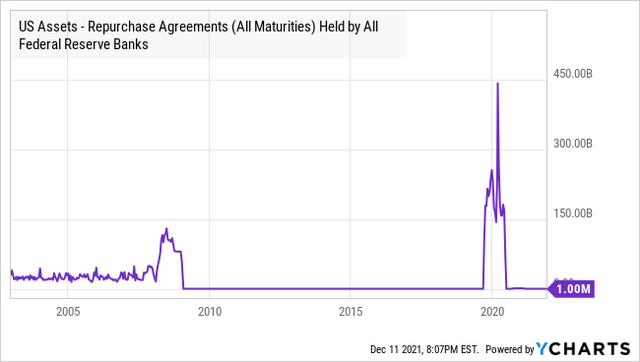

How does the Fed do this? The primary tool is the "repurchase agreement" or repos. These are agreements where the Fed loans money to banks at low-interest rates in the "overnight" market. The Fed buys treasuries or agency MBS from the bank, with an agreement that the bank will buy it back at a slightly higher price. This allows banks to access excess cash at very low rates with little notice.

Note that the Fed's repo program was in high-demand starting in September 2019 long before COVID became an issue. The repo market saw a lack of willing lenders, and bank-to-bank repo rates rose. The Fed stepped in to reduce rates and improve liquidity. This timing helped significantly limit the credit impact of COVID, allowing banks to continue lending and take lenient actions with borrowers who defaulted, like granting deferrals or forbearance. The banks were very comfortable with their liquidity levels and were not in a hurry to go after the assets of defaulting borrowers and risk small recoveries in court.

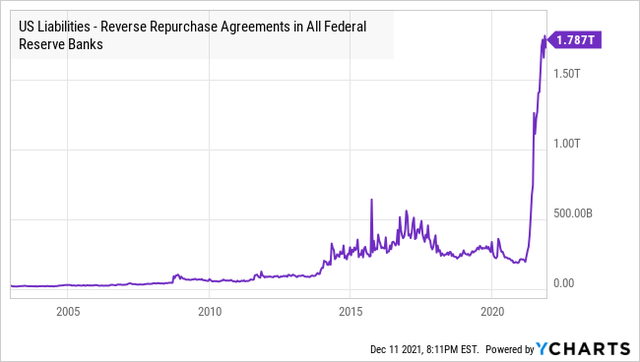

The other side of the coin is the "reverse repurchase agreement". Repos are where the Federal Reserve lends to banks, and reverse repos are where the Federal Reserve borrows from banks in the overnight market.

In other words, banks today are sitting on so much excess cash that they are willing to lend it back to the Federal Reserve at 0.05% annual interest.

This number has skyrocketed to unprecedented levels. Banks are lending $1.78 trillion to the Federal Reserve nightly. Sitting on such huge cash reserves, we can expect banks to continue to be willing to lend freely.

As long as banks have such massive amounts of cash, defaults will remain low, even for the junkiest of junk companies.

For the same reasons above, demand for conservative yield investments like Treasury bonds, senior CLO tranches, and investment-grade corporate bonds will remain very high among banks and financial institutions, simply because there are no other alternatives to park cash that cannot be deployed into equities for regulatory reasons. Even if this means that banks are absorbing big negative effective rates by doing so, with inflation running at 6.8%

This is one big reason why the long-term Treasury yields (or the 10-year yield) have lost touch with reality: Inflation or not, the 10-year yield is being kept artificially low by the excess cash at the bank level. They have no alternatives but to buy more Treasuries.

The Bubble of Liquidity starts with the banks, but it doesn't end there!

3- Consumers

Americans are sitting on an unprecedented amount of cash as household net-worth hits all-time highs. "Checkable deposits" have increased dramatically, having more than doubled since Q1 2020. Additionally, checkable deposits as a percentage of net worth have increased to 2.6%. This is up from 1% in Q4 2019 and the highest since Q4 1994.

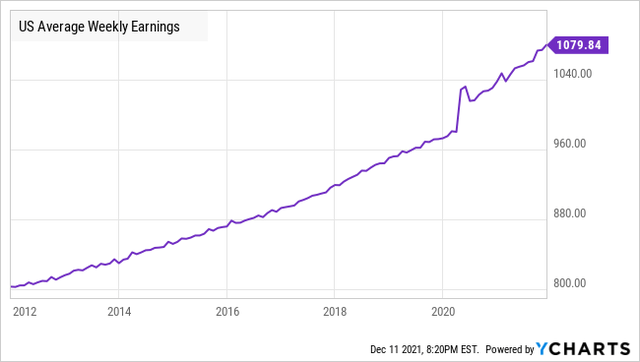

On top of sitting on record amounts of cash in their checking accounts, American workers are seeing much faster than average income growth. After growing at around 3% for years, average weekly earnings are up over 11.5% since January 2020. Approximately four years of wage growth compressed into less than two years.

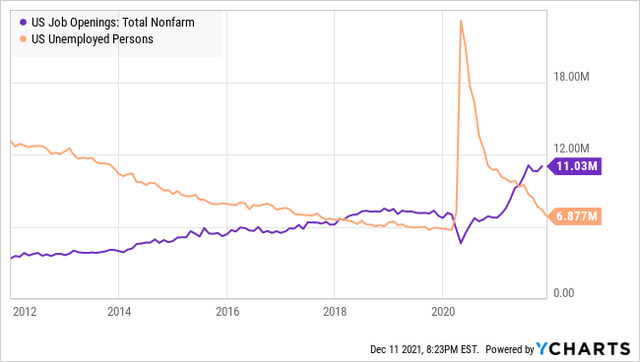

Signs point to this above-average wage growth continuing as the number of job openings is at all-time highs, while the number of unemployed is near pre-pandemic levels. There are 4 million more jobs than people looking for jobs, with some estimates reaching up to 10 million jobs needed.

With job openings materially higher than the number of unemployed, employers can expect an "employee's market". In negotiations, the potential employee will continue to have leverage, and employers will need to remain vigilant against the risk that employees will have the option to entertain switching jobs.

It is simple supply and demand - the supply of workers is low, while demand for workers is high. Wages will continue to go up until that situation is resolved. There is no quick solution in sight. In the meantime, we can expect wages to continue to climb faster, and the vast majority of consumers who drive the American economy have been happily accepting to buy goods and products at higher prices..... because they have the cash to do it!

4- Corporations

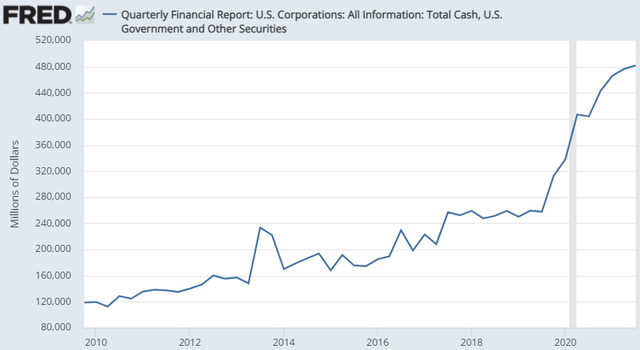

Additionally, corporations are sitting on large amounts of liquidity.

- Source: St. Louis Fed

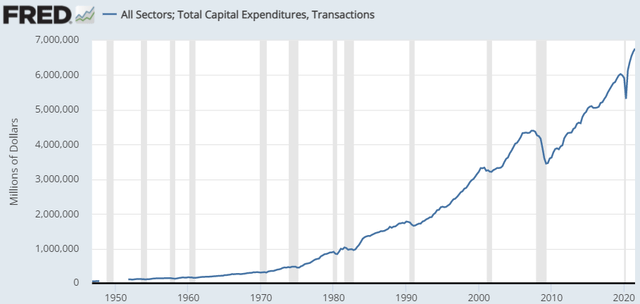

Some have suggested that cash built up because businesses were "cutting back" or being cautious with capital expenditures to fuel expansion plans. The data shows this is not the case. Capital expenditures skyrocketed after declining for only a single quarter:

- Source: St. Louis Fed

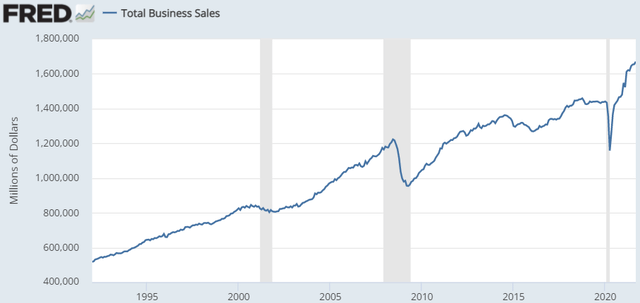

Corporations can invest more in cap-ex because sales have increased dramatically above pre-COVID trends.

- Source: St. Louis Fed

In other words, corporations have record amounts of cash on hand even as they are investing record amounts in capital expenditures. This is fueled by access to cheaper debt as interest rates remain low and banks are flush with cash. Many corporations are saving substantially on interest expense just by refinancing old debt.

Add in high demand from consumers, who are also flush with cash, and you have the ingredients corporations need to grow. There is demand for products, capital on hand to invest in expansion, and debt is cheap and widely available to leverage the capital on hand.

This leads us to perhaps one of the greatest misunderstandings of the current economic conditions. Blame for inflation has been put on "supply chain" problems! Many believe that inflation will disappear once the supply chain is fixed, and we go back to the pre-COVID economy.

They are wrong. The pre-COVID economy is never coming back. The U.S. economy has shifted forever and, in the future, will be recognized as pre-COVID and post-COVID by economic historians.

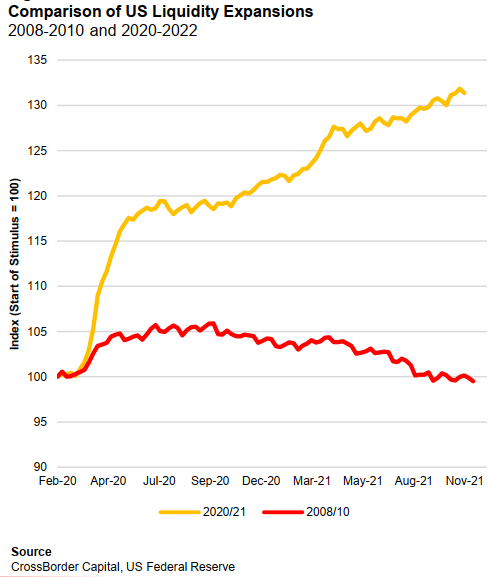

Just look at the difference in how much liquidity was pumped during the Great Financial Crisis (housing bubble) of 2008-2010 and the COVID crisis!

The figures are mind-blowing!

Pundits who are operating under the assumption that this is temporary and that the economy (and therefore the market) will react like it did before 2020 are set to strongly underperform with their investments.

What Can The Fed Do About It?

The Bubble of Liquidity has grown immense, and inflation is here. The U.S. Government is not going to slow down its spending. Can the Fed do something about it? So far, the Fed has also continued to feed the bubble, only slowing down asset purchases as it tapers.

The market believes that raising rates is the solution, and a cursory glance of financial news will reveal numerous statements that the Fed "must" raise rates now.

The problem?

- Demand is fueled by liquidity: It is too late for modest rate raises to be effective. Rate raises work by decreasing demand. Potential consumers who need to borrow funds are less likely to borrow as much at higher rates. As noted above, demand is already high and is fueled by liquid assets, not debt! This is a very different situation than we've seen in recent cycles, where demand was primarily fueled by debt. Today, demand is fueled by cash already in hand.

- Hiking rates will not "resolve" the supply chain problems: If the Fed hikes rates and demand remains extremely high - which it will - this will put even more pressure on suppliers. With the lack of resources, all that suppliers can do is pass the rate hikes to the consumers without tangible benefits to the economy. The Fed will be creating even more inflation and bottlenecks.

- The inflation tiger is already free: Economist Friedrich Hayek famously compared the Federal Reserve's attempts at controlling inflation to catching a tiger by the tail. Once free, it is incredibly hard and dangerous to contain it again. For decades, the Federal Reserve hiked rates pre-emptively at the first signs of inflation. This time around, inflation has broken free for the first time in 40 years. The 0.25% or 0.50% raises we have seen in the past are only sufficient when inflation is still controlled.

- Lots of talk, little action: The Federal Reserve has been big on talking about controlling inflation but has taken no action even as it was obvious that inflation was coming earlier this year. Powell's response has been to attempt to "talk down" inflation. Saying it is temporary, that it will resolve itself. The Fed's inflation projections have been downright laughable. Some have criticized me for using "lying" to describe what the Fed is doing. However, in September, the Fed projected a PCE inflation rate for 2021 at only 4.2%. With only three months left in the year, that projection can only fall into two categories, either incompetence or intentional deceit. PCE was already at 5% in October and certainly rose in November. Less than one month after their meeting, the Fed's forecast was utterly debunked. Yet, we are supposed to believe that inflation will conveniently fall to 2.2% in 2022? And conveniently be at 2%-2.2% after that with the Federal Funds rate rising to only 1%. They are either completely incompetent, or they are being intentionally deceitful.

- Powell is no Volcker: When Paul Volcker took over as Fed Chair, the Fed had failed to tame inflation for a decade. Volcker was willing to raise rates as much as it took to end inflation, regardless of the consequences. He was perfectly willing to cause a recession to pop the inflation bubble. Powell? In 2018 the Federal Reserve embarked on an attempt to reduce the size of its balance sheet. It was selling off bonds that were purchased from 2009-2016 and hiking the target rate to 2.25%. The bond markets absorbed the changes well, but the stock market did not. Powell's Fed quickly reversed course. In 2019, despite a fundamentally healthy economy, the Fed started cutting rates, stopped selling bonds, and by October 2019, started buying bonds again. The Fed started pursuing monetary easing policy only to support the stock market. The truth of the matter is that we live in very fragile economic times today, and Powell is living in a different set of rules than Volker did. If the stock market falls, then the economy falls with it. Banks are riddled with junk loans and we would be facing a massive credit crunch where many banks will go bust. We do not have the same tailwinds that can lift us out of a recession that we had in the early 1980s. A new Volker will not succeed in today's weak economy for many reasons I explained in previous market outlooks.

The reality is that the Fed has its hands tied and cannot hike rates much without causing a great global financial crisis. It is very likely just to do symbolic rate hikes, or maybe not at all. If we look back, this has been the most dovish Fed in history. This Fed cut rates and engaged in quantitative easing in 2019, long before COVID was an issue. The Fed abandoned its "bold" plan to shrink its balance sheet at the first sign of weakness in the economy.

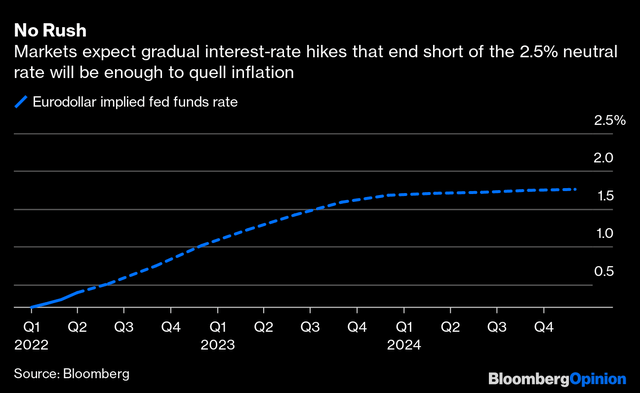

Despite the current high inflation, Mr. Market is still expecting a very gradual rise in the Fed Funds rate:

The Fed will surprise us again and be even more conservative. Any rate increase is likely to be small - probably in the magnitude of 0.10% instead of the normal 0.25% that we have historically seen. The Fed will quickly reverse course at any sign of equity market weakness, much like we have seen in the past 12 years.

The Fed will surprise us again and be even more conservative. Any rate increase is likely to be small - probably in the magnitude of 0.10% instead of the normal 0.25% that we have historically seen. The Fed will quickly reverse course at any sign of equity market weakness, much like we have seen in the past 12 years.

The bottom line is:

- A small rate hike would provide no benefit in dealing with the inflation problem since, at its core, inflation is being driven by a massive pool of excess liquidity.

- A small rate hike is a bit like trying to dry up a swimming pool with a towel. You might take out some of the water, but there will still be a lot left.

The money is already spread around, and it's too late to bring it back. The tiger is free, and the only thing the Fed can do is let it run until it falls asleep.

The Dip Was Bought

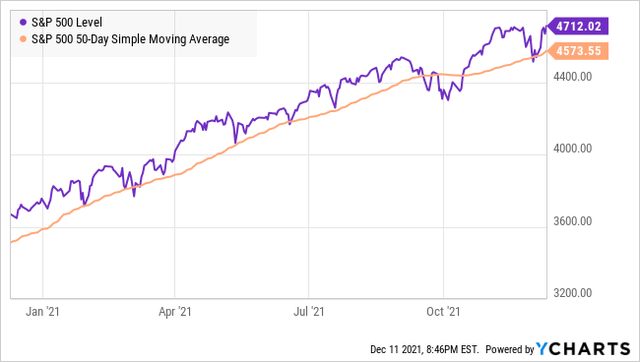

And I noted last week when there was extreme fear and panic, the pullback is likely to be very short-lived. In fact, the S&P 500 index ended the week within the stone's throw of a record high. The 50-day moving average has proved once again to be a very firm level of resistance for the S&P:

This is why I have recommended buying every dip sooner rather than later. Investors who see a red day and decide it is "too early" and try to wait for better prices find themselves still sitting on cash when the market recovers.

It is crucial to understand that liquidity is fueling this bull market. Dips are briefer and more shallow than you might expect based on history. Here is a look at the same chart of the S&P 500 from 2018-2019:

Note how often the S&P breached below its 50-day moving average. Investors waiting for these kinds of dips will be disappointed. While waiting, their cash is losing value at a rate of 6.8%!

To the upside, my price target for the S&P 500 index remains at the 5200 level at least (or 10% higher from here) over the next 6 months. This will set up the index for its next run to the 5500 level (or 17% higher from here), which I expect to happen before year-end 2022. A run toward the 6000 level by year-end 2022 is not completely out of the question, but it is too soon to set it as a target for now.

On the downside, I expect the 50-day moving average to continue to be a signal for the dip to be bought. This means that 4600 will be a significant resistance level.

The Hunt for Yield is Set to Continue

It is critical that you are aware of the major macroeconomic forces at play that are impacting the markets so that you can make informed decisions. This is why I write these "Market Outlooks" to share with you the big picture as it evolves. Keeping an eye on the big picture helps us make adjustments to our portfolio as needed, in a planned and methodical manner.

Now that we explained why we should not worry about Fed rate hikes, and that the Fed has our backs as investors, we lay down our Portfolio Strategy for the next 12 to 24 months. It is based on these four trends:

1 - Interest Rates Will Remain Low: The current effective yields on savings accounts, CDs, Money Markets, Treasuries, and investment-grade bonds are currently offering deeply negative effective yields (inflation-adjusted). Even if the Fed were to increase its fund rates from here, they would remain very low relative to inflation and would not derail this great bull market. As noted above, the Fed cannot hike rates by much in 2023 and is likely to reverse course in 2024 or even sooner through rate cuts. Lower for longer interest rates are here to stay. There are no alternatives to equities. Companies that benefit from the combination of low interest rates and inflation, such as REITs, will benefit.

2 - The Economy Will Continue to Run Hot: Today, the U.S. economy is growing at a very fast pace and is expected to continue to do so for several years. Economic growth will require access to equity capital and debt capital to expand. Economically sensitive stocks that provide equity and/or debt investments like BDCs (business development companies) will continue to be the biggest winners.

3 - Liquidity Will Remain High: In 2021, we are seeing record-low default rates. Thanks to the combination of high demand and easy access to capital, very few companies are failing. Debt is easily refinanced, and cash flow is high. These conditions are likely to persist as the Federal Reserve is making no move to reduce liquidity in the financial system. In November, banks loaned over $1.7 trillion to the Federal Reserve every night at 0.05% yields. With so much liquidity, borrowers will have no problems accessing debt. Companies that will benefit from high liquidity and low default rates are set to be big winners. This is why Oxford Lane Capital (OXLC) and BrightSpire (BRSP) are two of our "Picks of the Year" for 2022.

4 - The Fed Will continue to support the markets as it did over the past 12 years: Not because the Fed loves us, but because they cannot afford another great and painful financial crisis that would take years, or decades to recover from.

With record-low interest rates and massive liquidity in the system, investors seeking income will continue ditching their holdings in bank products (savings, money markets, CDs) and Treasuries. They will seek quality, high dividend stocks, similar to the ones we hold at HDI. I expect that higher demand and big cash inflows will drive higher prices and spectacular returns for our portfolio over the next few years!

Note: This bull market is far from over. While we may continue to see high volatility over the next two weeks, the best course of action remains the same: Buying the dip. As usual, we will share our weekly top picks tomorrow on Monday.

Have a great Sunday,

Rida MORWA