Market Outlook: Growing Income In Growing Uncertainty

Summary

- The markets rebounded last week.

- Will the upward momentum continue? We look at what news is coming this week.

- How to navigate uncertainty by using the Income Method.

Good morning HDI!

The markets had a good week, rebounding off last week's lows and finishing especially strong on Friday.

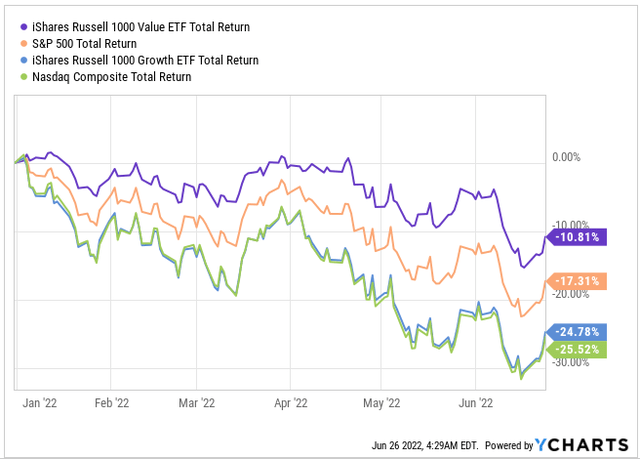

Value stocks continue to significantly outperform year-to-date, as evidenced by the Russell 1000 Value ETF (IWD). These are stocks with low price-to-earnings ratios and are a category that most of our HDI Model Portfolio holdings fit into. This outperformance in Value is why the HDI portfolio has been holding up much better than the market averages.

News Heavy Week Ahead

There is no shortage of potential catalysts to blame for any market movements this week. On Wednesday, the third estimate for Q1 GDP will come out, and there could be some adjustments to the second estimate that GDP was -1.5%.

Then on Thursday, May's PCE Inflation (Personal Consumption Expenditures) will be reported, providing us with a clearer picture of inflation. Finally, the ISM Manufacturing Index will provide our first indication of whether manufacturing continued to weaken in May.

These items aren't necessarily newsworthy on their own. We already know GDP was negative in Q1. Whether it was -1.4%, -1.5%, or -1.6% isn't a huge difference.

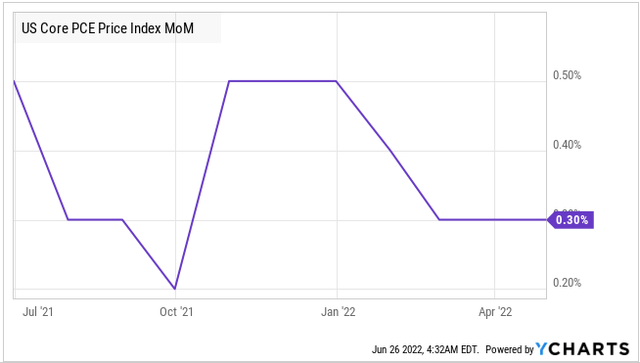

We know that inflation was higher in May as we have already seen CPI (consumer price index) and that gasoline and oil were significant contributors to inflation in May. However, the market could react if Core PCE is different from the expected 0.4% rise month over month.

The expectation of 0.4% is a modest tick up from the 0.3% we've seen in February, March, and April, but still lower than the 0.6% seen in May of 2021.

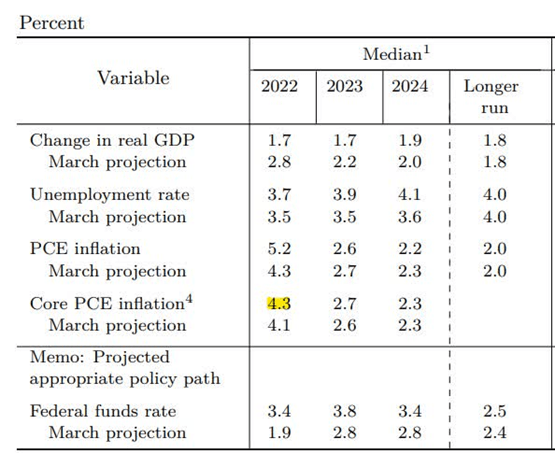

Year to date, Core PCE is 1.3%. The Fed's newest projection is for Core PCE inflation to be at 4.3% by year-end.

To reach 4.3%, inflation would need to average 0.375%/month for the rest of the year. In other words, inflation will need to be higher than it was in the first four months of the year.

If these reports differ from expectations and indicate more aggressive or less aggressive inflation than anticipated, we can expect the market to react.

Uncertainty Abounds

The economy is extremely complex. We often talk about the economy "going up" or "going down" as if it moves as a single entity. It doesn't. "The economy" is the net result of trillions of minor decisions people make daily.

Do I fill my gas tank today or try to hold off until tomorrow? Should I splurge on summer vacation for the family, or should I keep it low budget? To buy or not to buy, to work or not to work, to save, to invest, to spend. Every single day we make these decisions. When you see an internet ad, you decide whether or not to click on it. These decisions are so second nature that you might not even think of them. Yet each decision has just the tiniest bit of influence on supply and demand. When added up across the 8 billion odd people worldwide, those little decisions have a very material impact.

Everyone has their own individual situations and decision-making abilities. Some people will make wise financial decisions, and many won't. This goes for consumers, politicians, Federal Reserve officials, and investors too.

At any given moment, some investors believe the next doomsday will happen soon, and others believe that idea is crazy and the dip is a great buying opportunity.

The economy, and the market, are both the result of all these different forces pushing and pulling in different directions. Oil prices are coming down because futures traders fear a recession is imminent, but gasoline prices have continued to march higher because there is more demand than the supply can handle. You might look at that, shake your head and declare that the market is crazy.

The market is crazy, but there is a sense behind it as well. You have different people making decisions for different reasons. Some of the same people selling oil out of recession fears might also be buying up equities just in case there isn't a recession.

Kind of like at HDI, we are simultaneously buying up fixed-income that would benefit greatly if the Fed smashes the brakes on their hiking plans while also buying floating-rate investments that will benefit if the Fed follows its new plan.

Smart investors never assume they are always right.

What Will Happen Next? Does It Matter?

Last year, I was wrong! Totally, completely, and utterly wrong when I predicted that the Fed would follow a Dovish path. The Fed initially laid out a fairly Dovish plan in March. It made me think that I was generally right. Then the other week, the Fed came out every bit as Hawkish as the market feared.

On the other hand, I knocked the ball out of the park on my inflation predictions, even as the vast majority of the market was buying the Fed's story of "transitory" inflation.

This is investing, we're constantly making projections about what will happen in the future. Sometimes you will be right, sometimes you will be wrong. We were able to position our portfolio to benefit from inflation relative to the rest of the market.

Fortunately, by following the Income Method, we don't have to be right about everything. We buy income when it is relatively cheap, if it gets "cheaper", that is ok because our plan allocates a portion of our income to reinvestment. The dividends coming in will provide us steady cash returns, month after month.

Yes, it would be nice to "back up the truck" and invest 100% at the perfect market bottom. Yet the odds of such perfect timing are remote. Fortunately, investing at the perfect bottom is not necessary to have great returns, to beat the market, or to have a very comfortable retirement.

A recession will happen, nobody knows exactly when. My outlook is still for late 2023 after the market has forgotten about the threat and has started thinking the coast is clear. It could be sooner, or it might be later. What factors will influence when a recession might happen?

- The Federal Reserve: The Fed has significant influence over demand. Hiking rates reduces demand for almost everything. It's a hammer that can strike the economy down when it is too hot. The problem is that the Fed is hammering away when demand was already on the way down. Maintaining its Hawkish position too long will accelerate a recession. While backing off soon might delay one.

- Energy Prices: Energy prices, and specifically gasoline prices, similarly influence the costs of almost everything. This is a type of inflation that the Fed can't control. It was proved in the 1970s that energy-induced inflation can continue even in the face of aggressive rate hikes. Oil might not be as trendy as it once was, but it is still essential for modern living. There are no oil alternatives that have anywhere close to the scale to replace it. As energy costs rise, demand for other things consumers consider less essential will fall.

- Food Prices: Another essential cost, that like energy will often take priority among consumers over other expenses. Are Fed hikes going to reduce demand for basic food? No. Corn, wheat, and many other agricultural products have risen in price due to supply disruptions from Ukraine and Russia, two countries that are significant exporters of food. Prices are already high, and things could get worse from completely unpredictable events like bad weather. A poor harvest for another major exporter of food could cause prices to skyrocket higher. The U.S. is lucky enough to be a major supplier of food and for Americans, it would be a financial impact. Many other countries will not be so lucky and a bad harvest could lead to starvation.

- Government action/inaction: As consumers start to struggle more, how will the government respond? Will it pump out more stimulus? We've learned from COVID that the government can increase demand through brute force. There will be consequences later (inflation), but I wouldn't count on politicians to worry about that. The government could delay a recession through brute force.

We can't know for certain which way these variables will go. They could accelerate a recession, they could delay a recession.

How does the Income Method deal with these uncertainties?

Dealing With Uncertainty

Uncertainty is a fact of life, but one thing I am always certain of is that more income is useful in every situation. I have been investing for more years than I care to count, and one thing I have never thought to myself is "I have too many dividends coming in."

Bull markets, bear markets, sideways markets, rollercoaster markets, dead cat bounces, and whatever other kind of market there is, having more income is better.

Income gives you flexibility. What can you do with your dividends?

- Spend them: Isn't this what it is all about? Many on Wall Street will act as if you should never, ever, spend a penny of your portfolio. You should just keep investing and get more. Well, since they get paid for things like "assets under management", of course, they believe you shouldn't take any cash out. Just like you and me, they want more income too. I'm here to tell you, that it's ok to enjoy the fruits of your hard work!

- Reinvest them: You should always be reinvesting a portion of your income. Just like you invested a portion of your income when you were working. This helps your income grow, ensures your principal keeps growing and that your income will keep pace with inflation. Maybe you want to tie how much you reinvest into the market action. Someone mentioned in chat that they decided to avoid withdrawing any dividends to be able to reinvest more today. That's a smart move if your personal budget allows it and prices are low. Ideally, you have a base amount that you reinvest consistently, then some flexibility in your personal budget that you can "tighten the belt" and reinvest a little extra when the market is down.

- Let them build up: Personally, I'm not one to hoard too much cash. I like to keep my cash busy. However, if you believe prices are high and might go lower, you might want to build up a little cash. I recommend always reinvesting a minimum amount, to ensure your income is always growing. Say you reinvested 25% of your income, and you have another 5% available that you didn't need this month. You might let it build for a bit, or maybe put out some lowball limit orders on stocks you want but think are too expensive.

- Speculate: If you have already taken what you need to live on, and you have reinvested your minimum to keep your income growing, you can use your dividends to aim for some of those "home runs". Everyone wants to invest in "the next AMZN". Most don't. But if you think you have identified the next big thing, a portion of your dividends can be redirected into those more speculative Growth investments. Or you can just buy lottery tickets.

- Donate them to charity: For those who are financially comfortable enough to see to their own needs, charitable donations are great for the recipients and also for those who are doing the giving. As Andrew Carnegie said, "It is more difficult to give money away intelligently than to earn it in the first place."

- Whatever you want: Ultimately, your dividends are your money. The more cash flow you have, the more flexibility you have to do whatever it is you want.

The markets will come and go. Prices will go up and they will go down. Having a large amount of income coming in will give you the flexibility to wait out the downswings, and to redirect your cash flow into your current investments or into new ones. This is why we focus on building our income so that whatever the economy throws at us, we will have the cash flow we need to fund our lives, reinvest and use for whatever other purposes we find fulfilling.

The Invisible Hand Is At Work

What is going to happen? Well, we can already see that demand is slowing down, we're starting to see the signs. The S&P Global Flash Composite Output Index indicates a significant slowdown in June. Chris Williamson, Chief Business Economist at S&P Global Market Intelligence summarized the report:

Having enjoyed a mini-boom from consumers returning after the relaxation of pandemic restrictions, many services firms are now seeing households increasingly struggle with the rising cost of living, with producers of non-essential goods seeing a similar drop in orders. There has consequently been a remarkable drop in demand for goods and services during June compared to prior months.

The most remarkable thing is that some people might find this surprising. Note that the Fed's rate hike was not implemented for most of June, this slowdown was happening anyway.

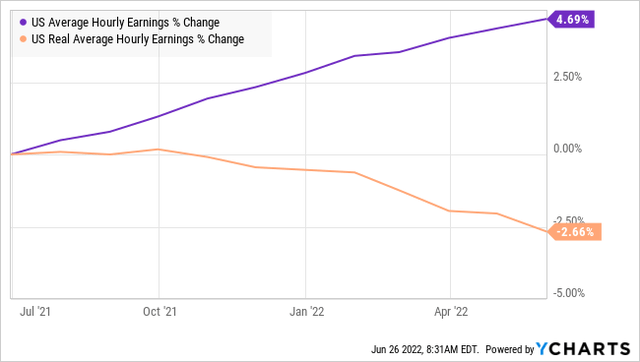

Workers across the U.S. felt great about getting new jobs with higher wages. They treated themselves, as normal people do when they get a new job or a pay raise. Then as living expenses climb, they are starting to face the reality that their expenses climbed as fast, or faster than their wages.

Note that average hourly earnings have gone up, but "real" earnings, which adjust for the impact of inflation, are down.

Workers have more dollars than they had a year ago but are discovering that it buys less. As a result, they slow down their spending, and demand decreases. Adam Smith's "invisible hand" is at work, as inflation drives up prices, demand naturally declines. This isn't something that happens immediately. It requires people to change their habits, something that they do slowly. It is simply the nature of people, they are creatures of habit and will often only make changes when their budget forces them to.

For decades, the Fed has intervened. Recognizing that inflation was coming it would swoop in to reduce demand before the invisible hand had an opportunity to do its work. By raising rates, the Fed could discourage borrowing and remove cash from consumers by causing them to pay higher interest rates.

The risk has always been going too far. Interest rate hikes don't reduce demand overnight, it takes time. So the Fed has to hike rates, but avoid going too far or risk recession.

Last year, the Fed chose not to hike rates to proactively reduce demand. Instead, it sat on the sidelines while inflation surged, and continued to prop up demand by continuing the buy Treasuries and Agency MBS (which kept mortgage rates at all-time lows). Now, just as the invisible hand has started doing its job to push down demand, the Fed is pulling its support. It is inevitable that demand will fall a lot.

But Will It Be Too Far?

The great unknown is whether demand will fall too far. On one hand, demand is extraordinarily high. Consumers have been buying far more than normal, and the supply chain has struggled to keep pace. Arguably, there is a lot of slack that can come out of demand before it actually starts to hurt the economy.

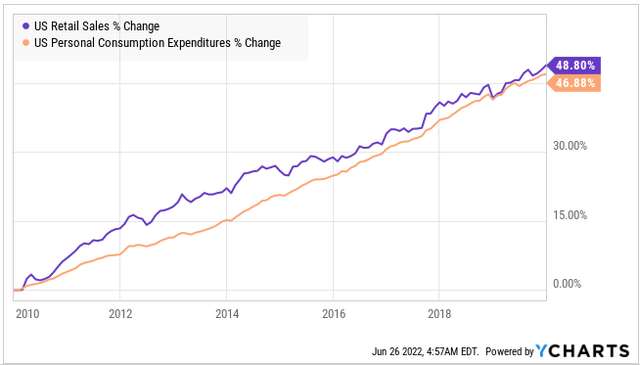

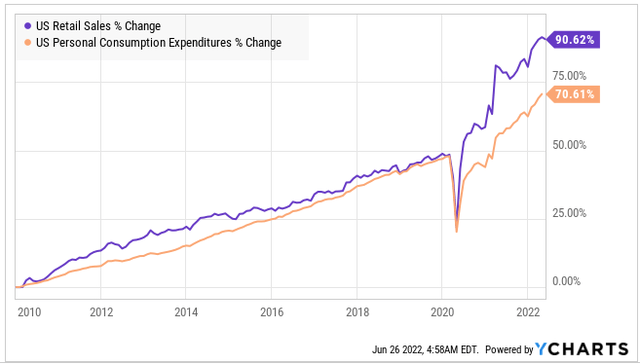

For example, here is a chart of retail sales vs PCE from 2010-2020.

Notice how the lines are fairly close, demand grew at a stable pace. Now let's add 2020-2022 to the same chart:

Retail sales exploded upwards, and PCE followed, this is the excess demand, well above the normal trend. The problem is that supply doesn't just magically appear. This isn't Star Trek, we don't have replicators that make any item we ask for out of thin air. The things we buy have to be manufactured, often using materials from all around the world. The infrastructure to do that takes time to develop. In short, supply couldn't keep up with demand. Inflation is how the invisible hand in the market deals with this excess demand.

Demand coming down to a level where it can be met by today's infrastructure, or at least by infrastructure that can be built in the near future, would be healthy. That would cause inflation to come down to normal levels, while companies would be able to continue growing earnings and unemployment would remain low. This is the ideal "soft landing" scenario.

With the Fed adding more downward pressure on demand, when natural forces are already gaining steam and bringing demand down, going too far has become very likely.

Dividend Cuts Unlikely

Whenever I talk about recessions, I am always asked about dividend cuts and whether I am worried about them.

Many investors remember the 2008-2009 recession, which led to dividend cuts averaging 23.1% in the S&P 500. The reality is that the Great Financial Crisis was a rare event. Dividends were cut, primarily because the financial sector and REIT sectors which pay above-average dividends were hit really hard. The credit markets froze, which hurt both borrowers and lenders. This isn't something that happens every recession. It doesn't happen in most recessions. There is a reason why the GFC is called "great" because it was significant and unusual. If it happened every few years, it wouldn't have its own name. What is the recession of 1990 called? I have no idea either.

Most recessions lead to much lower rates of dividend cuts. From 2000 to 2002 the S&P 500 saw an average dividend cut of just 0.5%. In the period between 1990-1991, the S&P 500 saw dividends cut by just 2%. In fact, to find a recession with greater than 2% dividend cuts, you have to go back to 1973-1975, when dividends were cut by 9.4%.

The coming recession is not showing the features that would cause a credit crisis or otherwise cause significant dividend cuts. Banks are healthy, the credit markets remain liquid, private equity has plenty of cash on hand, and earnings are climbing. GDP is at risk of going negative primarily because inflation is high. Companies are making more money, there is simply a question of whether growth will keep pace with inflation.

Cuts are unlikely, whether dividends will grow as fast or faster than inflation is a more difficult question to answer. The HDI portfolio is geared towards companies that benefit from inflationary forces, so we believe our dividend growth will meet or exceed inflation.

Conclusion

Our strategy will be to:

- Continue growing our income by opportunistically investing in high yields. As market turbulence brings prices down, we can reinvest at higher rates and grow our income faster.

- Remain agnostic towards rates. The Federal Reserve could reverse course. I would argue they should reverse course. We want a healthy allocation to high-yielding fixed income and also to companies exposed to floating-rate debt.

- Opportunistically get defensive. If a recession comes, we want allocations to agency MBS, utilities, municipal bonds, and other "flight to safety" types of investments. For example, we've added AQNU and DMB to our portfolio as part of this shift.

- Don't panic, stay focused on the income. The most important thing is to understand that the price movements in the market often are not tied to dividend safety. We've seen numerous dividend hikes year-to-date. The market might be red, but our income is growing!

Those who keep their calm in the market will outperform over the long run. Does that mean that you will see your portfolio outperform every single day? No. Investing is a marathon, not a sprint. Stay focused on the goal, and don't let the emotions of others in the market influence your actions.

Everything should be looked at through the lens of what it means for the earnings of the companies you are buying. Often, the price will go down even as earnings improve! That is why we provide our Sunday Market Outlooks and our Weekly Picks, to help you stay on top of what is happening and what it means for your portfolio.

Happy dividend collecting, and have a great Sunday!