Market Outlook: Focus On Your Goal

We welcome new subscribers that have recently joined us. The following is the "quick link" to our live google sheet:

Summary

- The market rally last week was driven by the belief that the rate hiking cycle is likely over.

- The jobs report and manufacturing sector show signs of weakness, indicating a potential recession.

- The HDI Model Portfolio is well-positioned for the upcoming recession with low valuations and a focus on growing income.

= = = =

Good Morning HDI!

Last week we saw a significant rally throughout the markets, and in particular, among the most interest rate sensitive stocks. What changed? The market decided that the rate hiking cycle is likely over.

In my writings, I continuously encourage investors not to get overly focused on price swings. When the market is crashing, my advice is to focus on your income and make sure you keep growing it.

Now the market is rallying, should we be excited about it? No. Unless you are selling, unrealized gains are as meaningful as unrealized losses. Don't count your chickens before they hatch, stay focused on growing your income.

From an income perspective, we saw dividend raises from CSWC and NEP last month. We saw a dividend reduction from DMB. And there was certainly a lot of opportunity for funds designated for reinvestment to be put to work at a high yield last month. If you are following the Income Method, your income is likely up, and let's keep it climbing – that should be our focus, not the big number that had a good week.

Fed Futures

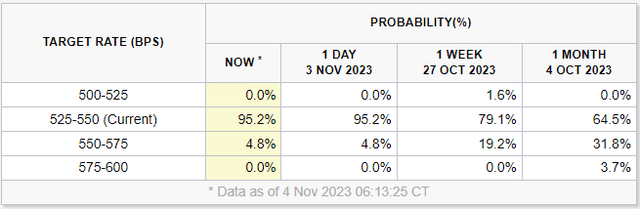

Over the past week, the Fed Futures market went from pricing in a 19% probability of another rate hike at the December meeting, to a 95% probability that rates will remain paused. Source

CME Group FedWatch Tool

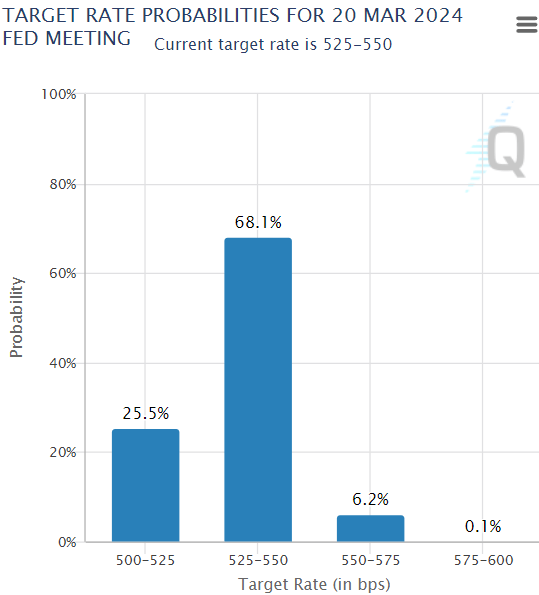

Looking further into the future, the futures market is projecting a 90%+ probability that rates are at peak and a 25% probability that the first-rate cut could occur as soon as March.

CME Group FedWatch Tool

This belief is what drove the equity markets up so strongly last week. The rally will continue to the extent that the market doesn't have a bucket of cold water poured over it.

The market's optimism was driven in part by the Federal Reserve's meeting and aided by a rather weak jobs report. A jobs report that many talking heads are calling a "Goldilocks" report, I would call it very bad for those who rely on jobs to pay their bills.

Goldilocks Jobs Report?

Many news reports have portrayed the jobs report as a "Goldilocks" report where job growth is slowing just enough that the Fed will stop hiking, but a recession won't happen. They suggest that we could be heading for the Holy Grail of monetary policy: A "soft" landing.

I've said it before, and I'll say it again: Economies have momentum. Sure, if you take last month's jobs report, and future jobs reports are absolutely flat, then mission accomplished. Roll out the banner, do a presser, Jay Powell can be crowned the greatest Fed Chair of all time.

Unfortunately, you can't pause the real world. It's like a teeter-totter; there is that smallest moment where everything is level, but the momentum ensures that it keeps going past that moment when someone is going to land on the ground.

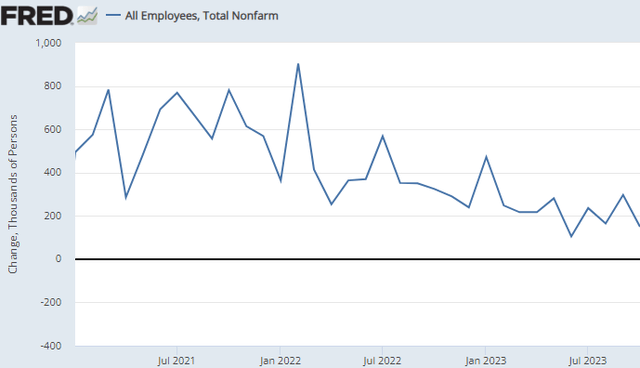

The fact is that job growth has been trending downward for three years now. Source

St Louis Fed

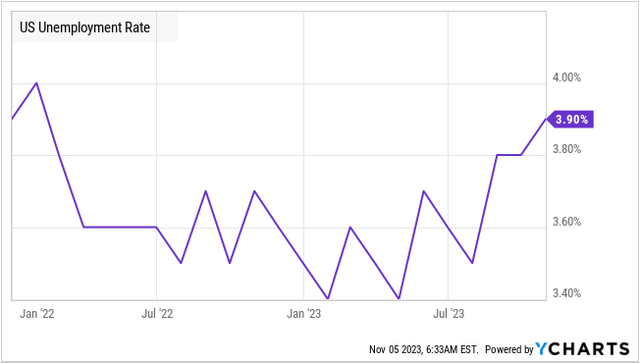

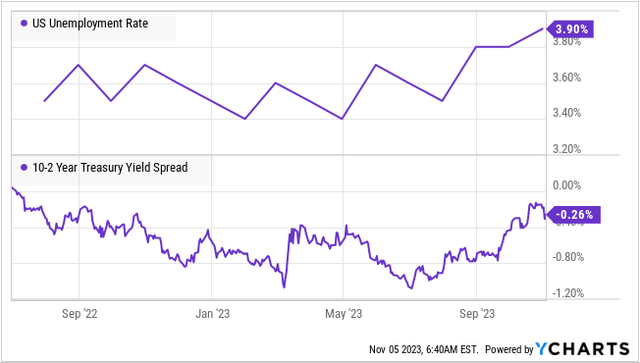

This is also reflected in the unemployment rate, which at 3.9% is "low" compared to history, but is the highest it has been since January 2022.

More importantly, it broke out of the range it has been in for most of the past two years. Month-to-month fluctuations are expected, but it was consistently between 3.4-3.7% from March 2022 through August 2023. Breaking up to 3.8% and then continuing upward to 3.9% is not disastrous in absolute numbers, but it is a very unfavorable trend that points to the momentum of the economy shifting in what most people would consider an unfavorable way.

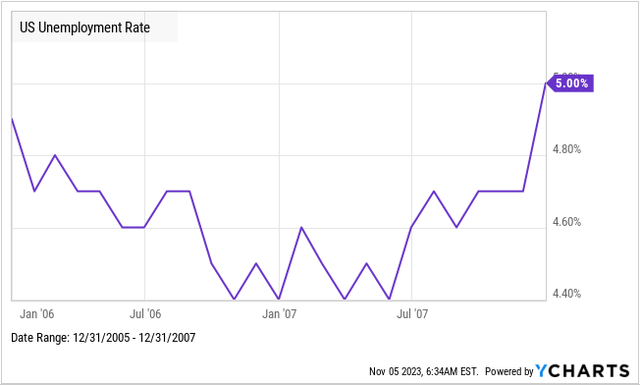

This is a pattern we have seen before other recessions. Unemployment declines to the cycle bottom, bounces around for a bit, and then breaks out. Here is a look at 2006-2007:

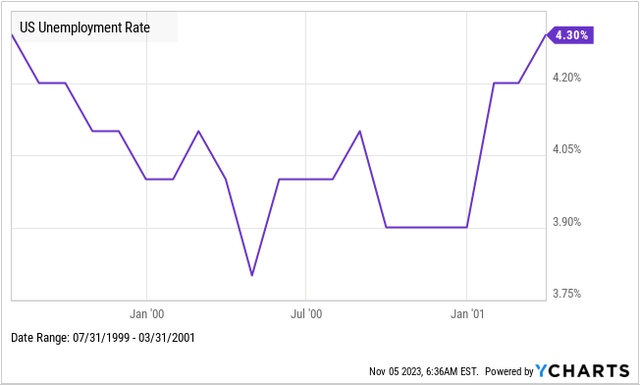

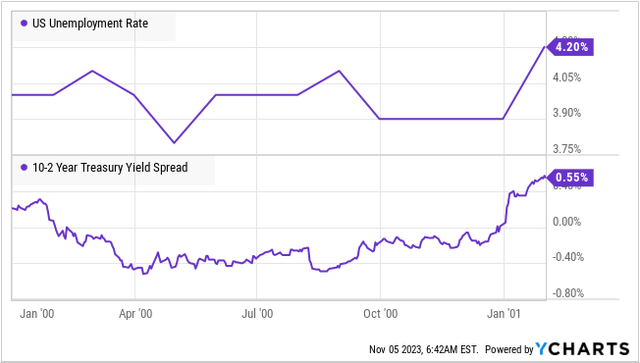

We all know what happened after unemployment broke out of its range in December 2007 – the recession officially started the next month. If we look back at the Dot-Com bust:

Again, we see unemployment falling, bouncing at the bottom, and once it broke out to the highest since 1999, the recession started, and unemployment kept going up.

Typically, jobs data doesn't give us a lot of warning. In one report, the jobs data is a little weak, but still quite decent in absolute numbers. The next month, the jobs market is dead on arrival, and a recession is underway.

Manufacturing Is Faltering

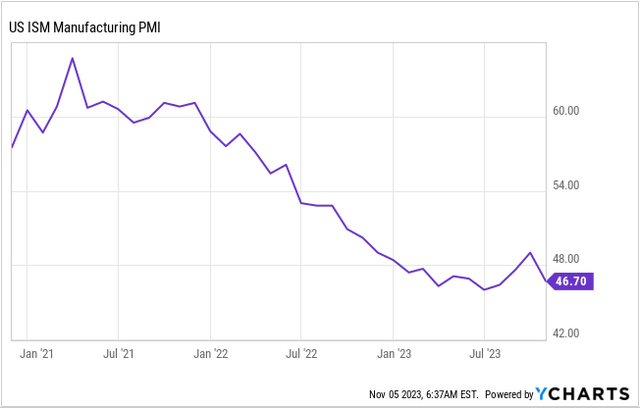

The ISM Report on Business has reported a contracting manufacturing sector for 12 months now. A PMI reading below 50 means that the manufacturing sector is contracting.

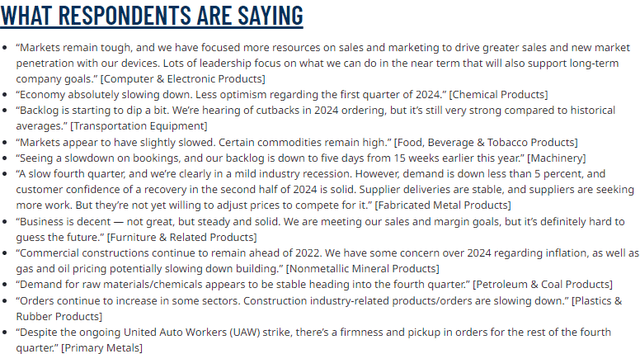

Looking at the commentary from the survey, respondents are not in despair yet, but clearly, many are seeing a slowdown in their businesses. Source

As I've stated numerous times over the past year, the very large backlogs that businesses had trying to "catch up" with COVID-era demand was propping up the manufacturing sector. Even as new orders slowed, they had ample work to complete and plenty of demand for employees. So, while the PMI number was reporting contraction, businesses were still humming along full speed ahead. It is when they catch up on that backlog, and have to rely on current demand that they start having issues.

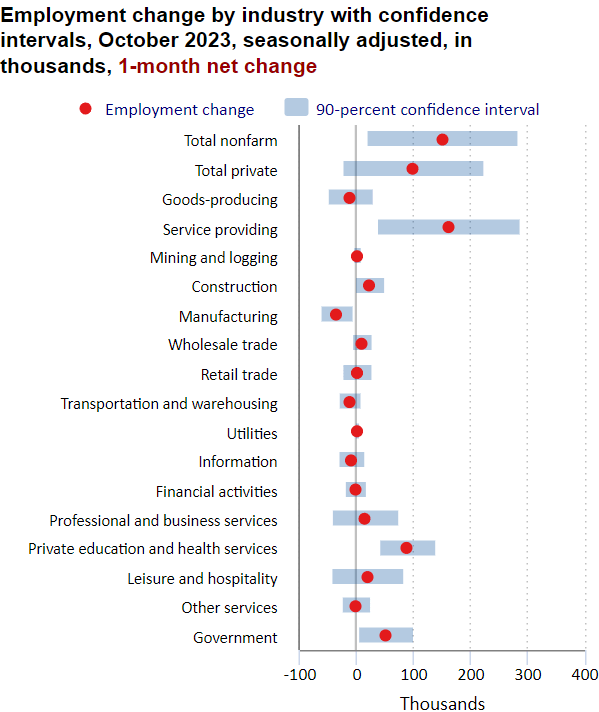

When we combine the statements in the ISM report with the recent jobs report, we can see this area of weakness. Goods-producing companies are seeing declining jobs, while the overall jobs report is being propped up by service jobs. Source

BLS Website

Indeed, we can see that the "strength" of the jobs sector is highly isolated to a handful of industries like health services and government, which account for 140,000 added jobs in a report that had 150,000 added jobs. That leaves a very sizable chunk of the economy that is seeing barely positive job growth or declining jobs. It is hard to see how these dynamics don't have consequences for the broader economy.

The Yield Curve Inversion

One recession signal I've been following is the yield curve. As I noted back in March 2022, an inverted yield curve is a sign that a recession will come in the future, not that one is happening right now. I wrote:

"In fact, in the past four recessions, the recession has not occurred until several months after the curve stopped being inverted and spreads widened."

Here we are, 16 months after the 10-year and 2-year Treasuries inverted, and the inversion is closing while unemployment is rising.

The setup for the upcoming recession continues to rhyme the most with the dot-com bust – which, on the timeline, puts us somewhere around late 2000/early 2001, months before the recession started.

In 2000/2001, the Fed stopped hiking interest rates in May 2000 and cut rates twice in January 2001. Note that the 10-2 years yield curve had substantially uninverted before the Fed started cutting.

What This Means For Our Portfolio?

Every recession has its own "flavor". I am frequently asked what "a recession" means for different investments, and the answer is that "a recession" can mean anything. The stocks that perform the best in one recession can be body-slammed by the next.

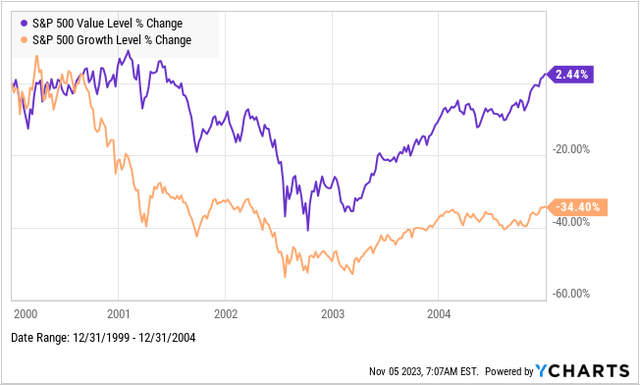

During the dot-com bust, Value stocks held up very well compared to Growth stocks.

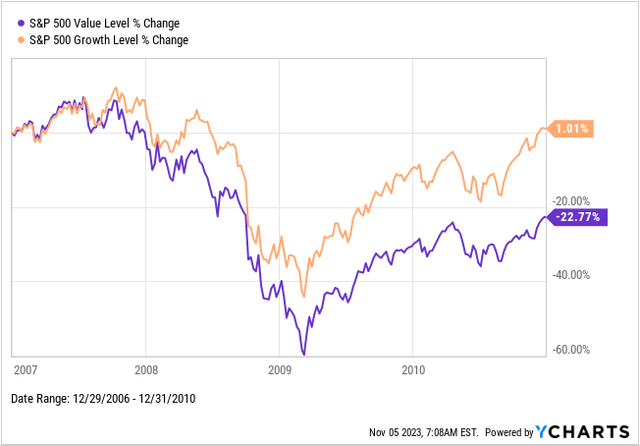

During the GFC, Value stocks led the way down and took longer to recover.

What is consistent is that you don't want to be owning things that are trading at a high valuation relative to their own history prior to a recession. Before the dot-com bust, you didn't want to hold tech stocks (growth); before the GFC, you didn't want to hold real estate or banks (value).

When I look at individual holdings throughout the HDI Model Portfolio, the majority of our holdings are trading at low valuations relative to their own history. In some cases, they are trading at lower valuations than they traded at during recessions. This provides me with a lot of confidence that our portfolio is well-positioned for the upcoming recession.

On the income side, we will continue to monitor each holding on an individual basis. The greatest risk to dividends is a credit crisis, which did not happen during the dot-com bust, and I do not expect one to happen now.

Conclusion

One of the hardest things to do when investing is to manage your emotions. We get upset when our portfolio turns red, and we get happy when it turns green. Hey, everybody likes to have more money.

Yet, it is important to keep our emotions in check when investing – that includes the lows and the highs. Stay focused on your goal, and make sure that you are making progress towards that goal. Look for opportunities to grow your income more, whether the market is green or red.

I continue to believe that a recession is going to happen, and it could happen quite soon. Yet I am attempting to predict the future, which means I can be fantastically wrong. In the near term, the markets are going to respond to what the Fed might do. This week will be a quiet one in terms of economic news releases. The next major release scheduled that can be expected to shift sentiment towards the Fed will be CPI, which is scheduled to be reported on November 14th. This leaves the path open for the market to be in its own head, and either keep the rally going or start second-guessing.

Either way, we'll be here – buying up more income and growing our dividend stream. Whether the market is green or red, my income is growing!