Market Outlook: Equities Soar, The Fed Confirms It Is As Dovish As Ever

Market Outlook: Equities Soar, the Fed Confirms it is as Dovish as Ever

Summary

- We had another great week on Wall Street with the main driver being excess liquidity financed by the Fed and government spending.

- We take a look at what happened at the Jackson Hole meeting, and why it is very bullish for equities.

We had another great week on Wall Street with equities closing at record highs for the 4th time this week. The S&P 500 Index closed the week up by 1.5%, the DOW Index by 1%, while small-cap Russell 2000 experienced its best week since last March, up 5.1%.

The main driver of this big rally has been, as I have been pointing out in my market outlooks, the excess liquidity in the system, the "bubble of cash" on the sideline, and cheap money. On Friday, we had some more positive news from Jackson Hole with Jerome Powell confirming that the Fed has no intention of pulling liquidity from the system, at least not anytime soon, or in any meaningful form. Let us dig into the details.

Following Powell's speech, the S&P 500 and the Nasdaq closed at record highs for the fourth time this week. The yield on the benchmark 10-year U.S. Treasury note fell to 1.31% after Powell's remarks.

Jackson Hole

Federal Reserve Chairman Jerome Powell spoke at the Jackson Hole Summit. He appeared (on the surface) to be more hawkish than usual, but if you dig into the details he is as dovish as ever:

- He pointed out that there is some worry about inflation. Still, he played it down significantly, maintaining that it is "transient" and will reverse, despite all the evidence that points to the opposite.

- He made it clear that there will be no rate hike anytime soon, stating that any tapering should not be seen as a timetable for rate hikes. He wants to see full employment and sustained inflation above 2%. The next rate hike seems to be on track for 2023. In my personal opinion, it will be in late 2022, but that is still a very long time from now. The most important takeaway is that tapering does not carry a rate hike signal.

- He expects tapering of asset purchases to begin this year, but he put conditions about tapering, leaving the amount of purchases "open ended". The conditions are focused on a healthy labor market, and not inflation. With the spike in Delta, Powell made it clear that there is no final decision but rather a "wait and see" situation. Clearly a very dovish sign.

- Importantly, the Fed will "continue to support accommodative financial conditions" by maintaining a large balance sheet even after purchases are ended.

This is perhaps the most dovish Fed we have ever seen, and I expect any tapering will be implemented slowly, and most likely will be much less than the markets initially expected.

Here we should note that today is unlike the "taper tantrum" of 2013, when the Fed's tapering had a devastating impact on Treasuries, and yields soared. In my opinion, tapering will have little impact, if any, on the treasury market (or on the equity markets). U.S. Treasuries continue to see huge demand as an alternative to other high-quality government bonds worldwide which are currently yielding negative rates. Foreign buyers continue to show up at auctions of U.S. Treasuries in force, buying the majority of the Treasuries being auctioned.

So in effect, with the Fed buying Treasuries, they are competing with U.S. financial institutions, U.S. individuals, and international buyers. There is no need for the Fed to compete with the market players at a time when there is already so much demand and competition to buy these notes. This is resulting in the Treasury yields being kept artificially low due to "un-needed" Fed intervention.

Inflation

Powell's speech overshadowed the release of the PCE (Personal Consumption Expenditures) report. Yet the PCE went up yet again, up 4.2% year over year. This is the largest annual increase since 1991.

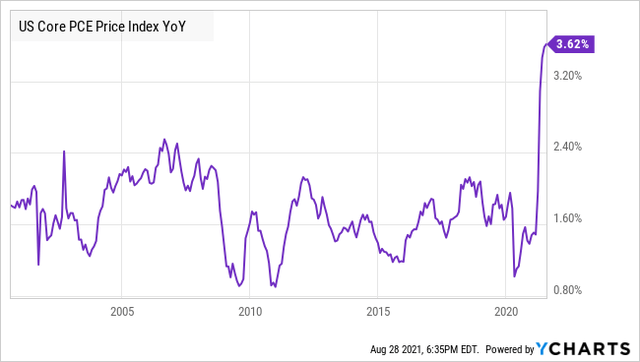

"Core PCE", which is the Fed's favored tool to measure inflation, and which ignores food and energy, is above 3.6%. It is also the highest since 1991. While not yet to the grand-heights achieved in the 1970s and 1980s, these are the highest inflation rates that most investors have experienced and are not typical of the recoveries we saw from the Great Financial Crisis, the Dot-Com Bust, and other economic events we have seen in the past 30 years.

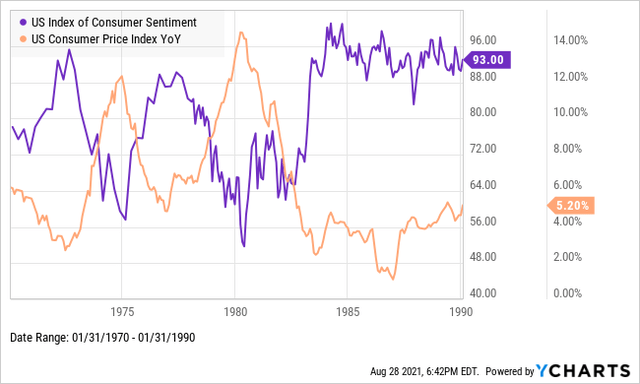

Additionally, consumer sentiment as measured by the University of Michigan declined to a decade low to 70.2. The lowest level since 2011. While Delta might carry some of the blame, it is clear that inflation expectations play a large role for consumers. Consumers are worried as their bills are going up.

Historically, large drops in consumer sentiment have been followed by large spikes in inflation. Here is consumer sentiment compared to CPI from 1970-1990.

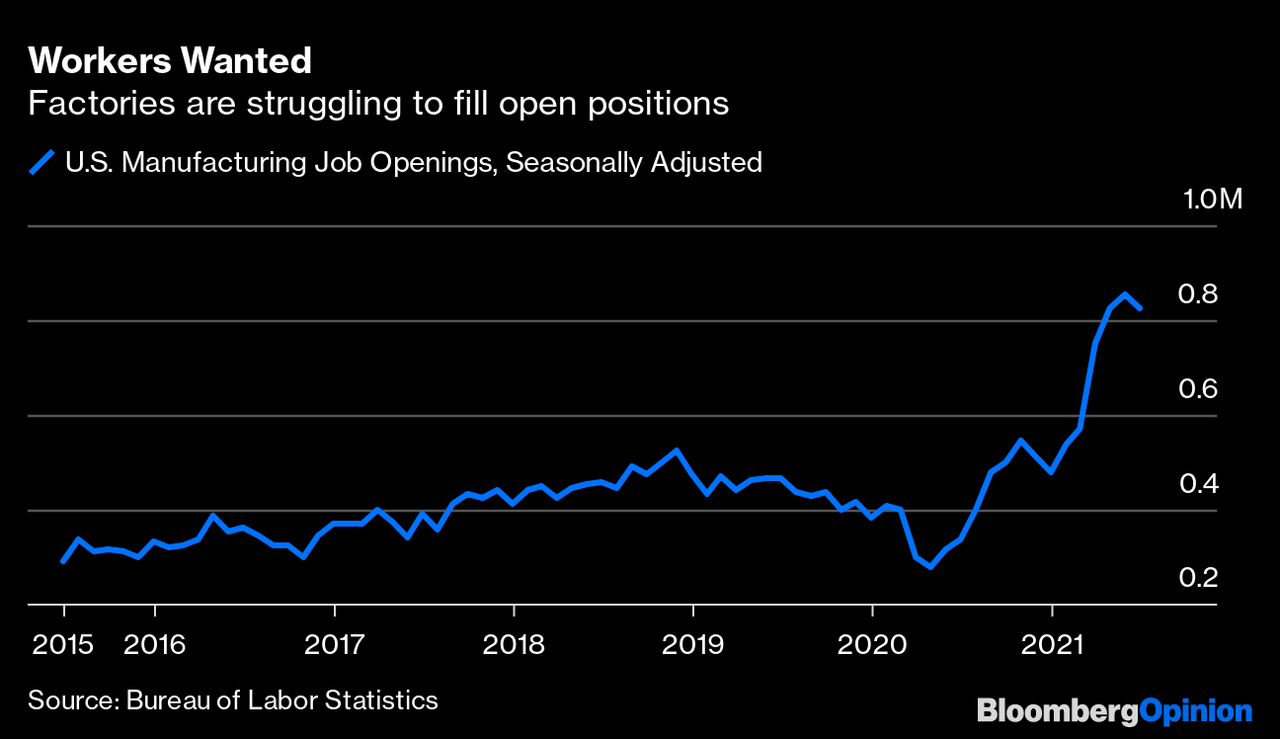

But nothing can prepare us for how much worse the problem looks when you see it in the context of recent history. Manufacturing jobs openings are soaring and having difficulties to be filled.

In this environment, we can expect that workers will aggressively seek higher wages. They know they need them.

Market Impact

The markets do not believe Mr. Powell about tapering:

- Investors do not believe that inflation is under control. In fact, investors realize that inflation is going to be a huge problem in the coming years. As a result, the WTI Crude is up 10% this week and Gold saw immediate gains following Mr. Powell's speech. Commodities and precious metals are a traditional inflation hedge. In this rapidly rebounding economy, the demand for oil, natural gas, and other essential commodities remains strong.

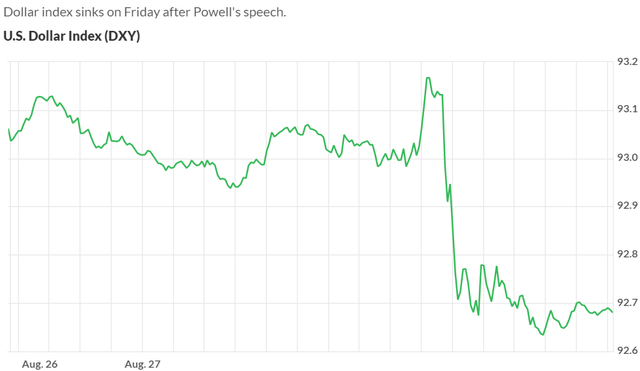

- The U.S. Dollar index is exhibiting the clearest sign of what the market thinks of the Fed’s stance on inflation:

Source: Marketwatch

Global currencies such as the Euro and the British Pound Sterling are rallying. This means that international investors do not believe that the U.S. Federal Reserve is in control of this inflation.

- The good news is that a very dovish Fed is very bullish for the equity markets. The S&P 500 and the NASDAQ rallied to reach record levels after Mr. Powell’s remarks.

- However, the biggest beneficiaries are small-cap stocks, and high-dividend stocks. Small-cap stocks are the best positioned to fight off inflation. High-dividend small-cap stocks, such as the ones we target at HDO, are your best hedge against inflation, and help you beat inflation while generating income no matter what. This is especially true if you are invested in super high dividends of +7%. Inflation is highly unlikely to hit close to that level. If you invest with yields of 7% and reinvest your dividends, not only are you are beating inflation, but you are boosting your future income, and you are setting yourself up for success when inflation gets back under control in a few years. You will have excess income to spend and reach a happy comfortable retirement that will exceed your income needs.

Technicals

The S&P 500 index has broken to the upside, above the 4500 level, which is a level of resistance for the index. This is of course is a very bullish sign. The next target for the S&P 500 index is 4600 which I expect that we will reach relatively soon. There is a lot of buying pressure underneath and as we have noticed this week, and since the beginning of the year, investors have been buying each and every dip, and I do not anticipate that anything will change anytime soon. There is just too much liquidity out there chasing too few opportunities. Furthermore, we should note that big banks and financial institutions have started their yearly buyback program which should reduce the market's overall volatility and put upside pressure on equities.

To the downside, the 4400 level should offer good support should we see any market turbulence.

Bottom Line

We remain in a powerful uptrend fueled by excess liquidity, cheap money, strong earning. This week, we got another confirmation that the Fed has got investors' back and is not willing to tighten its policy anytime soon or over the next two years, which is great news for equity investors. We cannot under-estimate the message that was given to us by Mr. Powell. He is effectively saying that the Fed will remain accommodative until the year 2023 meaning that equities are the best place to be!

Today we are in an environment where there is a lack of investment opportunities, other than the equity markets and real estate. This has been a big driver for equity prices. Inflation fears are also playing in favor of investors, and few want to keep cash idle in the bank, losing out to increasingly high inflation pressures.

A dovish Fed that is ignoring inflationary pressures will keep bond and Treasury yields low, and thus make dividend stocks ever more valuable for investors seeking income. I expect that demand for our dividend picks will continue to be high which will drive up prices. This will result in both strong capital gains in addition to our high income. I am very excited about the prospects of our portfolio over the next 24 months! Over the next two weeks, we will be adding to our "model portfolio" two high-yield picks that are undervalued and will boost our overall portfolio yield. Stay tuned!

===========

Want to access our full report, all our top picks, and portfolio?

We invite you to take a 15-day free trial to our service. It is the #1 Service for Income Investors and Retirees. By taking the free trial, you will have access to our model portfolio targeting a +9% yield by investing in dividend stocks, bonds, and preferred stocks. Test it for yourself, I am confident that you will like it!