Market Outlook: Don't Look Backwards, And Keep Collecting Your Dividends!

Market Outlook: Don't Look Backwards, And Keep Collecting Your Dividends!

During the week, the markets have been exhibiting some signs of weakness. The S&P 500 index closed down 1.7% and the Nasdaq down 1.6%. There has also been a lack of market breadth, which has resulted in many individual stocks already in a market correction, with 90% of small and medium cap stocks down over 10% recently. On Friday, we got the inflation numbers which looked scary, we will dig deep into them later in this report. As a result, we saw the 10-year Treasury yields up by 3.2% on Friday.

The good news however is that the market fundamentals are still extremely supportive, financial conditions are very easy. Despite the volatility, and possible further market pullbacks, we remain in one of the strongest bull markets that I have ever seen. This is a liquidity-driven bull market, and the world is awash in liquidity. Investors will continue to buy the dip. Even if we see a big market correction soon, it is likely to be short-lived with a swift recovery. I will dig into all the details in this report, with a special focus on inflation and why the Fed will not be raising interest rates anytime soon, or possibly many years. Lower interest rates for longer is very bullish for equities. This is a rather long report, however a very important one, and I recommend that our members go through it in detail.

Inflation: Everyone Is Looking Backwards

We have been spending a lot of time this year talking about inflation. We don't want to beat a dead horse, but this particular horse is the one that will have the largest impact on the markets and your personal finances. Just reported on Friday, the annual rate of inflation rose by 2.8% in August, its biggest increase in almost ten years. This makes inflation up 8.3% year on year! The numbers are getting scarier each month, and it is worth stopping here and taking another look.

In discussing inflation, we have discussed a number of different metrics. There is no single "right" inflation number. Like many things in economics, it is complex. There are a lot of different things that sell and there is no one "price" of any particular product. I can buy a product in one store, walk across the road and buy the identical product for a different price. So measuring overall inflation becomes tricky. It is easy to become lost in all the metrics and what they are telling you. Here is a quick refresher:

Consumer Price Index: CPI is calculated by the Bureau of Labor Statistics using a "basket" of goods that the "typical" urban consumer buys. CPI is important because it is one of the most common inflation references. CPI is used to determine how much government payments like Social Security will go up each year. Also, CPI is frequently used in commercial rental contracts to determine how much rent will go up year to year.

Personal Consumption Expenditures Index PCE: The PCE index is also calculated by the Bureau of Labor Statistics using a "basket" of goods and comparing the changes in prices. There are a few key differences. PCE is important because this is the metric the Fed relies on most when making policy decisions. Typically, PCE and CPI are similar, but PCE tends to be a little less volatile.

Looking Backwards

The important thing to remember is that CPI and PCE are both backward-looking metrics while the impact measurements are delayed. If you collect Social Security, you won't get your CPI-based raise until January, and that will be based on CPI throughout 2021. In other words, you get the raise after you already spent the year paying more.

We Should Be Looking Forward

As investors, looking backward tells us where we have been, but what really matters for our investments is where things are going. We don't want to look backward, we want to look forward to know how to position ourselves today. The forward-looking indicators suggest that inflation is not "transitory" as the Fed would have us believe. There are a lot of tailwinds that will maintain inflation and even push it higher over the next year. Let's look at a few of them.

1- Your Rent

Today, both CPI and PCE are not including the impact of one of the largest bills for consumers: rent. Residential rents were held down by COVID "on average". In some areas, rents were rising, in a few areas like large urban cities like New York and San Francisco they crashed.

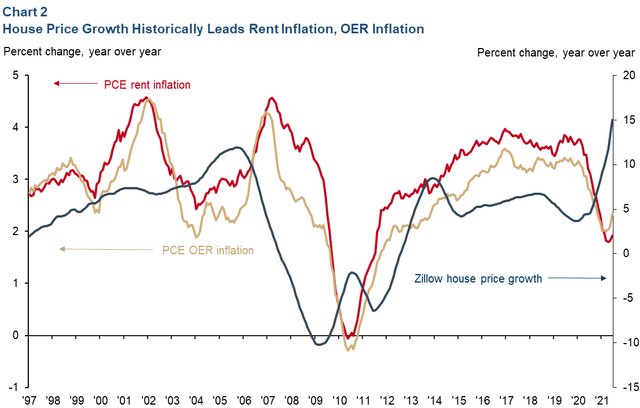

What has been rising almost uniformly across the country is the price of houses. A recent report from the Federal Reserve Bank of Dallas points out that rising housing prices is a leading indicator. Rent inflation is measured in two ways, "rent inflation" which is a measurement of rent at apartments, and "OER inflation" or "owners equivalent rent" which reflects the cost of ownership of a house.

Note in the chart below that the blue line, representing inflation in the cost of houses has surged, while rent and OER inflation remain low.

Source: Federal Reserve of Dallas

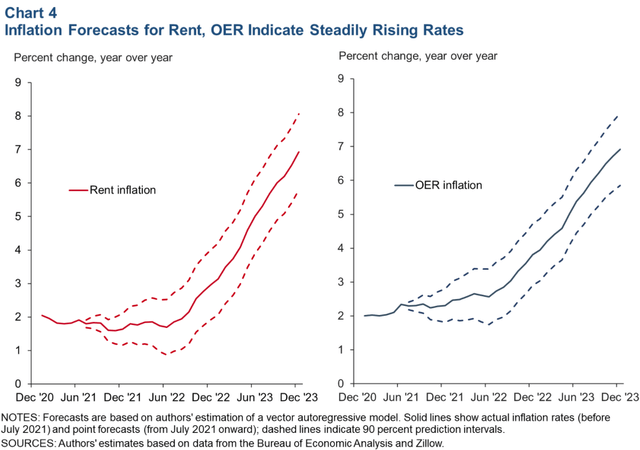

Housing prices are a "leading indicator" meaning that they go up before rent increases, and slow down before rent inflation slows. Historically, there is a 16-18 month lag between housing prices going up and the impact on rent inflation. The study's authors project that inflation for rent and OER will remain around the current 2% range and start taking off in 2022, reaching 7%+ in 2023.

Source: Federal Reserve of Dallas

In other words, rent inflation, which makes up about 1/3rd of the CPI measurement and 15% of PCE, will be increasing at 7%+ within the next two years!

2- Commercial Rents

For commercial rental contracts based on CPI, the rental rate is not reassessed every month. It might be assessed once a year, every 3 years or even every 5 years, based on the average CPI over the prior period. In other words, CPI today will not impact commercial rents until next year, and this year's CPI will continue to have an impact over the next 3-5 years raising commercial rents.

How will businesses pay for rising rents? They'll raise prices.

3- Listen To The Producers

Price increases are not immediate. Raising prices is a business decision that is always fraught with risk. If you raise prices, and a competitor does not, then you risk alienating the consumer. In this modern day, it is easier than ever for consumers to quickly compare the prices of similar products. Many producers are willing to "hold out" and avoid raising prices, hoping to make up for the losses in profit margin by gaining a larger market-share.

However, when the cost of producing a product remains high, the costs will inevitably be passed along to the consumer. This is something we are just now starting to see.

- Nestle (OTCPK:NSRGF) announced at the Barclays Consumer Staples conference that it expects input costs to be higher in 2022 than in 2021 and that they intend on raising prices to reflect it.

Our strategy is to offset anything we receive through pricing. The idea is to pass it on to the trade and to consumers whenever we receive it," he said, adding there would be a delay.

The price of almost everything is going up, and it is unlikely that many of these price increases will be repealed down the road. They are being described as "permanent".

4- Producer Price Index

Price increases to the consumer are often driven by price increases for the producer. The "Producer Price Index" or PPI, formerly known as the "Wholesale Price Index" is an index that tracks inflation for producers. The headline metric, called the PPI For Final Demand, measures the last commercial sale. In other words, the price the retailer pays before selling the product to the consumer. The CPI and PCE discussed above measure the price the consumer pays, the PPI measures the price paid by the retailer.

When prices go up for retailers, they often pass that along to the end consumer. Although there is often a lag, and retailers often let margins compress a little before increasing prices. Therefore, PPI is often a leading indicator and large increases point to future CPI increases.

On Friday, the PPI index was released for August showing inflation at 8.3% year-on-year.

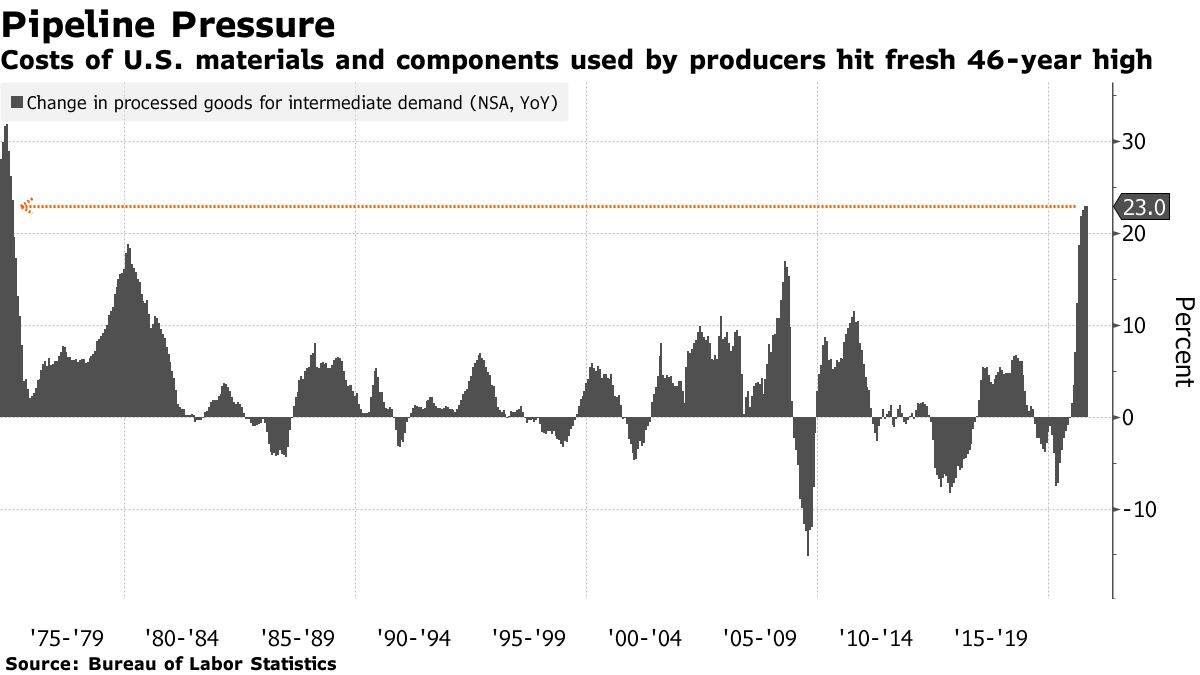

Even this number is relatively tame. There is significant pressure at the intermediate level, where manufacturers operate, that has not fully worked its way to the final number yet.

Source: Bloomberg

Source: Bloomberg

The chart above shows the inflation being paid by manufacturers is at 23% – the highest level it has been in 46 years.

The Fed Knows

Perhaps the most newsworthy event that was generally underreported was the release of the Fed's "Beige Book". This report is a summary from each district of the economic conditions. Mind you, this is the same Federal Reserve that is telling us that inflation is "transitory":

Even at greatly increased prices, many businesses reported having trouble sourcing key inputs. Some Districts reported that businesses are finding it easier to pass along more cost increases through higher prices. Several Districts indicated that businesses anticipate significant hikes in their selling prices in the months ahead.

Wait, "significant hikes" in the "months ahead"? The inflation metrics discussed above are backward-looking and are showing inflation levels we haven't seen in many decades. The Fed is telling us that there will be significant price hikes in the future – hikes that are not yet reflected in the inflation metrics.

Inflation is just getting started. Remember how we have been hammering the coming wage inflation? Well turns out the Fed agrees with us even if Fed Chairman Jerome Powell won't say it in a speech. Here are a few quotes from various Federal Reserve Banks:

The bottom line is that the theme is consistent across the country. From San Francisco to New York City and everywhere in-between, every single Federal Reserve Bank noted wage pressures created by a shortage of labor with many companies planning wage increases in the coming months for both existing and new employees.

Even as the Fed speaks of "transitory" inflation, their own book points towards inflation becoming more extreme in the coming months. Unless you believe that businesses will raise their employee wages, but not their prices....

The Fed Will Not Stop Inflation

Modern investors have gotten used to a Federal Reserve that acts aggressively and proactively to stem inflation. We have gotten used to the Federal Reserve stepping in and raising rates as soon as it smells inflation.

We cannot emphasize enough that the current Federal Reserve is remarkably different. The Fed is not stepping in to stop inflation, and we believe it has absolutely no intention of doing so. In fact, the Fed has overstepped its mandate of just "the lender of last resort", only to become "the market-maker and even the broker-dealer of last resort". The Fed is going to willfully allow inflation to run rampant, and as investors and consumers, we need to protect ourselves more than ever.

Why is the Fed doing nothing in the face of inflation accelerating?

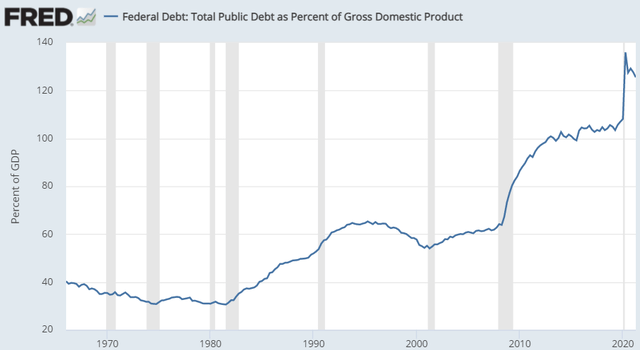

Well, the National Debt provides some $28.7 trillion reasons. The US debt/GDP was already above 100% and skyrocketed in 2020 as the government responded with massive levels of spending.

Source: St. Louis Federal Reserve

The big issue that the Fed is facing today is that the more debt there is, the less there will be future economic growth as most future productivity becomes mortgaged to pay for current expenses including debt servicing.

Allowing inflation to "run hot" is the most viable option, for the government to effectively manage this debt load. As inflation occurs, the dollar devalues, and GDP increases. The debt can then either be paid back with devalued currency or allowed to become less meaningful as it is a smaller percentage of a larger GDP.

In addition to the debt, the Federal Government is being pressured to deal with shortfalls in the Social Security Trust Fund which is now projected to be unable to pay full benefits by 2034. Inflation, especially wage inflation, will help increase tax revenues allowing the government to meet its future obligations more easily. Make no mistake, significant inflation would be very convenient for Uncle Sam!

Inflation Will Go Higher

When I first started talking about inflation, a lot of people laughed. We live in a world where we haven't seen significant inflation for 40 years. Deflationary pressures reigned supreme thanks in part to technological advances, which many inflation doubters still point to today. Yes, technology will continue to be a deflationary pressure, however, it is not the strongest pressure anymore.

At its core, inflation is really a monetary issue. The Federal Reserve has been the primary power in holding back inflation since Volcker was the chairman. For the past 40 years, the Fed has been quick to react to inflationary signs and were quick to snuff out even small embers before they could burn. I'd argue that the Fed's willingness to raise rates whenever inflation pressures reared up played the largest role in explaining why inflation has been kept under control.

This Fed is different. It does not fear inflation, nor does it see controlling inflation as its primary mandate. Powell has outwardly stated that he intends to let inflation "run hot", noting that for most of the past few decades inflation has been under the 2% overall target. Instead of snuffing out the ember, the Fed allowed it to burn and now it is starting to catch fire. Inflation is taking off before our eyes.

How bad will it get? That is unclear. However, no investor or consumer should casually dismiss comparisons to the 1970s. What is crystal clear is that inflation will continue to accelerate for the next six months. Inflation is not even close to having peaked with residential and commercial rents increasing, wage pressures building, and shortages caused by a lack of labor.

Make Inflation Work For You!

As a member of HDI, you are already positioning your portfolio to benefit from inflation. We have been positioning ourselves in sectors that benefit from inflation, including economically sensitive stocks, real estate, financials, energy, commodities, and floating-rate products.

Over the summer, the market started taking inflation less seriously, buying the idea that inflation was "transitory". We saw that belief being reflected with the rally in Treasuries and the resurgence of growth stocks. Inflation is not transitory, and as that reality sinks into the market, we will see the market go back to the trends we saw from January to June when inflation-sensitive stocks rallied and growth stocks underperformed.

You want to position your portfolio in:

- Stocks that have revenues that grow with inflation will benefit as they grow. These tend to be economically sensitive stocks such as banks and BDCs (business development companies).

- "Value" stocks, which trade at lower P/E ratios based on current income will become more favorable compared to "Growth" stocks which are valued based on future cash-flows. With inflation, future cash-flow becomes less valuable.

- Don't forget to hedge against rising rates. I continue to believe that the current Fed will be very reluctant to raise rates. The target rate will likely remain at 0% until the year 2023 at least. However, the only way to control inflation is to raise rates. The higher inflation gets, the Fed may be forced to hike rates, even if they will end up to be minor ones which I would expect. So even though we don't anticipate rates to rise over the next two years, markets are always forward-looking. It is a good idea to continue building exposure to floating-rate investments to be prepared for 2024-2025 when rates are likely to be raised. Fortunately, the HDI portfolio is full of picks with floating rate exposure that are also producing attractive incomes now.

- Stocks that benefit from rising long-term interest rates will also be great beneficiaries. With inflation soaring, we are set to see the 10-year Treasury yields slowly creep higher. Some of the best investments in this kind of environment are agency mortgage REITs such as Annaly (NLY) yield 10.3%, AGNC (AGNC) yield 9%, and Dynex Capital (DX) yield 8.9%. DX is a non-HDO stock pick but one that we like very much. The good news is that all three picks are very much undervalued today and offer a good entry point.

- Super high dividend stocks: Stocks that pay high yields today will become more attractive as, by definition, money today will be more valuable than money next year in an inflationary environment. I like to call "super high dividends" stocks that yield over 7%. Inflation is highly unlikely to remain close to that level on a consistent basis. If you invest with yields of 7% and reinvest only half of your dividends, not only are you are beating inflation, but you are boosting your future income, and you are setting yourself up for success to reach a happy comfortable retirement. Importantly, you can still have good spending money whether you re-invest 50% of your dividends or not. A yield of +7% is hard to beat in an inflationary environment!

It is because we saw this threat approaching well in advance that we have been able to slowly ease our portfolios into a position to benefit from it. This week, I hope that I was able to provide a bit of a clearer picture as to why we are positioning our portfolio the way we are, and to provide a peek into the macro ideas that I consider when determining which picks will be added to the portfolio.

Inflation can be scary for retirees and those saving for retirement, but it is something that we can prepare for, it is something we can deal with and it is something that we can profit from to ensure that your retirement is secure!

Risks of Stagflation

We are also facing another risk which is stagflation. Stagflation is a situation whereby inflation becomes much higher than economic growth. During such periods, we see persistent high inflation combined with high unemployment and stagnant demand in a country's economy. There are a few triggers that cause stagflation, and one of the most important ones is a high national debt burden.

Stagflation is a really painful situation, even much more painful than inflation itself. This is a subject that requires a lot of explaining, and my objective for next weekend's market outlook is to explain what leads to stagflation and how to prepare for it. I will also explain the options the Government has to prevent or to get out of stagflation. Interestingly, letting inflation run high to reduce the value of debt load is one great way to prevent stagflation, and this is exactly what the Fed is doing.

Are We in an Asset Bubble?

I get asked this question almost on a daily basis. Are equities and home prices in a bubble? Is it going to burst? My reply is that you cannot under-estimate the power of liquidity and how much it can push prices higher. As long as the Fed keeps interest rates this low, and the government keeps spending and injecting liquidity, the more asset prices will go up. Furthermore, inflation fears are pushing people to keep their cash levels low by investing it either in equities, bonds, or real estate. All this is contributing to a rise in asset prices across the board, and there is still a bubble of cash (and savings) not yet invested!

The best way to look at valuations of homes or equities is their relative prices to "interest rates" (or to the Fed Funds Rate). By looking at these valuation metrics, we are definitely not in a bubble, or in an "irrational exuberance" situation.

Surely, prices cannot keep going up indefinitely, but as an investor, I am first an economist, and this is why I provide this weekly market update to our members. I take a view for 18 to 24 months, and I do not see a market crash happening during this period, but rather asset prices keep going up, and even more rapidly than the past year.

About A Market Correction in the Magnitude of 10%

Also, note that we have been due for a market correction in the magnitude of 10% for several months now (or in fact for six months since the beginning of this bull market back in March). Such corrections happen on average once every 12 months. But the big bubble of cash on the sidelines keeps preventing it from happening.

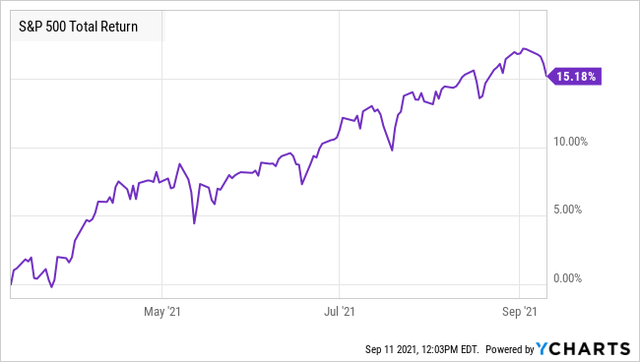

I believe that we will eventually see this 10% correction, but when it comes, we should not be worried about it. Those investors who pulled back from the markets waiting for the 10% correction to happen have seen the markets go up by 15% in the past 6 months.

They have already missed many opportunities. Furthermore, it could take several more months for this correction to happen, and by then the markets could be much higher from here. As long as we are confident of our bull market thesis, market corrections should not be scary. In fact, they would be opportunities for those who have still some cash to put to work.

Even if it happens, I expect any pullback to be short-lived and followed by a swift recovery. Keep in mind that any market dip will get the Federal Reserve worried, and become even more dovish. Because of this, I think that investors will continue to buy each and every dip.

Personally, I am fully invested, and I am happy that our portfolio volatility is much lower than that of the general markets (the S&P 500, the Nasdaq, and the DOW). The reason is that we have a good allocation to preferred stocks and baby bonds which helps us absorb market shocks much better.

The best part of owning an income portfolio is you do not have to worry about market fluctuations or pullbacks. I love to keep collecting my recurrent income whatever happens to the markets in the short term. This is the beauty of dividend investing! However, this is only true if we are in a full-blown bull market like today. Whenever recession risks increase, we will re-position our portfolio accordingly with a higher allocation to defensive stocks that are both more recession resilient, and still produce a decent income. This is why we call our "model portfolio" a managed portfolio. We need to fine-tune it from time to time based on macroeconomic events.

Bottom Line, and the Best Course of Action

We remain in a strong bull market sponsored by excess liquidity from both the Fed and the government. This bull market is far from over.

I continue to believe that fundamentally superior dividend stocks, especially those that are economically sensitive, and those that provide inflation protection, are an oasis in the current inflationary environment. I expect our portfolio of stocks to continue to outperform, and I am very excited about the medium and long-term outlook for both high income and capital gains.

Keep in mind that September is historically one of the most turbulent months of the year. Even if we see a pullback, the best course of action is not to panic and sell. Rather hold your dividend stocks and keep collecting your income. The most important point to note is that we are confident that we remain in a resilient super bull market. Even if we pull back significantly, we are likely to see a very swift recovery. It is best not to time this market or try to trade it. I am personally holding all my positions and have no plans to trade. I am happy to collect my big recurrent income knowing that a few months from now, most of the prices will be higher from today, no matter what the short-term market moves present to us.

Good investing!

=======

I invite you to take a 15-day free trial to our service. It is the #1 Service for Income Investors and Retirees. By taking the free trial, you will have access to our model portfolio targeting a +9% yield by investing in dividend stocks, bonds, and preferred stocks. Test it for yourself, I am confident that you will like it!