Market Outlook April 11, 2021

Market Outlook April 11, 2021

All major indexes all made surprise moves to the upside (again) this week, breaking all-time high levels. I keep reminding our members that during strong bull markets, surprises to the upsides should not be "unexpected".

The S&P 500 index has made a significant move and broke through the 4100 level (a resistance level) without any resistance, indicating that the markets are likely to be heading much higher.

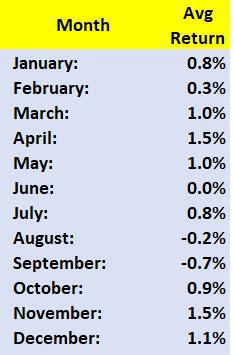

As noted earlier, it is liquidity that is the main driver for equities. As long as there is all this liquidity sloshing around, equities are set to continue to move much higher. Keep in mind that April is the best performing month of the year (along with November) as you can see in the statistics below (taken from years 1980 to 2019):

I expect that this month will be no different. The summer/autumn season could be volatile, and the markets for sure do not go up in a straight line. Here again, my best advice is to never try to time the markets. Being a long-term investor is a much better strategy, and has been proven by several market studies. As income investors, time is always by our side. I always take a look at our "Dividend Tracker" to check out when I will be collecting my next dividend paycheck, or at our "preferred stock dividend tracker" to check out when my next preferred dividend will hit my account. I am happier to collect the income rather than to game the markets. Time is always by my side!

Long-Term Outlook: Goldilocks Moment For the U.S. Economy

My projections since late 2020 have been that this secular (post-covid) bull market will last until year-end 2022 at least and possibly into the year 2023.

Just last Wednesday, the leader of America’s biggest bank JP Morgan Chase (JPM) Jamie Dimond, in his annual letter to shareholders, said the U.S. economy is emerging from the coronavirus pandemic into a boom that could last until 2023. The reasons being strong consumer savings, expanded vaccine distribution, and the Biden administration’s proposed $2.3 trillion infrastructure plan could lead to an economic “Goldilocks moment”—fast, sustained growth alongside inflation and interest rates that drift slowly upward.

My personal views have always been to never bet against the American economy. This is more true during this period of grand re-opening. Our high yield "model portfolio" is actively managed, which means that our aim is to have it positioned in the right stocks and sectors to maximize both our income and returns, given the economic and political environment.

One of the main market risks that I highlighted two weeks ago for the equity markets was a significant tax hike on corporate taxes, but it seems that this risk will not be a significant one. Any changes to the corporate tax rate will be “reasonable and moderate” to keep the U.S. competitive with other countries. In fact, president Biden stated last Wednesday that he is willing to negotiate on corporate tax rates, which leads me to believe that he clearly understands the risks of hiking corporate taxes will derail the economic recovery.

The Case for Value Stocks

I have made the case for the outperformance of value stocks in many of my previous market updates. Value stocks, the market’s cheapest, tend to profit the most during the initial phases of the economic recovery. They tend to be economically sensitive and usually see higher earnings growth as the economy recovers. Note that these "value stocks" are usually the small and medium companies (the heart of the U.S. economy) that will be the prime beneficiary of the stimulus plans. Small and medium-sized businesses will thrive first.

Even following the rally, the valuation gap between growth and value is very wide due to years of underperformance for value stocks. Add to this that value stocks are seeing much higher growth than seen in many years, this makes them prime for outperformance.

Importantly, value stocks are much more resilient to higher interest rates than growth stocks. The reason? Growth stocks trade at high valuations (or high Price/Earnings ratios) which are based on assumptions that include "interest rate" projections. The higher interest rates go, the lower these growth projections become. In fact, higher interest rates are bearish for most growth stocks, should interest rates continue to climb higher.

Where We Are Likely Heading Next?

I expect that the month of April is likely to be a great one for equities. We should expect some volatility and choppiness, but I would not worry about it. As we have seen over the past few months, I expect every dip to find buyers and that the downside risk is likely to remain low. This should remain true throughout the year 2021.

I am excited about the prospect of our portfolio for the year. We are invested in both economically sensitive stocks and sectors that are set to strongly outperform for the next two years. We have also started to adjust our portfolio well in advance for rising inflation and higher interest rates.

= = = =

Good investing from your HDO Research Team,

Rida Morwa, Philip Mause, Treading Softly, Beyond Saving, PendragonY, & Preferred Stock Trader