Market In Bull Flag

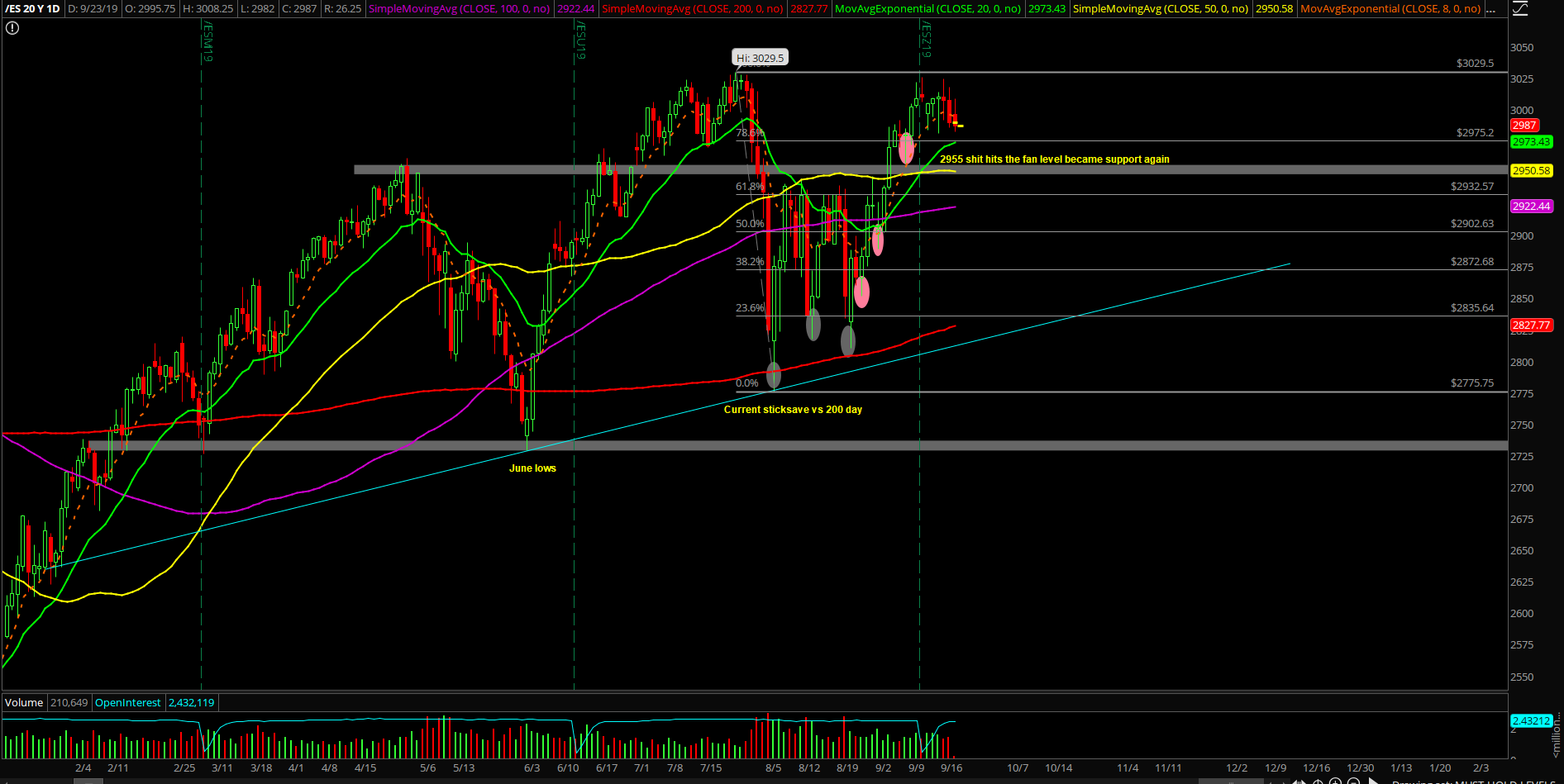

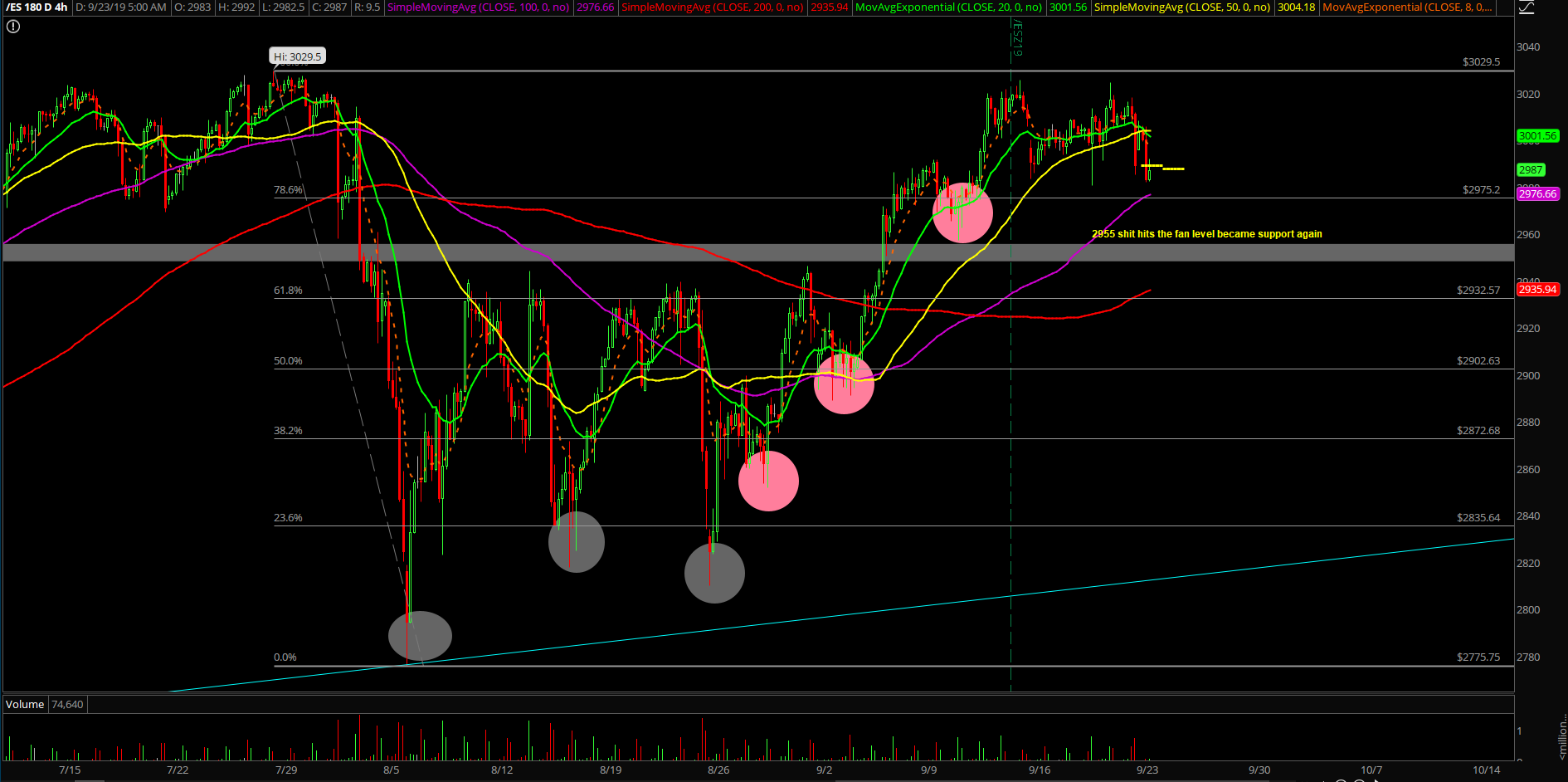

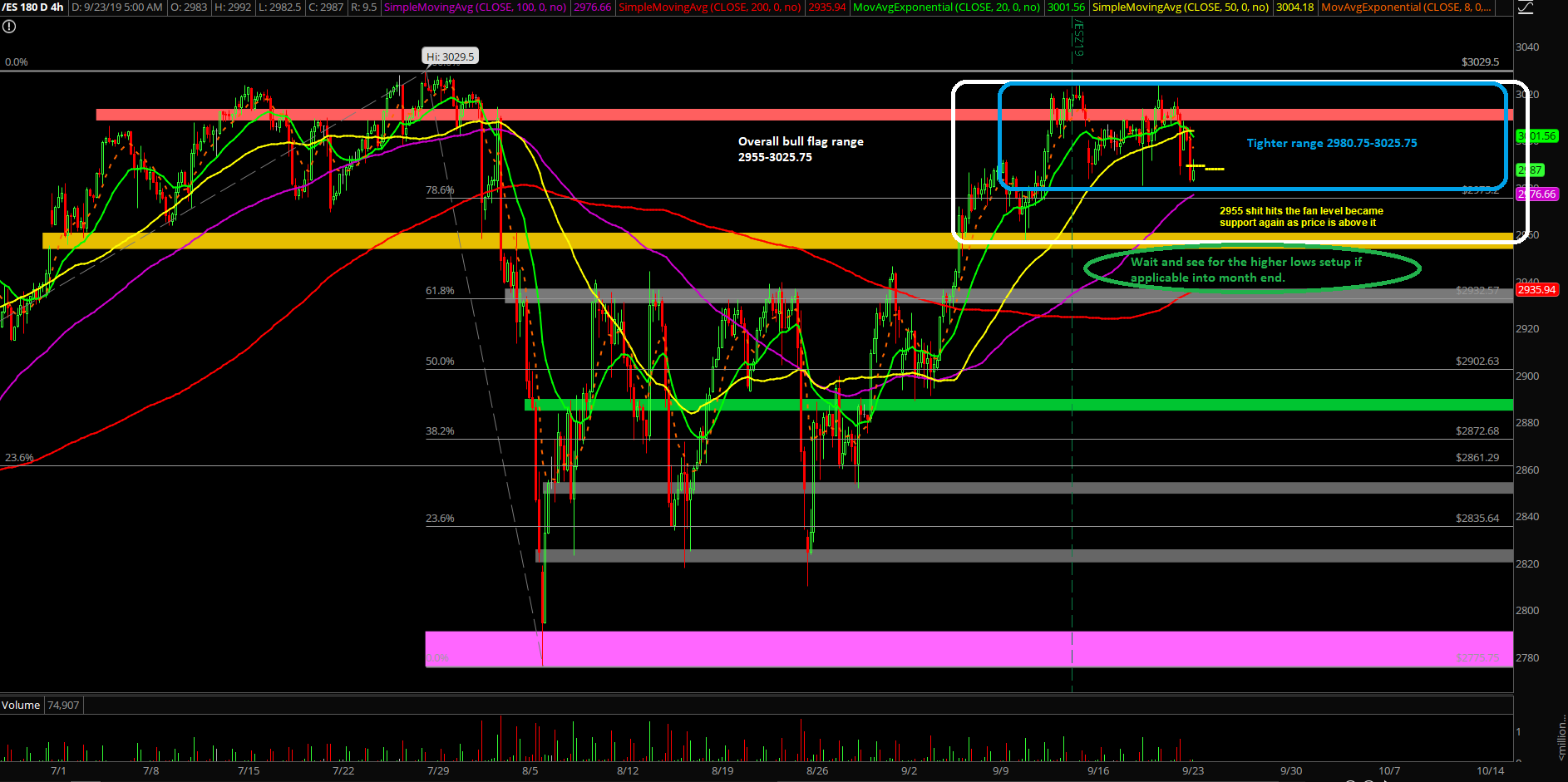

The third week of September was an inside week as expected per projections. However, the bulls could not muster the big win with Friday’s weak closing print near the week’s range low. Essentially, the entire week played out as digestion as price action remained in a bull flag pattern given the prior 3 weeks of upside continuation from 2810 to 3025 on the Emini S&P 500 (ES).

What’s next?

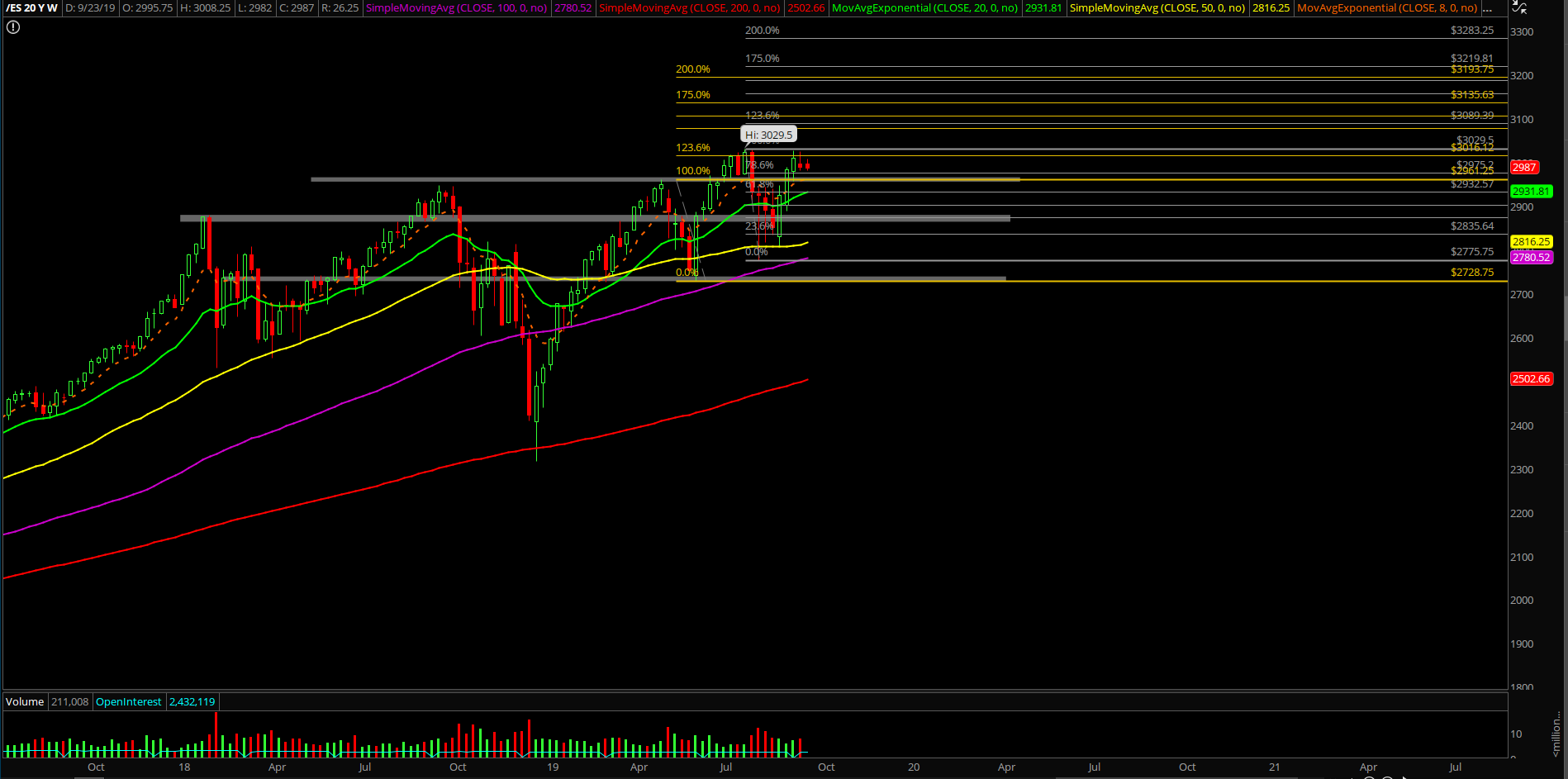

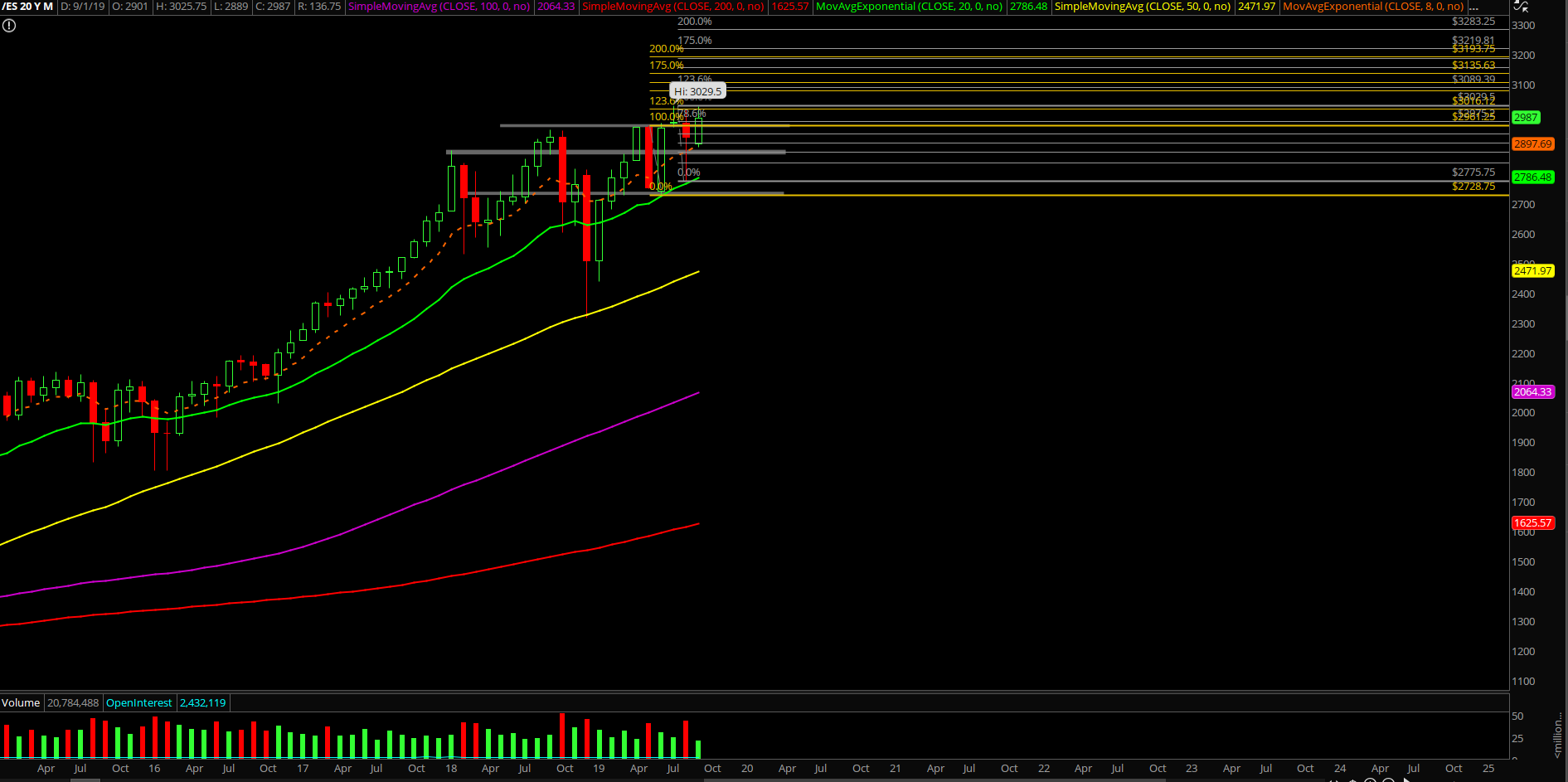

There are six sessions left and it’s month/quarter end closing print. There are only two scenarios: weekly bull flag pattern vs. weekly double top and the prevailing trend favors the bulls given the current odds. Obviously, odds would shift if our key support levels get backtested and broken.

Friday closed at 2989.25 on the ES, around the inside week’s range low, and the win rate for bulls has gone down to 71% YTD (27/38) for the Friday dead highs closing print within 1%. Not much has changed from the prior report. The general theme of the backtest into 2975-2965 and then rally into month-end new all-time highs remains favorable given the trending daily 20EMA. We’ll repeat these key points:

- Market in consolidation mode given last week’s inside week, 3 weeks up in a row and 1 inside week so far going towards month end closing print

- We’re expecting bulls to attempt the bullish monthly closing print next Monday when above supports 2972/2955

- Can trade both directions this week, but odds still heavily favor longs if trending daily 20EMA holds as everything is just a bull flag on the weekly chart

- Odds would start to shift if we get a close below 2972 as it opens up 2955 shit hits the fan level from July for another backtest threat from the bears

- Potential feedback loop to the downside given the 3024.5 double top possibility, but no support has been broken yet so current odds are low until levels actually break. (It was an inside week.)