Major Low Update - Market Analysis for Mar 10th, 2022

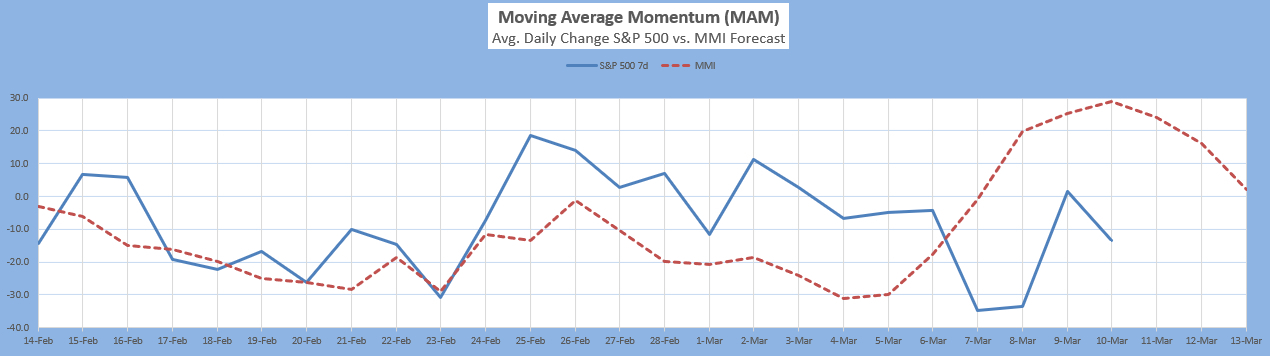

Back on February 20, our MAM indicator, which gives the moving average momentum of both sentiment and market price, found that both sentiment and the market had declined sufficiently to generate a major low signal for February 22-Mar. 2 telling us to watch for a major low in market price during that time. As sentiment continued to fall sharply enough, this range kept extending all the way to Mar. 14. In the meantime, a new signal for Mar. 9-18 for an upward trend change was issued overlapping with the major low window.

Going back through six years of data, there is no precedence for this combination. My inclination is to combine the two as they both point to a similar change of direction. If we combine them, it would imply both a major low AND upward trend change in the Mar. 9-14 window.

Alternative ways to look at this would be a major low already in and a visible bounce showing in the Mar. 9-18 window. Finally, it could also mean that the major low signal was invalidated by this new signal and that we are only looking for a near term bounce beginning sometime in the Mar. 9-18 window. Because I have never seen this combination before, I can't eliminate any of these three options just yet.