MSFT: The Strongest Hyperscaler — But Is the Phase Itself Nearing a Peak?

In the modern market, few words carry as much weight as hyperscaler. It sounds technical, but the concept is simple: hyperscalers are the companies that own and operate the digital factories of the global economy. They build massive datacenters, fill them with servers and GPUs, and rent computing power to businesses, governments, and consumers worldwide. Microsoft sits squarely at the center of that group.

Lyn Alden recently framed the AI landscape by dividing it into clear buckets: chip designers, pure-play AI labs, and hyperscalers. Microsoft belongs to the third group—the firms spending tens of billions of dollars to turn physical infrastructure into future digital dominance. What makes Microsoft distinct, however, is how it is absorbing this capital intensity.

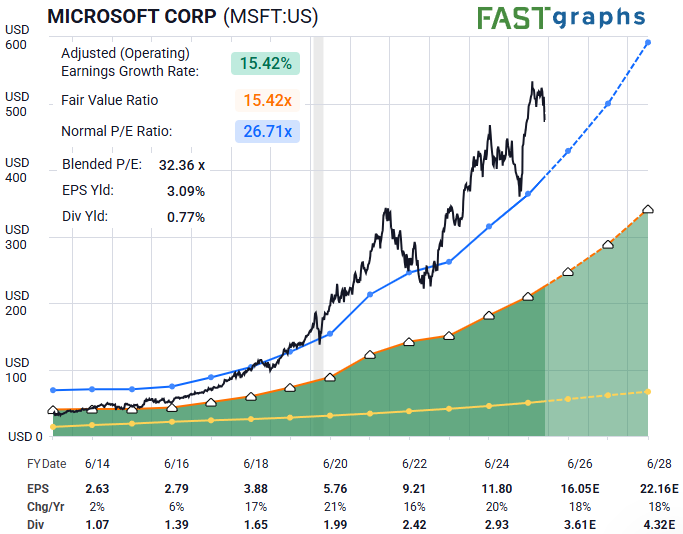

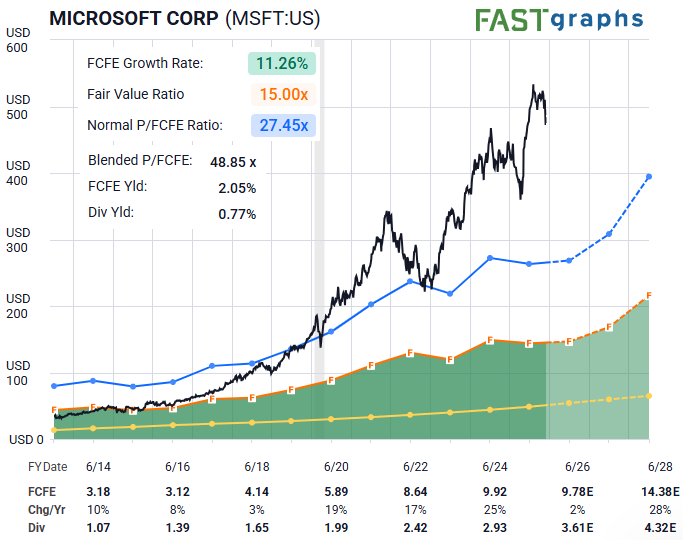

Unlike some of its peers, Microsoft’s free cash flow has not meaningfully deteriorated during this capex cycle. Azure continues to scale, enterprise software remains sticky, and the company’s balance sheet allows it to fund AI expansion without materially stressing its financial foundation. In that sense, Microsoft resembles Alphabet more than Oracle or some of the other hyperscalers currently drawing scrutiny. The investment is heavy—but the cash engine is still running.

A key distinction, to be sure.

It suggests that Microsoft is not merely betting on AI; it is funding the transition from a position of strength. And so far, the crowd has rewarded that discipline—without pushing expectations quite as far into the future as it has with some other AI-adjacent names.

But strength does not exist in a vacuum.

And while Microsoft may be executing better than most within the hyperscaler cohort, sentiment across the broader AI infrastructure trade is beginning to look mature. When capital flows cluster, even the strongest balance sheets are not immune to shifts in crowd psychology.

Microsoft may be the best house in the neighborhood—but if the neighborhood itself is nearing a sentiment peak, price will eventually reflect that reality.

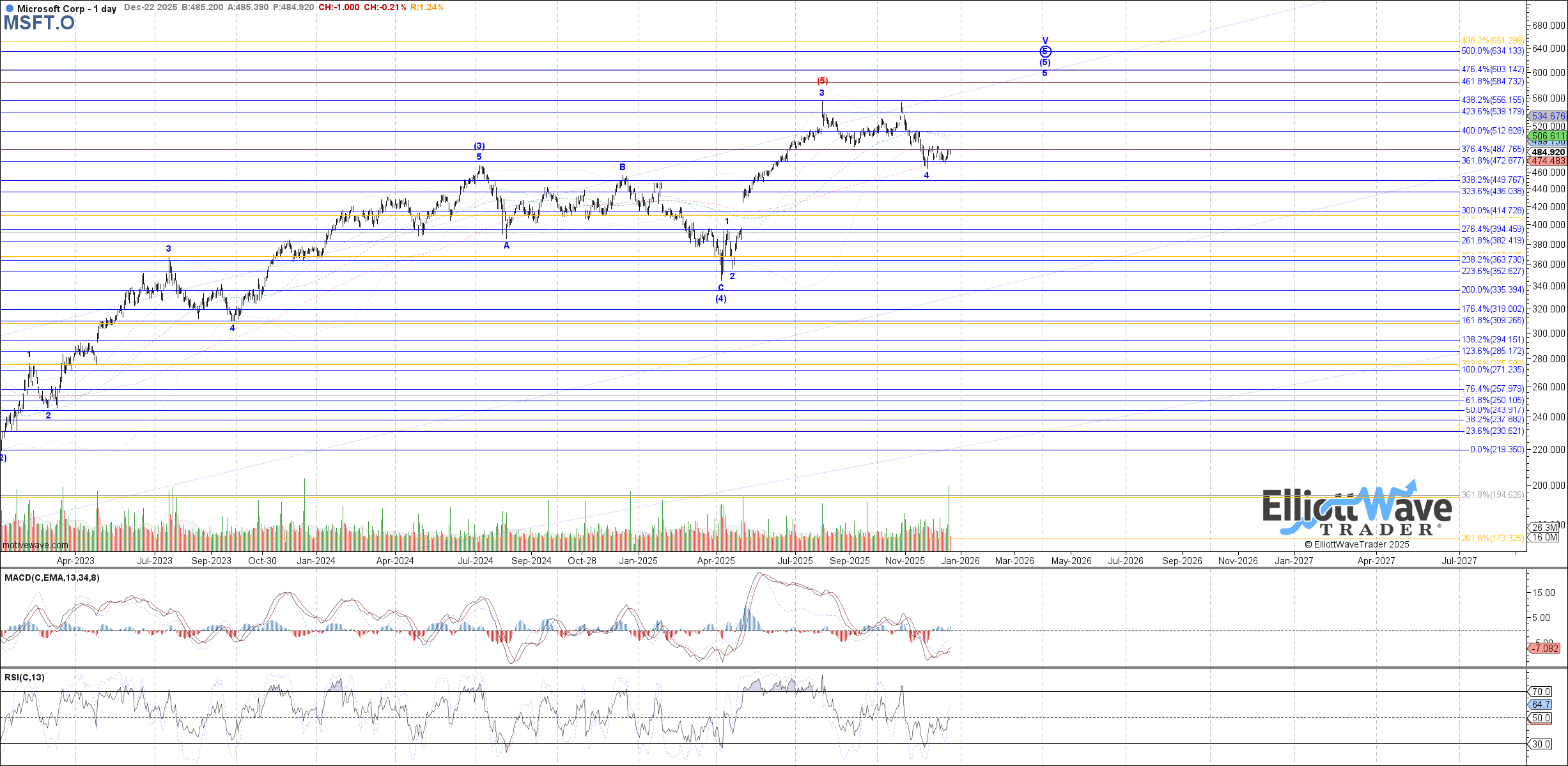

That’s where the chart comes in.

And that’s what sentiment will tell us next.

⸻

Sentiment Speaks

As we study sentiment through the structure of price, we must keep one point firmly in view: markets are dynamic and fluid by nature. Any useful methodology must adapt accordingly. Over thousands of case studies, we’ve also observed that markets are variably self-similar across all degrees of structure.

Why does this matter? Because larger structures are composed of similarly formed smaller ones. A five-wave advance at a higher degree will be built from five-wave advances at lower degrees. It’s this self-similarity that allows us to project probabilities—not to explain the past, but to anticipate what is most likely as structure matures.

Viewed in its entirety from the 2009 low, the MSFT chart suggests that an important high may be approaching. Both Zac Mannes and Garrett Patten are tracking this scenario, with slight variation in how it resolves.

Both analysts see Microsoft’s structure as quite mature, with multiple degrees nearing completion. One key distinction is that Garrett’s primary scenario allows for one more rally higher before culmination, while Zac treats that outcome as the alternate path.

For now, as long as price remains above the $464 level in the near term, that additional push higher remains a reasonable assumption.

Great companies don’t top because they fail—they top because expectations finish forming. Microsoft has earned its place at the front of the hyperscaler pack, but sentiment doesn’t differentiate forever. When belief peaks, structure resolves. And when structure resolves, price follows.

From here, MSFT isn’t a question of strength.

It’s a question of phase.