MM Quick Weekend Update

Apparently, we did get our paradigm shift yesterday and the Sharp Pop Alert is satisfied. However, there is still no evidence that *the* low is in. Also, since SPAs usually go with Elliott Wave "c" waves, the base case is still that this rally is a countertrend bounce.

As was mentioned in last night's report, today's mood pattern can point to displays of "panic" for bulls, bears or both. It seems that the bears got primarily caught in this one.

As far as the weekend, there is just too much uncertainty for a call for Monday RTH open. Sunday's pattern is "breakout or breakdown," and is likely to make for a gap one way or the other. Our bull / bear trendline through Monday RTH open is at 4019 SPX (cash). The ES equivalent is about 4014. The easiest way to scalp trade this for futures traders is bearish bias below 4014 and bullish above it.

It could be a very negative weekend news-wise in terms of violence and instability, and it could also be a breakthrough weekend in a positive sense. A potential inversion makes it impossible to tell. CDMS* for Monday base case is Intraday Buy (i.e. watch for a potential buy setup on Monday after market open).

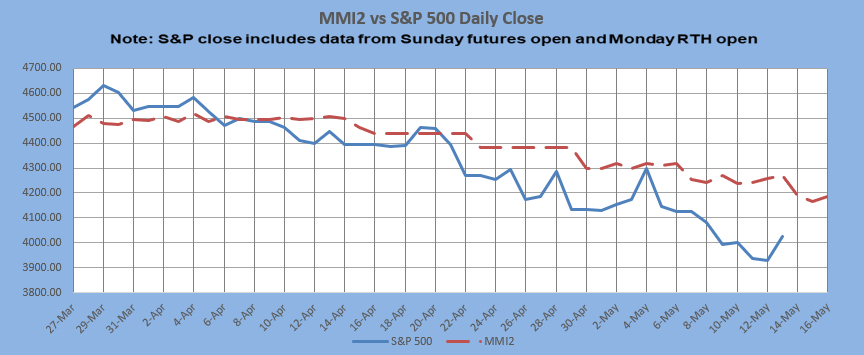

Latest chart:

Have a great weekend!

*Composite daily mood signal