MM Quick Update - Market Analysis for Sep 28th, 2022

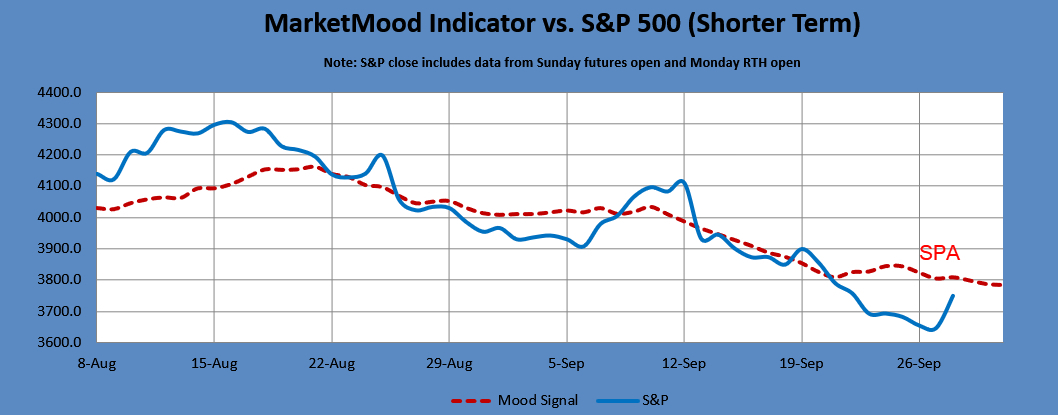

Today's mood pattern reflected "Shake-ups, Storms, and Evacuations" and it's not surprising to see some abandoning of previous positions and short covering. MMI was up today and the market so far is up. MMI is down the rest of the week.

There was a Sharp Pop Alert today, which means a higher than usual chance of a larger than usual move up. Regardless of how the day closes, I consider that fulfilled. We are still waiting for confirmation of a Major Low being in. Our MAM signal gave highest likelihood of a closing low by yesterday. In order to confirm that the low is likely in we would need the S&P 500 to close today above 3750.15. Baring that, one more low looms large and still remains a good possibility.

The new Major High/Low trading system gives tomorrow's open as an entry if the market closes up today. Without additional confirmation that a low is in, and with MMI down through end of week, this trade carries some additional risk of being stopped out with a move below 3% of entry. If there happened to be a drop overnight, that might give us a better entry tomorrow morning.