MM Morning Notes - Market Analysis for Feb 24th, 2022

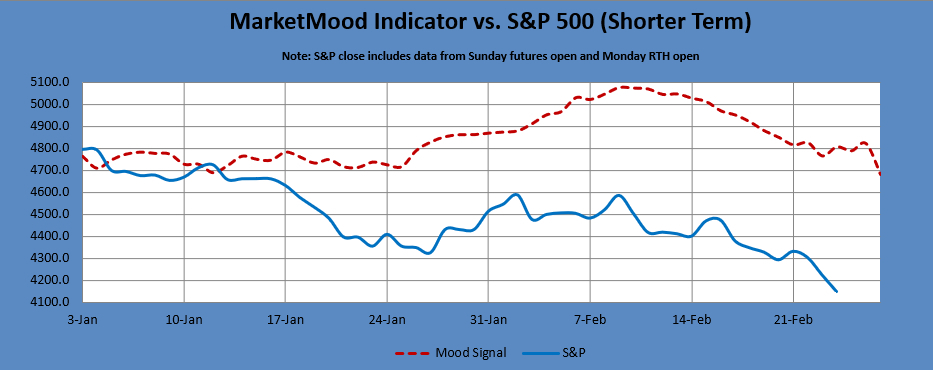

Here's what we were looking at as the week began: "The mood pattern is quite odd through Wednesday, looking somewhat twisted and tense. There appears to be a breakthrough by Thursday one way or another." So, war broke out last night. Now we know how that tension got resolved.

Today we are still watching for a flip from down to up in the markets. Ideally, that would be down first (got that), then ambiguous, then a turning up.

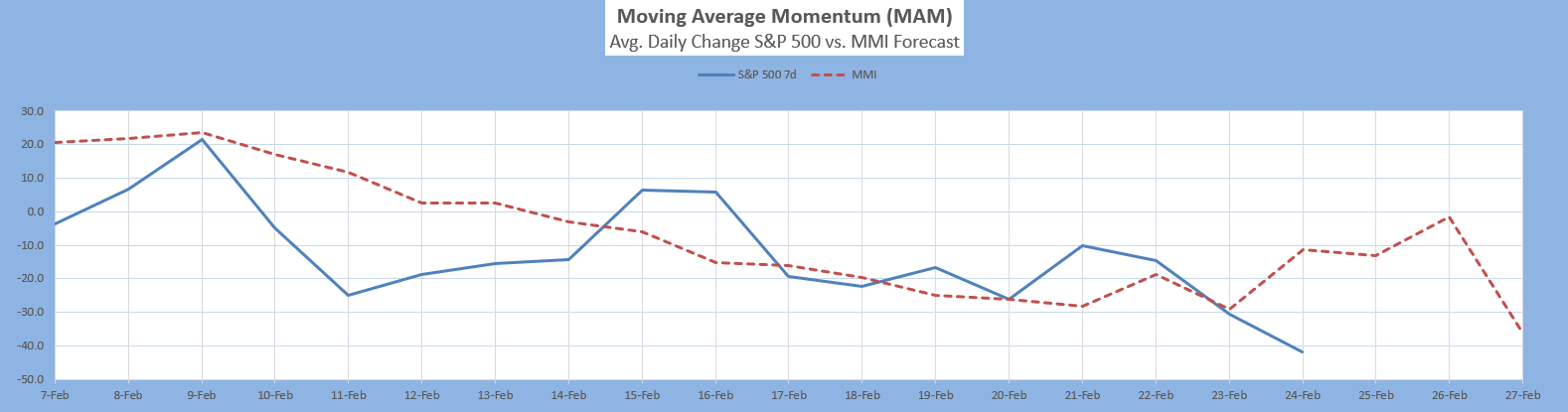

If the flip checks out, Friday's MarketMood Indicator will be down. Preliminary MMI for the weekend (Monday RTH open) is down. Preliminary data is showing an extension of the MAM major low signal to March 3. We'll see if that changes by end of day.

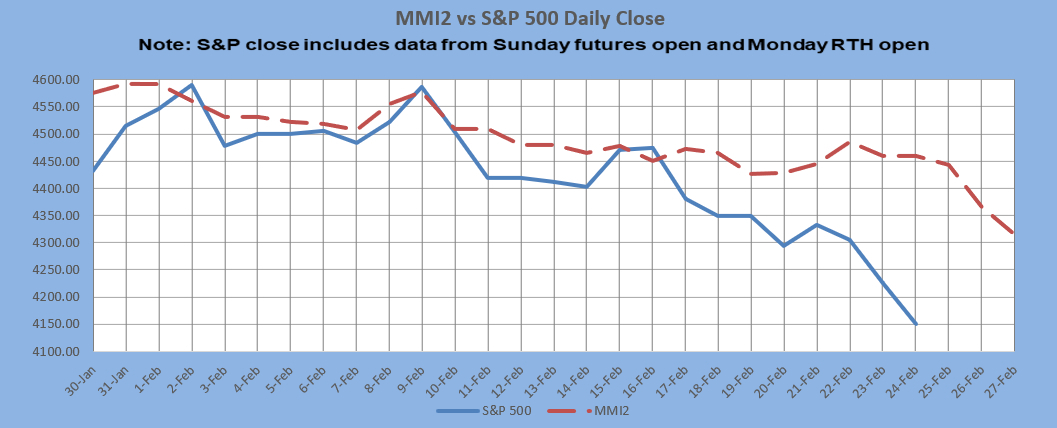

The MM Trend Trader is fully bearish meaning all bounces are considered to be temporary rallies in a larger bearish trend. A break above the bull / bear trendline (4318 SPX for today) would imply that the bulls are in process of making a serious attempt at recovery.

TRADING STRATEGIES: Per LTTI, long and intermediate term traders would still be fully short. Day traders per CDMS can watch for intraday buying opportunities today.

Latest charts follow the summary table (today's flip is assumed in the charts). For more detailed info see this evening's full report:

MM Indicators and Trading Parameters Summary:

| Indicator | Scope | Direction |

| LTTI | Longer Term Trend | Strong Bearish |

| MMTT (main) | Medium Term Trend | Bearish |

| MMTT (HP) | Medium Term Trend | Bearish |

| MMTT (b/b) | Near Term bull/bear Trend Line | 4318 SPX (cash) |

| MM MACD | Swing Trade | Sell < 4500 |

| CDMS** | Today Close to Next Trade Day Close | No Trade |

Note: Medium term is roughly 1 week to 2 months. Longer term is roughly 1 month to a year or more.

**Composite Daily Mood Signal (CDMS) combines the MMI daily signal and the various MM trend and trading indicators into one overall daily trade signal. Possible signals are intraday buy, daily buy, no trade, intraday sell, and daily sell. An "intraday" signal is more likely to be a mixed day, so the implied strategy is to watch for day trade setups in the indicated direction during the trading day. A "daily" signal points to less cross-currents and an implied strategy of entering at market close for the next day's trade.