MM Closing Notes - Market Analysis for Apr 6th, 2020

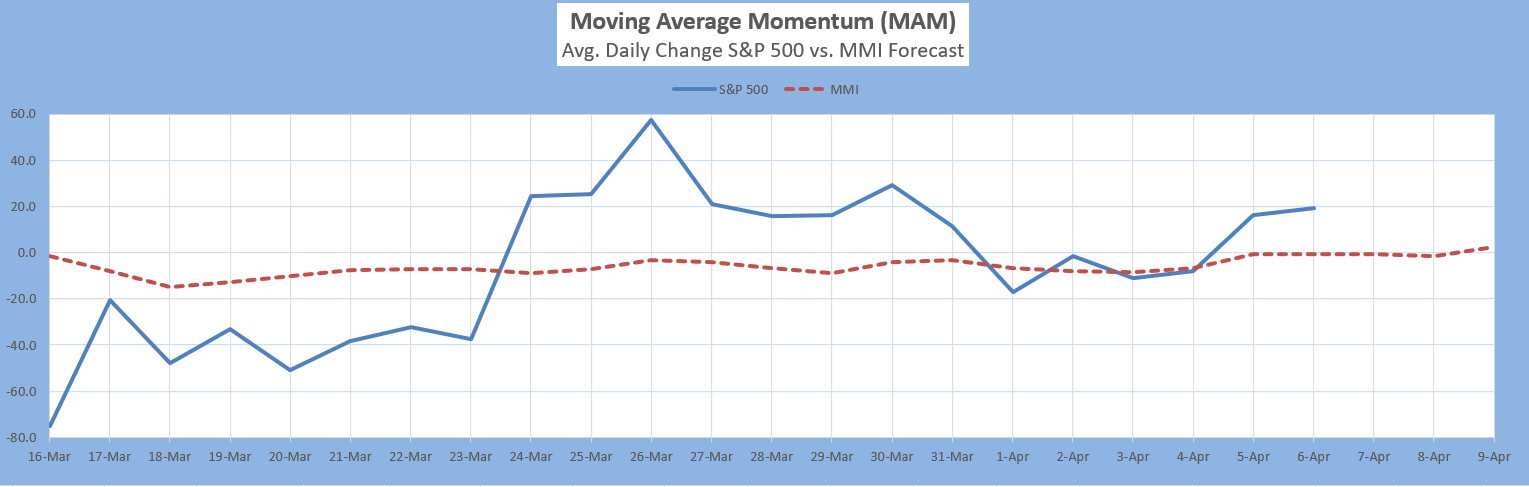

MMI was looking for a possible complex flip over the weekend (up-down-up) with an up open this morning. There was a clear up open, so assuming the flip, MMI was pointing down (below open) for today's close. That did not occur. Today's mood pattern pointed to global crisis or disaster. The hope was that it was simply more of the same. However, the news about Boris Johnson in ICU was something new that also fits into this pattern. Usually, the global crisis pattern accompanies a downward move in markets. Yet, people are so burned out on crisis, and the liquidity situation continues to improve -- thus for the moment markets appear to only want to go up.

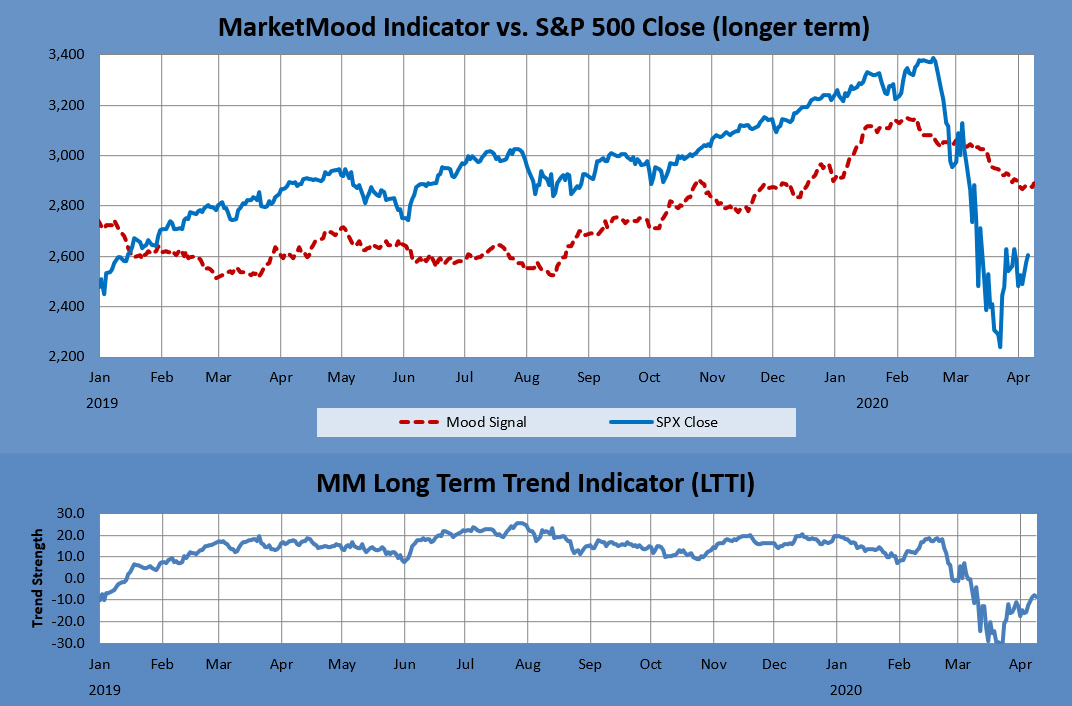

A close today above 2660 SPX signals a shift in the long term trend to neutral from bearish. MMI is still pointing down for Wednesday and up (preliminary) for Thursday. Tuesday is uncertain.